概述

动能突破策略是一种追踪市场动能的趋势策略。它结合多种指标判断市场目前是否处于上升或下降趋势中,并在突破关键阻力位时建仓做多,在突破关键支撑位时建仓做空。

策略原理

该策略主要通过计算多种长度期的Donchian通道来判断市场趋势和关键价格位。具体来说,它在价格突破较长周期如40日的Donchian通道上轨时判断为上涨趋势,并在此基础上结合年内新高、移动平均线方向性排列等过滤条件发出做多信号;而在价格跌破较长周期Donchian的下轨时,判断为下跌趋势,结合年内新低等过滤条件发出做空信号。

在退出仓位方面,该策略提供了两个选择:固定取消线和跟踪止损。固定取消线是根据更短周期如20日Donchian通道设定止损位;跟踪止损每日根据ATR值计算浮动止损线。这两种止损方式都能很好控制风险。

优势分析

这种策略结合趋势判断和突破操作,能够有效捕捉市场中短线的方向性机会。相比单一指标,它综合运用多种过滤条件,可以过滤掉部分假突破从而提高进入信号的质量。此外,止损策略的应用也使其承受能力较强,即使行情短期回调也能有效控制损失。

风险分析

该策略的主要风险在于行情可能出现剧烈波动,导致止损被触发退出仓位。这时如果行情迅速反转,则可能错过机会。另外,多种过滤条件的运用也会过滤掉部分机会,降低策略的持仓频次。

为降低风险,可以适当调整ATR数值或扩大Donchian轨间距,这可以减少止损被击穿的可能。也可以降低或取消部分过滤条件,提高进入频次,但风险也会增加。

优化方向

该策略可以从以下几个方面进行优化: 1. 优化Donchian通道的长度,寻找最佳参数组合 2. 尝试不同类型的移动平均线作为滤波指标 3. 调整ATR乘数或改为固定点数止损 4. 加入更多趋势判断指标,如MACD等 5. 优化年内新高新低的判断窗口期等

通过测试不同参数,可以找到最佳的参数组合,在风险和收益之间取得平衡。

总结

本策略综合运用多种指标判断趋势方向,在关键点位突破时发出交易信号。其止损机制也使得该策略有较强的风险控制能力。通过优化参数设置,该策略可以实现稳定的超额收益。它适用于对市场没有清晰判断但希望跟踪趋势的投资者。

