概述

该策略通过计算两条不同参数设置的移动平均线,并比较其交叉情况来判断价格趋势方向,从而实现趋势追踪交易。当快速移动平均线从下方突破慢速移动平均线时,判断为看涨信号;当快速移动平均线从上方下破慢速移动平均线时,判断为看跌信号。该策略可以通过参数设置实现对不同周期的趋势判断。

策略原理

本策略使用两组不同参数设置的移动平均线进行比较,第一个移动平均线参数由len1和type1设置,第二个移动平均线参数由len2和type2设置。其中len1和len2分别代表两条移动平均线的周期长度,type1和type2代表移动平均线的算法类型。

当快速移动平均线从下方突破慢速移动平均线形成金叉时,判断为看涨信号;当快速移动平均线从上方下破慢速移动平均线形成死叉时,判断为看跌信号。

根据交叉信号的方向,执行做多或做空操作。当看涨信号触发时,如果needlong参数为true,则按照default_qty_value的数量或仓位percentage_of_equity的百分比做多;当看跌信号触发时,如果needshort参数为true,则按照default_qty_value的数量或仓位percentage_of_equity的百分比做空。

策略优势

- 支持7种不同类型的移动平均线进行组合,能灵活适应市场环境

- 可自定义两条移动平均线的参数,实现对长期趋势和中短期趋势的判断

- 策略信号判断规则简单清晰,容易理解实现

- 支持做多和做空操作,可以进行趋势追踪交易

风险及解决

移动平均线具有滞后性,可能错过价格反转点 解决方法:适当缩短移动平均线周期,或与其他指标组合使用

不适用于具有高波动率和频繁反转的市场 解决方法:增加过滤条件,避免在震荡行情中交易

存在一定的假信号风险 解决方法:加入其他过滤指标进行组合,提高信号的可靠性

优化方向

- 优化移动平均线的周期组合,分别测试长短周期参数对策略收益率的影响

- 测试不同类型移动平均线的绩效表现,找出最佳移动平均线算法

- 加入交易量VARIABLE或布林通道等指标进行组合,提高信号质量

- 优化仓位管理策略,改进固定仓位percentage_of_equity的方式

总结

本策略通过比较两条移动平均线的交叉情况判断价格趋势,并进行相应的看涨看跌操作,从而实现对趋势的捕捉和跟踪获利。策略优点是信号规则简单清晰,参数可调节,适用性强,能对多种市场环境进行优化调整。需要注意防范移动平均线滞后以及震荡行情的风险,可通过加入其它指标进行过滤以提高信号质量。

