概述

动量突破EMA交叉策略充分利用动量指标与移动平均线的交叉信号,识别股价中的趋势与反转机会。该策略采用快速EMA线与慢速EMA线的金叉与死叉,判断市场潜在的多头与空头机会。此外,该策略还引入中长线趋势判断指标——中轨SMA指标,对原有EMA交叉信号进行过滤,以确保仅在市场总体趋势方向一致时,才产生交易信号。

策略原理

该策略主要由三部分组成:

快速EMA线(9日线)与慢速EMA线(21日线)的交叉运算。EMA交叉金叉为买入信号,死叉为卖出信号。该部分利用EMA指标对股价的趋势性与反转性进行判断。

中长线趋势判断指标:50日SMA指标。该指标反映了中长线的价格走势,可用来识别总体趋势的方向。

动量指标:以收盘价与SMA中轨的比较,作为决定是否发出交易信号的动量过滤条件。仅在收盘价突破中轨方向时,才产生实际的交易信号。

在具体实施时,该策略以9日EMA与21日EMA的交叉作为基本判断buy/sell的输入信号。而后在该信号发出时,再检验收盘价是否突破50日SMA中轨,以判断总体趋势的方向。仅当基本交易信号与总体趋势方向一致的时候,才会最终产生实际的买入与卖出信号,并对应建立看多或看空的头寸。

策略优势

能有效识别股价中的趋势性机会,捕捉中长线精确的涨跌方向。

借助动量指标有效过滤掉部分噪音与反转信号,减少不必要的头寸打开与关闭。

EMA交叉与SMA过滤器的配合使用,可产生比较理想的稳定盈利模式。

策略风险

在震荡格局中,EMA交叉信号可能过于频繁,造成频繁交易与滑点损耗。

SMA中轨指标的参数设定可能不当,未能有效确认中长线趋势。

EMA与SMA参数选择不当,响应速度与稳定性失衡,可能出现平滑后的延迟。

风险解决思路

优化参数,寻找最佳的参数组合;

增加其他指标验证信号,确保交易信号的质量;

适当调整仓位管理,控制单次交易风险。

策略优化方向

测试更多参数组合,寻找最优参数;

增加价格突破,成交量等条件来确定趋势;

尝试不同的MA指标,如KDJ,MACD等判断潜在趋势;

优化仓位管理方式,通过风险管理进一步控制回撤。

总结

动量突破EMA交叉策略中,EMA交叉为基础信号,SMA中轨与价格关系的比较作为确认过滤器。这种思路充分利用指标联合使用的优势,提高了信号质量。有效解决了单一使用EMA时,出现过多反转信号的问题。该策略较好地平衡了捕捉趋势性机会与识别反转机会,实现了盈利模式的优化。未来可从参数选择与组合、仓位管理等方面进行深入优化。

