概述

该策略是一个结合了指数移动平均线(EMA)交叉、斐波那契回调水平、趋势判断以及止盈止损机制的综合交易系统。策略通过9周期和21周期EMA的交叉来确定交易信号,同时结合斐波那契回调水平来优化入场点位,并通过实时趋势状态监控来提高交易的准确性。系统还集成了百分比止盈止损机制,有效控制风险。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 当快速EMA(9周期)向上穿越慢速EMA(21周期)时,系统产生做多信号 2. 当快速EMA向下穿越慢速EMA时,系统产生做空信号 3. 通过计算100个周期的最高价和最低价,绘制23.6%、38.2%、50%和61.8%的斐波那契回调水平 4. 通过收盘价与快速EMA的位置关系判断当前趋势状态 5. 在交易执行时,系统自动设置固定百分比的止盈位(4%)和止损位(2%)

策略优势

- 多维度信号确认:结合EMA交叉、斐波那契水平和趋势状态,提供更可靠的交易信号

- 风险管理完善:通过预设的止盈止损百分比,实现自动化风险控制

- 趋势跟踪能力强:EMA交叉结合趋势状态判断,能有效捕捉市场趋势

- 视觉反馈清晰:通过标签显示关键价格水平、趋势状态和交易信号,便于交易决策

- 系统化程度高:交易逻辑明确,减少主观判断带来的干扰

策略风险

- 振荡市场风险:在横盘整理阶段,EMA频繁交叉可能导致虚假信号

- 滞后性风险:移动平均线本质上是滞后指标,可能错过最佳入场时机

- 固定止损风险:预设的固定百分比止损可能不适合所有市场环境

- 信号冲突风险:多个指标之间可能出现矛盾信号,增加决策难度

- 市场波动风险:剧烈波动可能导致止损点位不合理

策略优化方向

- 动态止损优化:可根据ATR或市场波动率动态调整止损距离

- 信号过滤增强:增加成交量、动量等辅助指标来过滤假信号

- 参数自适应:引入自适应机制,根据市场状态动态调整EMA周期

- 入场优化:结合价格形态和成交量在斐波那契水平附近优化入场

- 仓位管理完善:基于波动率和账户风险设计动态仓位管理系统

总结

该策略通过整合多个经典技术分析工具,构建了一个较为完整的交易系统。其优势在于信号确认的多维度性和风险管理的系统化,但仍需要针对不同市场环境进行优化。建议交易者在实盘运用时,结合市场具体情况对参数进行优化调整,并始终保持对风险的警惕。

策略源码

/*backtest

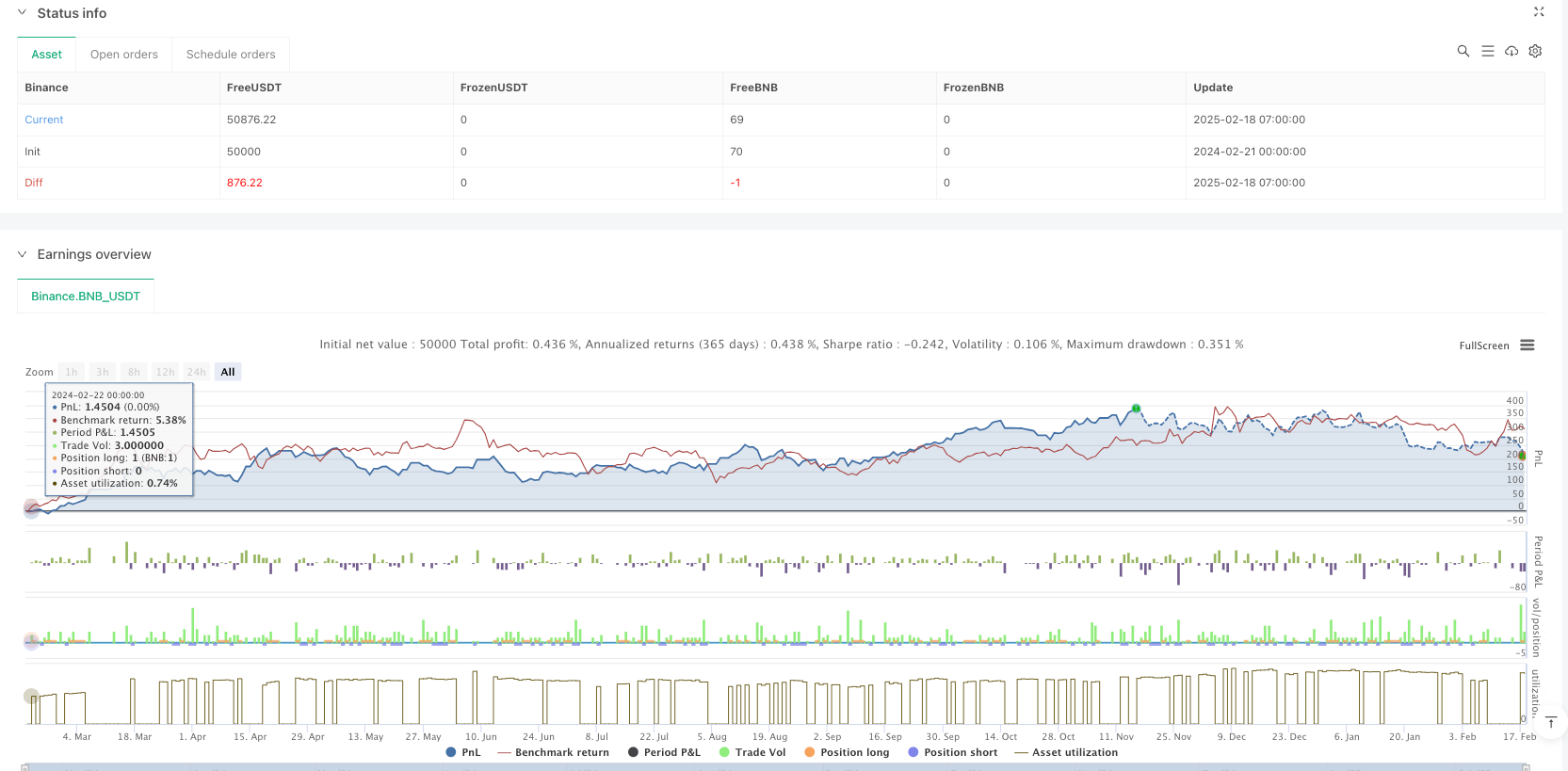

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"BNB_USDT"}]

