概述

这是一个非常简单的趋势跟随策略。它会在出现多头型公平价差时做多,出现空头型公平价差时平仓或做空。它在盘整行情下表现不佳,但在趋势行情中可以获得非常丰厚的利润。

策略原理

该策略的核心逻辑是识别公平价差形态。所谓“公平价差”,是指当天的最高价低于前一天的最低价,或当天的最低价高于前一天的最高价,会形成一个“突破的间隙”。这通常预示着可能的趋势转折。具体来说,策略规则是:

- 如果当天最高价低于前两天的最低价,且收盘价低于前两天最低价,则认为形成空头型公平价差,做空。

- 如果当天最低价高于前两天的最高价,且收盘价高于前两天的最高价,则认为形成多头型公平价差,做多。

这里使用了两个lag,也就是前两根K线的高低价来判断公平价差,这样避免被假突破或短期回调影响,提高形态判断的可靠性和信号质量。

策略优势

- 识别恰当的公平价差形态可以很好预测未来的趋势可能出现反转。

- 策略逻辑和规则简单清晰易于理解和实施。

- 可以快速捕捉到新的趋势机会。

策略风险

- 公平价差形态判断并不完全准确,如果短期里出现回调也会产生错误信号。

- 该策略会在趋势发生反转的时候出现亏损,需要及时止损防范风险。

- 在盘整行情中表现较差,会有更多的虚假信号和小额亏损。

优化方向

- 优化止损机制。可以结合动态ATR实现动态的风险控制。

- 优化过滤条件。可以基于成交量、均线指标等判断公平价差突破的可靠性。

- 结合多因子模型预测未来趋势概率。

总结

本策略识别公平价差的形成来判断趋势可能发生反转,属于基本的趋势跟随策略。优点是捕捉趋势反转的时机较为精准,但也存在一定的误报率。可以通过止损与过滤来控制风险,也可以结合更多因子来提高判断的准确性。总的来说,这是一个非常简单实用的趋势交易策略,值得拓展与优化。

策略源码

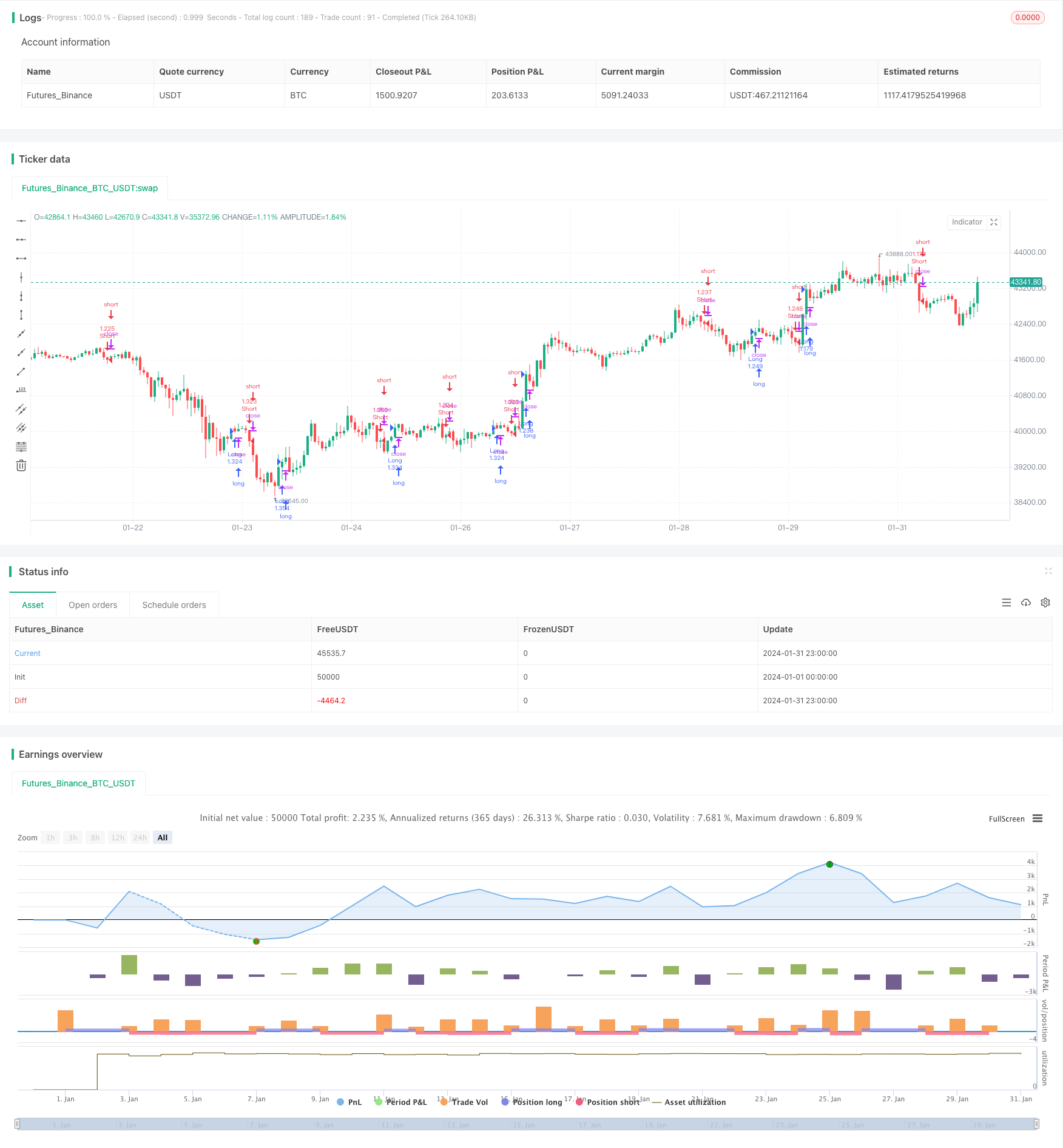

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Greg_007

//@version=5

strategy("Fair Value Gap Strategy", "FVG Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, pyramiding = 1)

var longOnly = input.bool(false, "Take only long trades?")

var pyramid = input.bool(false, "Since this can generate a lot of trades, make sure to fill in the commission (if applicable) for a realistic ROI.", group = "REMINDERS")

var pyramid2 = input.bool(false, "Modify pyramiding orders to increase the amount of trades.", group = "REMINDERS")

var bearFVG = false

var bullFVG = false

var plotBull = false

var plotBear = false

var bearTrend = false

var bullTrend = false

//BEARISH FVG

if high < low[2] and close[1] < low[2]

bullFVG := false

bearFVG := true

plotBear := true

if not longOnly

strategy.entry("Short", strategy.short)

else

strategy.close_all()

else

//BULLISH FVG

if low > high[2] and close[1] > high[2]

bullFVG := true

bearFVG := false

plotBull := true

strategy.entry("Long", strategy.long)

// plotshape(plotBull, style=shape.labeldown, location=location.abovebar, color=color.green, text="FVG",textcolor=color.white, size=size.tiny, title="Bull FVG", display=display.all - display.status_line)

// plotshape(plotBear, style=shape.labelup, location=location.belowbar, color=color.red, text="FVG",textcolor=color.white, size=size.tiny, title="Bear FVG", display=display.all - display.status_line)

// //reset the status

// plotBull := false

// plotBear := false