概述

突破最高价EMA交叉策略是一个基于价格突破和指数移动平均线(EMA)交叉的交易策略。该策略使用指定周期内的最高价作为买入信号,EMA作为卖出信号。当收盘价突破指定周期内的最高价时,策略会产生买入信号;当收盘价跌破EMA时,策略会产生卖出信号。该策略还设置了止损价格,以控制风险。此外,该策略还提供了多个参数供用户自定义,以适应不同的交易风格和市场环境。

策略原理

突破最高价EMA交叉策略的核心原理是利用价格突破和EMA交叉来捕捉市场趋势。当价格突破指定周期内的最高价时,表明市场可能进入上升趋势,因此策略会产生买入信号。同时,EMA作为一个趋势跟踪指标,当价格跌破EMA时,表明上升趋势可能结束,因此策略会产生卖出信号。

该策略使用以下步骤来实现交易:

- 计算指定周期内的最高价作为突破买入价格。

- 计算EMA作为卖出信号。

- 当收盘价突破突破买入价格时,如果当前没有持仓,策略会产生买入信号。

- 当收盘价跌破EMA时,如果当前有持仓,策略会产生卖出信号。

- 计算指定周期内的最低价作为止损价格。

- 如果价格跌破止损价格,策略会立即平仓。

通过以上步骤,该策略可以在市场上升趋势中获利,同时使用止损来控制下行风险。

策略优势

突破最高价EMA交叉策略有以下优势:

- 趋势跟踪:该策略利用价格突破和EMA交叉来捕捉市场趋势,可以在上升趋势中获利。

- 风险控制:该策略使用止损价格来控制下行风险,可以有效降低策略的最大回撤。

- 参数灵活:该策略提供了多个参数供用户自定义,如周期、风险比例、是否使用止损等,可以根据不同的交易风格和市场环境进行调整。

- 简单有效:该策略逻辑简单清晰,易于理解和实现,同时在趋势市场中可以获得不错的收益。

策略风险

尽管突破最高价EMA交叉策略有一定的优势,但它也存在以下风险:

- 市场波动风险:在市场波动较大的情况下,该策略可能会产生较多的虚假信号,导致频繁交易和资金损失。

- 趋势转折风险:当市场趋势发生转折时,该策略可能会延迟卖出,导致利润回吐或转亏为亏损。

- 参数设置风险:该策略的表现依赖于参数的设置,如周期、风险比例等。如果参数设置不当,可能会导致策略表现不佳。

为了缓解这些风险,可以考虑以下措施:

- 适当调整参数:根据不同的市场环境和交易品种,适当调整策略参数,如增大周期、降低风险比例等,以减少虚假信号和频繁交易。

- 结合其他指标:可以结合其他技术指标,如RSI、MACD等,以确认趋势和信号的有效性,提高策略的可靠性。

- 设置合理的止损:设置合理的止损价格,既可以控制下行风险,又不会过早止损,导致错失利润机会。

策略优化方向

为了进一步提高突破最高价EMA交叉策略的性能,可以考虑以下优化方向:

- 动态调整参数:根据市场波动性和趋势强度,动态调整策略参数,如在波动较大时增大周期,在趋势较强时提高风险比例等,以适应不同的市场环境。

- 引入多空机制:在原有的多头交易基础上,引入空头交易机制,在下跌趋势中也能获利,提高策略的适应性和收益性。

- 优化止损和止盈:优化止损和止盈的设置,如使用移动止损、部分止盈等方法,以更好地控制风险和锁定利润。

- 结合基本面分析:将基本面分析与技术分析相结合,如在企业财报、经济数据发布等重要事件前后,调整策略的仓位和参数,以应对可能的市场变化。

通过以上优化措施,可以提高突破最高价EMA交叉策略的稳定性、适应性和收益性,使其能够在更多的市场环境中获得良好的表现。

总结

突破最高价EMA交叉策略是一个简单有效的趋势跟踪策略,通过利用价格突破和EMA交叉来捕捉市场趋势,同时使用止损来控制下行风险。该策略逻辑清晰,参数灵活,易于理解和实现。尽管该策略存在一定的风险,如市场波动风险、趋势转折风险和参数设置风险,但可以通过适当的风险控制措施来缓解这些风险,如调整参数、结合其他指标和设置合理的止损等。此外,该策略还有进一步优化的空间,如动态调整参数、引入多空机制、优化止损和止盈,以及结合基本面分析等,以提高策略的性能和适应性。总的来说,突破最高价EMA交叉策略是一个值得尝试和优化的量化交易策略。

