概述

该策略基于技术分析中的反转形态(锤头线、吞没形态和十字星)以及支撑位和阻力位,在1小时图表上进行交易。策略通过识别潜在的市场反转点,并在预定的止盈和止损水平执行交易。

该策略的主要思路是在支撑位附近出现看涨反转形态(如锤头线、看涨吞没形态或十字星)时开多仓,在阻力位附近出现看跌反转形态(如锤头线、看跌吞没形态或十字星)时开空仓。同时设置止盈和止损水平,以控制风险和锁定利润。

策略原理

- 通过 ta.lowest() 和 ta.highest() 函数分别计算指定回望期内的最低价和最高价,确定支撑位和阻力位。

- 判断当前蜡烛图是否形成锤头线、吞没形态或十字星。

- 如果在支撑位附近出现看涨反转形态,开多仓;如果在阻力位附近出现看跌反转形态,开空仓。

- 设置止盈价格为开仓价格的3%,止损价格为开仓价格的1%。

- 当价格达到止盈或止损水平时,平仓。

策略优势

- 结合反转形态和关键支撑阻力位,提高交易信号的可靠性。

- 设置明确的止盈和止损水平,有效控制风险。

- 适用于趋势和震荡市场,可捕捉潜在的反转机会。

- 代码简洁,易于理解和实现。

策略风险

- 在震荡市场中,频繁出现反转信号,可能导致过度交易和手续费损失。

- 支撑位和阻力位的判断依赖于回望期的选择,不同的回望期可能导致不同的结果。

- 反转形态的可靠性并非绝对,虚假信号可能导致亏损。

解决方法: 1. 通过调整反转形态的参数和确认条件,减少虚假信号。 2. 结合其他技术指标或市场情绪指标,提高信号的可靠性。 3. 适当调整止盈和止损水平,以应对不同的市场状况。

策略优化方向

- 引入交易量指标,确认反转形态的有效性。高交易量的反转形态可能更可靠。

- 考虑多个时间框架的支撑阻力位,提高支撑阻力位的准确性。

- 结合趋势指标,如移动平均线,在趋势方向上进行交易,避免逆势交易。

- 优化止盈和止损水平,根据市场波动性动态调整,以获得更好的风险回报比。

总结

该策略通过识别支撑位和阻力位附近的反转形态,捕捉潜在的交易机会。它简单易用,适用于不同的市场环境。然而,策略的成功依赖于对反转形态和支撑阻力位的准确判断。通过优化交易信号的确认条件,结合其他技术指标,以及动态调整止盈止损水平,可以进一步提高策略的表现。

