概述

该策略是一个基于跨周期分析的趋势跟踪交易系统,结合了周线和日线级别的EMA均线以及RSI指标来识别市场趋势和动量。策略通过多重时间框架的趋势一致性来确定交易机会,并使用基于ATR的动态止损来管理风险。系统采用资金管理模式,每次交易使用账户100%的资金,并考虑了0.1%的交易手续费。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用周线级别的EMA作为主要趋势过滤器,结合日线收盘价与周线EMA的关系来确定市场状态 2. 通过ATR指标动态调整趋势判定的阈值,增加策略的适应性 3. 整合RSI动量指标作为额外的交易过滤条件 4. 使用基于7天最低价和ATR的追踪止损系统 5. 当出现过度上涨的警告信号时,策略会暂停开仓以规避风险

策略优势

- 多重时间框架分析提供了更全面的市场视角,能够有效过滤假突破

- 动态止损机制根据市场波动性自适应调整,提供了灵活的风险控制

- RSI动量过滤器帮助确认趋势强度,提高入场质量

- 系统包含过度上涨的预警机制,有助于规避回撤风险

- 策略的参数可调整性强,便于根据不同市场环境进行优化

策略风险

- 在横盘市场中可能频繁进出导致交易成本增加

- 使用100%资金进行交易存在较大的回撤风险

- 依赖技术指标可能在市场突发事件时反应不及时

- 多重时间框架分析可能在不同级别出现矛盾信号

- 追踪止损可能在剧烈波动时被过早触发

策略优化方向

- 引入波动率过滤器,在低波动期间减少交易频率

- 添加仓位管理系统,根据市场状态动态调整持仓比例

- 整合基本面指标,提供额外的市场环境判断

- 优化追踪止损参数,使其更好地适应不同的市场阶段

- 加入交易量分析,提高趋势判断的准确性

总结

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过多重时间框架分析和动态指标过滤,策略能够较好地捕捉主要趋势。虽然存在一些固有风险,但通过参数优化和添加补充指标,策略仍有较大的改进空间。建议在实盘交易前进行充分的回测,并根据具体的市场环境调整参数设置。

