概述

相对强弱指数发散策略是一种利用相对强弱指数(RSI)识别潜在价格反转机会的策略。该策略通过发现价格走势和RSI走势之间的背离来判断力量的减弱和潜在反转。

当价格走至新低但RSI并未走至新低时,就是多头背离,表示下跌动力在减弱,可能出现向上反转。当价格走至新高但RSI并未走至新高时,就是空头背离,提示上涨动力减弱,可能出现向下反转。

该策略将RSI的超买超卖水平与背离判定相结合,以优化入场和出场时机,捕捉市场反转,提高交易准确性和盈利能力。适用于各类交易品种,是交易者在市场波动中低吸高抛的有效工具。

策略原理

相对强弱指数发散策略基于以下几个关键判断:

计算RSI值:通过计算一定周期内的平均涨幅和平均跌幅,得到0-100区间的RSI指标。

判断超买超卖:当RSI上穿设定的超买线(如70)为超买;当RSI下穿设定的超卖区间(如30)为超卖。

识别背离:判断最新价格走势与RSI走势是否一致。如果价格创新高(低)而RSI没有,就是背离现象。

结合进入和退出:多头背离伴随RSI超卖区间出现时为做多信号。空头背离伴RSI超买现象为做空信号。

设置止盈止损:RSI重新进入超买超卖区间时平仓止盈。

通过比较价格波动与RSI变化判断市场力量,策略可以在反转前低吸高抛,套利市场的不合理波动。

策略优势

相对强弱指数发散策略具有以下优势:

捕捉市场反转:策略擅长发现价格和RSI之间的背离,判断市场力量衰竭,捕捉反转机会。

配合超买超卖:结合RSI指标本身的超买超卖水平,有助于进一步优化入场和出场点位。

策略简单易行:相对简单的逻辑和参数设置,易于理解和实施。

通用性强:适用于差价合约、数字货币和股票等不同品种,使用广泛。

提高盈利:相对机械化的系统策略,回撤可控,助力打造长期稳定收益。

策略风险

相对强弱指数发散策略也存在以下风险:

错误信号风险:价格和RSI之间的背离不一定会持续或者反转成功,存在错误信号。

参数优化难:RSI参数、超买超卖线等设置对结果有很大影响,需要不断测试优化。

市场异常风险:在市场出现异常波动或者策略普遍滥用时,会失败。

技术指标滞后:RSI等技术指标总体上属于滞后的,无法准确判定反转点。

通过严格的风控,调整参数设置,结合其他因素分析,可以在一定程度上降低风险。

策略优化方向

相对强弱指数发散策略还可以从以下方面进行优化:

优化RSI参数:调整RSI计算周期,测试不同天数参数的实际效果。

结合其他指标:与MACD,KD等其他技术指标结合使用,形成交叉验证。

增加止损方式:除了原有的止盈之外,设置移动止损或振荡止损。

适应更多品种:进行针对不同交易品种的参数调整,扩大适用范围。

利用深度学习:使用RNN等深度学习模型对RSI背离进行判断,减少错误信号。

总结

相对强弱指数发散策略通过比较价格变动和RSI变化判断市场中反转机会。策略简单清晰,通用性强,能有效捕捉短期反转,获取超额收益。但也存在一定程度作用有限的风险,需要持续优化测试以适应市场。

