概述

该策略是一个基于价格形态识别的量化交易系统,核心是识别并利用”鲨鱼32”这种特殊的K线形态进行交易。策略通过对高点和低点的连续性变化进行分析,在形态确认后设定关键价格水平,并在突破这些水平时进行交易。该策略结合了形态识别、趋势跟踪和价格突破等多个技术分析要素,建立了一个完整的交易系统。

策略原理

策略的核心在于识别”鲨鱼32”形态,这种形态需要满足以下条件:前两根K线的低点连续走低,同时高点连续走高。当形态确认后,策略会锁定形态起始K线的高点和低点作为关键价格水平。系统在价格突破这些关键水平时开仓:当收盘价突破锁定的高点时做多,突破锁定的低点时做空。策略采用了投影目标线作为获利目标,止损位置则通过百分比参数来灵活设定。

策略优势

- 形态识别准确:通过严格的数学定义来识别形态,避免了主观判断

- 风险管理完善:包含了清晰的止损和获利目标设置

- 视觉反馈清晰:使用不同颜色的线条和背景来标示形态和交易信号

- 过滤重复信号:每个形态只允许执行一次交易,避免过度交易

- 目标设置合理:基于形态波动幅度来设定获利目标,具有良好的风险收益比

策略风险

- 震荡市场风险:在横盘震荡市场可能产生频繁的假突破信号

- 滑点风险:在快速行情中可能面临较大的滑点

- 单一形态依赖:过度依赖单一形态可能错过其他交易机会

- 参数敏感性:止损和获利目标的参数设置对策略表现影响较大

策略优化方向

- 加入成交量确认:可以结合成交量变化来确认突破的有效性

- 引入市场环境过滤:增加趋势强度指标来过滤不利的市场环境

- 优化止损方式:可以考虑使用动态止损来提高策略的适应性

- 增加时间过滤:加入交易时间段过滤来避免特定时段的波动

- 完善资金管理:增加仓位管理模块来优化资金利用效率

总结

E9鲨鱼32形态量化价格突破策略是一个结构完整、逻辑清晰的交易系统。它通过严格的形态定义和清晰的交易规则,构建了一个可量化执行的交易策略。策略的风险管理体系完善,视觉反馈清晰,便于交易者理解和执行。通过建议的优化方向,策略还有进一步提升的空间。该策略适合追求系统化交易的投资者,但使用时需要注意市场环境的适应性和参数的优化。

