概述

该策略基于布林带指标,主要思想是在价格突破布林带上轨或下轨后,等待价格回归到布林带内部,然后在回归点建立与突破方向相同的头寸。该策略利用了价格在极端区域往往会出现反转的特点,通过布林带突破和回归的组合条件来捕捉市场转折点,以期获得更高的胜率。

策略原理

- 计算布林带的中轨、上轨和下轨。中轨为移动平均线,上轨和下轨为中轨加减一定标准差。

- 判断价格是否突破布林带的上轨或下轨。如果收盘价超过上轨,则认为是向上突破;如果收盘价跌破下轨,则认为是向下突破。

- 如果发生向上突破,记录该突破K线的最高价为peak。如果发生向下突破,记录该突破K线的最低价为peak。peak用于后续判断价格是否回归。

- 在发生突破后,等待价格回归到布林带内部。如果此时收盘价位于上轨和下轨之间,则认为价格已经回归。

- 在价格回归时,如果前一根K线为向上突破(break_up[1] and inside),则开多头;如果前一根K线为向下突破(break_down[1] and inside),则开空头。

- 持仓管理:如果多头持仓时,收盘价上穿中轨,则平多;如果空头持仓时,收盘价下穿中轨,则平空。

优势分析

- 布林带有很强的自适应性,能够根据价格波动情况动态调整,对于捕捉趋势和波动很有帮助。

- 相比单纯的布林带突破策略,增加了回归条件,能够一定程度上避免追高杀跌,提高进场质量。

- 平仓条件以中轨为参考,简单易用,能够较好地保护利润。

- 可以自定义布林带的参数,如长度、偏差倍数等,灵活性高。

风险分析

- 布林带参数选择不当可能导致过早或过晚进场,影响策略表现。可以通过优化参数来缓解。

- 价格在布林带附近震荡时可能会出现频繁开平仓,导致交易成本增加。

- 如果趋势很强,价格长时间不回归布林带内部,可能会错失趋势利润。

- 单纯使用布林带指标可能对于某些品种或某些行情并不奏效,需要配合其他信号。

优化方向

- 可以考虑引入更多过滤条件,如价格在布林带上方运行一段时间后再突破更可靠,或者MA角度、ADX等趋势判断指标用于辅助判断。

- 针对震荡行情,可以增加限价单和计时器,避免盲目开仓。

- 平仓方面可以再结合ATR或均线,控制好出场时机。

- 对不同标的和周期进行参数优化和特征分析,选择适合的交易标的和周期。

- 可以考虑加入仓位管理,如波动率收缩时加大仓位,波动率放大时减少仓位。

总结

布林带突破回归交易策略是一个简单实用的量化交易策略。它利用价格对极端情况的反应,通过布林带工具构建开平仓条件,能够在一定程度上捕捉趋势起始点和终结点,控制频繁交易。同时该策略也存在参数选择、震荡行情下表现不佳、对趋势把握不足等问题。通过细节的优化以及与其他信号的结合,有望进一步提升该策略的适应性和鲁棒性。