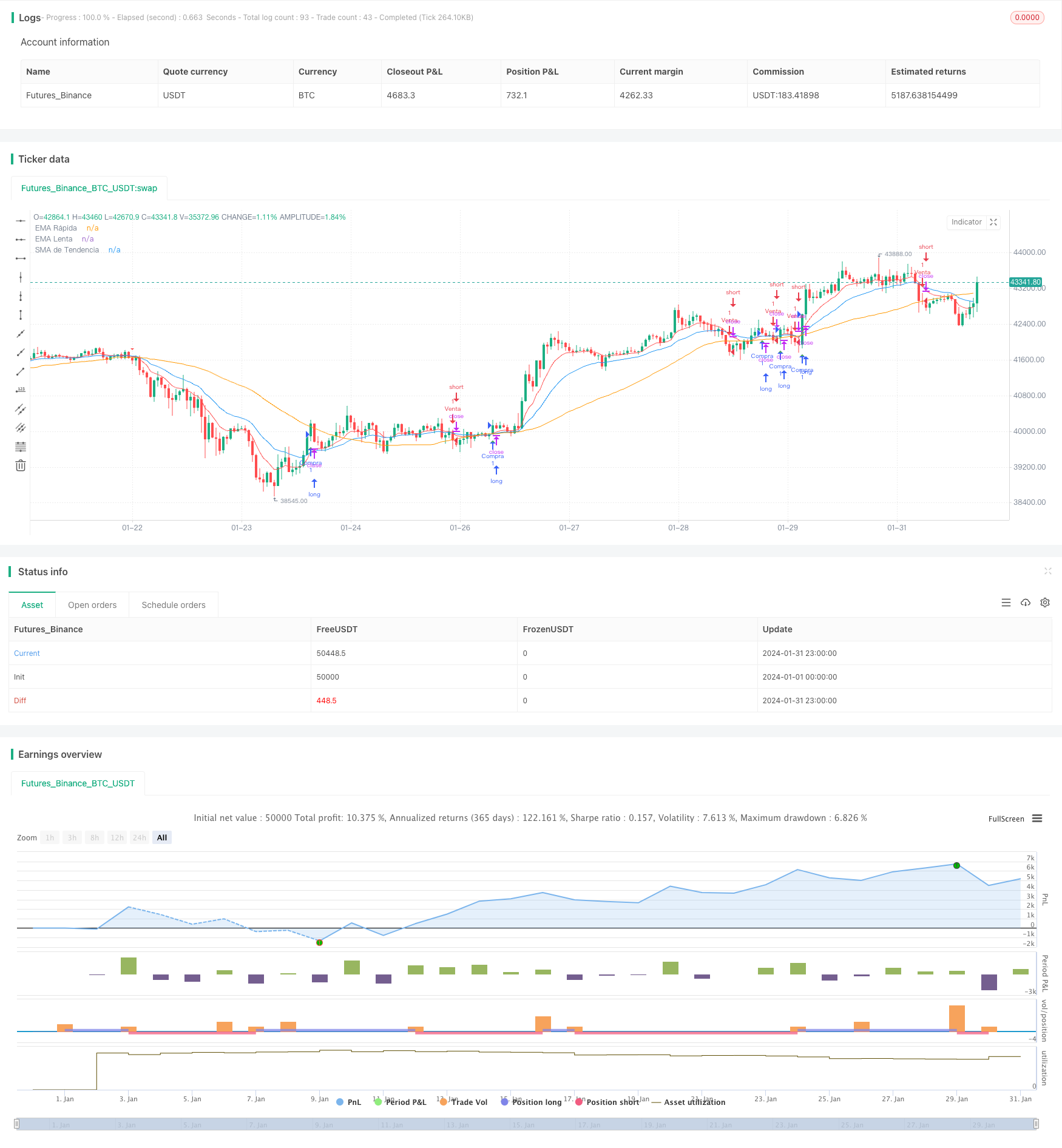

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia EMA Cruzada con Filtro de Tendencia", overlay=true)

// Configuración de EMAs

fastLength = input(9, title="Longitud EMA Rápida")

slowLength = input(21, title="Longitud EMA Lenta")

emaFast = ta.ema(close, fastLength)

emaSlow = ta.ema(close, slowLength)

// Configuración del filtro de tendencia

trendSMA = ta.sma(close, 50)

// Condiciones de entrada mejoradas con filtro de tendencia

longCondition = ta.crossover(emaFast, emaSlow) and close > trendSMA

shortCondition = ta.crossunder(emaFast, emaSlow) and close < trendSMA

// Ejecutar entradas y salidas

if (longCondition)

strategy.entry("Compra", strategy.long)

if (shortCondition)

strategy.entry("Venta", strategy.short)

// Dibujar EMAs y SMA en el gráfico

plot(emaFast, color=color.red, title="EMA Rápida")

plot(emaSlow, color=color.blue, title="EMA Lenta")

plot(trendSMA, color=color.orange, title="SMA de Tendencia")

// Indicadores visuales para las señales de compra y venta

plotshape(series=longCondition, title="Señal de Compra", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=shortCondition, title="Señal de Venta", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)