策略源码

/*backtest

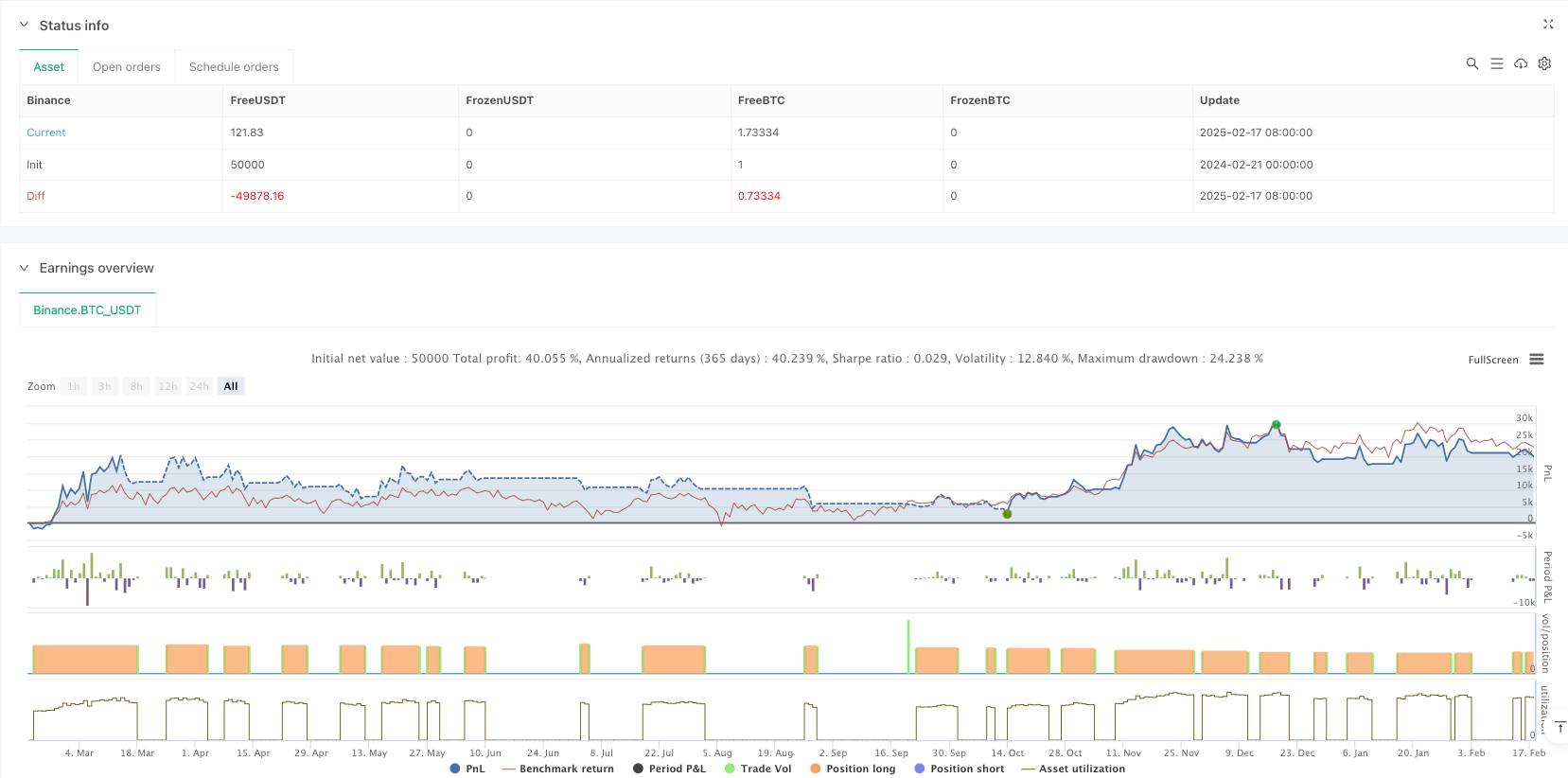

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

// @version=6

strategy("Bitcoin Regime Filter Strategy", // Strategy name

overlay=true, // The strategy will be drawn directly on the price chart

initial_capital=10000, // Initial capital of 10000 USD

currency=currency.USDT, // Defines the currency used, USDT

default_qty_type=strategy.percent_of_equity, // Position size will be calculated as a percentage of equity

default_qty_value=100, // The strategy uses 100% of available capital for each trade

commission_type=strategy.commission.percent, // The strategy uses commission as a percentage

commission_value=0.1) // Transaction fee is 0.1%

// User input

res = input.timeframe(title = "Timeframe", defval = "W") // Higher timeframe for reference

len = input.int(title = "EMA Length", defval = 20) // EMA length input

marketTF = input.timeframe(title = "Market Timeframe", defval = "D") // Current analysis timeframe (D)

useRSI = input.bool(title = "Use RSI Momentum Filter", defval = false) // Option to use RSI filter

rsiMom = input.int(title = "RSI Momentum Threshold", defval = 70) // RSI momentum threshold (default 70)

// Custom function to output data

f_sec(_market, _res, _exp) => request.security(_market, _res, _exp[barstate.isrealtime ? 1 : 0])[barstate.isrealtime ? 0: 1]

// The f_sec function has three input parameters: _market, _res, _exp

// request.security = a Pine Script function to fetch market data, accessing OHLC data

// _exp[barstate.isrealtime ? 1 : 0] checks if the current bar is real-time, and retrieves the previous bar (1) or the current bar (0)

// [barstate.isrealtime ? 0 : 1] returns the value of request.security, with a real-time check on the bar

// Define time filter

dateFilter(int st, int et) => time >= st and time <= et

// The dateFilter function has two input parameters: st (start time) and et (end time)

// It checks if the current bar's time is between st and et

// Fetch EMA value

ema = ta.ema(close, len) // Calculate EMA with close prices and input length

htfEmaValue = f_sec(syminfo.tickerid, res, ema) // EMA value for high time frame, using f_sec function

// Fetch ATR value

atrValue = ta.atr(5)

// Check if price is above or below EMA

marketPrice = f_sec(syminfo.tickerid, marketTF, close)

regimeFilter = marketPrice > (htfEmaValue + (atrValue * 0.25)) // Compare current price with EMA in higher timeframe (with ATR dependency)

// Calculate RSI value

rsiValue = ta.rsi(close, 7)

// Bullish momentum filter

bullish = regimeFilter and (rsiValue > rsiMom or not useRSI)

// Set caution alert

caution = bullish and (ta.highest(high, 7) - low) > (atrValue * 1.5)

// Set momentum background color

bgCol = color.red

if bullish[1]

bgCol := color.green

if caution[1]

bgCol := color.orange

// Plot background color

plotshape(1, color = bgCol, style = shape.square, location = location.bottom, size = size.auto, title = "Momentum Strength")

plot(htfEmaValue, color = close > htfEmaValue ? color.green : color.red, linewidth = 2)

// Initialize trailing stop variable

var float trailStop = na

// Entry logic

if bullish and strategy.position_size == 0 and not caution

strategy.entry(id = "Buy", direction = strategy.long)

trailStop := na

// Trailing stop logic

temp_trailStop = ta.highest(low, 7) - (caution[1] ? atrValue * 0.2 : atrValue)

if strategy.position_size > 0

if temp_trailStop > trailStop or na(trailStop)

trailStop := temp_trailStop

// Exit logic

if (close < trailStop or close < htfEmaValue)

strategy.close("Buy", comment = "Sell")

// Plot stop loss line

plot(strategy.position_size[1] > 0 ? trailStop : na, style = plot.style_linebr, color = color.red, title = "Stoploss")

相关推荐