概述

该策略是一个基于移动平均线的短期追踪策略。它使用长期和短期移动平均线的黄金交叉作为买入信号,死叉作为卖出信号,并结合RSI指标过滤假信号。这是一个典型的短线交易策略,适合高频日内交易。

策略原理

该策略使用 200 期长期简单移动平均线 malong 和 21 期短期指数移动平均线 mashort。当价格上穿长期均线且 RSI 指标小于 20 时产生买入信号;当价格下穿短期均线且 RSI 指标大于 80 时产生卖出信号。为过滤假信号,它还设置了附加条件:只有价格低于短期均线且高于前一根K线的最低价时才会平仓做多头仓位;只有价格高于短期均线且低于前一根K线的最高价时才会平仓做空头仓位。

该策略同时设置了 1% 的止损和 1% 的止盈。也即做多头仓位止损价为买入价格的 99%,止盈价为买入价格的 101%;做空头仓位则相反,这确保了每个交易都有严格的风险控制。

策略优势

该策略最大的优势在于其短期追踪特性。移动平均线的黄金/死叉组合被证明是有效识别短期趋势转折的技术指标。结合 RSI 极值过滤,可以有效识别短期反转机会,及时调整仓位。这种高频交易策略可以充分捕捉价格的短期波动,实现盈利。

另一个优势在于该策略设置了严格的止损机制。无论做多还是做空,止损点都设置为买入/卖出价格的 1% 以下,可以快速止损,防止亏损扩大。止盈也类似设置为 1%,确保盈利后及时止盈。

策略风险

该策略最大的风险在于容易产生过度交易。当价格在均线附近震荡时,会频繁触发开仓平仓,不利于持仓成本和手续费的控制。这时需要适当放宽指标参数,减少无谓交易。

另一个风险是移动平均线容易发出假信号。当价格出现剧烈波动时,实际趋势并未转变,但是移动平均线可能发出错误信号。这时则需要依赖 RSI 极值过滤来避免追顶撤底。可以测试优化 RSI 参数,使过滤更加严格。

策略优化方向

该策略可以从以下几个方面进一步优化:

增加其他指标过滤,如KD,MACD等,结合更多指标判断市场实际走势,避免假信号。

优化移动平均线参数,测试不同周期参数对策略效果的影响。

优化止损止盈参数,适当扩大止损范围来减少止损被触发的概率。

增加交易时间过滤,只在活跃交易时段开仓,避免隔夜风险。

增加日内循环及空仓期过滤逻辑,降低无谓交易频率,减少费用支出。

总结

本策略总体而言是一个典型的短期追踪策略。它利用移动平均线的黄金/死叉组合判断短期趋势,并辅以 RSI 指标过滤假信号。策略具有高频日内交易的优势,可以充分捕捉价格的短期波动。但也存在一定的假信号风险和过度交易风险。通过参数优化及增加其他指标可以进一步完善该策略,提高策略稳定盈利的能力。