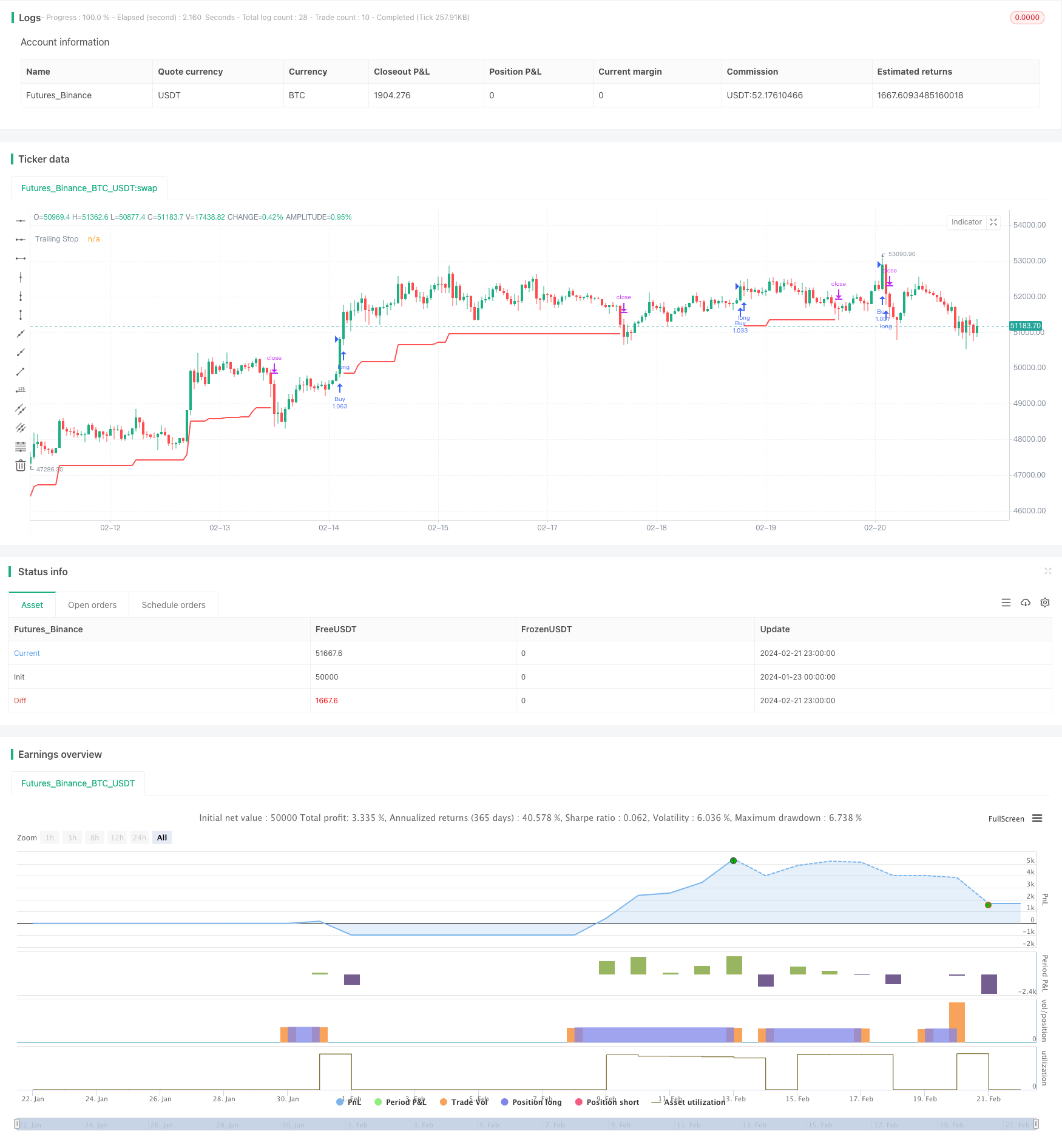

/*backtest

start: 2024-01-23 00:00:00

end: 2024-02-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HeWhoMustNotBeNamed

//@version=4

strategy("BuyHigh-SellLow Strategy", overlay=true, initial_capital = 10000, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type = strategy.commission.percent, pyramiding = 1, commission_value = 0.01, calc_on_order_fills = true)

donchianEntryLength = input(40, step=10)

donchianExitLength = input(20, step=10)

considerNewLongTermHighLows = input(true)

shortHighLowPeriod = input(120, step=10)

longHighLowPeriod = input(180, step=10)

considerMAAlignment = input(true)

MAType = input(title="Moving Average Type", defval="ema", options=["ema", "sma", "hma", "rma", "vwma", "wma"])

LookbackPeriod = input(40, minval=10,step=10)

atrLength = input(22)

atrMult = input(4)

exitStrategy = input(title="Exit Strategy", defval="tsl", options=["dc", "tsl"])

considerYearlyHighLow = input(true)

backtestYears = input(10, minval=1, step=1)

f_getMovingAverage(source, MAType, length)=>

ma = sma(source, length)

if(MAType == "ema")

ma := ema(source,length)

if(MAType == "hma")

ma := hma(source,length)

if(MAType == "rma")

ma := rma(source,length)

if(MAType == "vwma")

ma := vwma(source,length)

if(MAType == "wma")

ma := wma(source,length)

ma

f_getTrailingStop(atr, atrMult)=>

stop = close - atrMult*atr

stop := strategy.position_size > 0 ? max(stop, stop[1]) : stop

stop

f_getMaAlignment(MAType, includePartiallyAligned)=>

ma5 = f_getMovingAverage(close,MAType,5)

ma10 = f_getMovingAverage(close,MAType,10)

ma20 = f_getMovingAverage(close,MAType,20)

ma30 = f_getMovingAverage(close,MAType,30)

ma50 = f_getMovingAverage(close,MAType,50)

ma100 = f_getMovingAverage(close,MAType,100)

ma200 = f_getMovingAverage(close,MAType,200)

upwardScore = 0

upwardScore := close > ma5? upwardScore+1:upwardScore

upwardScore := ma5 > ma10? upwardScore+1:upwardScore

upwardScore := ma10 > ma20? upwardScore+1:upwardScore

upwardScore := ma20 > ma30? upwardScore+1:upwardScore

upwardScore := ma30 > ma50? upwardScore+1:upwardScore

upwardScore := ma50 > ma100? upwardScore+1:upwardScore

upwardScore := ma100 > ma200? upwardScore+1:upwardScore

upwards = close > ma5 and ma5 > ma10 and ma10 > ma20 and ma20 > ma30 and ma30 > ma50 and ma50 > ma100 and ma100 > ma200

downwards = close < ma5 and ma5 < ma10 and ma10 < ma20 and ma20 < ma30 and ma30 < ma50 and ma50 < ma100 and ma100 < ma200

upwards?1:downwards?-1:includePartiallyAligned ? (upwardScore > 5? 0.5: upwardScore < 2?-0.5:upwardScore>3?0.25:-0.25) : 0

