概述

RSI均线双金叉震荡策略是一种同时利用RSI指标与均线的金叉死叉信号来决定买入卖出的量化交易策略。该策略运用RSI指标判断市场是否被高估或低估,并结合均线的趋势判断,在RSI指标显示超买超卖现象的同时发出交易信号。这可以有效过滤假信号,提高策略的稳定性。

策略原理

该策略主要基于RSI指标与均线的组合使用。首先计算一定周期的RSI值,并设置超买超卖线。其次,计算快速均线及慢速均线。当RSI指标上穿上慢速均线,同时RSI值低于超卖线及下轨时产生买入信号;当RSI指标下穿下慢速均线,同时RSI值高于超买线及上轨时产生卖出信号。

优势分析

这种策略最大的优势就是同时利用RSI指标判断超买超卖现象,以及均线判断趋势方向,能有效避免假突破。此外,RSI与BOLL通道的组合运用也可以进一步过滤噪音,使交易信号更加准确。

风险分析

该策略可能存在的风险主要有:操作频率过高,容易迭仓;参数设置不当可能导致信号精确度降低。此外,震荡行情下也可能出现亏损。

优化方向

可以考虑调整RSI参数或均线周期参数以适应不同周期;结合其他指标过滤信号;设置止损止盈点以控制风险;优化每次交易的仓位管理。

总结

RSI均线双金叉震荡策略整体来说是一种较为稳定可靠的短线交易策略。通过参数调优与风险控制的配合,可以获得较好的收益回报率。该策略易于理解与实现,非常适合量化交易初学者学习与应用。

