概述

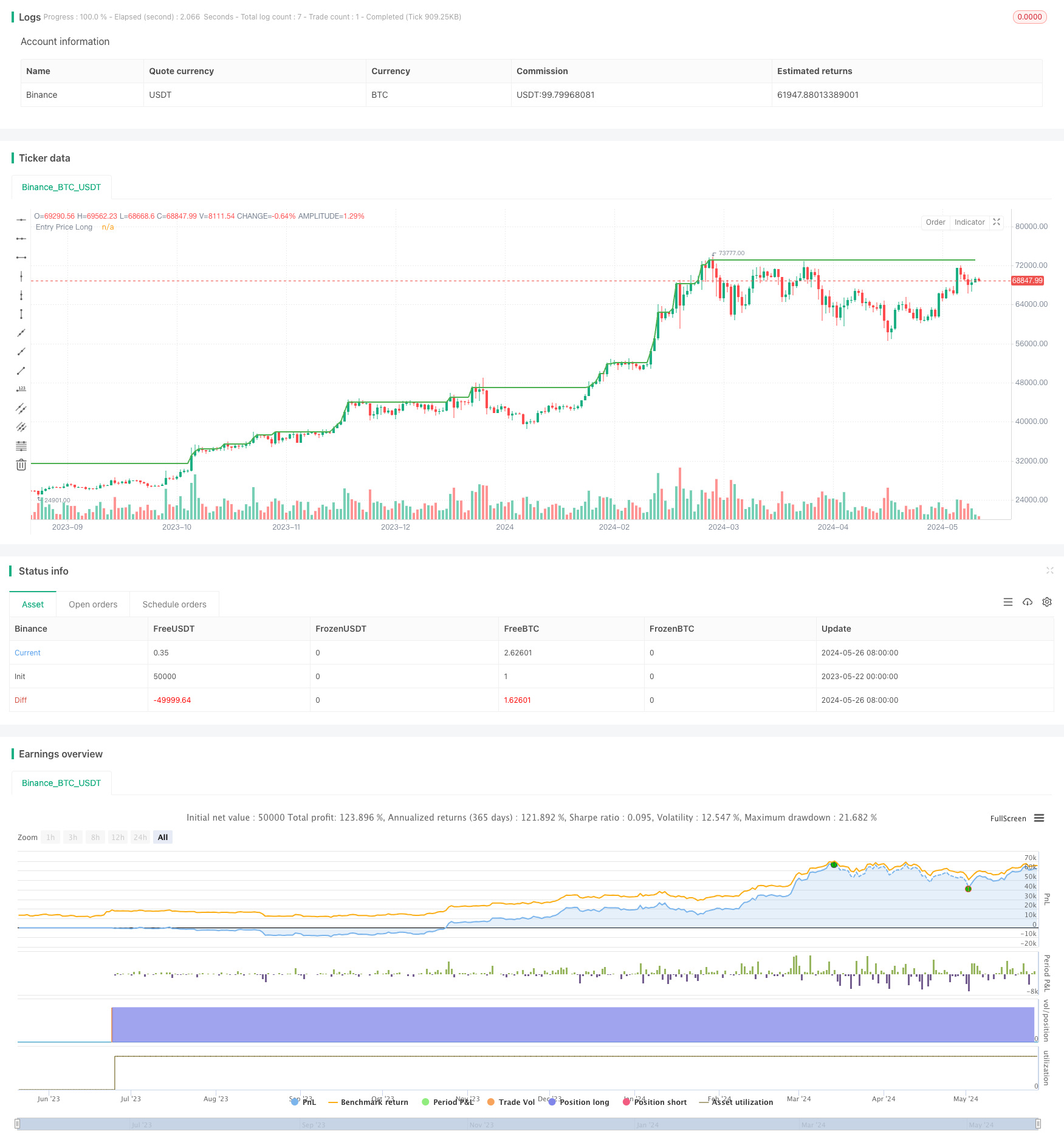

这个策略采用了一种一致的每日交易方法,着重于在严格控制风险的同时捕捉小目标利润。该策略从2021年开始进行了回测,展现出稳健的表现,交易胜率达到了100%。策略的主要思路是根据前一天的市场状况,在每个交易日开始时开立新的多头或空头仓位。关键参数包括0.3%的目标利润和0.2%的止损,初始资金为1000美元,每笔交易的佣金为0.1%。

策略原理

该策略的核心原理是基于前一交易日的市场走势,在每个交易日开盘时开立新的多头或空头仓位。具体来说,如果前一天没有任何仓位,策略会在新的一天开盘时开立多头仓位。如果已经有多头仓位,策略会检查是否达到0.3%的目标利润,如果达到就平仓。对于空头仓位,策略会检查是否达到0.2%的止损,如果达到,就平掉空头仓位,同时开立一个新的多头仓位来替代。这确保了策略在市场中始终保持敞口。

策略优势

这个每日交易策略有几个显著的优势:

- 100%胜率:在36个已平仓交易中,该策略实现了100%的胜率,凸显了其一贯的表现。

- 动态仓位管理:如果空头仓位触及止损,策略会立即开立一个新的多头仓位来替代它,确保持续的市场敞口。

- 严格的风险管理:该策略设定了0.3%的目标利润和0.2%的止损,有效地控制了风险。

- 定期市场参与:策略在每天开始时开立仓位,保证了定期参与市场。

- 稳健的回测结果:从2021年开始的回测展现出稳健的表现,净利润达到22.2%,最大回撤为13.75%。

策略风险

尽管该策略展现出了优异的表现和风险控制,仍然存在一些潜在的风险:

