策略概述

Kuberan策略是由Kathir编写的一款强大的交易策略。它融合了多种分析技术,形成了一个独特而强大的交易方法。该策略以财富之神Kuberan命名,象征着其丰富交易者投资组合的目标。

Kuberan不仅仅是一个策略,更是一个全面的交易系统。它结合了趋势分析、动量指标和成交量指标,以识别高概率的交易机会。通过利用这些要素的协同作用,Kuberan提供了明确的进场和出场信号,适用于各种水平的交易者。

策略原理

Kuberan策略的核心是多指标交汇原理。它利用了一种独特的指标组合,这些指标相互配合,以减少噪音和错误信号。具体来说,该策略使用了以下几个关键组件:

- 趋势方向判断:通过比较当前价格与支撑位和阻力位,判断当前趋势方向。

- 支撑阻力位:通过zigzag指标和枢轴点来识别关键的支撑位和阻力位。

- 背离判断:通过比较价格走势与动量指标,判断是否出现背离,提示潜在的趋势反转。

- 波动率自适应:通过ATR指标动态调整止损位,以适应不同的市场波动率。

- K线型态判断:通过特定的K线组合来确认趋势和反转信号。

通过综合考虑以上因素,Kuberan策略能够在各种市场环境下自适应调整,捕捉高概率的交易机会。

策略优势

- 多指标交汇:Kuberan策略利用了多个指标的协同作用,大大提高了信号的可靠性,降低了噪音干扰。

- 自适应性强:通过动态调整参数,该策略能够适应多变的市场环境,不易失效。

- 明确信号:Kuberan提供清晰的进场和出场信号,简化了交易决策过程。

- 回测稳健:该策略经过了严格的历史回测,在各种市场行情下都表现稳健。

- 适用性广:Kuberan适用于多种市场和品种,不限于特定交易标的。

策略风险

- 参数敏感:Kuberan策略的表现对参数选择较为敏感,不当的参数可能导致表现下降。

- 突发事件:该策略主要基于技术面信号,对基本面突发事件的应对能力有限。

- 过拟合风险:如果在参数优化时考虑过多的历史数据,可能导致策略过于迎合过去,而对未来行情适应性下降。

- 杠杆风险:如果使用过高杠杆,遭遇较大回撤时有爆仓风险。

针对以上风险,可以采取适当的控制措施,如定期调整参数、设置合理止损、适度控制杠杆、关注基本面变化等。

优化方向

- 机器学习优化:可以引入机器学习算法来动态优化策略参数,提高适应性。

- 加入基本面因素:考虑将基本面分析纳入交易决策,以应对技术面信号失效的情况。

- 投资组合管理:在资金管理层面,可以将Kuberan策略纳入投资组合,与其他策略形成有效对冲。

- 细分市场优化:针对不同市场品种的特点,定制优化策略参数。

- 高频化改造:将策略改造为高频交易版本,捕捉更多短线交易机会。

总结

Kuberan是一款功能强大,安全可靠的交易策略。它巧妙地融合了多种技术分析方法,通过指标交汇原理,在捕捉趋势和把握转折点方面表现出色。尽管任何策略都难免面临风险,但Kuberan已经在回测中证明了其稳健性,通过适当的风险控制和优化措施,相信该策略能够帮助交易者在市场博弈中掌控先机,驱动投资组合的长期稳健增长。