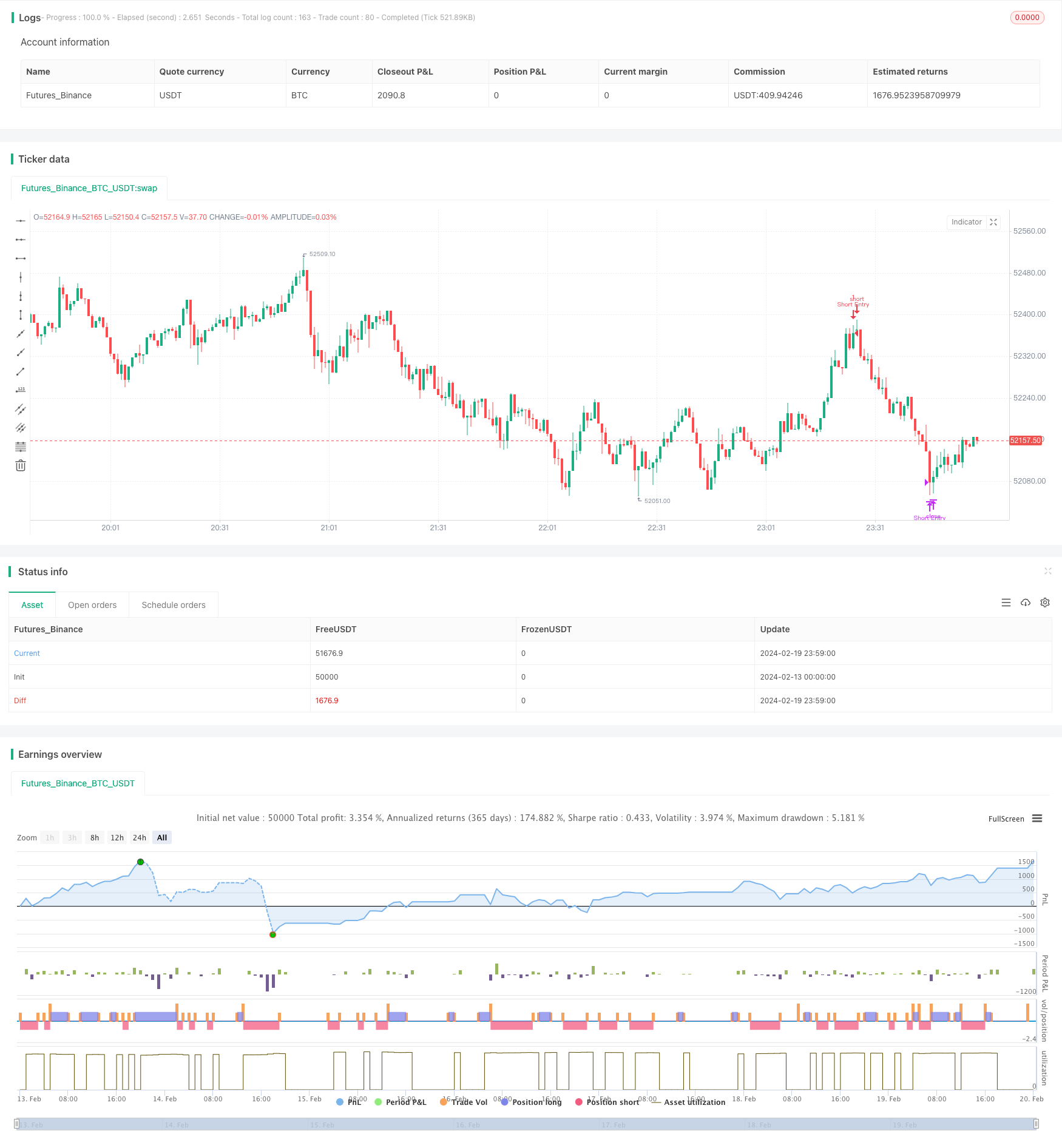

/*backtest

start: 2024-02-13 00:00:00

end: 2024-02-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI Divergence Strategy", overlay=true)

// RSI Parameters

rsiLength = input(14, "RSI Length")

overboughtLevel = input(70, "Overbought Level")

oversoldLevel = input(30, "Oversold Level")

rsiValue = ta.rsi(close, rsiLength)

// Divergence detection

priceLow = ta.lowest(low, rsiLength)

priceHigh = ta.highest(high, rsiLength)

rsiLow = ta.lowest(rsiValue, rsiLength)

rsiHigh = ta.highest(rsiValue, rsiLength)

bullishDivergence = low < priceLow[1] and rsiValue > rsiLow[1]

bearishDivergence = high > priceHigh[1] and rsiValue < rsiHigh[1]

// Strategy Conditions

longEntry = bullishDivergence and rsiValue < oversoldLevel

longExit = rsiValue > overboughtLevel

shortEntry = bearishDivergence and rsiValue > overboughtLevel

shortExit = rsiValue < oversoldLevel

// ENTER_LONG Condition

if (longEntry)

strategy.entry("Long Entry", strategy.long)

// EXIT_LONG Condition

if (longExit)

strategy.close("Long Entry")

// ENTER_SHORT Condition

if (shortEntry)

strategy.entry("Short Entry", strategy.short)

// EXIT_SHORT Condition

if (shortExit)

strategy.close("Short Entry")