概述

震荡突破策略是一个用于主流加密货币15分钟时间框架的积极交易策略。它利用技术指标来识别市场趋势,发现潜在的突破点,并通过设定止损来有效管理风险。

策略原理

该策略使用两条简单移动平均线(SMA50和SMA200)来确定市场趋势方向。当SMA50上穿SMA200时为看涨信号,反之则为看跌信号。

相对强弱指数(RSI)被用来判断超买超卖情况。当RSI低于设定的超卖区域(默认为40)时为超卖区,视为潜在买入信号。

具体交易逻辑是:

- RSI低于40并且收盘价高于SMA200构成买入条件;

- 进入长仓;

- 止损设定为入场价的5%;

- 如果SMA50下穿SMA200且RSI高于50时平仓以锁定利润。

该策略简单易行,通过双重确认来寻找潜在的突破点。止损设置防止亏损扩大,SMA指标的交叉作为退出信号。

优势分析

该策略具有以下优势:

- 策略操作简单,容易实施;

- 利用双移动平均线过滤假突破,确保突破VALIDITY;

- RSI指标识别超卖区形成买入时机;

- 包含止损来主动控制风险;

- SMA交叉作为退出机制。

风险分析

该策略也存在一些风险:

- 市场出现剧烈波动时,止损可能被突破;

- SMA期限设置不当可能错过趋势;

- 多头行情中空仓时间过长影响收益。

可以通过以下方法加以优化:

- 动态调整止损幅度;

- 优化SMA参数;

- 考虑增加其他因子判断持仓时机。

总结

总的来说,震荡突破策略是一个简单实用的短线策略。它具有操作简便,风险可控等优点,适合对加密货币市场不太熟悉的交易者。通过进一步优化,可以使策略在更多市场环境下保持稳定收益。

策略源码

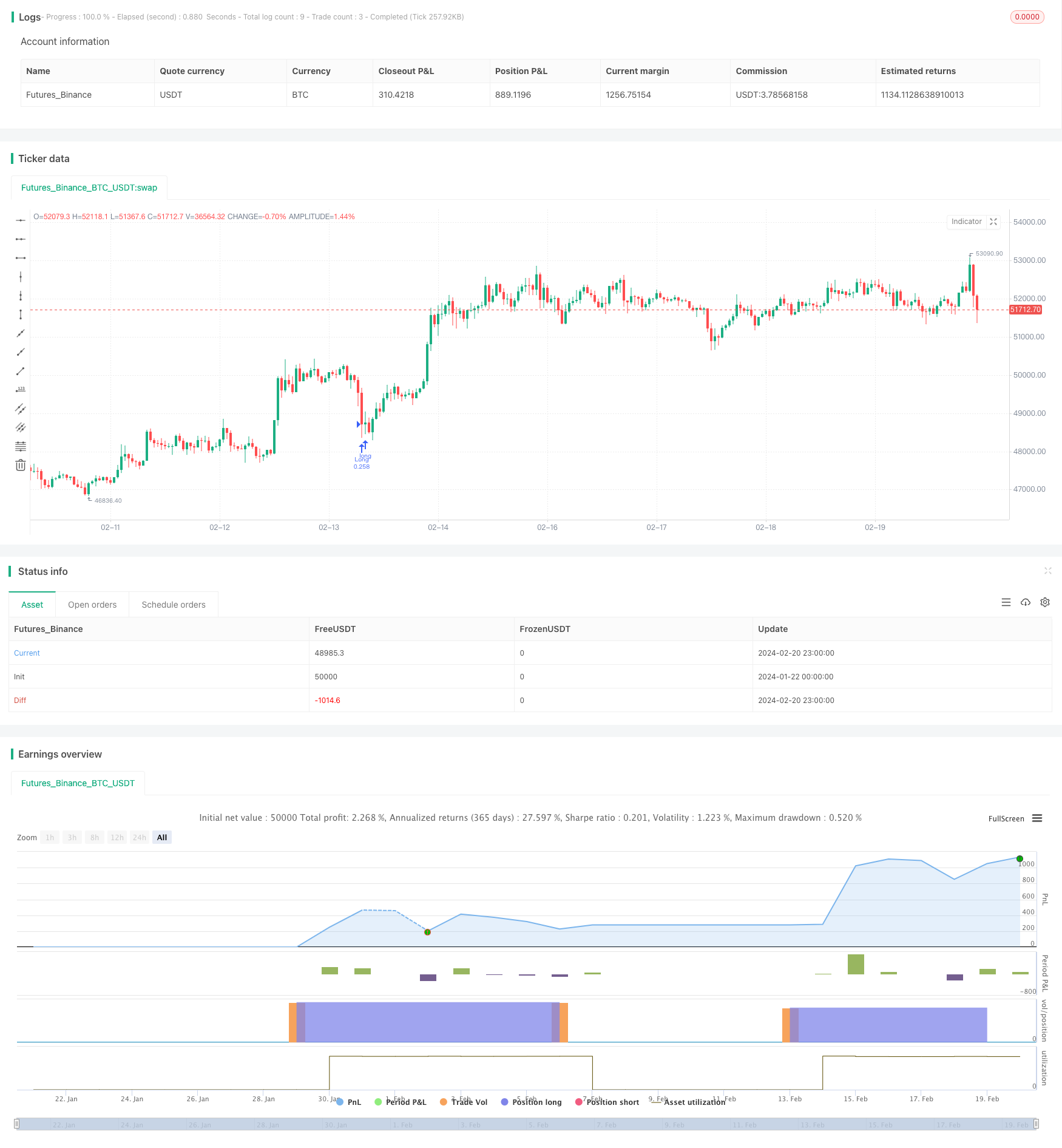

/*backtest

start: 2024-01-22 00:00:00

end: 2024-02-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Wielkieef

//@version=5

strategy("Crypto Sniper [15min]", shorttitle="ST Strategy", overlay=true, pyramiding=1, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=25, calc_on_order_fills=false, slippage=0, commission_type=strategy.commission.percent, commission_value=0.03)

sma50Length = input(90, title=" SMA50 Length", group="Simple Moving Average")

sma200Length = input(170, title=" SMA200 Length", group="Simple Moving Average")

rsiLength = input(14, title=" RSI Length", group="Relative Strenght Index")

overSoldLevel = input(40, title=" Oversold Level", group="Relative Strenght Index")

sl = input.float(5.0, '% Stop Loss', step=0.1)

rsi = ta.rsi(close, rsiLength)

sma50 = ta.sma(close, sma50Length)

sma200 = ta.sma(close, sma200Length)

longCondition = rsi < overSoldLevel and close > sma200

if (longCondition)

strategy.entry("Long", strategy.long)

stopLossPrice = strategy.position_avg_price * (1 - sl / 100)

strategy.exit("Stop Loss", stop=stopLossPrice)

if (ta.crossunder(sma200, sma50) and rsi >= 50)

strategy.close("Long")

Bar_color = ta.crossunder(sma200, sma50) and rsi >= 50 ? color.orange : rsi < overSoldLevel ? color.maroon : strategy.position_avg_price != 1 ? color.green : color.gray

barcolor(color=Bar_color)

//by wielkieef