策略源码

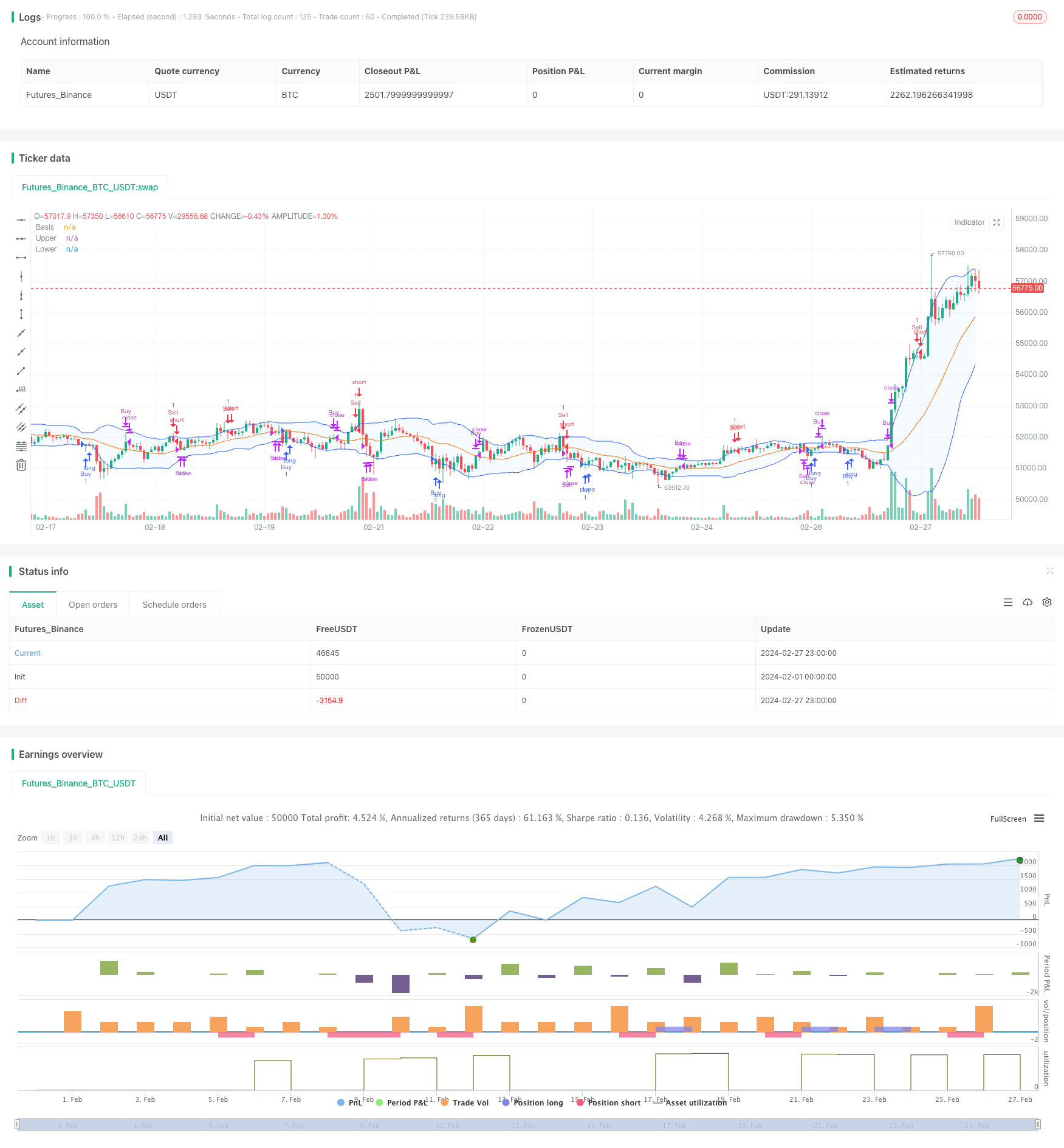

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-27 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(shorttitle="BB", title="Bollinger Bands", overlay=true)

length = input.int(20, minval=1)

maType = input.string("SMA", "Basis MA Type", options = ["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = input.float(1.7, minval=0.001, maxval=50, title="StdDev")

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

break_up = close > upper

break_down = close < lower

inside = close > lower and close < upper

sell_condition = break_up[1] and inside

buy_condition = break_down[1] and inside

// Conditions to close trades

close_sell_condition = close > basis

close_buy_condition = close < basis

trade_condition = sell_condition or buy_condition

// Tracking the high of the breakout candle

var float peak = na

if (not trade_condition)

peak := close

if (break_up and peak < high)

peak := high

if (break_down and peak > low)

peak := low

// Entering positions

if (buy_condition)

strategy.entry("Buy", strategy.long)

if (sell_condition)

strategy.entry("Sell", strategy.short)

// Exiting positions when close crosses the basis

if (strategy.position_size > 0 and close_sell_condition) // If in a long position and close crosses above basis

strategy.close("Buy")

if (strategy.position_size < 0 and close_buy_condition) // If in a short position and close crosses below basis

strategy.close("Sell")