概述

这是一个利用三重叠加超趋势指标进行交易决策的策略。它可以在趋势行情中捕捉较大的方向性机会。

策略原理

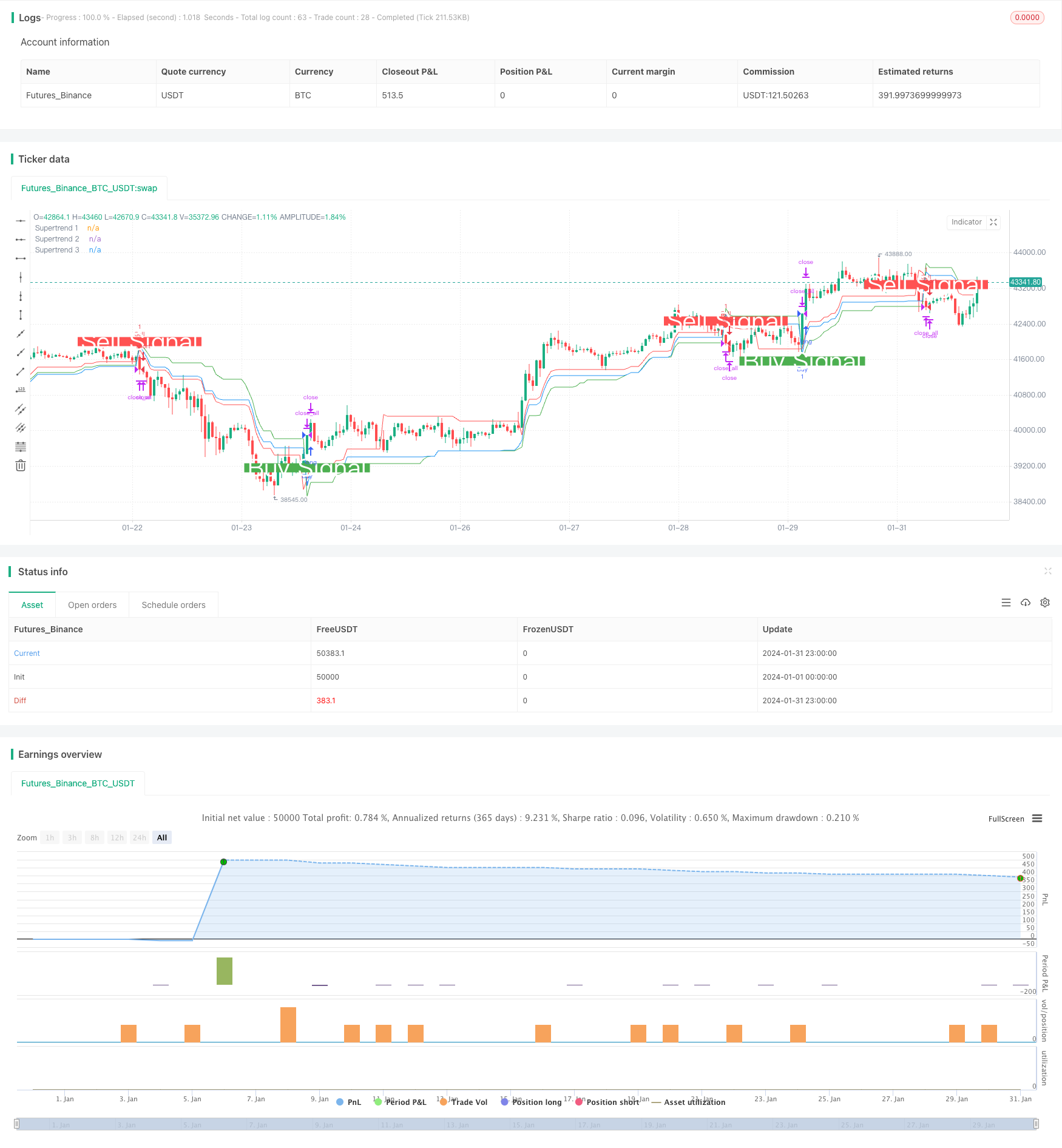

该策略利用ta.supertrend()函数计算三个不同参数设置的超趋势指标。分别计算10日3倍ATR的超趋势1,14日2倍ATR的超趋势2,以及20日2.5倍ATR的超趋势3。当价格上穿所有三条超趋势时生成买入信号。当价格下穿所有三条超趋势时生成卖出信号。