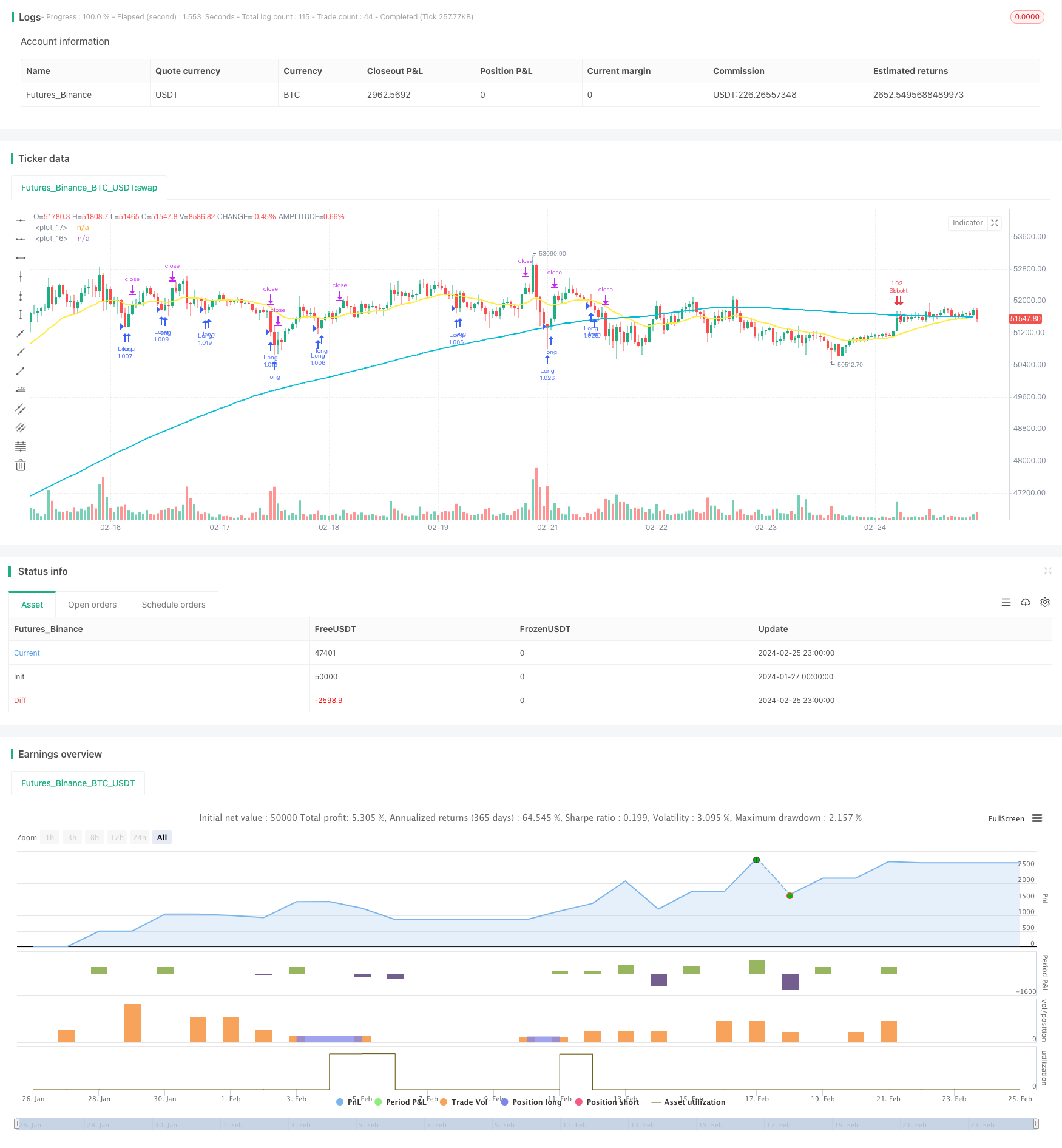

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("simple pull back", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input values

malongperiod = input.int(200, "Long Term SMA Period", group="Parameters")

mashortperiod = input.int(21, "Short Term SMA Period", group="Parameters")

stoprate = 1 // Set the stop loss percentage to 1%

profit = input.int(1, "Take Profit Percentage", group="Parameters") // Change the take profit percentage to 1%

startday = input(title="Start Trade Day", defval=timestamp("01 Jan 2000 13:30 +0000"), group="Period")

endday = input(title="End Trade Day", defval=timestamp("1 Jan 2099 19:30 +0000"), group="Period")

// Plotting indicators

malong = ta.sma(close, malongperiod)

mashort = ta.ema(close, mashortperiod)

plot(malong, color=color.aqua, linewidth=2)

plot(mashort, color=color.yellow, linewidth=2)

// Date range

datefilter = true

// Long entry condition

if close > malong and close < mashort and strategy.position_size == 0 and datefilter and ta.rsi(close, 3) < 20

strategy.entry("Long", strategy.long)

// Short entry condition

if close < malong and close > mashort and strategy.position_size == 0 and datefilter and ta.rsi(close, 3) > 80

strategy.entry("Short", strategy.short)

// Exit conditions with 1% stop loss and 1% take profit

strategy.exit("Cut", "Long", stop=(1 - 0.01 * stoprate) * strategy.position_avg_price, limit=(1 + 0.01 * profit) * strategy.position_avg_price)

if close > mashort and close < low[1] and strategy.position_size > 0

strategy.close("Long")

if close < mashort and close > high[1] and strategy.position_size < 0

strategy.close("Short")