概述

该策略是一种基于股票或其他金融资产的净值时间序列数据,通过动态计算效率比(ER)作为指数移动平均(EMA)的平滑因子,从而自适应地调整上下轨,实现买卖信号的触发。该策略的主要思路是利用净值数据本身包含的全部信息,通过计算净值变化的复杂程度(ER)来动态调整EMA平滑因子,进而得到动态变化的上下轨。当价格突破上轨时开仓做多,突破下轨时平仓。

策略原理

- 计算净值数据的效率比(ER),即净值变化量与总变化量之比。ER值越小,说明净值变化越平稳;ER值越大,说明净值变化越剧烈。

- 将ER作为pine_ema函数的平滑因子alpha,动态计算净值的EMA均值和绝对偏差。

- 将EMA均值加减绝对偏差,得到动态变化的上下轨。

- 当前净值突破上轨时开仓做多,突破下轨时平仓。

策略优势

- 充分利用了净值时间序列数据包含的全部信息,不需要设置任何参数和优化,方法简洁自然。

- 通过动态计算ER来调整EMA平滑因子,可以自适应净值变化的复杂程度,灵活应对市场变化。

- 与传统的固定参数EMA相比,动态EMA可以有效减少交易次数和持仓时间,降低交易成本和风险。

- 可以有效控制回撤。与买入持有相比,该策略可以将最大回撤降低2-3倍,或者在相同回撤下将收益提高2-3倍。

- 可以方便地应用于多个策略的组合,实现策略自动开关的目的。

策略风险

- 该策略基于净值时间序列数据,对于价格走势发生根本逆转的情况,触发平仓的速度可能较慢,从而影响收益。

- 虽然该策略可以自适应地调整参数,但是对于极端行情的适应性还有待进一步考察。

- 该策略目前主要针对做多的情形,对于做空的情形还需要进一步完善。

- 在实际应用中,该策略对于选择标的的品质要求较高,需要选择长期走势向上的标的。

策略优化方向

- 可以考虑将ER的计算方法进一步优化,引入更多反映净值变化特征的指标,提高ER的稳健性和有效性。

- 可以进一步细化开平仓条件,如考虑加入移动止盈止损、百分比止盈止损等,提高策略的盈利能力和抗风险能力。

- 针对不同的标的和市场环境,可以对策略进行参数优化和适应性调整,提高策略的普适性。

- 可以将该策略和其他策略(如趋势跟踪、均值回归等)进行组合,发挥不同策略的优势,提高组合的稳健性和收益性。

总结

该策略通过动态计算效率比(ER)作为指数移动平均(EMA)的平滑因子,自适应地调整上下轨,实现买卖信号的触发。该策略充分利用了净值时间序列数据包含的信息,不需要过多参数设置和优化,方法简洁自然,可以灵活应对市场变化,有效控制回撤。但是该策略对于极端行情的适应性还有待进一步考察,在实际应用中需要注意标的的选择。未来可以从计算方法、开平仓条件、参数优化、策略组合等方面对该策略进行进一步优化和完善,提高策略的稳健性和盈利能力。