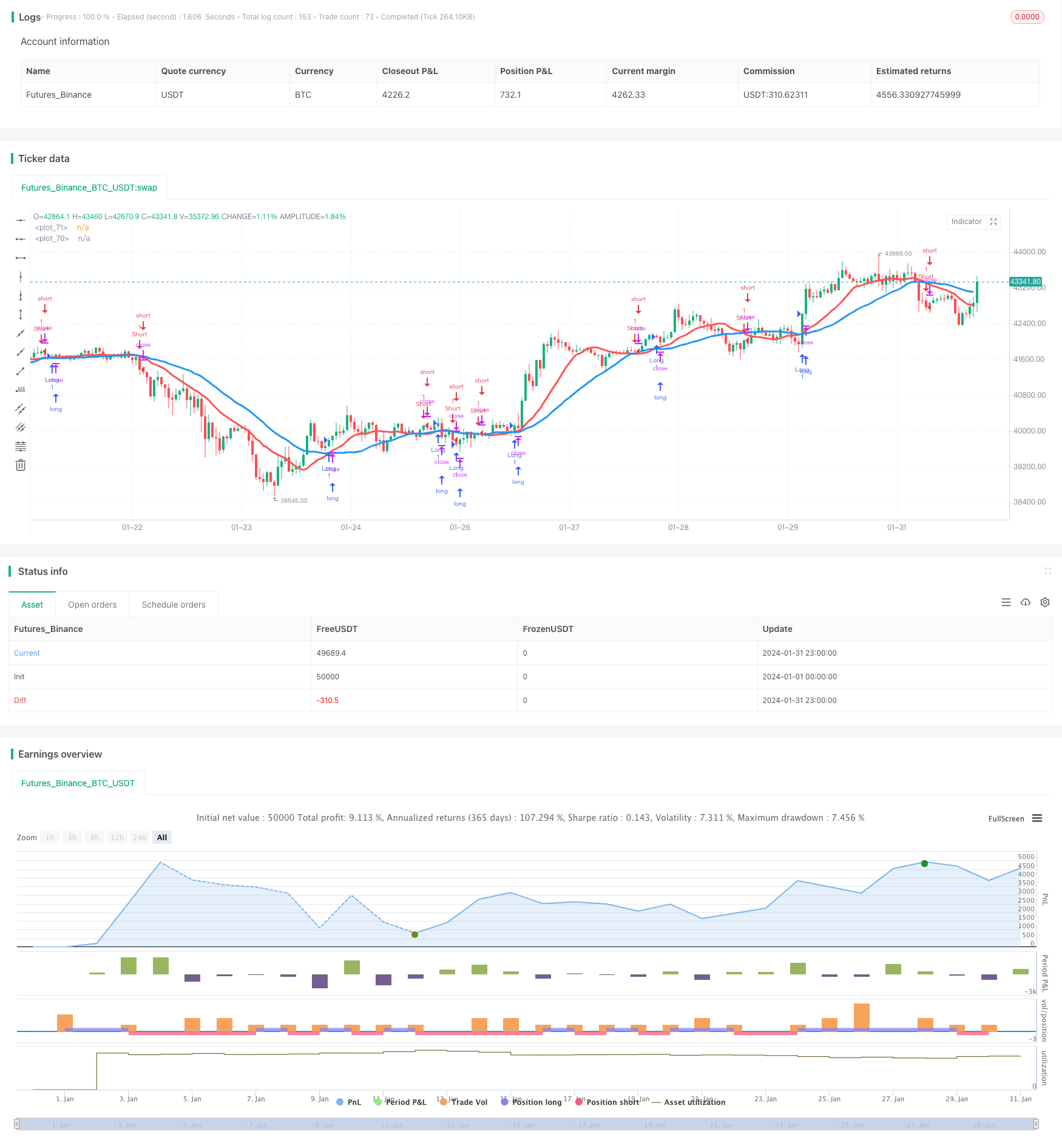

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Noro's MAs Cross Tests v1.0", shorttitle = "MAs Cross tests 1.0", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100.0, pyramiding = 0)

needlong = input(true, "long")

needshort = input(true, "short")

len2 = input(15, defval = 15, minval = 2, maxval = 1000, title = "Fast MA length")

type2 = input(1, defval = 1, minval = 1, maxval = 7, title = "Fast MA Type")

src2 = input(close, defval = close, title = "Fast MA Source")

len1 = input(30, defval = 30, minval = 2, maxval = 1000, title = "Slow MA length")

type1 = input(1, defval = 1, minval = 1, maxval = 7, title = "Slow MA Type")

src1 = input(close, defval = close, title = "Slow MA Source")

col = input(false, defval = false, title = "Color of bar")

o = input(false, title = "1 SMA, 2 EMA, 3 VWMA, 4 DEMA, 5 TEMA, 6 KAMA, 7 Price Channel")

//DEMA 1

dema1 = 2 * ema(src1, len1) - ema(ema(close, len1), len1)

//TEMA 1

xEMA1 = ema(src1, len1)

xEMA2 = ema(xEMA1, len1)

xEMA3 = ema(xEMA2, len1)

tema1 = 3 * xEMA1 - 3 * xEMA2 + xEMA3

//KAMA 1

xvnoise = abs(src1 - src1[1])

nfastend = 0.20

nslowend = 0.05

nsignal = abs(src1 - src1[len1])

nnoise = sum(xvnoise, len1)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

kama1 = nz(kama1[1]) + nsmooth * (src1 - nz(kama1[1]))

//PriceChannel 1

lasthigh1 = highest(src1, len1)

lastlow1 = lowest(src1, len1)

center1 = (lasthigh1 + lastlow1) / 2

//DEMA 2

dema2 = 2 * ema(src2, len2) - ema(ema(close, len2), len2)

//TEMA 2

xEMA12 = ema(src2, len2)

xEMA22 = ema(xEMA12, len2)

xEMA32 = ema(xEMA22, len2)

tema2 = 3 * xEMA12 - 3 * xEMA22 + xEMA32

//KAMA 2

xvnoise2 = abs(src2 - src2[1])

nfastend2 = 0.20

nslowend2 = 0.05

nsignal2 = abs(src2 - src2[len2])

nnoise2 = sum(xvnoise2, len2)

nefratio2 = iff(nnoise2 != 0, nsignal2 / nnoise2, 0)

nsmooth2 = pow(nefratio2 * (nfastend2 - nslowend2) + nslowend2, 2)

kama2 = nz(kama2[1]) + nsmooth2 * (src2 - nz(kama2[1]))

//PriceChannel 2

lasthigh2 = highest(src2, len2)

lastlow2 = lowest(src2, len2)

center2 = (lasthigh2 + lastlow2) / 2

//MAs

ma1 = type1 == 1 ? sma(src1, len1) : type1 == 2 ? ema(src1, len1) : type1 == 3 ? vwma(src1, len1) : type1 == 4 ? dema1 : type1 == 5 ? tema1 : type1 == 6 ? kama1 : type1 == 7 ? center1 : 0

ma2 = type2 == 1 ? sma(src2, len2) : type2 == 2 ? ema(src2, len2) : type2 == 3 ? vwma(src2, len2) : type2 == 4 ? dema2 : type2 == 5 ? tema2 : type2 == 6 ? kama2 : type2 == 7 ? center2 : 0

plot(ma1, color = blue, linewidth = 3, transp = 0)

plot(ma2, color = red, linewidth = 3, transp = 0)

//Signals

trend = ma2 > ma1 ? 1 : ma2 < ma1 ? -1 : trend[1]

up = trend == 1 and ((close < open and close[1] < open[1]) or col == false)

dn = trend == -1 and ((close > open and close[1] > open[1]) or col == false)

if up

strategy.entry("Long", strategy.long, needlong == false ? 0 : na)

if dn

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)