策略源码

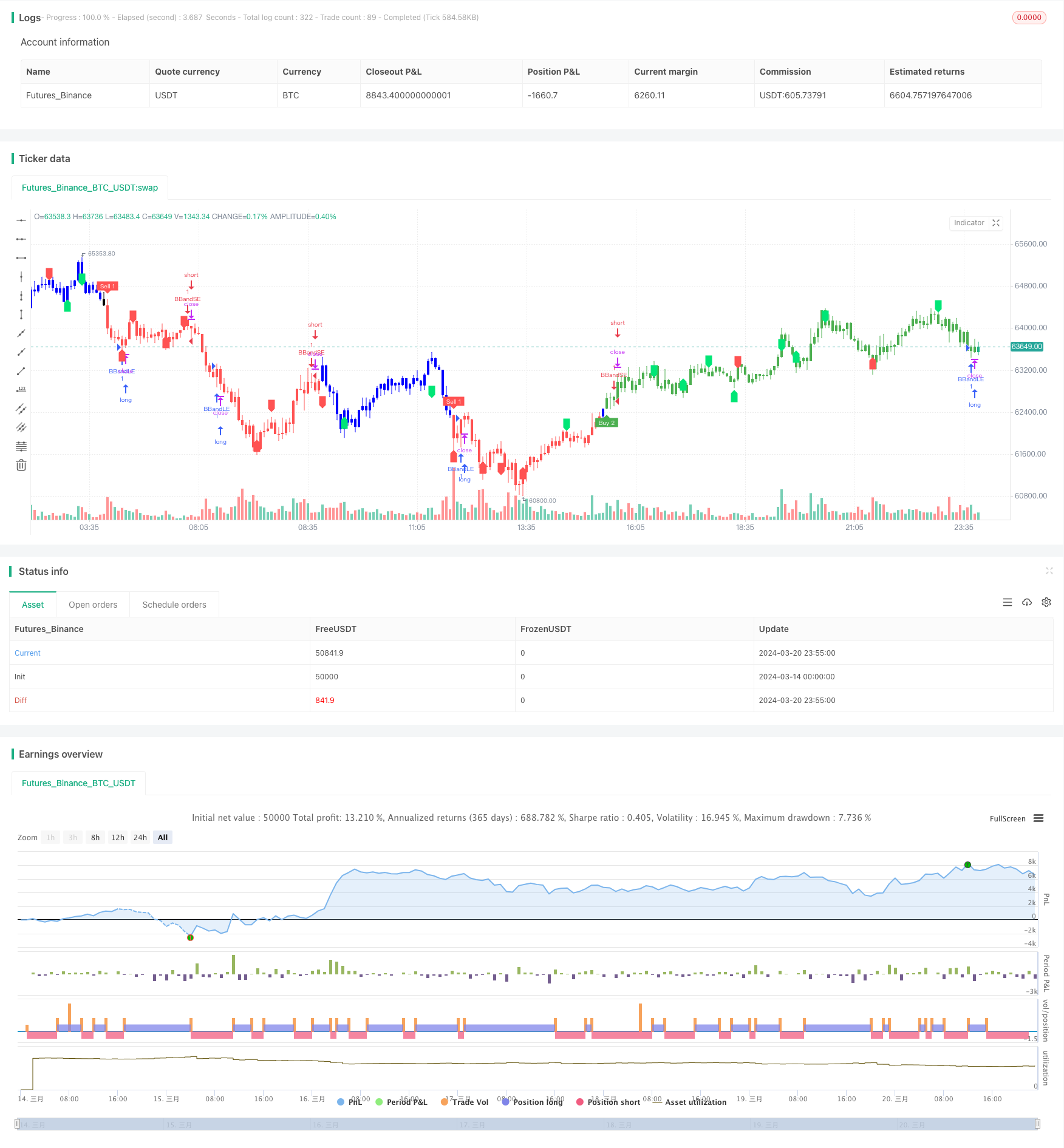

/*backtest

start: 2024-03-14 00:00:00

end: 2024-03-21 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

//@version=5

strategy('Kuberan*', overlay=true, max_lines_count=500)

lb = input.int(5, title='Left Bars', minval=1)

rb = input.int(5, title='Right Bars', minval=1)

showsupres = input.bool(false, title='Support/Resistance', inline='srcol')

supcol = input.color(color.lime, title='', inline='srcol')

rescol = input.color(color.red, title='', inline='srcol')

// srlinestyle = input(line.style_dotted, title='Line Style/Width', inline='style')

srlinewidth = input.int(3, title='', minval=1, maxval=5, inline='style')

changebarcol = input.bool(true, title='Change Bar Color', inline='bcol')

bcolup = input.color(color.blue, title='', inline='bcol')

bcoldn = input.color(color.black, title='', inline='bcol')

ph = ta.pivothigh(lb, rb)

pl = ta.pivotlow(lb, rb)

iff_1 = pl ? -1 : na // Trend direction

hl = ph ? 1 : iff_1

iff_2 = pl ? pl : na // similar to zigzag but may have multTLiple highs/lows

zz = ph ? ph : iff_2

valuewhen_1 = ta.valuewhen(hl, hl, 1)

valuewhen_2 = ta.valuewhen(zz, zz, 1)

zz := pl and hl == -1 and valuewhen_1 == -1 and pl > valuewhen_2 ? na : zz

valuewhen_3 = ta.valuewhen(hl, hl, 1)

valuewhen_4 = ta.valuewhen(zz, zz, 1)

zz := ph and hl == 1 and valuewhen_3 == 1 and ph < valuewhen_4 ? na : zz

valuewhen_5 = ta.valuewhen(hl, hl, 1)

valuewhen_6 = ta.valuewhen(zz, zz, 1)

hl := hl == -1 and valuewhen_5 == 1 and zz > valuewhen_6 ? na : hl

valuewhen_7 = ta.valuewhen(hl, hl, 1)

valuewhen_8 = ta.valuewhen(zz, zz, 1)

hl := hl == 1 and valuewhen_7 == -1 and zz < valuewhen_8 ? na : hl

zz := na(hl) ? na : zz

findprevious() => // finds previous three points (b, c, d, e)

ehl = hl == 1 ? -1 : 1

loc1 = 0.0

loc2 = 0.0

loc3 = 0.0

loc4 = 0.0

xx = 0

for x = 1 to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc1 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc2 := zz[x]

xx := x + 1

break

ehl := hl == 1 ? -1 : 1

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc3 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc4 := zz[x]

break

[loc1, loc2, loc3, loc4]

float a = na

float b = na

float c = na

float d = na

float e = na

if not na(hl)