策略源码

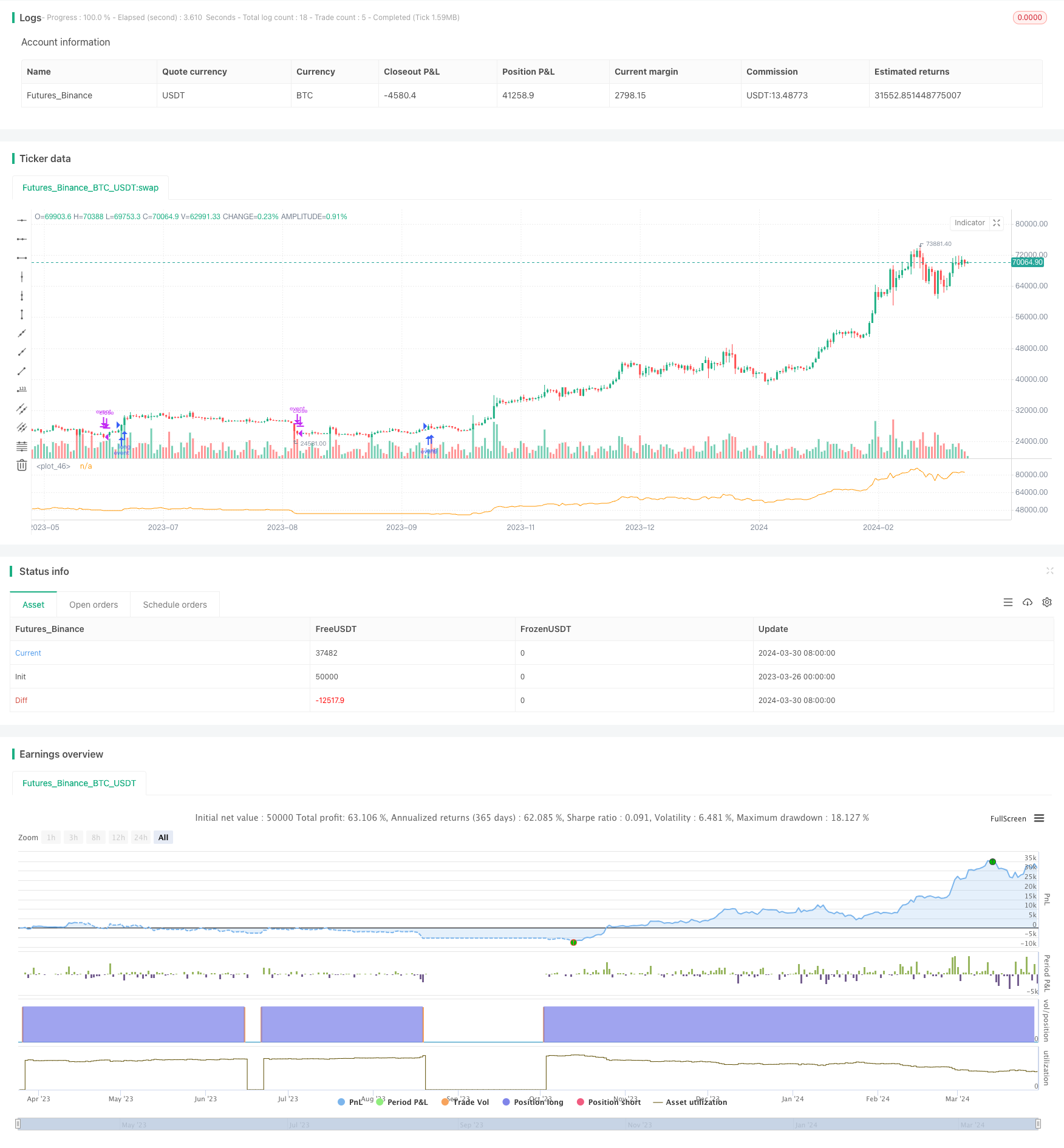

/*backtest

start: 2023-03-26 00:00:00

end: 2024-03-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy('Equity control', 'EC')

// study('Exponential bands', 'EB', overlay = true)

er(src) =>

var start = src

var total = 0.0

total += abs(src - nz(src[1], src))

net = abs(src - start )

net / total

pine_ema(src, alpha) =>

mean = 0.0

dev = 0.0

mean := na(mean[1]) ? src : (1 - alpha) * mean[1] + alpha * src

dev := na(dev [1]) ? 0 : (1 - alpha) * dev [1] + alpha * abs(src - mean)

[mean, dev]

src = input(close)

a = er (src )

[mean, dev] = pine_ema(src, a)

dev_lower = mean - dev

dev_upper = mean + dev

// plot(dev_lower, 'lower deviation', color.silver, 2, plot.style_stepline)

// plot(mean , 'basis' , color.purple, 1, plot.style_stepline)

// plot(dev_upper, 'upper deviation', color.silver, 2, plot.style_stepline)

if src > dev_upper

strategy.entry('event', true, comment = 'on')

if src < dev_lower

strategy.close('event', comment = 'off')

plot(strategy.equity)

//bigDope