策略源码

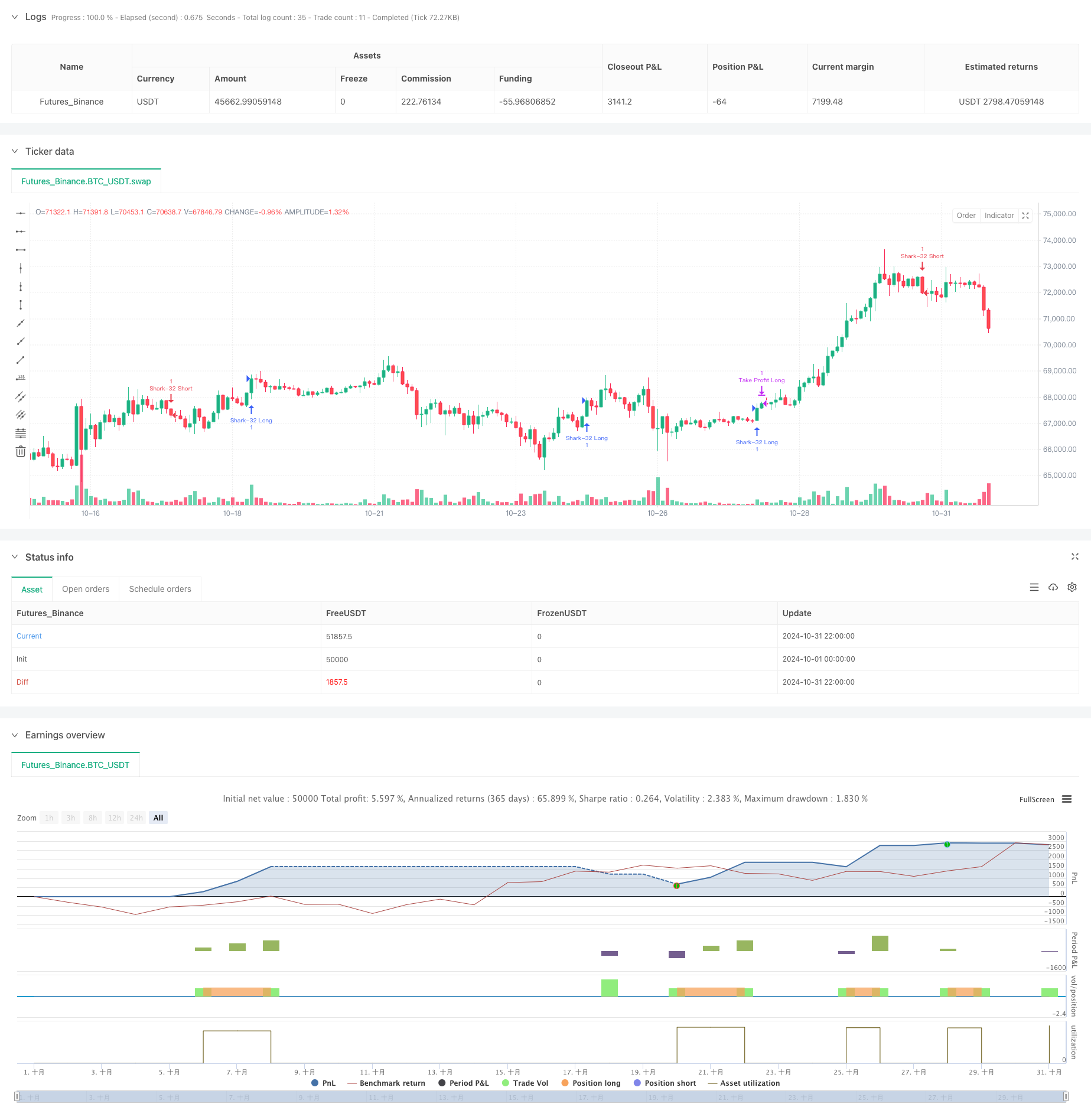

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//╔═════════════════════════════════════════════════════════════════════════════════════════════════════════════╗

//║ ║

//║ ░▒▓████████▓▒░▒▓███████▓▒░ ░▒▓██████▓▒░░▒▓███████▓▒░░▒▓████████▓▒░▒▓███████▓▒░ ░▒▓████████▓▒░▒▓██████▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓███████▓▒░░▒▓████████▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓██████▓▒░ ░▒▓███████▓▒░. ░▒▓██████▓▒░ ░▒▓███████▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓███████▓▒░░▒▓████████▓▒░▒▓█▓▒░░▒▓█▓▒. ░▒▓████████▓▒░▒▓██████▓▒░ ║

//║ ║

//╚═════════════════════════════════════════════════════════════════════════════════════════════════════════════╝

//@version=5

strategy("E9 Shark-32 Pattern Strategy with Target Lines", shorttitle="E9 Shark-32 Strategy", overlay=true)

// Inputs for background color settings

bgcolorEnabled = input(true, title="Enable Background Color")

bgcolorColor = input.color(color.new(color.blue, 90), title="Background Color")

// Inputs for bar color settings

barcolorEnabled = input(true, title="Enable Bar Color")

barcolorColor = input.color(color.rgb(240, 241, 154), title="Bar Color")

// Inputs for target lines settings

targetLinesEnabled = input(true, title="Enable Target Lines")

targetLineColor = input.color(color.white, title="Target Line Color")

targetLineThickness = input.int(1, title="Target Line Thickness", minval=1, maxval=5)

// Define Shark-32 Pattern

shark32 = low[2] < low[1] and low[1] < low and high[2] > high[1] and high[1] > high

// Initialize color variables for bars

var color barColorCurrent = na

var color barColor1 = na

var color barColor2 = na

// Update color variables based on Shark-32 pattern

barColorCurrent := barcolorEnabled and (shark32 or shark32[1] or shark32[2]) ? barcolorColor : na

barColor1 := barcolorEnabled and (shark32[1] or shark32[2]) ? barcolorColor : na

barColor2 := barcolorEnabled and shark32[2] ? barcolorColor : na

// Apply the bar colors to the chart

barcolor(barColorCurrent, offset=-2, title="Shark-32 Confirmed Current")

barcolor(barColor1, offset=-3, title="Shark-32 Confirmed Previous Bar 1")

barcolor(barColor2, offset=-4, title="Shark-32 Confirmed Previous Bar 2")

