概述

本策略称为“双均抄底策略”。该策略利用EMA均线系统与RSI指标的组合,形成交易信号,并设定止损和止盈条件,实现亏损控制和盈利目标。策略适用于BTC/USD和其他数字货币交易。

策略原理

该策略以50日EMA均线和100日SMA均线为核心技术指标。当短期EMA上穿长期SMA时产生买入信号;当EMA下穿SMA时产生卖出信号,这是典型的趋势跟踪策略。同时结合RSI指标判断市场是否过热过冷,RSI高于70为超买区,低于30为超卖区,可以避免不必要的追高杀跌。

具体交易规则如下:

买入条件:50日EMA上穿100日SMA

卖出条件:50日EMA下穿100日SMA

止盈条件:RSI大于70时平多单;RSI小于30时平空单

策略优势

该策略集成了均线、RSI等多种指标,形成比较稳定和可靠的交易信号。相比单一指标,多指标集成能够过滤掉一些假信号。

EMA快速响应价格变化,SMA能抑制短期噪音。EMA和SMA的配合使用,平衡了指标的灵敏度。

RSI指标判断超买超卖区,有助于把握大趋势,避免追高杀跌。

策略风险

该策略依赖指标拟合历史数据,存在过拟合风险。如果市场状态发生重大变化,策略表现会受到影响。此外,数字货币市场波动大,止损点设定也有难度。

应对方法:

1. 继续优化指标参数,改进信号质量

2. 结合更多因子,判断交易机会

3. 动态调整止损位,优化止损策略

策略优化方向

该策略可以从以下几个方面进行进一步优化:

整合更多指标,如MACD、布林带等,形成指标集群,增强信号的稳健性。

尝试机器学习模型自动优化指标参数。目前参数依赖经验值设定,可以采用强化学习、进化优化等算法自动寻找最优参数。

结合交易量指标。增加交易量确认,避免出现无量突破的假信号。

增加自动止损策略,通过追踪波动率等指标,实现止损点的动态调整。

总结

该策略整合EMA、SMA和RSI指标,形成稳定的交易信号。并设定比较清晰的止盈止损规则,对资金风险控制到位。但仍存在过拟合、止损点设置困难等问题。未来将从提高信号质量、止损策略优化等方面进行改进。

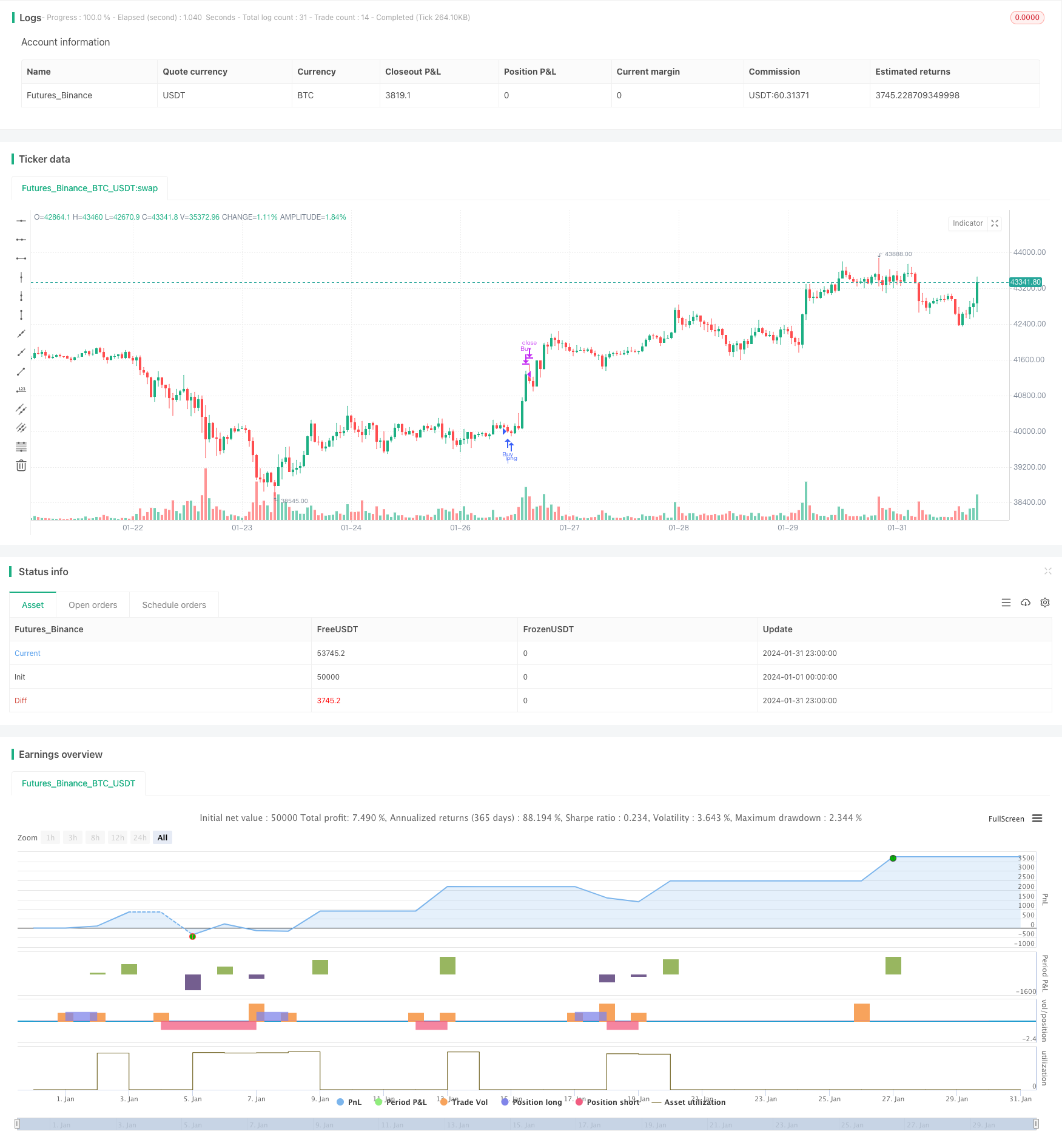

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Wallstwizard10

//@version=4

strategy("Estrategia de Trading", overlay=true)

// Definir las EMA y SMA

ema50 = ema(close, 50)

sma100 = sma(close, 100)

// Definir el RSI

rsiLength = input(14, title="RSI Length")

overbought = input(70, title="Overbought Level")

oversold = input(30, title="Oversold Level")

rsi = rsi(close, rsiLength)

// Condiciones de Compra

buyCondition = crossover(ema50, sma100) // EMA de 50 cruza SMA de 100 hacia arriba

// Condiciones de Venta

sellCondition = crossunder(ema50, sma100) // EMA de 50 cruza SMA de 100 hacia abajo

// Salida de Operaciones

exitBuyCondition = rsi >= overbought // RSI en niveles de sobrecompra

exitSellCondition = rsi <= oversold // RSI en niveles de sobreventa

// Lógica de Trading

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

if (exitBuyCondition)

strategy.close("Buy")

if (exitSellCondition)

strategy.close("Sell")