概述

本策略基于30日、60日和200日简单移动平均线的金叉和死叉形成交易信号。当短期移动平均线上穿长期移动平均线时,形成买入信号;当短期移动平均线下穿长期移动平均线时,形成卖出信号。该策略结合了趋势跟踪和均线交叉的优点,既可以抓住长期趋势,也可以在趋势转折点形成交易信号。

策略原理

本策略使用3条不同周期的简单移动平均线:30日线、60日线和200日线。其中,30日线代表短期趋势,200日线代表长期趋势,60日线作为中间参考。当短期趋势线上穿长期趋势线时,表示行情由盘整转为上涨,产生买入信号;当短期趋势下穿长期趋势线时,表示行情趋势由上涨转为盘整,产生卖出信号。

该策略同时结合了止损和止盈点来控制风险。在买入后设置了40点的止损空间,以控制亏损;同时设置了40点的止盈空间以锁定 profit。

优势分析

本策略具有以下优势:

结合趋势跟踪和瞬时信号的优点,既考虑了长期趋势判断,又SETS短期买卖点。

均线交叉 timesteps 明确,不易产生多次重复信号。

止损止盈设置合理,可以有效控制单笔亏损。

策略逻辑简单清晰,容易理解和实现。

移动平均线技术成熟稳定,应用广泛。

风险分析

本策略也存在一些风险:

短期止损可能被击穿,无法完全避免亏损。

金叉死叉信号可能出现假突破。

大盘震荡时,止损止盈难以设置合理。

参数設置如周期选择存在主观性,可能影响策略表现。

优化方向

本策略可以从以下几个方面进行优化:

创新止损机制,采用像跟踪止损、指数移动止损等动态止损方式,降低亏损风险。

优化参数选择,如测试更多周期参数的优劣,寻找最优参数组合。

增加仓位管理机制,通过资金管理优化整体 profit。

结合 momentum 指标等过滤假突破。

增加机器学习算法,利用大データ训练出更优规则。

总结

本文详细介绍了基于均线金叉死叉的交易策略。该策略以 30、60、200 日移动平均线交叉作为交易信号,兼顾趋势跟踪和瞬时点选时定位。止损止盈设置合理,可以有效控制单笔亏损。但也存在被套、假突破等风险。我们可以从改进止损方式、参数优化、资金管理等多方面进行策略增强和优化,使得策略更加稳定profit。

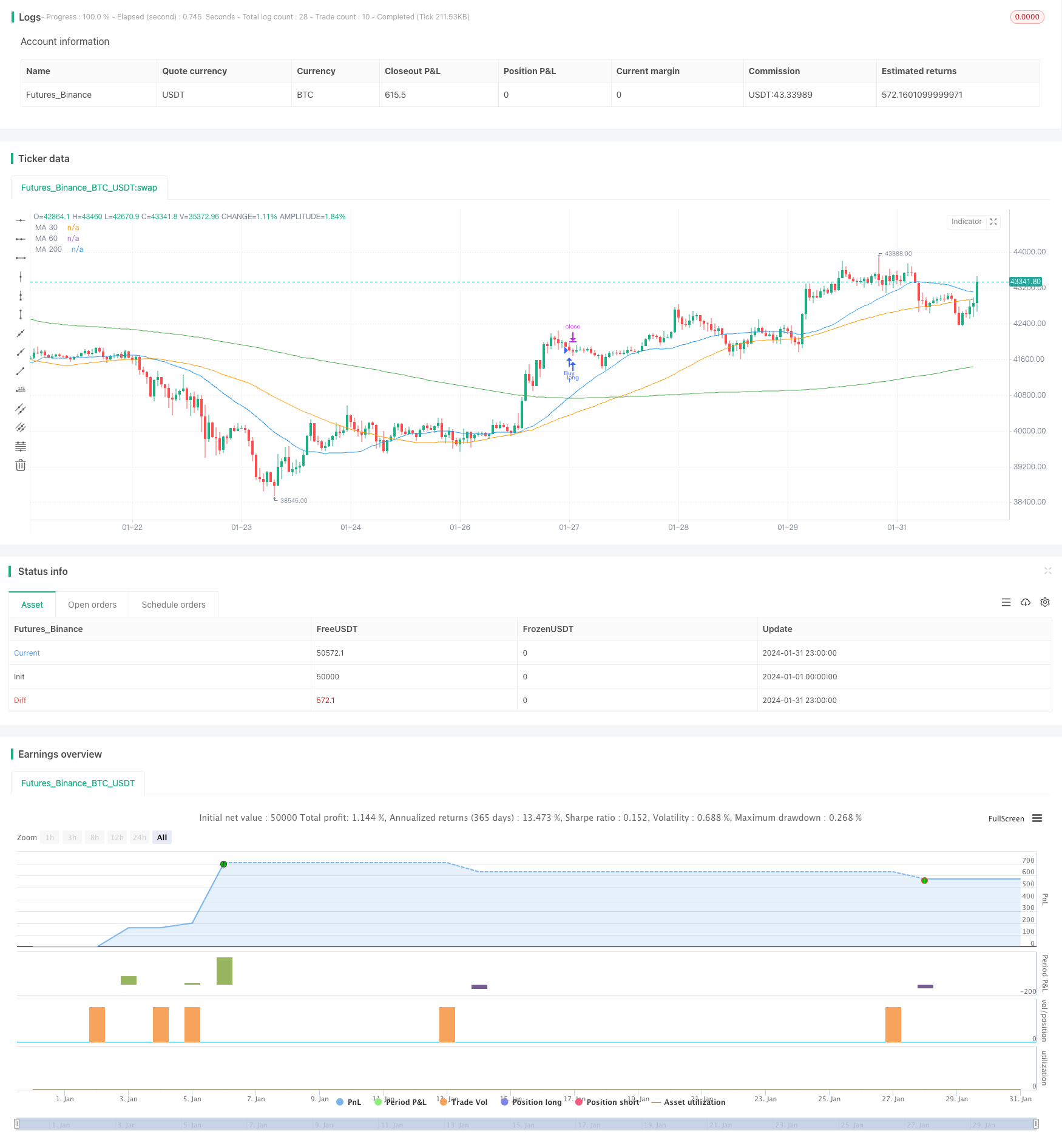

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia de Cruce de Medias Móviles", overlay=true)

// Medias móviles

ma30 = ta.sma(close, 30)

ma60 = ta.sma(close, 60)

ma200 = ta.sma(close, 200)

// Cruce de medias móviles

crossoverUp = ta.crossover(ma30, ma200)

crossoverDown = ta.crossunder(ma30, ma200)

// Señales de compra y venta

longCondition = crossoverUp

shortCondition = crossoverDown

// Ejecución de órdenes

if (longCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("Cover", "Buy", stop=close - 40.000, limit=close + 40.000)

if (shortCondition)

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=close + 40.000, limit=close - 40.000)

// Plot de las medias móviles

plot(ma30, color=color.blue, title="MA 30")

plot(ma60, color=color.orange, title="MA 60")

plot(ma200, color=color.green, title="MA 200")

// Condiciones para cerrar la posición contraria

if (strategy.position_size > 0)

if (crossoverDown)

strategy.close("Buy")

if (strategy.position_size < 0)

if (crossoverUp)

strategy.close("Sell")