概述

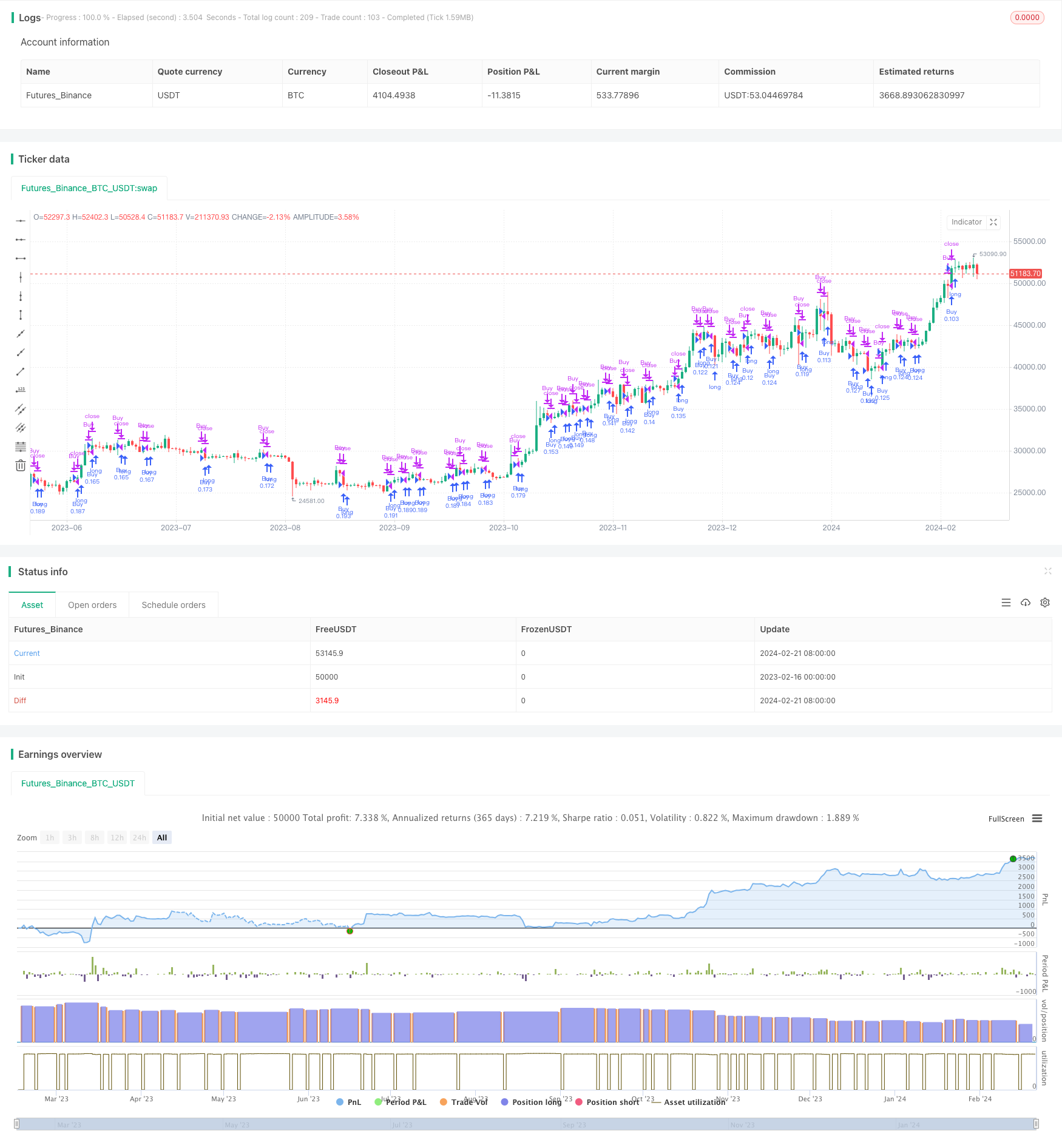

该策略将美元成本平均法(Dollar Cost Averaging, DCA)与交易所平台上的止盈滑点(Trailing Take Profit)功能相结合。它设置了1%的价格偏差用于购买,并针对每次出售目标0.5%的利润。这种微小利润的理由是为了确保交易机器人平稳运行,避免在市场缓慢期被困住的风险。根据回测结果,该机器人已被证明足够适应市场波动和操纵。尽管年化收益率(Annual Percentage Rate, APR)可能不会特别高,但它提供了一个满意和安全的长期投资选择,通常优于传统的买入并持有(Buy and Hold, HODL)策略。