// Variables for locking the high and low of confirmed Shark-32

var float patternHigh = na

var float patternLow = na

var float upperTarget = na

var float lowerTarget = na

// Once Shark-32 pattern is confirmed, lock the patternHigh, patternLow, and target lines

if shark32

patternHigh := high[2] // The high of the first bar in Shark-32 pattern

patternLow := low[2] // The low of the first bar in Shark-32 pattern

// Calculate the upper and lower white target lines

upperTarget := patternHigh + (patternHigh - patternLow) // Dotted white line above

lowerTarget := patternLow - (patternHigh - patternLow) // Dotted white line below

// Initialize variables for the lines

var line greenLine = na

var line redLine = na

var line upperTargetLine = na

var line lowerTargetLine = na

// Draw the lines based on the locked patternHigh, patternLow, and target lines

// if shark32

// future_bar_index_lines = bar_index + 10

// // Draw lines based on locked patternHigh and patternLow

// greenLine := line.new(x1=bar_index[2], y1=patternHigh, x2=future_bar_index_lines, y2=patternHigh, color=color.green, width=2, extend=extend.none)

// redLine := line.new(x1=bar_index[2], y1=patternLow, x2=future_bar_index_lines, y2=patternLow, color=color.red, width=2, extend=extend.none)

// // Draw dotted white lines if targetLinesEnabled is true

// if targetLinesEnabled

// upperTargetLine := line.new(x1=bar_index[2], y1=upperTarget, x2=future_bar_index_lines, y2=upperTarget, color=targetLineColor, width=targetLineThickness, style=line.style_dotted, extend=extend.none)

// lowerTargetLine := line.new(x1=bar_index[2], y1=lowerTarget, x2=future_bar_index_lines, y2=lowerTarget, color=targetLineColor, width=targetLineThickness, style=line.style_dotted, extend=extend.none)

// // Create a box to fill the background between the red and green lines

// if bgcolorEnabled

// box.new(left=bar_index[2], top=patternHigh, right=future_bar_index_lines, bottom=patternLow, bgcolor=bgcolorColor)

// -------------------------------------------------------------------------

// Strategy Entry and Exit Parameters

// -------------------------------------------------------------------------

// Input parameters for stop loss

longStopLoss = input.float(1.0, title="Long Stop Loss (%)", minval=0.1) // Percentage-based stop loss for long

shortStopLoss = input.float(1.0, title="Short Stop Loss (%)", minval=0.1) // Percentage-based stop loss for short

// Variable to track if a trade has been taken

var bool tradeTaken = false

// Reset the flag when a new Shark-32 pattern is confirmed

if shark32

tradeTaken := false

// Entry conditions only trigger after the Shark-32 is confirmed

longCondition = ta.crossover(close, patternHigh) and not tradeTaken // Long entry when close crosses above locked patternHigh

shortCondition = ta.crossunder(close, patternLow) and not tradeTaken // Short entry when close crosses below locked patternLow

// Trigger long and short trades based on the crossover conditions

if (longCondition)

label.new(bar_index, high, "Long Trigger", style=label.style_label_down, color=color.green, textcolor=color.white, size=size.small)

strategy.entry("Shark-32 Long", strategy.long)

tradeTaken := true // Set the flag to true after a trade is taken

if (shortCondition)

label.new(bar_index, low, "Short Trigger", style=label.style_label_up, color=color.red, textcolor=color.white, size=size.small)

strategy.entry("Shark-32 Short", strategy.short)

tradeTaken := true // Set the flag to true after a trade is taken

// Exit long trade based on the upper target line (upper white dotted line) as take profit

if strategy.position_size > 0

strategy.exit("Take Profit Long", "Shark-32 Long", limit=upperTarget, stop=close * (1 - longStopLoss / 100))

// Exit short trade based on the lower target line (lower white dotted line) as take profit

if strategy.position_size < 0

strategy.exit("Take Profit Short", "Shark-32 Short", limit=lowerTarget, stop=close * (1 + shortStopLoss / 100))