概述

该策略是一个基于Nifty 50指数的高频量化交易策略。它通过跟踪Nifty 50指数的价格变化,结合开放利益变化情况,在支持位附近采取逢低买入,在阻力位附近采取逢高卖出的操作,实现盈利。

策略原理

该策略首先获取Nifty 50指数的开放利益变化情况。然后它会根据设置的支持阻力位,以及开放利益变化幅度的阈值,产生买入和卖出信号。具体来说:

- 当指数价位接近支持位,且开放利益变化超过设定的买入阈值时,产生买入信号

- 当指数价位接近阻力位,且开放利益变化低于设定的卖出阈值时,产生卖出信号

通过这种方式,可以在支持位附近进行逢低买入操作,在阻力位附近进行逢高卖出操作,进而获利。

优势分析

该策略具有以下几个优势:

- 操作频率高,可以捕捉短期价格波动,盈利空间大

- 利用开放利益信息辅助决策,可以更准确判断市场情绪

- 支持动态调整仓位,可以根据市场情况灵活应对

- 简单容易理解,参数调整也较为方便

- 可扩展性强,可以考虑融入机器学习等算法进一步优化

风险分析

该策略也存在一些风险:

- 高频交易带来的滑点风险。可以适当放宽买卖条件以减少交易频率。

- 支持阻力位设定不当,可能错过交易机会或增大亏损。应定期评估调整参数。

- 开放利益信息存在滞后,可能出现信号发出不准确。可以考虑多因子模型。

- 回测期限过短,可能高估了策略收益。应在更长的回测周期内验证策略稳健性。

优化方向

该策略可以从以下几个方面进行进一步优化:

- 增加止损逻辑,可以有效控制单笔亏损

- 结合波动率、成交量等指标设定动态交易信号

- 增加机器学习算法,实现参数的自动优化和调整

- 扩展多品种交易,进行股指期货和选股的组合

- 增加量化风控模块,可以更好地控制整体的尾部风险

总结

本策略是一个简单高效的基于Nifty 50的量化交易策略。它具有操作频率高、利用开放利益信息、支持动态调仓等优势,也存在一定的改进空间。总体来说,该策略为打造多因子、自动化、智能化的量化交易系统奠定了坚实的基础。

策略源码

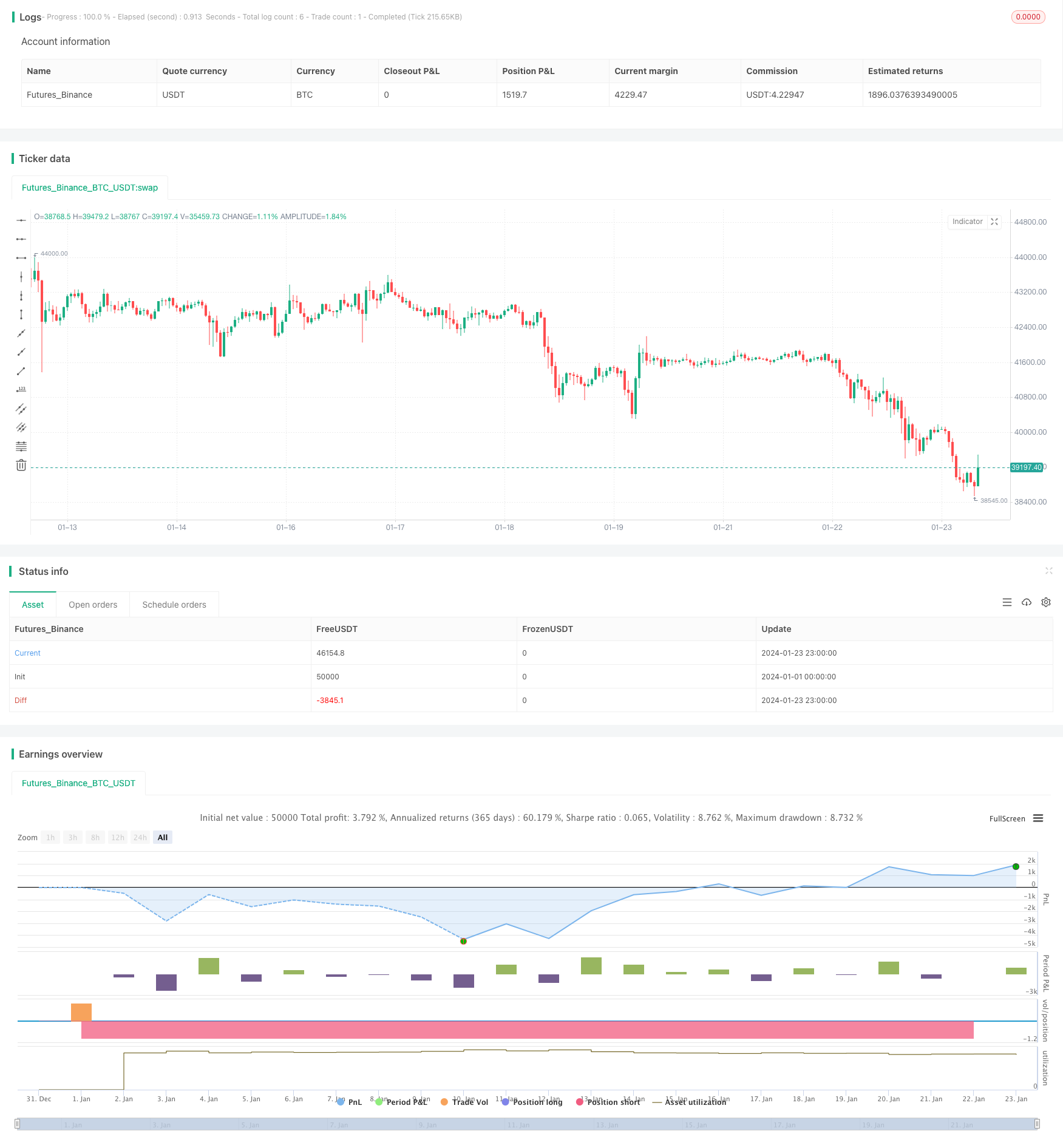

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Intraday Nifty 50 Bottom Buying and Selling with OI Strategy", overlay=true)

// Input parameters

niftySymbol = input("NIFTY50", title="Nifty 50 Symbol")

oiLength = input(14, title="Open Interest Length")

supportLevel = input(15000, title="Support Level")

resistanceLevel = input(16000, title="Resistance Level")

buyThreshold = input(1, title="Buy Threshold")

sellThreshold = input(-1, title="Sell Threshold")

// Fetch Nifty 50 open interest

oi = request.security(niftySymbol, "D", close)

// Calculate open interest change

oiChange = oi - ta.sma(oi, oiLength)

// Plot support and resistance levels

plot(supportLevel, color=color.green, title="Support Level")

plot(resistanceLevel, color=color.red, title="Resistance Level")

// Plot open interest and open interest change

plot(oi, color=color.blue, title="Open Interest")

plot(oiChange, color=color.green, title="Open Interest Change")

// Trading logic

buySignal = close < supportLevel and oiChange > buyThreshold

sellSignal = close > resistanceLevel and oiChange < sellThreshold

// Execute trades

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.entry("Sell", strategy.short, when=sellSignal)