概述

该策略结合布林带和相对强弱指标(RSI)来判断买卖信号。当价格突破布林带下轨且RSI低于设定的下限时产生买入信号;当价格突破布林带上轨且RSI高于设定的上限时产生卖出信号。同时,该策略还引入了买入间隔参数,避免频繁交易,有利于实现金字塔式仓位管理。

策略原理

- 计算RSI指标,用于衡量价格的超买超卖情况。

- 计算布林带上下轨,用于判断价格的突破情况。

- 结合RSI和布林带设定买卖信号:

- 当收盘价低于布林带下轨且RSI低于设定的下限水平时,产生买入信号。

- 当收盘价高于布林带上轨且RSI高于设定的上限水平时,产生卖出信号。

- 引入买入间隔参数,限制连续买入的频率,便于实现金字塔式仓位管理。

策略优势

- 双重确认:策略同时使用布林带和RSI两个指标,可以更可靠地捕捉趋势拐点,降低假信号风险。

- 金字塔式建仓:通过设置买入间隔参数,策略可以在趋势确立后逐步加仓,有利于控制风险和优化收益。

- 参数灵活:用户可以根据市场特点和个人偏好,灵活设置RSI上下限和买入间隔等参数。

策略风险

- 趋势延续风险:如果价格在突破布林带后出现短暂回撤,可能导致策略过早平仓,错失后续趋势。

- 参数优化风险:不同市场环境下,最优参数组合可能差异较大,策略可能面临过拟合风险。

- 黑天鹅事件:策略基于历史数据构建,可能无法有效应对极端行情。

策略优化方向

- 引入止损止盈:在策略中加入移动止损或固定止损止盈逻辑,以进一步控制单笔交易风险。

- 动态参数优化:根据市场状态的变化,动态调整RSI上下限和买入间隔等参数,提高策略适应性。

- 结合其他技术指标:引入其他趋势类或摆动类指标作为辅助判断,提高策略稳健性。

总结

该策略巧妙地结合了布林带和RSI两个经典技术指标,通过双重确认机制来捕捉趋势性机会。同时,策略引入了金字塔式建仓方法,在控制风险的同时力求优化收益。但策略也存在趋势延续风险、参数优化风险和黑天鹅事件风险,未来可以通过引入止损止盈、动态参数优化和结合其他指标等方式进一步优化。总的来说,这是一个思路清晰、逻辑严谨的量化交易策略,值得进一步探索和实践。

