概述

该策略名为”RSI50_EMA长仓策略”,主要思路是利用相对强弱指数(RSI)和指数移动平均线(EMA)两个技术指标的交叉信号来进行交易决策。当价格从下向上突破EMA上轨且RSI大于50时开仓做多,当价格从上向下突破EMA下轨或RSI跌破50时平仓。该策略只做多、不做空,是一个追涨策略。

策略原理

- 计算EMA和ATR,得到EMA上下轨。

- 计算RSI。

- 当收盘价上穿EMA上轨且RSI大于50时,开仓做多。

- 当收盘价下穿EMA下轨或RSI跌破50时,平掉所有多单。

- 只做多,不做空。

策略优势

- 适合在强势市场中使用,能有效捕捉强势股票的上涨行情。

- 同时使用EMA和RSI两个指标,能够更好地确认趋势信号,提高信号可靠性。

- 仓位管理采用百分比止损,风险可控。

- 代码逻辑清晰简单,容易理解和实现。

策略风险

- 在震荡市容易出现频繁交易和较大回撤。

- 参数选择不当会导致信号失效。如EMA长度选择不当,会导致趋势判断滞后;RSI上下限选择不当,会导致开平仓点不理想。

- 策略只能捕捉单边上涨行情,对下跌和震荡行情无法把握,容易踏空。

策略优化方向

- 引入趋势确认指标,如MACD等,提高趋势判断准确性。

- 对RSI进行参数优化,或引入RSI背离等改进信号。

- 考虑加入移动止损或波动率止损,改进风控。

- 可以考虑加入震荡市和下跌趋势中的反转开仓逻辑。

总结

RSI50_EMA长仓策略是一个基于RSI和EMA的简单易用的趋势追踪策略,适合在单边上涨行情中使用。该策略逻辑清晰,优势明显,但是也存在一些不足和风险。通过引入更多辅助指标、优化参数、改进风控等措施,可以进一步提升该策略的稳定性和收益性。但是在实际应用中,还需要根据市场特点、个人风险偏好等因素,灵活调整和改进。

策略源码

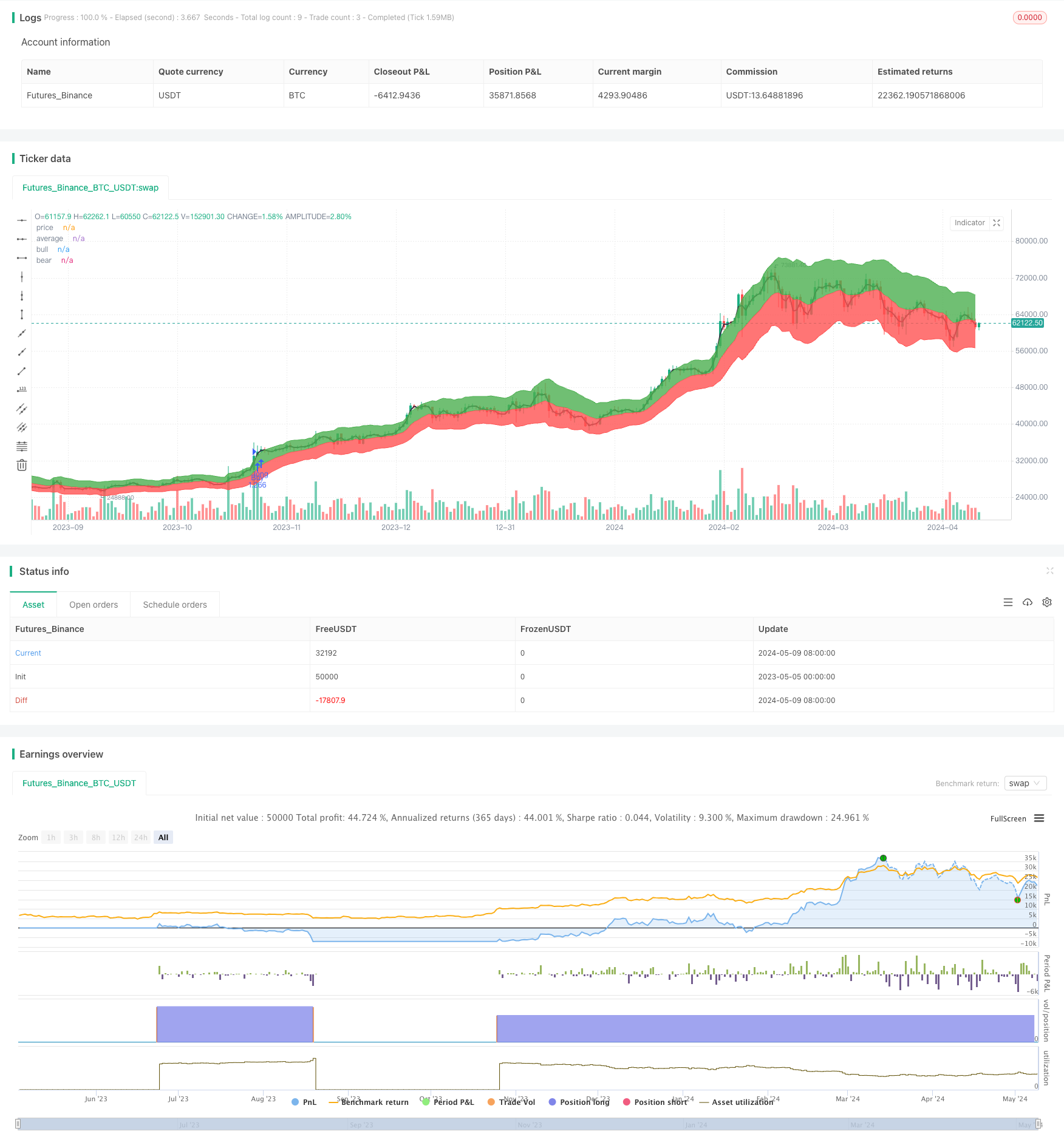

/*backtest

start: 2023-05-05 00:00:00

end: 2024-05-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("RSI50_EMA Long Only Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

len = input(11, type=input.integer, minval=1, title="Length")

mul = input(2, type=input.float, minval=0, title="Multiplier")

rsicap = input(50, type=input.integer, minval=1, title="rsicap")

rsi_1 = rsi(close,20)

price = sma(close, 2)

average = ema(close, len)

diff = atr(len) * mul

bull_level = average + diff

bear_level = average - diff

bull_cross = crossover(price, bull_level)

RENTRY = crossover(rsi_1,rsicap)

bear_cross = crossover(bear_level, price)

EXIT = crossunder(rsi_1,50)

strategy.entry("Buy", strategy.long, when=bull_cross)

strategy.close("Buy", when=bear_cross) //strategy.entry("Sell", strategy.short, when=bear_cross)

if (RENTRY)

strategy.entry("RSI", strategy.long, when=bull_cross)

if (EXIT)

strategy.close("RSICLose", when=bull_cross) //strategy.entry("Sell", strategy.short, when=bear_cross)

plot(price, title="price", color=color.black, transp=50, linewidth=2)

a0 = plot(average, title="average", color=color.red, transp=50, linewidth=1)

a1 = plot(bull_level, title="bull", color=color.green, transp=50, linewidth=1)

a2 = plot(bear_level, title="bear", color=color.red, transp=50, linewidth=1)

fill(a0, a1, color=color.green, transp=97)

fill(a0, a2, color=color.red, transp=97)

相关推荐