概述

双均线跟随策略是一种基于移动平均线的趋势跟随策略。它通过计算不同周期的移动平均线,判断行情趋势方向,以发出交易信号。当短期移动平均线上穿长期移动平均线时,做多;当短期移动平均线下穿长期移动平均线时,做空。该策略顺应趋势运行,以获利。

策略原理

双均线跟随策略通过计算14周期和28周期的简单移动平均线(SMA)判断趋势方向。具体来说,它在每个周期末计算close价格的14周期SMA和28周期SMA。当14周期SMA上穿28周期SMA时,发出做多信号并打开长仓;当14周期SMA下穿28周期SMA时,发出做空信号并打开短仓。

进入仓位后,它会通过设置止盈和止损来控制风险。止盈和止损的点数通过输入的参数转换为价格。此外,它还在图表上绘制了止盈线、止损线和入场均价的参考线,便于直观判断仓位利润和风险。

优势分析

双均线跟随策略具有以下优势:

- 操作简单,容易实现。

- 顺应趋势运行,回撤概率较小。

- 可以通过调整周期参数控制交易频率。

- 可以灵活设置止盈止损点数控制风险。

风险分析

双均线跟随策略也存在一些风险:

- 当突发事件打断市场趋势时,可能出现较大亏损。

- 如果止损点设置太小,可能会过早止损。

- 如果止损点设置太大,可能会扩大亏损范围。

- 交易频率可能过高或过低,影响资金效率。

为控制上述风险,可以从以下方面进行优化:

- 结合波动率指标判断止损点。

- 优化移动平均线的周期参数。

- 增加趋势滤波器,避免趋势末期的假信号。

优化方向

双均线跟随策略可以从以下几个方面进行优化:

增加波动率指标,动态调整止损点。例如结合ATR指标,当市场波动加大时扩大止损点,避免过早止损。

优化移动平均线周期参数。可以测试更多组合,选择产生交易信号次数更合适的周期。

添加趋势滤波器。例如增设MACD、DMI等指标,避免在趋势末期出现的假信号,减少不必要的交易。

增加机器学习模型。使用LSTM、GRU等深度学习模型预测价格趋势,替代传统均线法则,可能获得更好的效果。

多品种交易。将策略套用到更多品种,利用非相关性降低整体回撤。

总结

双均线跟随策略整体来说是一个简单实用的趋势策略。它顺应趋势而动,回撤风险较小,容易实现。我们可以通过调整周期参数、设置止损止盈、增加趋势判断指标等方式优化该策略,使其能够适应更多市场环境,获得更稳定的投资回报。

策略源码

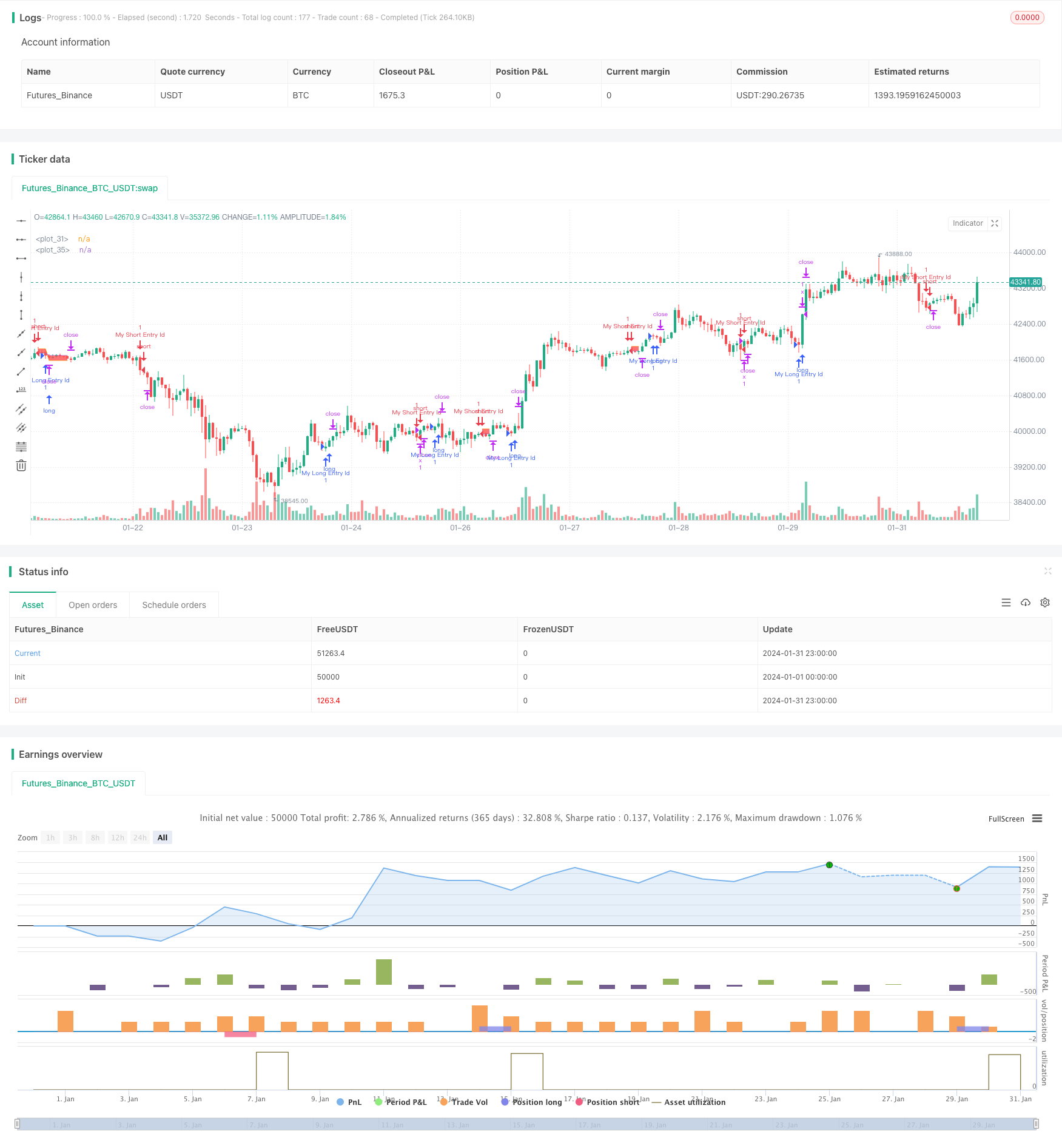

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © coinilandBot

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © adolgov

// @description

//

//@version=4

strategy("coiniland copy trading platform", overlay=true)

// random entry condition

longCondition = crossover(sma(close, 14), sma(close, 28))

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

shortCondition = crossunder(sma(close, 14), sma(close, 28))

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)

moneyToSLPoints(money) =>

strategy.position_size !=0 ? (money / syminfo.pointvalue / abs(strategy.position_size)) / syminfo.mintick : na

p = moneyToSLPoints(input(200, title = "Take Profit $$"))

l = moneyToSLPoints(input(100, title = "Stop Loss $$"))

strategy.exit("x", profit = p, loss = l)

// debug plots for visualize SL & TP levels

pointsToPrice(pp) =>

na(pp) ? na : strategy.position_avg_price + pp * sign(strategy.position_size) * syminfo.mintick

pp = plot(pointsToPrice(p), style = plot.style_linebr )

lp = plot(pointsToPrice(-l), style = plot.style_linebr )

avg = plot( strategy.position_avg_price, style = plot.style_linebr )

fill(pp, avg, color = color.green)

fill(avg, lp, color = color.red)