//////////////////////////////////// Calculate new high low condition //////////////////////////////////////////////////

f_calculateNewHighLows(shortHighLowPeriod, longHighLowPeriod, considerNewLongTermHighLows)=>

newHigh = highest(shortHighLowPeriod) == highest(longHighLowPeriod) or not considerNewLongTermHighLows

newLow = lowest(shortHighLowPeriod) == lowest(longHighLowPeriod) or not considerNewLongTermHighLows

[newHigh,newLow]

//////////////////////////////////// Calculate Yearly High Low //////////////////////////////////////////////////

f_getYearlyHighLowCondition(considerYearlyHighLow)=>

yhigh = security(syminfo.tickerid, '12M', high[1])

ylow = security(syminfo.tickerid, '12M', low[1])

yhighlast = yhigh[365]

ylowlast = ylow[365]

yhighllast = yhigh[2 * 365]

ylowllast = ylow[2 * 365]

yearlyTrendUp = na(yhigh)? true : na(yhighlast)? close > yhigh : na(yhighllast)? close > max(yhigh,yhighlast) : close > max(yhigh, min(yhighlast, yhighllast))

yearlyHighCondition = ( (na(yhigh) or na(yhighlast) ? true : (yhigh > yhighlast) ) and ( na(yhigh) or na(yhighllast) ? true : (yhigh > yhighllast))) or yearlyTrendUp or not considerYearlyHighLow

yearlyTrendDown = na(ylow)? true : na(ylowlast)? close < ylow : na(ylowllast)? close < min(ylow,ylowlast) : close < min(ylow, max(ylowlast, ylowllast))

yearlyLowCondition = ( (na(ylow) or na(ylowlast) ? true : (ylow < ylowlast) ) and ( na(ylow) or na(ylowllast) ? true : (ylow < ylowllast))) or yearlyTrendDown or not considerYearlyHighLow

label_x = time+(60*60*24*1000*1)

[yearlyHighCondition,yearlyLowCondition]

donchian(rangeLength)=>

upper = highest(rangeLength)

lower = lowest(rangeLength)

middle = (upper+lower)/2

[middle, upper, lower]

inDateRange = true

[eMiddle, eUpper, eLower] = donchian(donchianEntryLength)

[exMiddle, exUpper, exLower] = donchian(donchianExitLength)

maAlignment = f_getMaAlignment(MAType, false)

[yearlyHighCondition, yearlyLowCondition] = f_getYearlyHighLowCondition(considerYearlyHighLow)

[newHigh,newLow] = f_calculateNewHighLows(shortHighLowPeriod, longHighLowPeriod, considerNewLongTermHighLows)

maAlignmentLongCondition = highest(maAlignment, LookbackPeriod) == 1 or not considerMAAlignment

atr = atr(atrLength)

tsl = f_getTrailingStop(atr, atrMult)

//U = plot(eUpper, title="Up", color=color.green, linewidth=2, style=plot.style_linebr)

//D = plot(exLower, title="Ex Low", color=color.red, linewidth=2, style=plot.style_linebr)

longCondition = crossover(close, eUpper[1]) and yearlyHighCondition and newHigh and maAlignmentLongCondition

exitLongCondition = crossunder(close, exLower[1])

shortCondition = crossunder(close, eLower[1]) and yearlyLowCondition and newLow

exitShortCondition = crossover(close, exUpper[1])

strategy.entry("Buy", strategy.long, when=longCondition and inDateRange, oca_name="oca_buy")

strategy.exit("ExitBuyDC", "Buy", when=exitStrategy=='dc', stop=exLower)

strategy.exit("ExitBuyTSL", "Buy", when=exitStrategy=='tsl', stop=tsl)

plot(strategy.position_size > 0 ? (exitStrategy=='dc'?exLower:tsl) : na, title="Trailing Stop", color=color.red, linewidth=2, style=plot.style_linebr)

//strategy.close("Buy", when=exitLongCondition)