策略源码

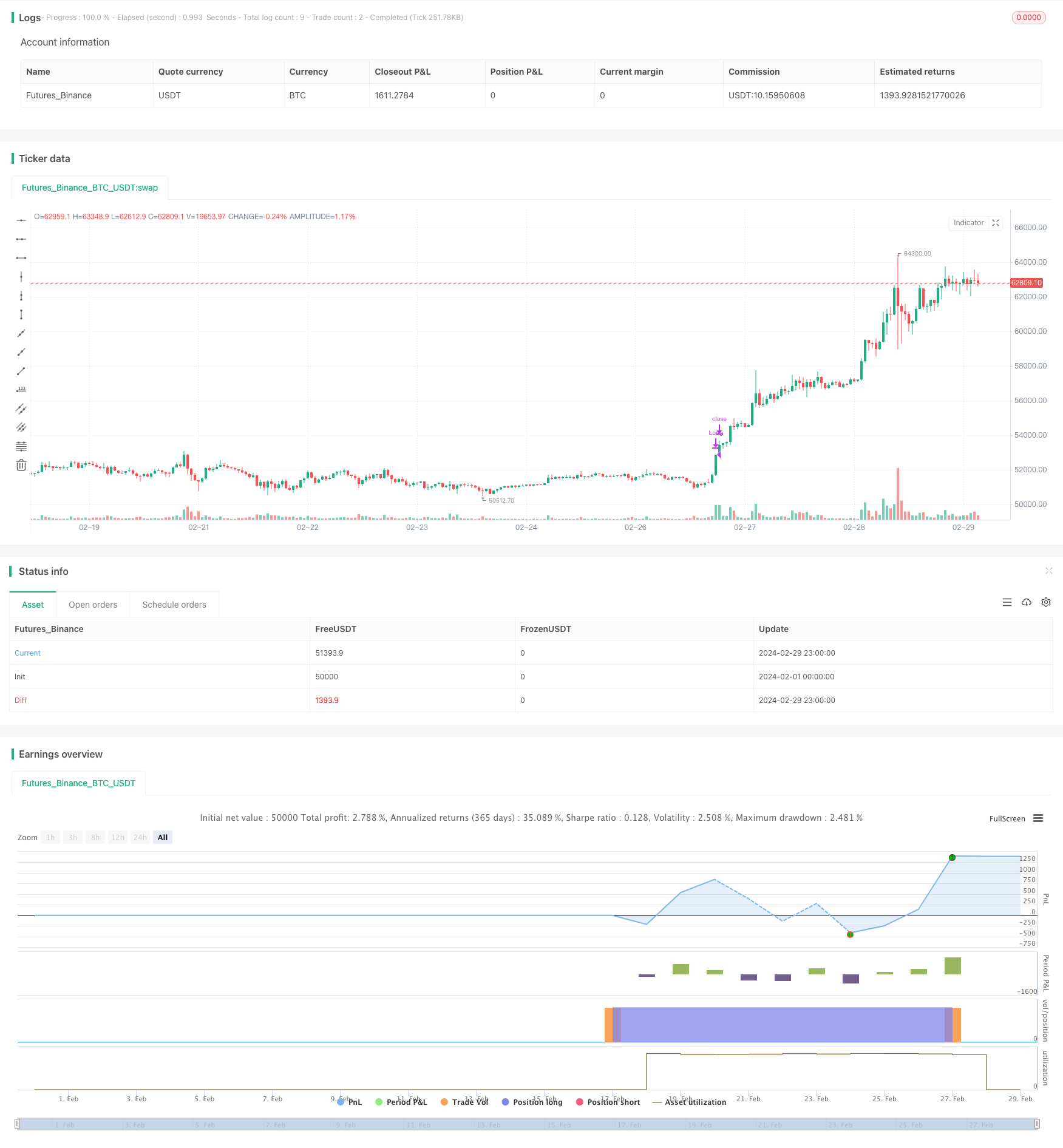

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

strategy(overlay=true, shorttitle="cakes'Strategy For RSI", default_qty_type = strategy.percent_of_equity, initial_capital = 100000, default_qty_value = 100, pyramiding = 0, title="cakes'Strategy", currency = 'USD')

////////// ** Inputs ** //////////

// Stoploss and Profits Inputs

v1 = input(true, title="GoTradePlz")

////////// ** Indicators ** //////////

// RSI

len = 14

src = close

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

// Bollinger Bands

length1 = 20

src1 = close

mult1 = 1.0

basis1 = sma(src1, length1)

dev1 = mult1 * stdev(src1, length1)

upper1 = basis1 + dev1

lower1 = basis1 - dev1

////////// ** Triggers and Guards ** //////////

// 输入

RSILowerLevel1 = input(30, title="RSI 下限水平")

RSIUpperLevel1 = input(70, title="RSI 上限水平")

// 购买间隔

buyInterval = input(5, title="购买间隔(K线数量)")

// 跟踪购买间隔

var int lastBuyBar = na

lastBuyBar := na(lastBuyBar[1]) ? bar_index : lastBuyBar

// 策略信号

BBBuyTrigger1 = close < lower1

BBSellTrigger1 = close > upper1

rsiBuyGuard1 = rsi < RSILowerLevel1

rsiSellGuard1 = rsi > RSIUpperLevel1

Buy_1 = BBBuyTrigger1 and rsiBuyGuard1 and (bar_index - lastBuyBar) >= buyInterval

Sell_1 = BBSellTrigger1 and rsiSellGuard1

if (Buy_1)

lastBuyBar := bar_index

strategy.entry("Long", strategy.long, when = Buy_1, alert_message = "Buy Signal!")

strategy.close("Long", when = Sell_1, alert_message = "Sell Signal!")