概述

趋势捕手-MACD动量复合均线策略是一种精妙的交易工具,专为追踪市场趋势的交易者设计。该策略建立在平均真实波动范围(ATR)、简单移动平均线(SMA)和移动平均聚散指标(MACD)的强大组合基础之上,通过过滤和精确确认交易信号进入。

策略原理

ATR止损

利用ATR指标动态调整止损价位。可自定义ATR长度和ATR乘数,策略随市场波动自动调整,提供平衡的风险管理。

SMA趋势过滤

采用SMA作为趋势过滤器。通过调整SMA周期参数,用户可以将策略与首选的市场趋势时间范围对齐,增强策略的适应性。

MACD确认信号

整合MACD指标细化入市信号。策略通过比较MACD线与信号线,区分潜在的多头和空头信号,确保交易与基本面势头一致。

入市逻辑

多头:当价格收盘高于SMA,并且前一周期低于SMA时,同时MACD线上穿信号线时,做多。入市价设置为当前价格加上ATR止损距离。

空头:当价格收盘低于SMA,并且前一周期高于SMA时,同时MACD线下穿信号线时,做空。入市价设置为当前价格减去ATR止损距离。

策略优势

该策略汲取市场波动、趋势和动量指标的精髓,构建系统的入市和风险管理机制。其指标的融合提高了策略在不同市况下的适应性,是参与趋势性行情的理想工具。

通过跟踪市场趋势动力,趋势捕手策略可协助交易者发现盈利机会。调整参数以匹配个人交易风格,观察策略如何在揭示市场有利交易点方面发挥重要作用。

风险分析

趋势捕手策略依赖指标组合判断市场状态,存在某些市况下判断失误的可能。此外,趋势反转可能导致亏损增加。

可通过适当调整参数降低假信号,或设置更宽松的止损距离。当出现异常行情时,亦可暂停策略,避免异常波动带来的损失。

优化思路

参数优化

可对ATR长度、SMA周期和MACD参数进行测试和优化,找出最适合自身风格的数值。

增加过滤器

可加入其他指标作为辅助过滤器,如KDJ、OBV等,提高策略准确性。或增加附加条件如交易量放大,避免被套。

止损策略

可设置曲线止损或振荡止损,通过追踪价格实时调整止损距离,降低亏损风险。

总结

趋势捕手-MACD动量复合均线策略汇聚市场波动、趋势和动量等多重指标判断力,构建精准的入市确认机制和风险控制体系。通过参数调整可配合个人交易方式,助力抓住市场机会。该策略值得量化交易者深入研究和应用。

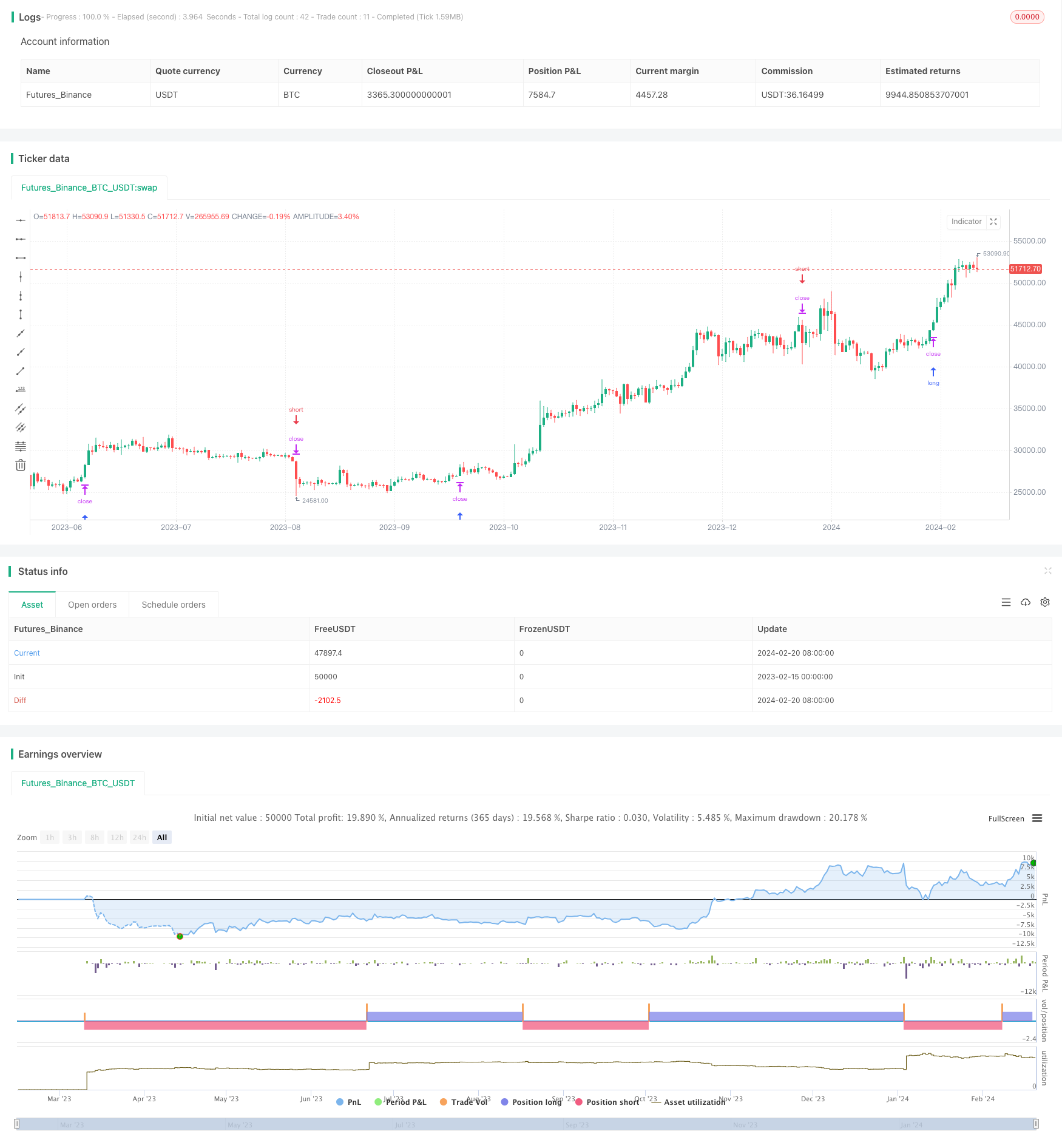

/*backtest

start: 2023-02-15 00:00:00

end: 2024-02-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("trend_hunter", overlay=true)

length = input(20, title="ATR Length")

numATRs = input(0.75, title="ATR Multiplier")

atrs = ta.sma(ta.tr, length) * numATRs

// Trend Filter

smaPeriod = input(32, title="SMA Period")

sma = ta.sma(close, smaPeriod)

// MACD Filter

macdShortTerm = input(12, title="MACD Short Term")

macdLongTerm = input(26, title="MACD Long Term")

macdSignalSmoothing = input(9, title="MACD Signal Smoothing")

[macdLine, signalLine, _] = ta.macd(close, macdShortTerm, macdLongTerm, macdSignalSmoothing)

// Long Entry with Trend and MACD Filter

longCondition = close > sma and close[1] <= sma[1] and macdLine > signalLine

strategy.entry("Long", strategy.long, stop=close + atrs, when=longCondition, comment="Long")

// Short Entry with Trend and MACD Filter

shortCondition = close < sma and close[1] >= sma[1] and macdLine < signalLine

strategy.entry("Short", strategy.short, stop=close - atrs, when=shortCondition, comment="Short")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_area)