概述

该策略基于Kaufman自适应移动平均线(KAMA)设计,可以动态调整交易头寸,自动跟踪市场趋势。策略的主要功能包括:

- 动态计算交易步长(以点子为单位),自适应市场波动率

- 根据KAMA方向产生买入和卖出信号

- 信号产生后,设置一个止损距离,并随价格移动进行调整

- 可选等待K线收盘确认信号,过滤假信号

通过这些功能的运用,策略试图获取趋势的额外收益,同时控制风险。

策略原理

该策略基于Kaufman自适应移动平均线指标工作。KAMA通过计算价格动量和波动率的比值,动态调整平均线的权重及平滑度,从而更快地响应价格变化。

当KAMA上穿下行止损线时,表示趋势反转,产生买入信号;当KAMA下穿上行止损线时,表示趋势反转,产生卖出信号。进入仓位后,策略会根据ATR计算出一个动态的止损距离,并设立止损线。KAMA向有利方向移动时,止损线也会跟随调整,将止损线移至更有利的位置,以锁定更多利润。

这样,策略可以跟踪趋势运行,逐步移动止损线,直至止损线被触发或反向信号被触发而平仓。

策略优势

相比传统移动平均线策略,该策略具有以下优势:

- KAMA指标灵敏度高,可以更快捕捉价格趋势;

- 动态计算止损距离,随趋势调整,可以锁更高利润;

- 有可选的K线收盘确认,可过滤假信号,减少不必要开仓。

总的来说,策略响应迅速,可控性强,是典型的趋势跟踪策略。

策略风险

该策略也存在一些风险:

- 趋势反转风险。KAMA指标可灵活应对价格波动,但对突发性趋势反转可能响应不够及时。

- 止损过于激进。动态止损距离如果设置过大,可能过于激进,让利润来不及锁定。

- 假信号风险。启用K线收盘确认可以减少假信号,但并不能完全消除。

针对这些风险,可通过优化止损距离、设置最大止损百分比等方法进行控制。也可以结合其他指标作为确认,避免错误交易。

策略优化方向

该策略可优化的方向包括:

- 优化KAMA参数:调整平均线长度,优化平滑度;

- 优化动态止损:根据不同品种特点,测试最佳止损距离和步长;

- 增加过滤指标:结合其他趋势指标,确认交易信号,提高信号的可靠性。

例如,可以测试增加MACD作为辅助确认指标,在KAMA金叉的同时,也要求MACDDif也为正并扩大。这可以过滤掉一些假信号,避免不必要的反复开仓。

总结

本策略整体运作顺畅,使用动态止损跟踪趋势运行,最大程度锁定趋势利润。KAMA指标的自适应性也让策略可以跟上市场的快速变化。通过一定优化,策略可以成为高效的趋势跟踪程序,适合于中长线操作。

