概述

本策略采用500日简单移动平均线来判断市场趋势方向,当价格突破均线时产生交易信号,属于典型的趋势跟踪策略。该策略简单易懂,容易实现,适用于中长线趋势交易。

策略原理

当价格高于500日移动平均线且前一天价格低于该平均线时,产生买入信号;当价格低于500日移动平均线且前一天价格高于该平均线时,产生卖出信号。也就是说,该策略利用价格与均线的关系来判断市场趋势,进而产生交易信号。

具体来说,策略主要的判断指标是500日简单移动平均线。该平均线能够有效判断长期趋势的方向。当价格从下向上突破该均线时,表明行情开始进入多头格局,这时产生买入信号;而当价格出现价格拐头,从上向下跌破该均线时,则表明行情开始进入空头格局,这时产生卖出信号。

优势分析

- 策略思路简单清晰,容易理解和实现

- 移动平均线是一种有效判断长期趋势的技术指标

- 可有效过滤短期市场噪音,捕捉中长线趋势

- 交易信号明确,不会过于频繁出入场

- 可将收益最大化,有利于降低交易成本和滑点损失

风险分析

- 长期均线容易滞后,不能及时捕捉短期调整

- 大盘趋势突变时,可能带来较大亏损

- 交易频次较低,可能错过部分交易机会

- 无法做到全天候的机械化交易

针对上述风险,可采取如下措施加以缓解:

- 结合其他指标判断市场短期内是否存在调整的可能

- 设置止损点,控制单笔亏损

- 适当调整均线周期参数,寻找最优参数组合

优化方向

- 尝试多种移动平均线的组合,寻找最优参数

- 结合其他指标过滤误信号

- 根据具体标的调整持仓和止损策略

- 优化资金管理,实现风险控制

总结

本策略总体来说属于简单实用型策略。该策略采用价格与均线关系判断趋势方向、产生交易信号的思路简单明了,容易理解实现,可有效跟踪中长线趋势,过滤短期市场噪音。但也存在一定的滞后性问题。可通过参数优化、结合其他指标等方式进一步完善。

策略源码

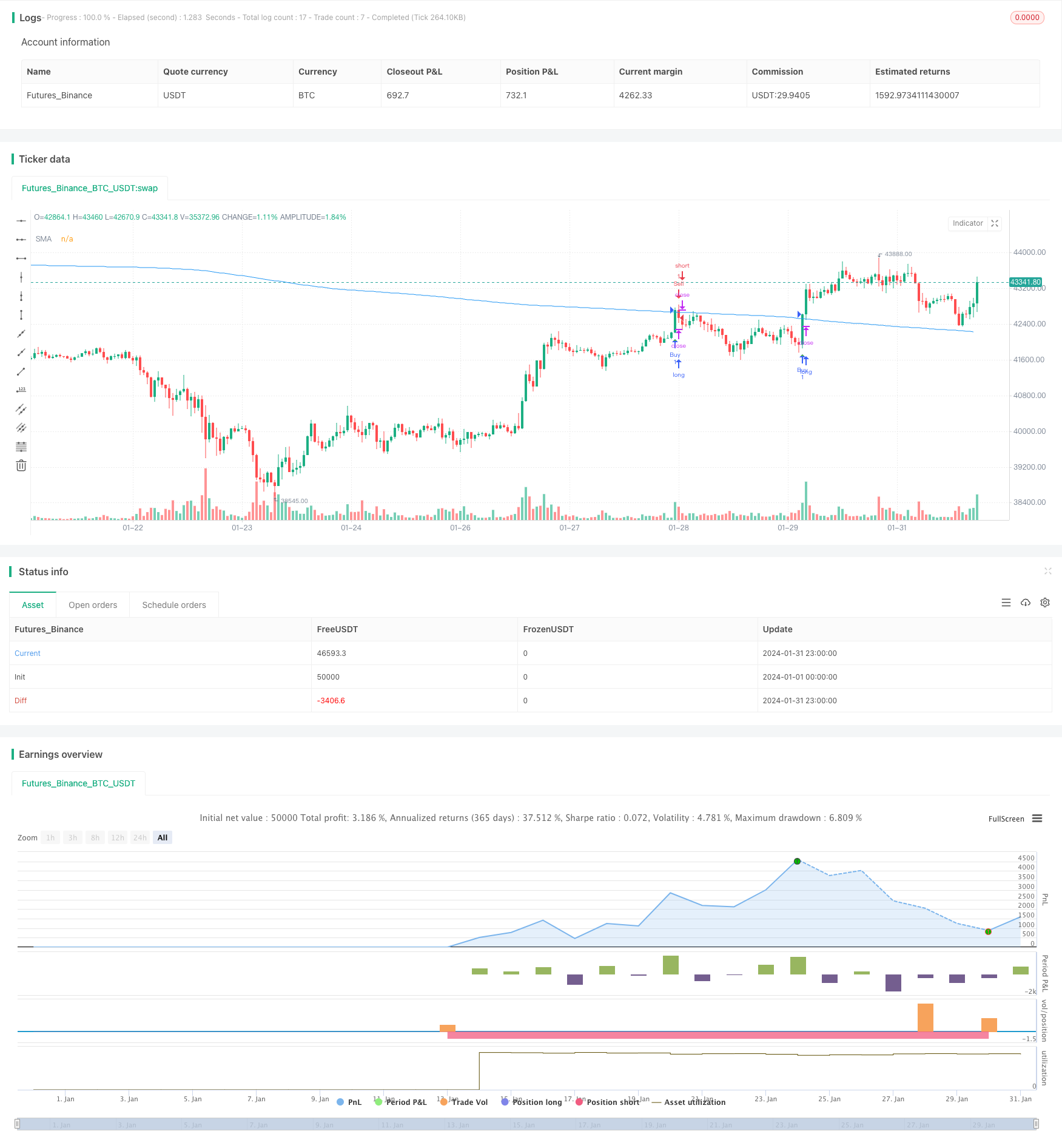

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Una AI Strategy", overlay=true)

// Устанавливаем период скользящей средней

smaPeriod = input(500, title="SMA Period")

// Вычисляем скользящую среднюю

sma = ta.sma(close, smaPeriod)

// Логика для входа в долгую позицию при пересечении вверх

longCondition = close > sma and close[1] <= sma

// Логика для входа в короткую позицию при пересечении вниз

shortCondition = close < sma and close[1] >= sma

// Вход в позиции

strategy.entry("Buy", strategy.long, when=longCondition)

strategy.entry("Sell", strategy.short, when=shortCondition)

// Выход из позиции

strategy.close("Buy", when=shortCondition)

strategy.close("Sell", when=longCondition)

// Рисуем линию скользящей средней для визуального анализа

plot(sma, color=color.blue, title="SMA")

// Метки сигналов

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.triangleup, size=size.small, location=location.belowbar)

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.triangledown, size=size.small, location=location.abovebar)