策略概述

双均线交叉策略是一种经典的趋势跟踪策略。该策略使用两条不同周期的移动平均线来捕捉市场趋势,当快速均线上穿慢速均线时产生做多信号,当快速均线下穿慢速均线时产生做空信号。这个策略的核心思想是快速均线对价格变化更敏感,能更快反应市场趋势的变化,而慢速均线反应市场的长期趋势。通过两条均线的交叉,可以判断出市场趋势的转变,从而进行交易。

策略原理

该策略代码中使用了两条移动平均线,一条是快速均线(默认14期),一条是慢速均线(默认28期)。移动平均线类型可以选择简单移动平均线(SMA)、指数移动平均线(EMA)、加权移动平均线(WMA)和相对移动平均线(RMA)。

策略的主要逻辑如下:

- 计算快速均线和慢速均线的值

- 如果快速均线上穿慢速均线,则产生做多信号,开仓做多

- 如果快速均线下穿慢速均线,且允许做空(allowShorting=true),则产生做空信号,开仓做空

- 如果快速均线下穿慢速均线,且不允许做空(allowShorting=false),则平掉多头仓位

通过这样的逻辑,策略可以跟踪市场的主要趋势,在上涨趋势中持有多头仓位,在下跌趋势中持有空头仓位或者空仓等待。均线周期和类型可以根据不同市场和交易品种进行调整优化。

策略优势

- 逻辑简单清晰,容易理解和实现

- 适用于趋势性市场,可以有效捕捉市场的中长期趋势

- 参数可调,适用于不同的市场和交易品种

- 可以根据市场特点和个人偏好,灵活选择是否允许做空

- 移动平均线是经典的技术分析指标,被广泛使用和验证

策略风险

- 在震荡市中,频繁的均线交叉可能导致频繁交易,增加交易成本

- 快速均线选择太短,或慢速均线选择太长,可能导致信号滞后,错过最佳交易时机

- 策略在市场趋势转变时,可能出现连续亏损的情况

- 固定的均线周期参数,可能不适应市场的动态变化

针对这些风险,可以采取以下措施:

- 根据市场特点,优化均线周期参数,选择合适的快慢均线长度

- 在震荡市中,可以考虑增加过滤条件,如ATR过滤,或均线交叉角度过滤等

- 合理设置止损止盈,控制单笔交易风险

- 定期回测评估,根据市场变化调整策略参数

策略优化

- 引入更多技术指标,如MACD、RSI等,构建多因子策略,提高信号准确性

- 优化仓位管理,如考虑ATR或波动率等因素,动态调整仓位大小

- 针对震荡市,可以考虑引入趋势判断指标,如ADX等,避免频繁交易

- 使用机器学习或优化算法,自动寻找最优参数组合

这些优化可以提高策略的适应性和稳定性,更好地适应不同市场状况。但同时也要注意,过度优化可能导致策略过拟合,在实盘中表现不佳。需要在样本外数据中进一步验证。

总结

双均线交叉策略是一个经典的趋势跟踪策略,通过两条不同周期移动平均线的交叉,产生交易信号。它逻辑简单,容易实现,适用于趋势性市场。但在震荡市中,可能出现频繁交易和连续亏损的情况。因此,在使用该策略时,需要根据市场特点,优化均线周期参数,并合理设置止损止盈。此外,还可以通过引入更多技术指标、优化仓位管理、趋势判断等方式,来提高策略的适应性和稳定性。但过度优化可能导致过拟合,需要谨慎对待。总的来说,双均线交叉策略是一个值得学习和研究的经典策略,通过不断优化和改进,可以成为一个有效的交易工具。

