概述

该策略使用日线的VWAP(成交量加权平均价)作为进场和出场的信号。当收盘价上穿VWAP时触发做多,止损设置在VWAP下方的前一根K线低点,目标价设置在开仓价上方3个点;当收盘价下穿VWAP时触发做空,止损设置在VWAP上方的前一根K线高点,目标价设置在开仓价下方3个点。该策略没有包含出场条件,交易会一直持有直到反向信号出现。

策略原理

- 获取日线的VWAP数据,作为趋势判断和交易信号的依据。

- 判断当前收盘价是否上穿/下穿VWAP,分别作为做多和做空的触发条件。

- 做多时,如果前一根K线低点在VWAP之下,则将其作为止损位,否则直接使用VWAP作为止损;做空则相反。

- 开仓后,分别设置固定3个点的止盈位。

- 策略持续运行,直到触发反向信号平仓并开立新的仓位。

通过跨周期的VWAP数据判断趋势,同时利用动态止损和固定点数止盈,可以有效把握趋势行情,控制回撤风险,并及时锁定利润。

优势分析

- 简单有效:策略逻辑清晰,仅使用VWAP一个指标,就可以实现趋势判断和信号触发,简单易于实现和优化。

- 动态止损:根据前一根K线的高低点设置止损,可以更好地适应市场波动,降低风险。

- 固定点数止盈:以固定点数设置目标价,有助于及时锁定利润,避免利润回吐。

- 及时止损止盈:策略在触发反向信号时会立即平仓,不会对已有利润造成额外损失,同时会开立新的仓位,捕捉新的趋势行情。

风险分析

- 参数优化:策略使用了固定的3个点作为止盈,实际交易中可能需要根据不同标的和市场特点进行优化,选择最佳参数。

- 震荡行情:在震荡行情下,频繁的进场和出场可能导致较高的交易成本,影响收益。

- 趋势持续性:策略依赖于趋势行情,如果市场处于区间震荡,或趋势持续性较差,可能会出现较多的交易信号,带来更多的风险。

优化方向

- 趋势过滤:加入其他趋势指标如移动平均线、MACD等,对趋势进行二次确认,提高信号可靠性。

- 动态止盈:根据市场波动性、ATR等指标,动态调整止盈点数,以更好地适应市场。

- 仓位管理:根据账户资金、风险偏好等因素,对每次交易的仓位大小进行动态调整。

- 交易时段选择:根据标的特性和交易活跃程度,选择最佳的交易时段,提高策略效率。

总结

该策略利用跨周期VWAP数据进行趋势判断和信号触发,同时采用动态止损和固定点数止盈的方式控制风险和锁定利润,是一个简单有效的量化交易策略。通过趋势过滤、动态止盈、仓位管理和交易时段选择等方面的优化,可以进一步提高策略的稳健性和收益潜力。但在实际应用中,仍需注意市场特点、交易成本和参数优化等因素,以期获得更好的策略表现。