- 持续亏损的可能性:虽然回测结果令人印象深刻,但过去的表现并不能保证未来的结果。连续的亏损交易可能会侵蚀利润。

- 黑天鹅事件:策略可能容易受到意外事件和极端市场波动的影响,导致超出预期的损失。

- 杠杆风险:策略在每笔交易中使用了200%的杠杆,这放大了潜在的回报,但也增加了风险。

为了缓解这些风险,可以考虑增加多样化,在不同的市场和资产类别中应用类似的策略。定期监控和调整策略参数也很重要,以适应不断变化的市场状况。

策略优化方向

- 参数优化:目标利润、止损和其他关键参数可以通过进一步的回测和优化来改进,以在不同的市场条件下实现最佳性能。

- 多元化:将策略扩展到其他市场和资产类别,可以提高整体回报并降低风险。

- 动态仓位调整:根据市场波动性或其他因素动态调整仓位大小,可以进一步优化风险调整后的回报。

- 加入额外的过滤器:引入额外的技术指标或市场情绪指标作为过滤器,可以提高交易信号的质量。

总结

总的来说,这个每日交易策略提供了一种平衡的方法来进行日内交易,重点是风险管理和持续盈利。它适合寻求系统化和严谨交易方法的交易者。策略展现出了令人印象深刻的回测结果,100%的胜率和稳健的风险调整后回报。然而,重要的是要认识到过去的表现并不能保证未来的结果,管理风险和适应市场变化至关重要。通过进一步的优化和改进,这个策略可以成为任何交易者工具箱中的一个有价值的补充。

策略源码

/*backtest

start: 2023-05-22 00:00:00

end: 2024-05-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Daily AUD-JPY Trading", overlay=true, initial_capital=1000, currency="AUD", default_qty_type=strategy.percent_of_equity, default_qty_value=200, commission_type=strategy.commission.percent, commission_value=0.1)

// Input parameters

profit_target = input(0.3, title="Profit Target (%)") / 100

loss_target = input(0.2, title="Loss Target (%)") / 100

start_year = input(2021, title="Start Year")

// Calculate daily open and close

new_day = ta.change(time("D"))

var float entry_price_long = na

var float entry_price_short = na

var bool position_long_open = false

var bool position_short_open = false

// Date check

trade_start = timestamp(start_year, 1, 1, 0, 0)

if new_day and time >= trade_start

// If there was a previous long position, check for profit target

if position_long_open

current_profit_long = (close - entry_price_long) / entry_price_long

if current_profit_long >= profit_target

strategy.close("AUD Trade Long", comment="Take Profit Long")

position_long_open := false

// If there was a previous short position, check for profit target

if position_short_open

current_profit_short = (entry_price_short - close) / entry_price_short

if current_profit_short >= profit_target

strategy.close("AUD Trade Short", comment="Take Profit Short")

position_short_open := false

// Check for daily loss condition for short positions

if position_short_open

current_loss_short = (close - entry_price_short) / entry_price_short

if current_loss_short <= -loss_target

strategy.close("AUD Trade Short", comment="Stop Loss Short")

position_short_open := false

// Open a new long position to replace the stopped short position

strategy.entry("AUD Trade Long Replacement", strategy.long)

entry_price_long := close

position_long_open := true

// Open a new long position at the start of the new day if no long position is open

if not position_long_open and not position_short_open

strategy.entry("AUD Trade Long", strategy.long)

entry_price_long := close

position_long_open := true

// Open a new short position at the start of the new day if no short position is open

if not position_short_open and not position_long_open

strategy.entry("AUD Trade Short", strategy.short)

entry_price_short := close

position_short_open := true

// Check for continuous profit condition for long positions

if position_long_open

current_profit_long = (close - entry_price_long) / entry_price_long

if current_profit_long >= profit_target

strategy.close("AUD Trade Long", comment="Take Profit Long")

position_long_open := false

// Check for continuous profit condition for short positions

if position_short_open

current_profit_short = (entry_price_short - close) / entry_price_short

if current_profit_short >= profit_target

strategy.close("AUD Trade Short", comment="Take Profit Short")

position_short_open := false

// Plot the entry prices on the chart

plot(position_long_open ? entry_price_long : na, title="Entry Price Long", color=color.green, linewidth=2)

plot(position_short_open ? entry_price_short : na, title="Entry Price Short", color=color.red, linewidth=2)

// Display current profit/loss percentage for long positions

var label profit_label_long = na

if position_long_open and not na(entry_price_long)

current_profit_long = (close - entry_price_long) / entry_price_long * 100

label.delete(profit_label_long)

profit_label_long := label.new(x=time, y=high, text="Long P/L: " + str.tostring(current_profit_long, format.percent), style=label.style_label_down, color=color.white, textcolor=color.black,xloc=xloc.bar_time)

// Display current profit/loss percentage for short positions

var label profit_label_short = na

if position_short_open and not na(entry_price_short)

current_profit_short = (entry_price_short - close) / entry_price_short * 100

label.delete(profit_label_short)

profit_label_short := label.new(x=time, y=high, text="Short P/L: " + str.tostring(current_profit_short, format.percent), style=label.style_label_down, color=color.white, textcolor=color.black,xloc=xloc.bar_time)