策略源码

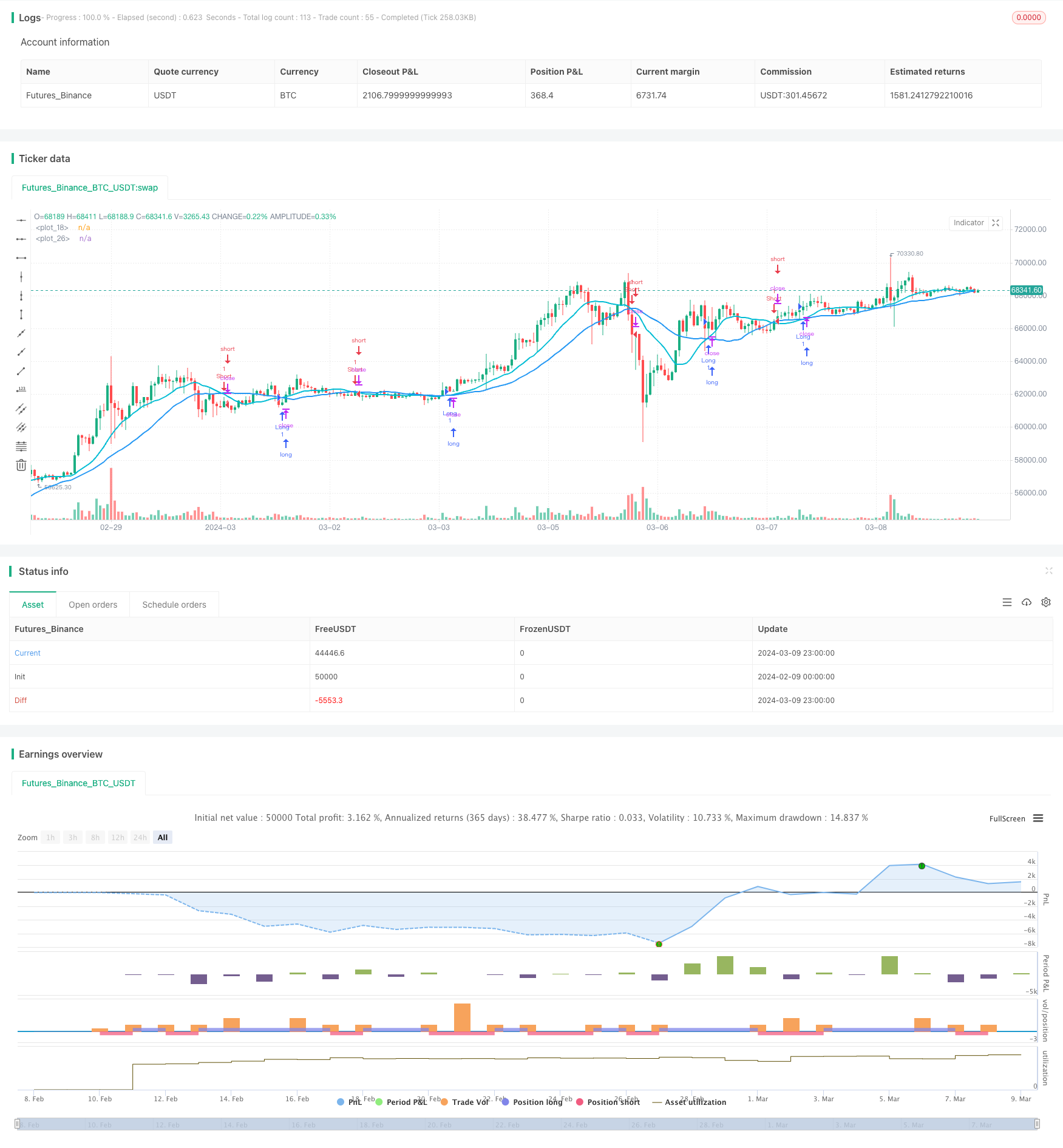

/*backtest

start: 2024-02-09 00:00:00

end: 2024-03-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © z4011

//@version=5

strategy("#2idagos", overlay=true, margin_long=100, margin_short=100)

allowShorting = input.bool(true, "Allow Shorting")

fastMALength = input.int(14, "Fast MA Length")

slowMALength = input.int(28, "Slow MA Length")

fastMAType = input.string("Simple", "Fast MA Type", ["Simple", "Exponential", "Weighted", "Relative"])

slowMAType = input.string("Simple", "Fast MA Type", ["Simple", "Exponential", "Weighted", "Relative"])

float fastMA = switch fastMAType

"Simple" => ta.sma(close, fastMALength)

"Exponential" => ta.ema(close, fastMALength)

"Weighted" => ta.wma(close, fastMALength)

"Relative" => ta.rma(close, fastMALength)

plot(fastMA, color = color.aqua, linewidth = 2)

float slowMA = switch slowMAType

"Simple" => ta.sma(close, slowMALength)

"Exponential" => ta.ema(close, slowMALength)

"Weighted" => ta.wma(close, slowMALength)

"Relative" => ta.rma(close, slowMALength)

plot(slowMA, color = color.blue, linewidth = 2)

longCondition = ta.crossover(fastMA, slowMA)

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = ta.crossunder(fastMA, slowMA) and allowShorting

if (shortCondition)

strategy.entry("Short", strategy.short)

closeCondition = ta.crossunder(fastMA, slowMA) and not allowShorting

if (closeCondition)

strategy.close("Long", "Close")