策略源码

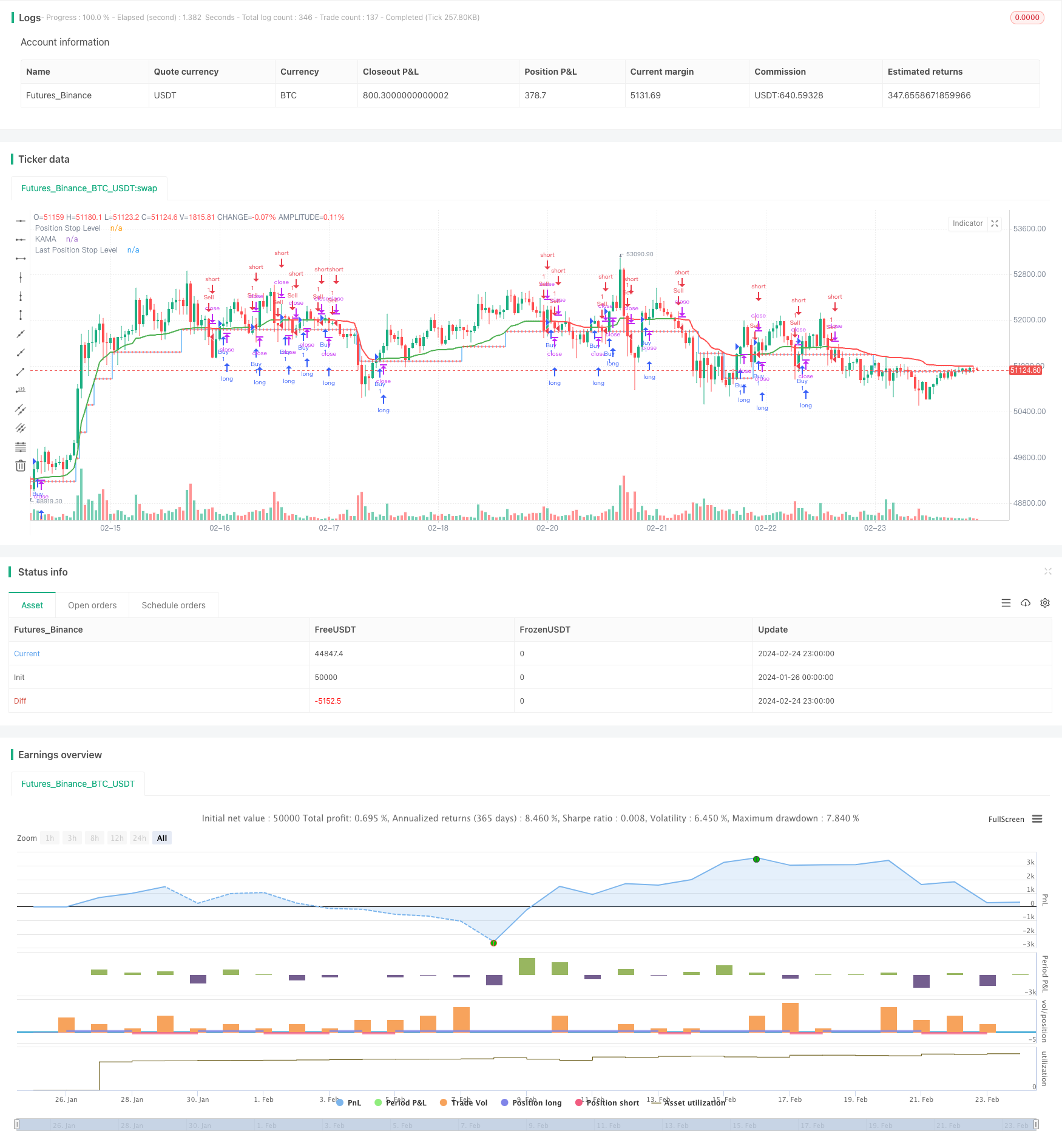

/*backtest

start: 2024-01-26 00:00:00

end: 2024-02-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("THMA - Bharath Vc Improved", overlay=true, process_orders_on_close=true)

// Function to calculate pips with higher precision

getPips(price) =>

difc = syminfo.mintick

hlpips = price / difc

math.round(hlpips / syminfo.mintick) * syminfo.mintick

// Inputs

buyMess = input.string("Buy Message","Buy Alert Message")

sellMess = input.string("Sell Message","Sell Alert Message")

buyExitMessage = input.string("Buy Exit","Buy Exit Alert Message" )

sellExitMessage = input.string("Sell Exit","Sell Exit Alert Message" )

tmf = input.timeframe("", "Timeframe")

length = input(title='Length', defval=14)

fastLength = input(title='Fast EMA Length', defval=2)

slowLength = input(title='Slow EMA Length', defval=30)

src = input(title='Source', defval=close)

highlight = input(title='Highlight ?', defval=true)

awaitBarConfirmation = input(title='Await Bar Confirmation ?', defval=true)

// Function to calculate the TMA

gettma() =>

mom = math.abs(ta.change(src, length))

volatility = math.sum(math.abs(ta.change(src)), length)

er = volatility != 0 ? mom / volatility : 0

fastAlpha = 2 / (fastLength + 1)

slowAlpha = 2 / (slowLength + 1)

alpha = math.pow(er * (fastAlpha - slowAlpha) + slowAlpha, 2)

kama = 0.0

kama := alpha * src + (1 - alpha) * nz(kama[1], src)

await = awaitBarConfirmation ? barstate.isconfirmed : true

maColor = highlight ? kama > kama[1] and await ? color.green : color.red : color.new(color.purple, 0)

thma = kama

hma_dif = (thma - thma[2])/2

colour = hma_dif > 0 ? color.green : color.red

isGreen = hma_dif > 0

[thma, isGreen, colour]

// Dynamic pip size based on ATR to adapt better to smaller timeframes

pips = ta.atr(14) * 0.1

// Main execution logic

var float psl = na

var int lastSignal = 0

var float lastPsl = na

[thma, isGreen, colour] = request.security(syminfo.tickerid, tmf, gettma(), gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_off)

plot(thma, title='KAMA', linewidth=2, color=colour)

if ta.crossover(thma, psl) and strategy.position_size < 0

strategy.exit("Sell Exit", stop=thma, alert_message=sellExitMessage)

if ta.crossunder(thma, psl) and strategy.position_size > 0

strategy.exit("Buy Exit", stop=thma, alert_message=buyExitMessage)

if isGreen and strategy.position_size <= 0

if na(psl)

psl := close + getPips(pips)

strategy.entry("Buy", strategy.long, alert_message=buyMess)

lastSignal := 1

if not isGreen and strategy.position_size >= 0

if na(psl)

psl := close - getPips(pips)

strategy.entry("Sell", strategy.short, alert_message=sellMess)

lastSignal := -1

if (thma >= lastPsl or na(lastPsl)) and thma > psl

psl := psl + getPips(pips)

lastPsl := psl

if (thma <= lastPsl or na(lastPsl)) and thma < psl

psl := psl - getPips(pips)

lastPsl := psl

plot(psl, title="Position Stop Level", style=plot.style_stepline, color=color.blue)

plot(lastPsl, title="Last Position Stop Level", style=plot.style_cross, color=color.red)