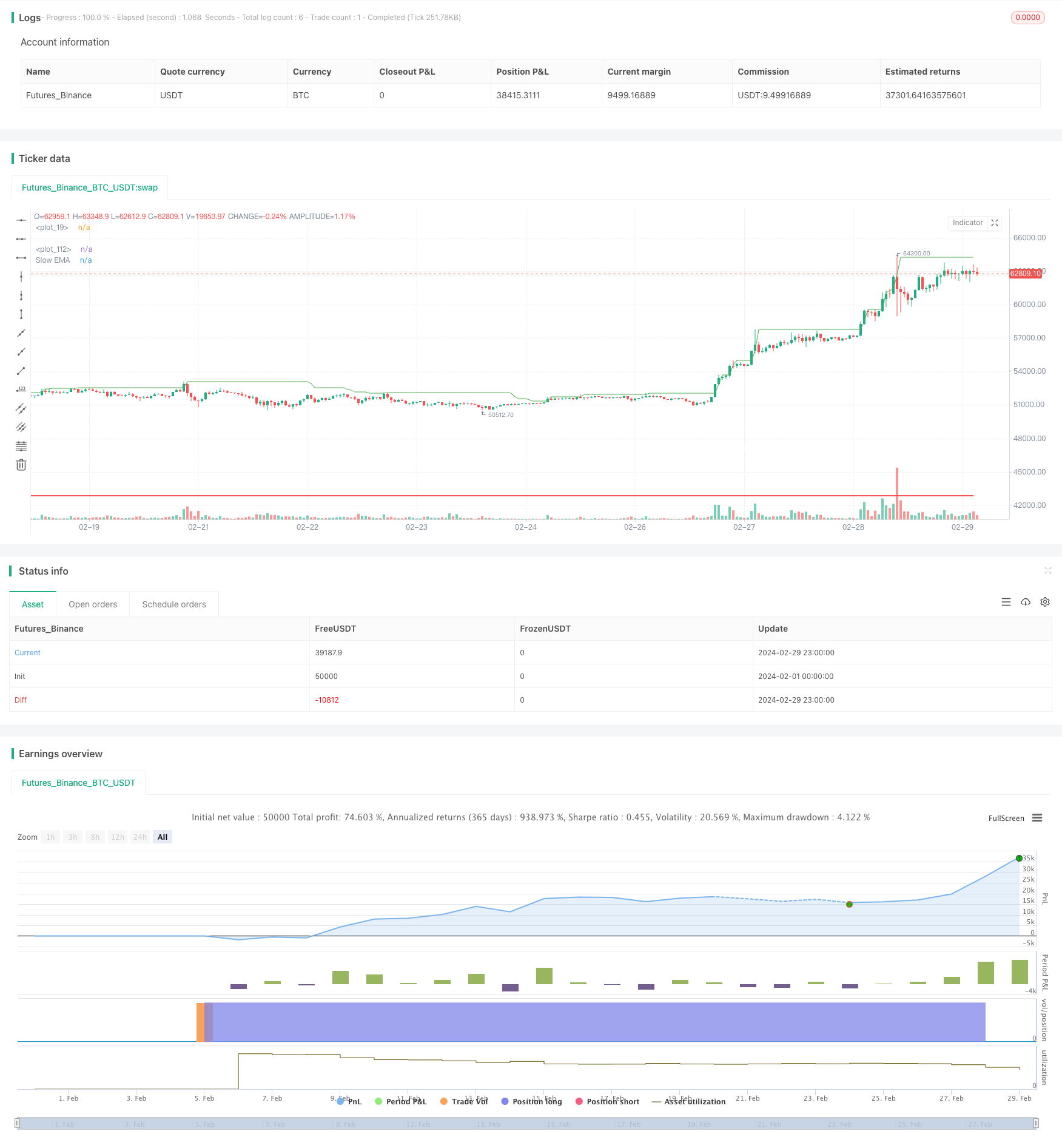

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version = 5

strategy(title="BreakHigh Strategy", overlay=true)

Period = input.int(34, "Number of previous bars(34,52 Recommend)")

showbg = input(defval = false,title = "Show BackGround Color")

showema = input(defval = true ,title = "Show Line")

MarkBuySig = input(defval = true ,title = "Show Buy/Sell Signal")

