概述

SPY RSI Stochastics 交叉值反转趋势策略是一个利用 RSI 指标的快慢线交叉来判断价格反转的量化交易策略。该策略结合了慢速线、快速线和 MA 线,在一定条件下产生买入和卖出信号,以捕捉较大的价格反转机会。

策略原理

该策略的核心逻辑基于 RSI 指标的快慢线交叉。RSI 通常在超买超卖区域反转,因此通过判断快速 RSI 线与慢速 RSI 线的金叉和死叉情况,可以提前判断价格可能反转的时机。具体来说,策略主要依赖以下几个指标和条件:

- 慢速 RSI 线 (Slow RSI):参数设置为 64 根周期的 RSI 线

- 快速 RSI 线 (Fast RSI):参数设置为 9 根周期的 RSI 线

- RSI MA 线:对快速 RSI 线进行 3 根周期的简单移动平均

- RSI 超买区阈值:参数设置为 83

- RSI 超卖区阈值:参数设置为 25

- RSI 中性区:介于 39 到 61 之间

- 交易时间设置为工作日的 9:00 到次日 9:00

当快速 RSI 线上穿慢速 RSI 线(金叉)并且快速线上穿 MA 线时,产生买入信号;当快速 RSI 下穿慢速 RSI(死叉)并且快速线下穿 MA 线时,产生卖出信号。

此外,为了过滤掉部分噪声交易,策略还设置了以下逻辑:

- 在 RSI 中性区之间不产生交易信号

- 只在工作日的 9:00 到次日 9:00 之间交易

入场后,有两个退出条件:

- 快速 RSI 线进入反向区域(超买区或超卖区)时平仓

- 产生反向的 RSI 交叉信号时平仓

策略优势分析

SPY RSI Stochastics 交叉值反转趋势策略最大的优势是可以在价格出现较明显反转前提前捕捉趋势。通过快慢 RSI 线交叉的方式,它可以提前一定时间发出交易信号,为入场创造机会。此外,该策略还具有以下几个优势:

- 策略信号生成规则清晰,容易理解和跟踪

- 利用双重滤波器设计,可以减少部分噪声信号

- 灵活设置超买超卖区间,适用于不同市场环境

- 兼具趋势跟踪和反转捕捉能力

总的来说,该策略结合趋势跟踪和价值反转判断,可以在一定程度上把握价格反转的时机,具有较强的实用性。

策略风险分析

尽管 SPY RSI Stochastics 交叉值反转趋势策略有一定优势,但也存在以下主要风险:

- 虽有双重滤波器设计,但仍无法完全避免噪声交易带来的风险

- RSI 交叉无法完美预测价格实际反转点,存在一定程度的困难

- 需要选择合适的参数设定,否则可能出现过于频繁或稀疏的交易

- 突发事件导致的假突破无法完全规避

针对以上风险,该策略可以通过以下几个方面来优化和改进:

- 利用机器学习算法训练最优参数,降低噪声信号

- 结合其他技术指标判断,提高交叉信号的可靠性

- 增加止损机制,控制单笔交易风险敞口

- 优化参数自适应更新,提高策略的适应性

策略优化方向

SPY RSI Stochastics 交叉值反转趋势策略主要可以从以下几个方面进行优化:

- 参数优化:通过更系统的方法如遗传算法、网格搜索等找到最优参数组合

- 特征工程:加入更多影响价格的特征,如交易量变化、波动率等来辅助决策

- 机器学习:利用机器学习算法对交叉判决进行训练,提高准确性

- 止损优化:引入浮动止损、时间止损等机制控制风险

- 自适应更新:使关键参数能根据实时市场情况进行自适应调整

这些优化可以使策略参数更加智能化,信号更可靠,同时也能根据市场变化调整策略规则,从而大大提高策略的稳定盈利能力。

总结

SPY RSI Stochastics 交叉值反转趋势策略通过判断 RSI 快慢线的交叉情况,设计了一套相对简单清晰的量化交易策略。它结合趋势跟踪和反转交易的特点,可以在一定程度上把握价格的反转时机。但该策略也存在一定的固有缺陷,需要通过参数、特征和模型优化来控制风险、提高信号质量。如果持续优化,该策略可以成为一个稳定盈利的量化系统。