*/

//@version=5

strategy("EMA Cross Strategy with TP, SL, Fibonacci Levels, and Trend", overlay=true)

// Input for stop loss and take profit percentages

stopLossPercentage = input.int(2, title="Stop Loss (%)") // Stop loss percentage

takeProfitPercentage = input.int(4, title="Take Profit (%)") // Take profit percentage

// EMA Length Inputs

fastEMALength = input.int(9, title="Fast EMA Length")

slowEMALength = input.int(21, title="Slow EMA Length")

// Compute EMAs

fastEMA = ta.ema(close, fastEMALength)

slowEMA = ta.ema(close, slowEMALength)

// Entry conditions for EMA crossover

longCondition = ta.crossover(fastEMA, slowEMA) // EMA 9 crosses above EMA 21

shortCondition = ta.crossunder(fastEMA, slowEMA) // EMA 9 crosses below EMA 21

// Plot EMAs

plot(fastEMA, color=color.blue, title="Fast EMA (9)")

plot(slowEMA, color=color.red, title="Slow EMA (21)")

// Fibonacci Retracement Levels

lookback = input.int(100, title="Lookback Period for Fibonacci Levels")

highLevel = ta.highest(high, lookback)

lowLevel = ta.lowest(low, lookback)

fib236 = lowLevel + (highLevel - lowLevel) * 0.236

fib382 = lowLevel + (highLevel - lowLevel) * 0.382

fib50 = lowLevel + (highLevel - lowLevel) * 0.5

fib618 = lowLevel + (highLevel - lowLevel) * 0.618

// Display Fibonacci levels (Left of the candle near price)

label.new(bar_index, fib236, text="Fib 23.6%: " + str.tostring(fib236, "#.##"), style=label.style_label_left, color=color.purple, textcolor=color.white, size=size.small)

label.new(bar_index, fib382, text="Fib 38.2%: " + str.tostring(fib382, "#.##"), style=label.style_label_left, color=color.blue, textcolor=color.white, size=size.small)

label.new(bar_index, fib50, text="Fib 50%: " + str.tostring(fib50, "#.##"), style=label.style_label_left, color=color.green, textcolor=color.white, size=size.small)

label.new(bar_index, fib618, text="Fib 61.8%: " + str.tostring(fib618, "#.##"), style=label.style_label_left, color=color.red, textcolor=color.white, size=size.small)

// Trend condition: Price uptrend or downtrend

trendCondition = close > fastEMA ? "Uptrending" : close < fastEMA ? "Downtrending" : "Neutral"

// Display Trend Status (Left of candle near price)

var label trendLabel = na

if (not na(trendLabel))

label.delete(trendLabel)

trendLabel := label.new(bar_index, close, text="Trend: " + trendCondition, style=label.style_label_left, color=color.blue, textcolor=color.white, size=size.small)

// Buy and Sell orders with Stop Loss and Take Profit

if (longCondition)

stopLossLevel = close * (1 - stopLossPercentage / 100)

takeProfitLevel = close * (1 + takeProfitPercentage / 100)

strategy.entry("BUY", strategy.long)

strategy.exit("Sell", "BUY", stop=stopLossLevel, limit=takeProfitLevel)

// Display TP, SL, and Buy label (Left of candle near price)

label.new(bar_index, takeProfitLevel, text="TP\n" + str.tostring(takeProfitLevel, "#.##"), style=label.style_label_left, color=color.green, textcolor=color.white, size=size.small)

label.new(bar_index, stopLossLevel, text="SL\n" + str.tostring(stopLossLevel, "#.##"), style=label.style_label_left, color=color.red, textcolor=color.white, size=size.small)

label.new(bar_index, close, text="BUY\n" + str.tostring(close, "#.##"), style=label.style_label_left, color=color.blue, textcolor=color.white, size=size.small)

if (shortCondition)

stopLossLevel = close * (1 + stopLossPercentage / 100)

takeProfitLevel = close * (1 - takeProfitPercentage / 100)

strategy.entry("SELL", strategy.short)

strategy.exit("Cover", "SELL", stop=stopLossLevel, limit=takeProfitLevel)

// Display TP, SL, and Sell label (Left of candle near price)

label.new(bar_index, takeProfitLevel, text="TP\n" + str.tostring(takeProfitLevel, "#.##"), style=label.style_label_left, color=color.green, textcolor=color.white, size=size.small)

label.new(bar_index, stopLossLevel, text="SL\n" + str.tostring(stopLossLevel, "#.##"), style=label.style_label_left, color=color.red, textcolor=color.white, size=size.small)

label.new(bar_index, close, text="SELL\n" + str.tostring(close, "#.##"), style=label.style_label_left, color=color.orange, textcolor=color.white, size=size.small)

// Plot Buy/Sell Signals

plotshape(series=longCondition, title="BUY Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="SELL Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

相关推荐