[loc1, loc2, loc3, loc4] = findprevious()

a := zz

b := loc1

c := loc2

d := loc3

e := loc4

e

_hh = zz and a > b and a > c and c > b and c > d

_ll = zz and a < b and a < c and c < b and c < d

_hl = zz and (a >= c and b > c and b > d and d > c and d > e or a < b and a > c and b < d)

_lh = zz and (a <= c and b < c and b < d and d < c and d < e or a > b and a < c and b > d)

plotshape(_hl, title='Higher Low', style=shape.labelup, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.belowbar, offset=-rb)

plotshape(_hh, title='Higher High', style=shape.labeldown, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.abovebar, offset=-rb)

plotshape(_ll, title='Lower Low', style=shape.labelup, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.belowbar, offset=-rb)

plotshape(_lh, title='Lower High', style=shape.labeldown, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.abovebar, offset=-rb)

float res = na

float sup = na

res := _lh ? zz : res[1]

sup := _hl ? zz : sup[1]

int trend = na

iff_3 = close < sup ? -1 : nz(trend[1])

trend := close > res ? 1 : iff_3

res := trend == 1 and _hh or trend == -1 and _lh ? zz : res

sup := trend == 1 and _hl or trend == -1 and _ll ? zz : sup

rechange = res != res[1]

suchange = sup != sup[1]

var line resline = na

var line supline = na

if showsupres

if rechange

line.set_x2(resline, bar_index)

line.set_extend(resline, extend=extend.none)

resline := line.new(x1=bar_index - rb, y1=res, x2=bar_index, y2=res, color=rescol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

resline

if suchange

line.set_x2(supline, bar_index)

line.set_extend(supline, extend=extend.none)

supline := line.new(x1=bar_index - rb, y1=sup, x2=bar_index, y2=sup, color=supcol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

supline

iff_4 = trend == 1 ? bcolup : bcoldn

barcolor(color=changebarcol ? iff_4 : na)

// Inputs

A1 = input(5, title='Key Value. \'This changes the sensitivity\' for sell1')

C1 = input(400, title='ATR Period for sell1')

A2 = input(6, title='Key Value. \'This changes the sensitivity\' for buy2')

C2 = input(1, title='ATR Period for buy2')

h = input(false, title='Signals from Heikin Ashi Candles')

xATR1 = ta.atr(C1)

xATR2 = ta.atr(C2)

nLoss1 = A1 * xATR1

nLoss2 = A2 * xATR2

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop1 = 0.0

iff_5 = src > nz(xATRTrailingStop1[1], 0) ? src - nLoss1 : src + nLoss1

iff_6 = src < nz(xATRTrailingStop1[1], 0) and src[1] < nz(xATRTrailingStop1[1], 0) ? math.min(nz(xATRTrailingStop1[1]), src + nLoss1) : iff_5

xATRTrailingStop1 := src > nz(xATRTrailingStop1[1], 0) and src[1] > nz(xATRTrailingStop1[1], 0) ? math.max(nz(xATRTrailingStop1[1]), src - nLoss1) : iff_6

xATRTrailingStop2 = 0.0

iff_7 = src > nz(xATRTrailingStop2[1], 0) ? src - nLoss2 : src + nLoss2

iff_8 = src < nz(xATRTrailingStop2[1], 0) and src[1] < nz(xATRTrailingStop2[1], 0) ? math.min(nz(xATRTrailingStop2[1]), src + nLoss2) : iff_7

xATRTrailingStop2 := src > nz(xATRTrailingStop2[1], 0) and src[1] > nz(xATRTrailingStop2[1], 0) ? math.max(nz(xATRTrailingStop2[1]), src - nLoss2) : iff_8

pos1 = 0

iff_9 = src[1] > nz(xATRTrailingStop1[1], 0) and src < nz(xATRTrailingStop1[1], 0) ? -1 : nz(pos1[1], 0)

pos1 := src[1] < nz(xATRTrailingStop1[1], 0) and src > nz(xATRTrailingStop1[1], 0) ? 1 : iff_9