策略源码

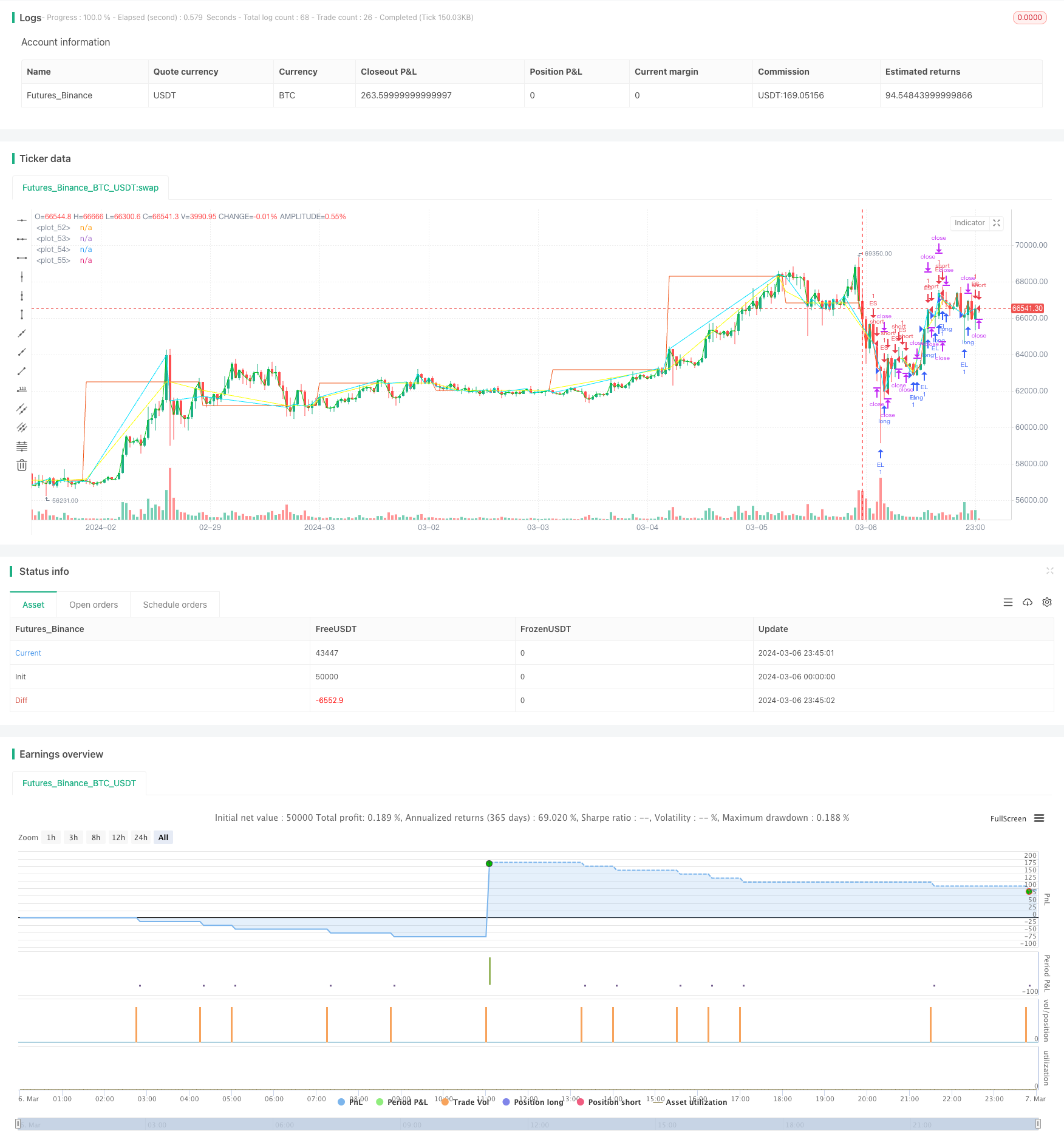

/*backtest

start: 2024-03-06 00:00:00

end: 2024-03-07 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Pine Script Tutorial Example Strategy 1', overlay=true, initial_capital=1000, default_qty_value=100, default_qty_type=strategy.percent_of_equity)

// fastEMA = ta.ema(close, 24)

// slowEMA = ta.ema(close, 200)

// Higher Time Frame

float sl = na

float tgt = na

posSize = 1

vwap_1d = request.security(syminfo.tickerid, "1D", ta.vwap(close))

// plot(vwap_1d)

// To avoid differences on historical and realtime bars, you can use this technique, which only returns a value from the higher timeframe on the bar after it completes:

// indexHighTF = barstate.isrealtime ? 1 : 0

// indexCurrTF = barstate.isrealtime ? 0 : 1

// nonRepaintingVWAP = request.security(syminfo.tickerid, "1D", close[indexHighTF])[indexCurrTF]

// plot(nonRepaintingVWAP, "Non-repainting VWAP")

enterLong = ta.crossover(close, vwap_1d)

exitLong = ta.crossunder(close, vwap_1d)

enterShort = ta.crossunder(close, vwap_1d)

exitShort = ta.crossover(close, vwap_1d)

if enterLong

sl := low[1]>vwap_1d ?low[1]:vwap_1d

tgt:=close+3

strategy.entry("EL", strategy.long, qty=posSize)

strategy.exit('exitEL', 'EL', stop=sl, limit=tgt)

if enterShort

sl := high[1]<vwap_1d ?high[1]:vwap_1d

tgt := close-3

strategy.entry("ES", strategy.short, qty=posSize)

strategy.exit('exitES', 'ES', stop=sl, limit=tgt)

// if exitLong

// strategy.close("EL")

// if exitShort

// strategy.close("ES")

// goLongCondition1 = ta.crossover(close, vwap_1d)

// timePeriod = time >= timestamp(syminfo.timezone, 2021, 01, 01, 0, 0)

// notInTrade = strategy.position_size <= 0

// if goLongCondition1 and timePeriod and notInTrade

// stopLoss = low[1]

// takeProfit = close+3

// strategy.entry('long', strategy.long)

// strategy.exit('exit', 'long', stop=stopLoss, limit=takeProfit)

plot(close, color=color.new(#00c510, 0))

plot(vwap_1d, color=color.new(#f05619, 0))

plot(sl, color=color.new(#fbff00, 0))

plot(tgt, color=color.new(#00e1ff, 0))