策略原理

该策略首先设置了滑点止损百分比、最大DCA订单数、价格偏差百分比等可配置参数。然后它会追踪上次买入价格、买入次数、初始买入价格和滑点止损价格等变量。在买入逻辑上,如果当前价格低于上次买入价格的(1 - 价格偏差百分比),且买入次数还没有达到最大DCA订单数,则会发出买入信号并记录本次买入价格。在卖出逻辑上,如果当前价格高于上次买入价格的(1 + 止盈百分比),则会设置一个滑点止损价格。如果价格继续上涨突破该滑点止损价格,则更新滑点止损价格为当前价格的(1 - 滑点百分比)。如果价格下跌突破滑点止损价格,则发出卖出信号,同时重置相关变量,准备开始新一轮的DCA买入。

策略优势

结合了DCA定投和滑点止损,既确保了定期定额买入的成本平均效果,也锁定了部分利润避免回撤。

滑点止损机制灵活,可以根据市场情况来调整止盈幅度和滑点比例,降低风险。

回测表现优于传统的买入持有策略,年化收益率平稳,适合长线投资。

实现简单,参数设置灵活,易于在主流交易所平台上实际应用。

策略风险

DCA买入次数有限,如果行情长期下跌,亏损可能扩大。

滑点止损设置不当可能导致利润频繁锁定,或亏损扩大。

交易成本会对利润产生一定影响。高滑点止损设置会增加交易次数。

需要足够的资金支持频繁的DCA买入。初始资金不足可能导致买入次数不enough。

策略优化

可以设置浮动滑点止损,当利润达到一定比例时逐步减小滑点。

结合均线指标,在关键支持位附近加大买入份额。

加入重新平衡机制,根据总资产调整每次DCA购买金额。

优化参数设置,测试不同持仓周期下的收益率。

总结

该策略整合了DCA定投和滑点止损方法,实现了长期稳定收益的量化交易。回测表现良好,适合那些追求稳健增长的投资者。代码简洁易于理解实现。通过优化参数设置和结合其他指标,可以获得更好的实盘效果。总的来说,该策略为投资者提供了一个相对安全平稳的自动化量化交易方案。

/*backtest

start: 2023-02-16 00:00:00

end: 2024-02-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Stavolt

//@version=5

strategy("DCA Strategy with Trailing Take Profit", overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Correctly using input to define user-configurable parameters

takeProfitPercent = input.float(0.6, title="Take Profit (%)", minval=0.1, maxval=5)

trailingPercent = input.float(0.1, title="Trailing Stop (%)", minval=0.05, maxval=1)

maxDCAOrders = input.int(10, title="Max DCA Orders", minval=1, maxval=20)

priceDeviationPercent = input.float(1.0, title="Price Deviation (%)", minval=0.5, maxval=5)

var float lastBuyPrice = na

var int buyCount = 0

var float initialBuyPrice = na

var float trailingStopPrice = na

// Strategy logic here...

// Note: The detailed logic for buying and selling based on the DCA strategy

// needs to be tailored to your specific requirements and tested for correctness.

if (buyCount < maxDCAOrders)

if (na(lastBuyPrice) or close < lastBuyPrice * (1 - priceDeviationPercent / 100))

strategy.entry("Buy", strategy.long)

lastBuyPrice := close

buyCount += 1

if (na(initialBuyPrice))

initialBuyPrice := close

if (not na(lastBuyPrice) and close > lastBuyPrice * (1 + takeProfitPercent / 100))

if (na(trailingStopPrice) or close > trailingStopPrice)

trailingStopPrice := close * (1 - trailingPercent / 100)

if (close < trailingStopPrice)

strategy.close("Buy")

lastBuyPrice := na

trailingStopPrice := na

buyCount := 0

initialBuyPrice := na