策略源码

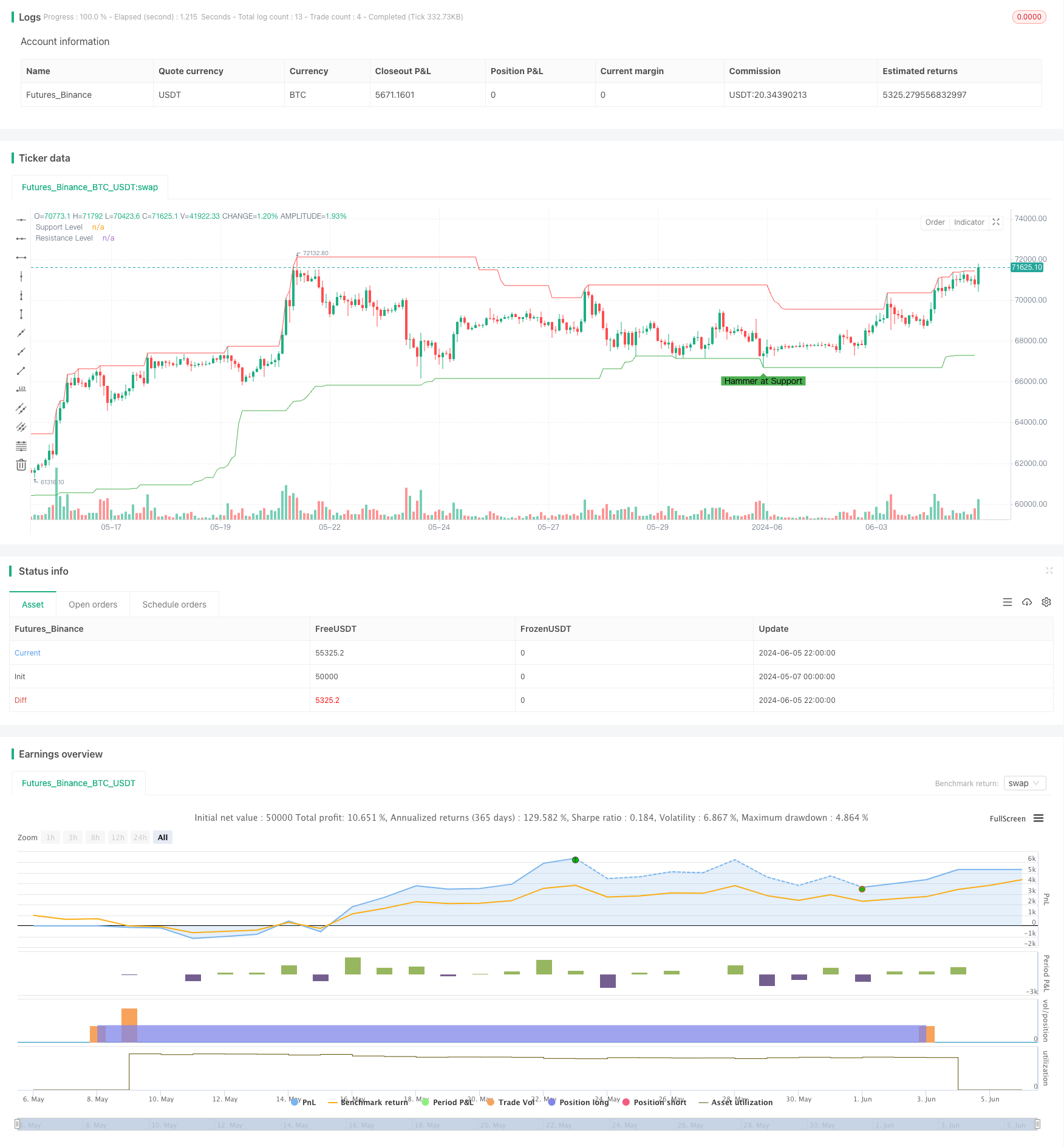

/*backtest

start: 2024-05-07 00:00:00

end: 2024-06-06 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Kingcoinmilioner

//@version=5

strategy("Reversal Patterns at Support and Resistance", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Parameters

support_resistance_lookback = input.int(50, title="Support/Resistance Lookback Period")

reversal_tolerance = input.float(0.01, title="Reversal Tolerance (percent)", step=0.01) / 100

take_profit_percent = input.float(3, title="Take Profit (%)") / 100

stop_loss_percent = input.float(1, title="Stop Loss (%)") / 100

// Functions to identify key support and resistance levels

findSupport() =>

ta.lowest(low, support_resistance_lookback)

findResistance() =>

ta.highest(high, support_resistance_lookback)

// Identify reversal patterns

isHammer() =>

body = math.abs(close - open)

lowerWick = open > close ? (low < close ? close - low : open - low) : (low < open ? open - low : close - low)

upperWick = high - math.max(open, close)

lowerWick > body * 2 and upperWick < body

isEngulfing() =>

(close[1] < open[1] and close > open and close > open[1] and open < close[1])

(close[1] > open[1] and close < open and close < open[1] and open > close[1])

isDoji() =>

math.abs(open - close) <= (high - low) * 0.1

// Identify support and resistance levels

support = findSupport()

resistance = findResistance()

// Check for reversal patterns at support and resistance

hammerAtSupport = isHammer() and (low <= support * (1 + reversal_tolerance))

engulfingAtSupport = isEngulfing() and (low <= support * (1 + reversal_tolerance))

dojiAtSupport = isDoji() and (low <= support * (1 + reversal_tolerance))

hammerAtResistance = isHammer() and (high >= resistance * (1 - reversal_tolerance))

engulfingAtResistance = isEngulfing() and (high >= resistance * (1 - reversal_tolerance))

dojiAtResistance = isDoji() and (high >= resistance * (1 - reversal_tolerance))

// Trading logic

if (hammerAtSupport or engulfingAtSupport or dojiAtSupport)

strategy.entry("Long", strategy.long)

stop_level = low * (1 - stop_loss_percent)

take_profit_level = close * (1 + take_profit_percent)

strategy.exit("Take Profit/Stop Loss", from_entry="Long", stop=stop_level, limit=take_profit_level)

if (hammerAtResistance or engulfingAtResistance or dojiAtResistance)

strategy.entry("Short", strategy.short)

stop_level = high * (1 + stop_loss_percent)

take_profit_level = close * (1 - take_profit_percent)

strategy.exit("Take Profit/Stop Loss", from_entry="Short", stop=stop_level, limit=take_profit_level)

// Plot support and resistance levels for visualization

plot(support, color=color.green, linewidth=1, title="Support Level")

plot(resistance, color=color.red, linewidth=1, title="Resistance Level")

// Plot reversal patterns on the chart for visualization

plotshape(series=hammerAtSupport, location=location.belowbar, color=color.green, style=shape.labelup, text="Hammer at Support")

plotshape(series=engulfingAtSupport, location=location.belowbar, color=color.green, style=shape.labelup, text="Engulfing at Support")

plotshape(series=dojiAtSupport, location=location.belowbar, color=color.green, style=shape.labelup, text="Doji at Support")

plotshape(series=hammerAtResistance, location=location.abovebar, color=color.red, style=shape.labeldown, text="Hammer at Resistance")

plotshape(series=engulfingAtResistance, location=location.abovebar, color=color.red, style=shape.labeldown, text="Engulfing at Resistance")

plotshape(series=dojiAtResistance, location=location.abovebar, color=color.red, style=shape.labeldown, text="Doji at Resistance")