超趋势指标结合ATR指标,能够有效跟踪价格变化趋势。三重叠加超趋势的策略,让信号更加可靠,从而在趋势行情中获取更大的收益。

策略优势

- 三重过滤机制,避免假信号,提高信号质量

- 超趋势指标本身就具有较好的去噪功能

- 可配置多个超参数组合,适应更广泛的市场环境

- 历史测试表现良好,收益风险比高

策略风险

- 多重过滤信号可能错过部分机会

- 震荡行情中表现并不出色

- 需优化三组超参数的组合

- 集中交易时间易受突发事件影响

可以考虑以下几点来降低风险: 1. 调整过滤条件,保留一两个超趋势 2. 增加止损策略 3. 优化超参数,提高胜率

策略优化方向

- 测试更多参数组合,寻找最佳超参数

- 增加机器学习算法,实时优化参数

- 增加止损策略,控制单笔损失

- 结合其他指标,识别趋势和震荡

- 扩展交易时间,避开单一时间节点的风险

总结

本策略通过三重叠加超趋势进行决策,能有效识别趋势方向。它具有信号质量高,参数可优化等优点。同时也存在一定的风险,需要对参数和退出时机进行调整,以适应不同市场环境。总的来说,该策略表现突出,值得进一步研究和应用。

策略源码

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Combined Supertrend Strategy - Ajit Prasad', overlay=true)

// Function to calculate Supertrend

supertrendFunc(atrLength, factor) =>

[supertrend, direction] = ta.supertrend(factor, atrLength)

[supertrend, direction]

// Input parameters for the first Supertrend

atrPeriod1 = input(10, 'ATR Length 1')

factor1 = input(3, 'Factor 1')

// Calculate the first Supertrend

[supertrend1, direction1] = supertrendFunc(atrPeriod1, factor1)

// Input parameters for the second Supertrend

atrPeriod2 = input(14, 'ATR Length 2') // Change values as needed

factor2 = input(2, 'Factor 2') // Change values as needed

// Calculate the second Supertrend

[supertrend2, direction2] = supertrendFunc(atrPeriod2, factor2)

// Input parameters for the third Supertrend

atrPeriod3 = input(20, 'ATR Length 3') // Change values as needed

factor3 = input(2.5, 'Factor 3') // Change values as needed

// Calculate the third Supertrend

[supertrend3, direction3] = supertrendFunc(atrPeriod3, factor3)

// Define market opening and closing times

marketOpenHour = 9

marketOpenMinute = 15

marketCloseHour = 15

marketCloseMinute = 30

exitTimeHour = 15

exitTimeMinute = 10

// Fetch historical close values using security function

histClose = request.security(syminfo.tickerid, "D", close)

// Buy condition

buyCondition = close > supertrend1 and close > supertrend2 and close > supertrend3 and close[1] <= supertrend1[1]

// Sell condition

sellCondition = close < supertrend1 and close < supertrend2 and close < supertrend3 and close[1] >= supertrend1[1]

// Exit conditions

buyExitCondition = close < supertrend1[1] or close < supertrend2[1] or close < supertrend3[1]

sellExitCondition = close > supertrend1[1] or close > supertrend2[1] or close > supertrend3[1]

// Execute orders with market timing

if true

// Buy condition without 'and not'

strategy.entry('Buy', strategy.long, when = buyCondition)

// Sell condition without 'and not'

strategy.entry('Sell', strategy.short, when = sellCondition)

// Close conditions

strategy.close('Buy', when = buyExitCondition )

strategy.close('Sell', when = sellExitCondition)

// Close all trades at 3:10 pm IST

if true

strategy.close_all()

// Plot Supertrends

plot(supertrend1, 'Supertrend 1', color=color.new(color.green, 0), style=plot.style_linebr)

plot(supertrend2, 'Supertrend 2', color=color.new(color.red, 0), style=plot.style_linebr)

plot(supertrend3, 'Supertrend 3', color=color.new(color.blue, 0), style=plot.style_linebr)

// Plot labels

plotshape(buyCondition, style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), size=size.large, text='Buy Signal', textcolor=color.new(color.white, 0))

plotshape(sellCondition, style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), size=size.large, text='Sell Signal', textcolor=color.new(color.white, 0))