策略源码

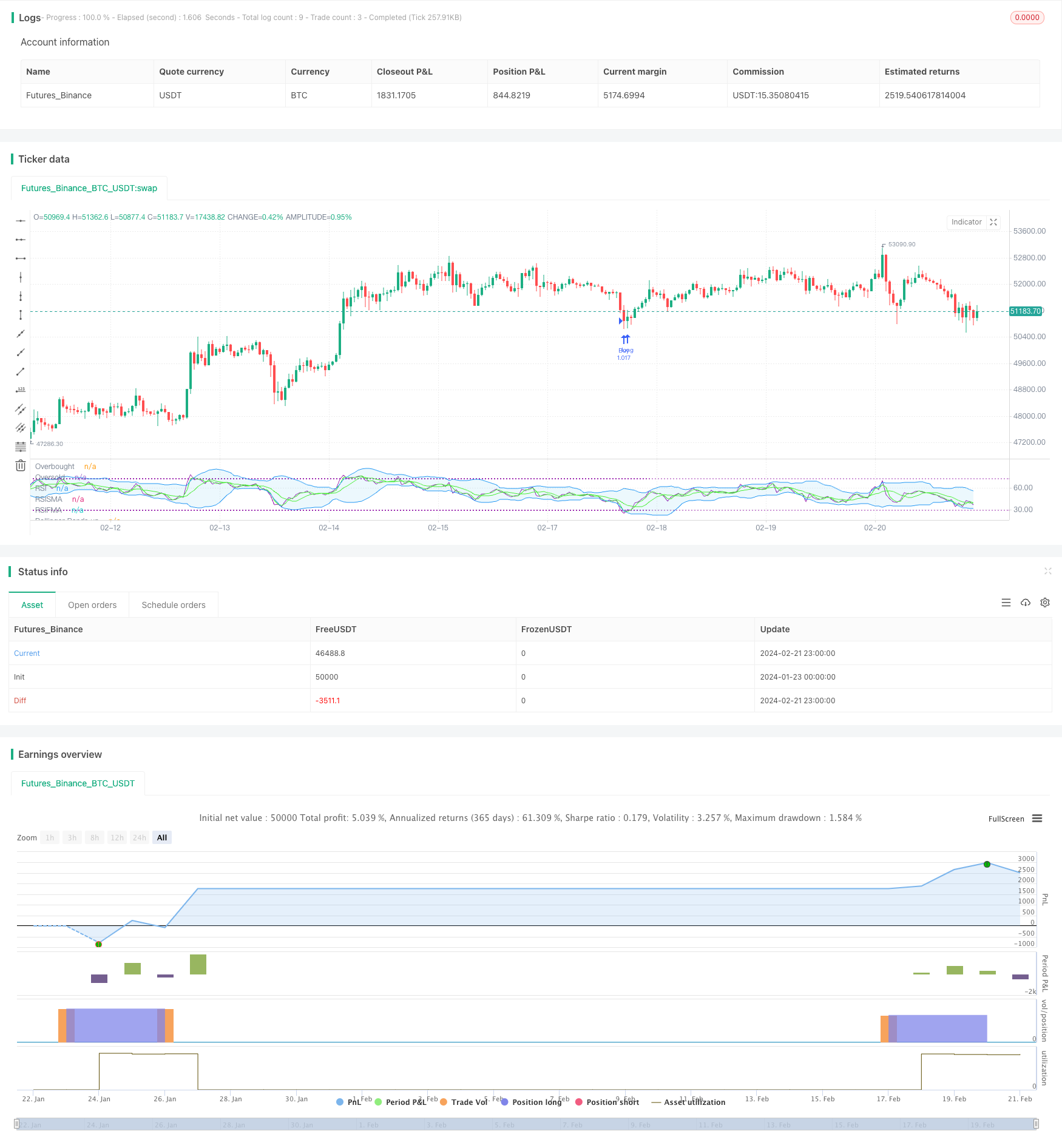

/*backtest

start: 2024-01-23 00:00:00

end: 2024-02-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI slowma Ismael", overlay=false, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Definir la longitud del RSI

rsi_length = input(title='RSI Length', defval=14)

//media

Fast = input(title='Fast', defval=7)

slow = input(title='Slow', defval=2)

// Definir los niveles de sobrecompra y sobreventa del RSI

rsi_overbought = input(title='RSI Overbought Level', defval=72)

rsi_oversold = input(title='RSI Oversold Level', defval=29)

// Definir la longitud y la desviación estándar de las Bandas de Bollinger

bb_length = input(title="Bollinger Bands Length", defval=14)

bb_stddev = input(title="Bollinger Bands StdDev", defval=2)

// Calcular RSI

rsi_value = ta.rsi(close, rsi_length)

// Calcular Bandas de Bollinger

bb_upper = ta.sma(rsi_value, bb_length) + bb_stddev* ta.stdev(rsi_value, bb_length)

bb_lower = ta.sma(rsi_value, bb_length) - bb_stddev * ta.stdev(rsi_value, bb_length)

//media movil adelantada

fastMA = ta.sma(rsi_value, Fast)

slowMA = ta.sma(rsi_value, slow)

// Definir la señal de compra y venta

buy_signal = (ta.crossover(rsi_value, slowMA) and rsi_value < bb_lower and rsi_value < rsi_oversold) or (rsi_value < bb_lower and rsi_value < rsi_oversold)

sell_signal = (ta.crossunder(rsi_value, slowMA) and rsi_value > bb_upper and rsi_value > rsi_overbought) or (rsi_value > bb_upper and rsi_value > rsi_overbought)

// Configurar las condiciones de entrada y salida del mercado

if buy_signal

strategy.entry("Buy", strategy.long)

if sell_signal

strategy.close("Buy")

// Configurar el stop loss y el take profit

stop_loss = input.float(title='Stop Loss (%)', step=0.01, defval=3)

take_profit = input.float(title='Take Profit (%)', step=0.01, defval=8)

strategy.exit("Exit Long", "Buy", stop=close - close * stop_loss / 100, limit=close + close * take_profit / 100)

// Configurar la visualización del gráfico

plot(slowMA, title='RSISMA', color=color.rgb(75, 243, 33), linewidth=1)

plot(fastMA, title='RSIFMA', color=color.rgb(75, 243, 33), linewidth=1)

plot(rsi_value, title='RSI', color=color.purple, linewidth=1)

// Marcar las zonas de sobrecompra y sobreventa en el grafico del RSI

hl= hline(rsi_overbought, title='Overbought', color=color.purple, linestyle=hline.style_dotted, linewidth=1)

hll= hline(rsi_oversold, title='Oversold', color=color.purple, linestyle=hline.style_dotted, linewidth=1)

fill(hl,hll, color= color.new(color.purple, 91))

bbfill = plot(bb_upper, title='Bollinger Bands up', color=color.blue, linewidth=1)

bbfill1= plot(bb_lower, title='Bollinger Bands down', color=color.blue, linewidth=1)

fill(bbfill,bbfill1, color= color.new(#2bb5ec, 91))