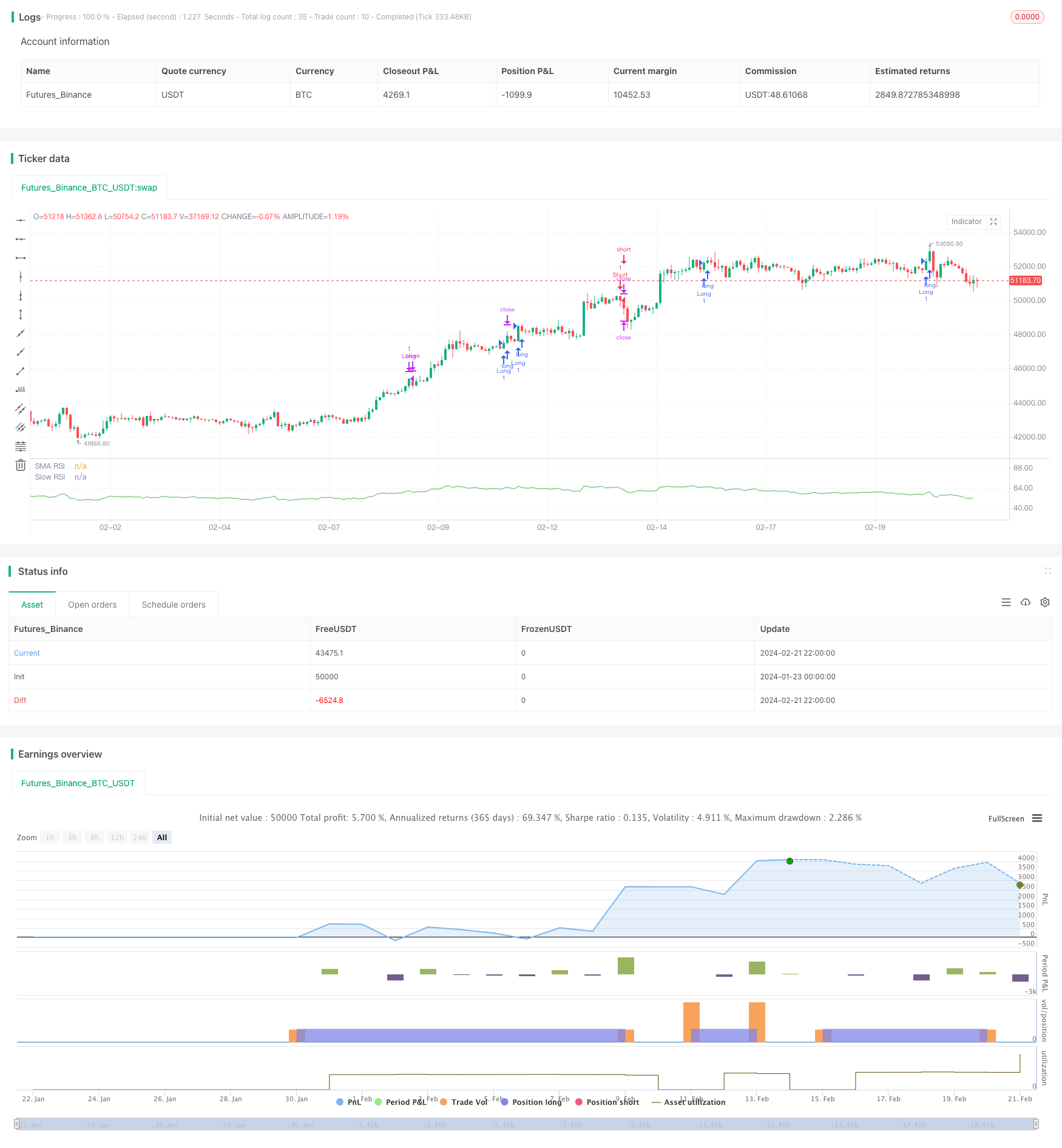

/*backtest

start: 2024-01-23 00:00:00

end: 2024-02-22 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SPY Auto RSI Stochastics", pyramiding = 3)

// Input parameters

slowRSILength = input(64, title="SLOW RSI Length")

fastRSILength = input(9, title="FAST RSI Length")

smaRSILength = input(3, title="RSI SMA Length")

RSIUpperThreshold = input(83, title="RSI Upper")

RSILowerThreshold = input(25, title="RSI Lower")

RSIUpperDeadzone = input(61, title='RSI Upper Deadzone')

RSILowerDeadzone = input(39, title='RSI Lower Deadzone')

blockedDays = (dayofweek(time) == 1 or dayofweek(time) == 7)

sessionMarket = input("0900-0900", title="Session Start")

allowedTimes() => time(timeframe = timeframe.period, session = sessionMarket, timezone = "GMT+1")

isvalidTradeTime =true

// RSI and ATR

slowRSI = ta.rsi(close, slowRSILength)

fastRSI = ta.rsi(close, fastRSILength)

smaRSI = ta.sma(fastRSI, smaRSILength)

rsi = fastRSI

// Entry condition

RSIUptrend() => ta.crossover(fastRSI, slowRSI) and ta.crossover(fastRSI, smaRSI)

RSIDowntrend() => ta.crossunder(fastRSI, slowRSI) and ta.crossunder(fastRSI, smaRSI)

isRSIDeadzone() =>

rsi < RSIUpperDeadzone and rsi > RSILowerDeadzone

isBullishEngulfing() =>

close > high[1]

isBearishEngulfing() =>

close < low[1]

// Declare variables

var float initialSLLong = na

var float initialTPLong = na

var float initialSLShort = na

var float initialTPShort = na

//var bool inATrade = false

entryConditionLong = RSIUptrend() and not isRSIDeadzone() and isvalidTradeTime

entryConditionShort = RSIDowntrend() and not isRSIDeadzone() and isvalidTradeTime

exitConditionLong = entryConditionShort or fastRSI > RSIUpperThreshold

exitConditionShort = entryConditionLong or fastRSI < RSILowerThreshold

if (entryConditionLong)

strategy.entry(id = "Long", direction = strategy.long, alert_message = 'LONG! beep boop, all aboard the long train')

if (entryConditionShort)

strategy.entry(id = "Short", direction = strategy.short, alert_message = 'Short! beep boop, all aboard the short train')

if (exitConditionLong)

strategy.exit("Long", from_entry="Long", limit=close, alert_message = 'Stop Long, halt halt, take the profits and runnn')

if (exitConditionShort)

strategy.exit("Short", from_entry="Short", limit=close, alert_message = 'Stop Short, halt halt, take the profits and runnn')

//plot(smaRSI, "RSI MA", color=color.red)

plot(slowRSI, "Slow RSI", color=color.green)

//plot(fastRSI, "Fast RSI", color=color.white)

plot(smaRSI, "SMA RSI", color=color.white)