pos2 = 0

iff_10 = src[1] > nz(xATRTrailingStop2[1], 0) and src < nz(xATRTrailingStop2[1], 0) ? -1 : nz(pos2[1], 0)

pos2 := src[1] < nz(xATRTrailingStop2[1], 0) and src > nz(xATRTrailingStop2[1], 0) ? 1 : iff_10

xcolor1 = pos1 == -1 ? color.red : pos1 == 1 ? color.green : color.blue

xcolor2 = pos2 == -1 ? color.red : pos2 == 1 ? color.green : color.blue

ema1 = ta.ema(src, 1)

ema2 = ta.ema(src, 1)

above1 = ta.crossover(ema1, xATRTrailingStop1)

below1 = ta.crossover(xATRTrailingStop1, ema1)

above2 = ta.crossover(ema2, xATRTrailingStop2)

below2 = ta.crossover(xATRTrailingStop2, ema2)

buy1 = src > xATRTrailingStop1 and above1

sell1 = src < xATRTrailingStop1 and below1

buy2 = src > xATRTrailingStop2 and above2

sell2 = src < xATRTrailingStop2 and below2

barbuy1 = src > xATRTrailingStop1

barsell1 = src < xATRTrailingStop1

barbuy2 = src > xATRTrailingStop2

barsell2 = src < xATRTrailingStop2

// plotshape(buy1, title="Buy 1", text='Buy 1', style=shape.labelup, location=location.belowbar, color=color.green, textcolor=color.white, transp=0, size=size.tiny)

plotshape(sell1, title='Sell 1', text='Sell 1', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(buy2, title='Buy 2', text='Buy 2', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// plotshape(sell2, title="Sell 2", text='Sell 2', style=shape.labeldown, location=location.abovebar, color=color.red, textcolor=color.white, transp=0, size=size.tiny)

// barcolor(barbuy1 ? color.green : na)

barcolor(barsell1 ? color.red : na)

barcolor(barbuy2 ? color.green : na)

// barcolor(barsell2 ? color.red : na)

// alertcondition(buy1, "UT Long 1", "UT Long 1")

alertcondition(sell1, 'UT Short 1', 'UT Short 1')

alertcondition(buy2, 'UT Long 2', 'UT Long 2')

// strategy.entry('long', strategy.long, when=buy2)

source = close

length = input.int(20, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50)

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

buyEntry = ta.crossover(source, lower)

sellEntry = ta.crossunder(source, upper)

if (ta.crossover(source, lower) )

strategy.entry("BBandLE", strategy.long, stop=lower, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

if (ta.crossunder(source, upper))

strategy.entry("BBandSE", strategy.short, stop=upper, oca_name="BollingerBands",comment="BBandSE")

else

strategy.cancel(id="BBandSE")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

lengthTL = input.int(14, 'Swing Detection Lookback')

multTL = input.float(1., 'Slope', minval = 0, step = .1)

calcMethod = input.string('Atr', 'Slope Calculation Method', options = ['Atr','Stdev','Linreg'])

backpaint = input(true, tooltip = 'Backpainting offset displayed elements in the past. Disable backpainting to see real time information returned by the indicator.')

//Style

upCss = input.color(color.teal, 'Up Trendline Color', group = 'Style')

dnCss = input.color(color.red, 'Down Trendline Color', group = 'Style')

showExt = input(true, 'Show Extended Lines')

//-----------------------------------------------------------------------------}

//Calculations

//-----------------------------------------------------------------------------{

var upperTL = 0.

var lowerTL = 0.

var slope_phTL = 0.

var slope_plTL = 0.

var offset = backpaint ? lengthTL : 0

n = bar_index

srcTL = close

phTL = ta.pivothigh(lengthTL, lengthTL)

plTL = ta.pivotlow(lengthTL, lengthTL)

//Slope Calculation Method

slope = switch calcMethod

'Atr' => ta.atr(lengthTL) / lengthTL * multTL

'Stdev' => ta.stdev(srcTL,lengthTL) / lengthTL * multTL

'Linreg' => math.abs(ta.sma(srcTL * n, lengthTL) - ta.sma(srcTL, lengthTL) * ta.sma(n, lengthTL)) / ta.variance(n, lengthTL) / 2 * multTL

//Get slopes and calculate trendlines

slope_phTL := phTL ? slope : slope_phTL

slope_plTL := plTL ? slope : slope_plTL

upperTL := phTL ? phTL : upperTL - slope_phTL

lowerTL := pl ? pl : lowerTL + slope_plTL

var upos = 0

var dnos = 0

upos := phTL ? 0 : close > upperTL - slope_phTL * lengthTL ? 1 : upos

dnos := pl ? 0 : close < lowerTL + slope_plTL * lengthTL ? 1 : dnos