Risk_Per_Trade = input(2.5, '% of Risk Per Trade') / 100 // Risk% Per Trade Switch

SLDAY = input(title='Lowest price of the previous number of bars', defval=9)

Buysig = input(defval=true, title='Start Strategy')

UseSl = input(defval=false, title='Use Stoploss Price')

Compound = input(defval = false ,title = "Compound Profit")

xtf = input.timeframe(title='** Fix chart to which time frame ? **)', defval='D')

//BUY

float buyLine = na

buyLine := ta.highest(high,Period)[1]

plot(showema ? buyLine : na, linewidth=1, style=plot.style_linebr, color=color.new(color.green, 0))

//SELL

output = ta.ema(close, Period)

show = request.security(syminfo.tickerid, xtf, output)

FastL = plot(showema ? show : na, color=color.new(color.white, 0), linewidth=2, title='Slow EMA')

//Buy-Sell Signal

Green = close > buyLine // Buy

Red = close < show // Sell

buycond = Green and Green[1] == 0

sellcond = Red and Red[1] == 0

bullish = ta.barssince(buycond) < ta.barssince(sellcond)

bearish = ta.barssince(sellcond) < ta.barssince(buycond)

buy = bearish[1] and buycond

sell = bullish[1] and sellcond

plotshape(MarkBuySig ? buy : na, style=shape.labelup, text='Buy Next Bar', textcolor=color.new(color.black, 0), location=location.belowbar, color=color.new(color.green, 0))

plotshape(MarkBuySig ? sell : na, style=shape.labeldown, text='Sell Next Bar', textcolor=color.new(color.black, 0), location=location.abovebar, color=color.new(color.red, 0))

bgcolor(showbg ? bullish ? color.new(color.green,90) : color.new(color.red,90) : na )

// === BACKTEST RANGE === //

use_date_range = input(true)

FromYear = input.int(defval=2012, title='From Year', minval=1950)

FromMonth = input.int(defval=1, title='From Month', minval=1)

FromDay = input.int(defval=1, title='From Day', minval=1)

ToYear = input.int(defval=9999, title='To Year', minval=1950)

ToMonth = input.int(defval=1, title='To Month', minval=1)

ToDay = input.int(defval=1, title='To Day', minval=1)

in_date_range = use_date_range ? time > timestamp(FromYear, FromMonth, FromDay, 00, 00) and time < timestamp(ToYear, ToMonth, ToDay, 23, 59) : true

//****************************************************************************//

//////////////////////////////////////////////

// define strategy entry / exit //

//////////////////////////////////////////////

//****************************************************************************//

// LONG CONDITIONS

Select_Long_Condition_1 = close > buyLine // Buy when Have Signal

Open_Long_Condition = Select_Long_Condition_1 and strategy.opentrades == 0

//****************************************************************************//

// STOP LOSS Price

float longSL = na

longSL := Open_Long_Condition ? ta.lowest(low, SLDAY)[1] : longSL[1]

//****************************************************************************//

// Cal StopLoss

Long_Entry_Price = close

Diff_OPEN_to_SL = math.abs(Long_Entry_Price - longSL)

// Exit CONDITIONS

Exit_Long_Condition = close < show // Sell when Have Signal

//****************************************************************************//

// POSITION SIZE CAP

strategy.initial_capital = 50000

float portSize = Compound ? strategy.netprofit + strategy.initial_capital : strategy.initial_capital

float LossAmoutUnit = portSize * Risk_Per_Trade //50

float PercentSL = ( Diff_OPEN_to_SL / Long_Entry_Price ) * 100

float PositionSize = LossAmoutUnit / Diff_OPEN_to_SL

//****************************************************************************//

// ENTRY/EXIT

if Buysig

if Open_Long_Condition and in_date_range

strategy.entry('LONG', strategy.long, qty=PositionSize)

if Exit_Long_Condition and in_date_range

strategy.close('LONG')

if close < longSL and UseSl

strategy.close('LONG')

//****************************************************************************//

// PLOT STOP LOSS

longPlotSL = strategy.opentrades > 0 and strategy.position_size > 0 ? longSL : na

// label.new(bar_index, high, text=str.tostring(longPlotSL),color=color.white, textcolor=color.black)

plot(longPlotSL, title="", linewidth=2, style=plot.style_linebr, color=color.new(color.red, 0))

//****************************************************************************//