概述

该策略采用双EMA均线跨度来判断OBV指标的多空趋势,根据趋势方向进行长短做法。其中,OBV指标可以更清晰地反映出价格和成交量的关系,判断市场参与者的意愿,因此可以用于捕捉市场趋势。该策略结合移动平均线的指标平滑处理,可以有效滤除市场噪音,捕捉主要趋势。

策略原理

该策略主要基于OBV指标是否处于上升趋势来判断多头入场时机。具体来说,是计算OBV的6日EMA和24日EMA,当6日EMA上穿24日EMA时产生多头信号。同理,当6日EMA下穿24日EMA时,产生空头信号。此外,策略还设置了3%的止损。

该策略判断趋势的关键在于OBV指标。OBV指标体现大资金的集合性意愿,可以有效反映市场参与者的态度。结合移动平均线处理,可以滤除部分噪声,使得信号更加清晰可靠。策略采用快速EMA线和慢速EMA线构建交易信号,可以平滑价格数据,同时也能较敏感地捕捉趋势变化。

优势分析

该策略具有以下几个优势:

基于成交量的OBV指标可以清晰判断市场参与者意愿,信号较为可靠。

双EMA均线处理可以滤除部分噪音,使得信号更加清晰。

采用快慢EMA线组合可以兼顾平滑价格和捕捉趋势变化。

策略操作简单,容易实施。

风险分析

该策略也存在一些风险:

OBV指标在某些时候会发出错误信号,此时策略可能亏损。

在剧烈行情中,EMA线处理有滞后,可能错过最优入场点。

固定的止损设置可能过于死板,无法适应市场的变化。

对策:

结合其他指标进行确认,避免错误信号。

优化参数设置,使EMA线更灵敏。

设置动态止损。

优化方向

该策略可以从以下几个方向进行优化:

优化EMA参数组合,找到更匹配的均线参数。

增加其他指标进行信号确认,如MACD、RSI等,提高信号准确率。

设置动态止损,能够根据市场波动实时调整止损点。

进行参数组合优化,找到最佳参数组合。

总结

该策略整体来说是一种较为简单可靠的趋势跟踪策略。它结合OBV指标和双EMA均线实现了对趋势的判断。优点是操作简单,信号清晰,能够有效跟踪趋势;缺点是可能出现错误信号,且EMA线处理有滞后。通过结合其他指标进行优化,可以获得更好的效果。

