概述

该策略主要利用前一交易日的最高价、最低价和收盘价作为当日的支撑和阻力位,在突破阻力位时做多,在回测试支撑位时做空,属于典型的突破策略。

策略原理

代码首先定义了一个计算支撑阻力位的函数calculateSupportResistance,该函数提取前一交易日的最高价、最低价和收盘价,作为当日的支撑阻力位。

然后在主逻辑中调用该函数获取这三个价格位并绘图显示出来。

在回测逻辑中,如果收盘价低于前一日最低价同时当前价高于该最低价构成突破,则做多;如果收盘价高于前一日最高价同时当前价低于该最高价构成突破,则做空。

通过这样的突破模型实现对趋势的判断和交易信号的产生。

策略优势

- 使用前一交易日的数据构建当日的支撑阻力位,避免了参数优化的问题

- 支撑阻力位来自真实市场交易数据,具有一定的参考价值

- 回测模型简单直接,容易理解实现

- 可视化显示支撑阻力位,形成对价格的感知

- 实时监控突破情况,及时捕捉交易机会

策略风险

- 支撑阻力位会随着时间推移变化,无法确定其有效性

- 无法预测趋势方向,存在错过反转的风险

- 容易受到假突破的影响,出现过早入场的风险

- 无法确定突破持续性,存在过早止损的可能

- 大盘剧烈波动时,个股支撑阻力失效的可能较大

对策:

- 结合更多因素判断突破的有效性

- 适当放大止损幅度,确保抓住趋势

- 分批建立头寸,降低个股波动的影响

策略优化

- 增加更多历史数据判断支撑阻力位,如5日线、10日线价格

- 结合交易量等指标判断突破的有效性

- 根据实际波动率设置止损位

- 优化资金管理,控制单笔损失

总结

该策略整体来说属于典型的突破策略,简单直观,通过前一交易日数据构建当日支撑阻力,回测该位突破做多做空。优点是容易理解实现,可直接看到支撑阻力;缺点是存在假突破风险,无法确定趋势持续性。下一步可从确定突破效力、控制风险、优化资金管理等方面进行优化。

策略源码

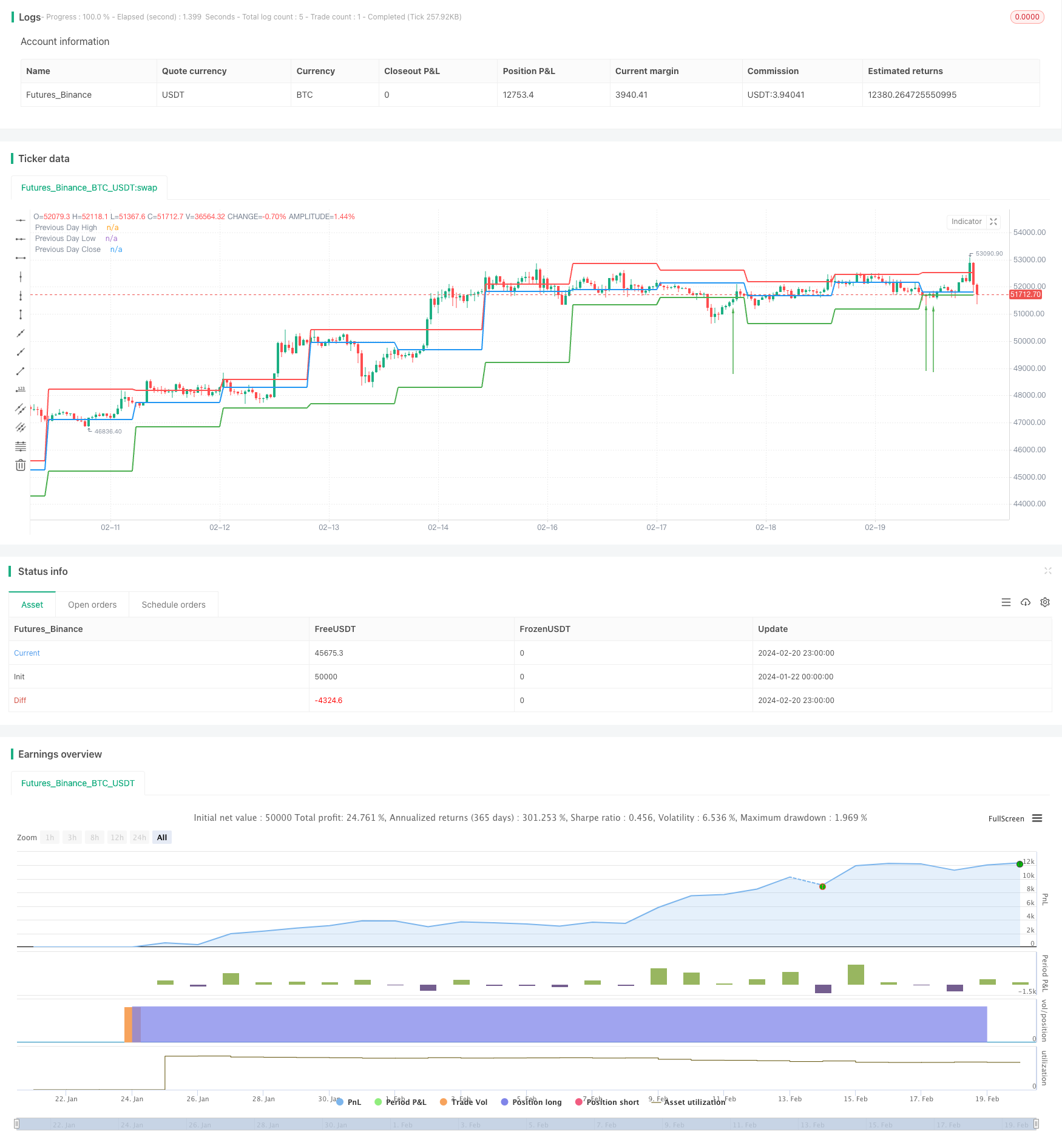

/*backtest

start: 2024-01-22 00:00:00

end: 2024-02-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Support and Resistance with Backtesting", overlay=true)

// Function to calculate support and resistance levels

calculateSupportResistance() =>

highPrevDay = request.security(syminfo.tickerid, "D", high[1], lookahead=barmerge.lookahead_on)

lowPrevDay = request.security(syminfo.tickerid, "D", low[1], lookahead=barmerge.lookahead_on)

closePrevDay = request.security(syminfo.tickerid, "D", close[1], lookahead=barmerge.lookahead_on)

[highPrevDay, lowPrevDay, closePrevDay]

// Call the function to get support and resistance levels

[supResHigh, supResLow, supResClose] = calculateSupportResistance()

// Plotting support and resistance levels

plot(supResHigh, color=color.red, linewidth=2, title="Previous Day High")

plot(supResLow, color=color.green, linewidth=2, title="Previous Day Low")

plot(supResClose, color=color.blue, linewidth=2, title="Previous Day Close")

// Backtesting logic

backtestCondition = close[1] < supResLow and close > supResLow

strategy.entry("Long", strategy.long, when=backtestCondition)

// Plotting buy/sell arrows for backtesting

plotarrow(backtestCondition ? 1 : na, colorup=color.green, offset=-1, transp=0)