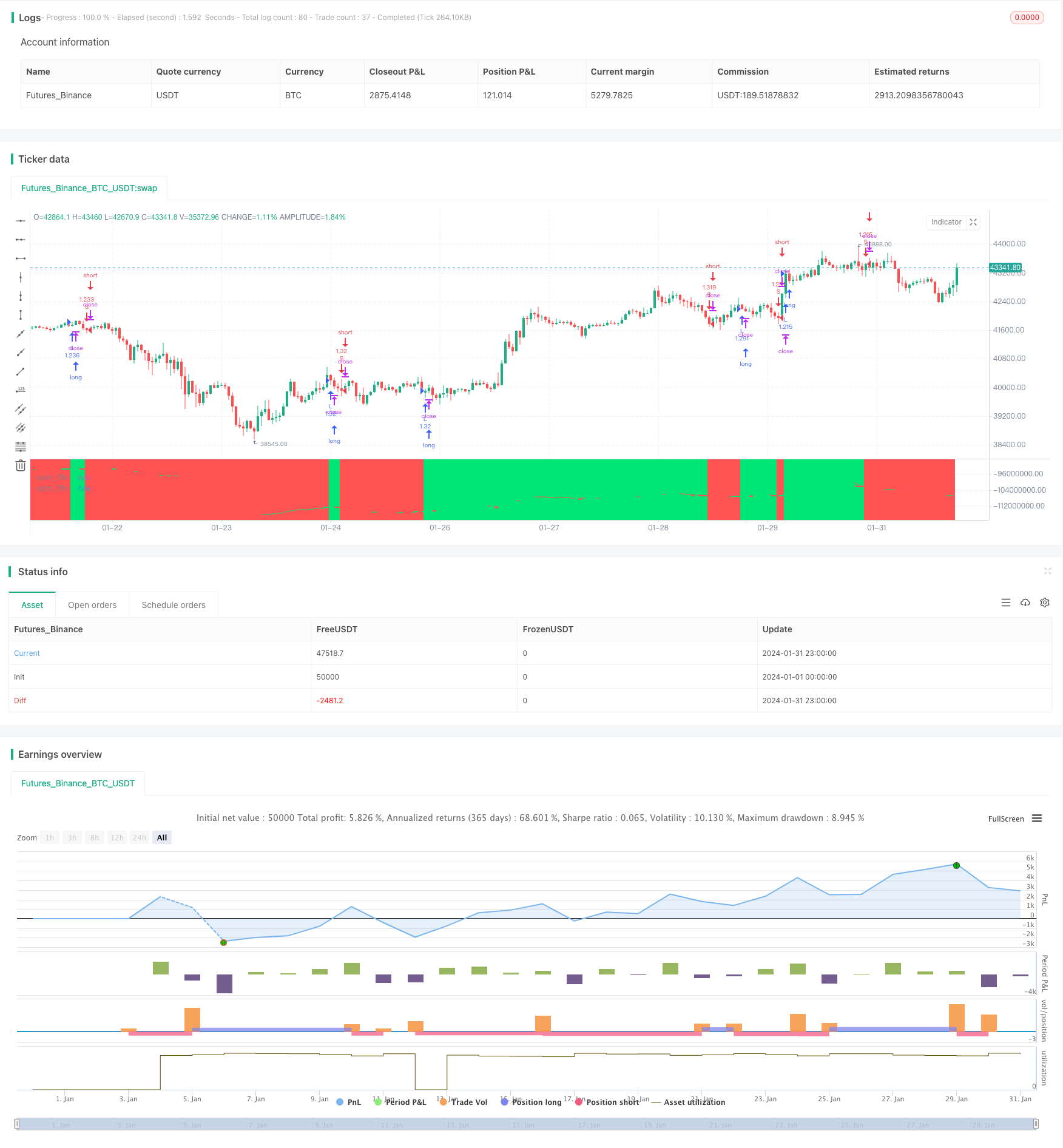

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("OBV EMA X BF 🚀", overlay=false, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.0)

/////////////// Time Frame ///////////////

testStartYear = input(2017, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay, 0, 0)

testStopYear = input(2019, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(31, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay, 0, 0)

testPeriod() => true

/////////////// OBV ///////////////

src = close

atr = atr(input(title="ATR Period", defval=3, minval=1))

atrmult = input(title="ATR Mult", defval=1, minval=0)

obv = cum(change(src) > 0 ? volume * (volume / atr) : change(src) < 0 ? -volume * (volume / atr) : 0 * volume / atr)

e1 = ema(obv, input(24))

e2 = ema(obv, input(6))

/////////////// Strategy ///////////////

long = crossover(e2, e1)

short = crossunder(e2, e1)

last_long = 0.0

last_short = 0.0

last_long := long ? time : nz(last_long[1])

last_short := short ? time : nz(last_short[1])

long_signal = crossover(last_long, last_short)

short_signal = crossover(last_short, last_long)

last_open_long_signal = 0.0

last_open_short_signal = 0.0

last_open_long_signal := long_signal ? open : nz(last_open_long_signal[1])

last_open_short_signal := short_signal ? open : nz(last_open_short_signal[1])

last_long_signal = 0.0

last_short_signal = 0.0

last_long_signal := long_signal ? time : nz(last_long_signal[1])

last_short_signal := short_signal ? time : nz(last_short_signal[1])

in_long_signal = last_long_signal > last_short_signal

in_short_signal = last_short_signal > last_long_signal

last_high = 0.0

last_low = 0.0

last_high := not in_long_signal ? na : in_long_signal and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_short_signal ? na : in_short_signal and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

since_longEntry = barssince(last_open_long_signal != last_open_long_signal[1])

since_shortEntry = barssince(last_open_short_signal != last_open_short_signal[1])

//////////////// Stop loss ///////////////

sl_inp = input(3.0, title='Stop Loss %') / 100

tp_inp = input(5000.0, title='Take Profit %') / 100

take_level_l = strategy.position_avg_price * (1 + tp_inp)

take_level_s = strategy.position_avg_price * (1 - tp_inp)

slLong = in_long_signal ? strategy.position_avg_price * (1 - sl_inp) : na

slShort = strategy.position_avg_price * (1 + sl_inp)

long_sl = in_long_signal ? slLong : na

short_sl = in_short_signal ? slShort : na

/////////////// Execution ///////////////

if testPeriod()

strategy.entry("L", strategy.long, when=long)

strategy.entry("S", strategy.short, when=short)

strategy.exit("L SL", "L", stop=long_sl, when=since_longEntry > 0)

strategy.exit("S SL", "S", stop=short_sl, when=since_shortEntry > 0)

/////////////// Plotting ///////////////

plot(e1, color = e1 > e1[1] ? color.lime : e1 < e1[1] ? color.red : color.white, linewidth = 2, offset = 0)

plot(e2, color = e2 > e2[1] ? color.lime : e2 < e2[1] ? color.red : color.white, linewidth = 1)

bgcolor(strategy.position_size > 0 ? color.lime : strategy.position_size < 0 ? color.red : color.white, transp=90)

bgcolor(long_signal ? color.lime : short_signal ? color.red : na, transp=60)