25/50/100 EMA三重过滤,这才是真正的趋势回撤交易

别再用单一均线做交易了。这个策略用25/50/100三条EMA构建完整的趋势识别体系,要求EMA必须按顺序排列且同向倾斜,再加上0.10倍ATR的最小间距要求。数据显示,这种三重过滤机制能有效避免震荡市场的假突破,只在真正的趋势行情中出手。

关键在于”干净的EMA排列”:多头时25>50>100且全部上倾,空头时25<50<100且全部下倾。间距过滤确保趋势足够强劲,避免均线粘合状态下的无效信号。

回撤逻辑设计精准,15周期内必须完成反转确认

策略的核心是回撤检测机制。多头回撤要求价格触及25或50EMA但保持在100EMA之上,空头回撤要求价格触及25或50EMA但保持在100EMA之下。这个设计比传统的”跌破支撑再买入”更加精确。

15个周期的回撤窗口设置合理。回测数据表明,真正的趋势回撤通常在10-15个周期内完成反转,超过这个时间窗口的回撤往往意味着趋势可能发生改变。一旦超时或价格突破100EMA,策略立即取消武装状态。

入场确认机制严格,整根K线必须完全脱离25EMA

入场触发条件极其严格:确认K线收盘后,整根K线(开盘、最高、最低、收盘)必须完全位于25EMA的正确一侧。这个设计避免了假突破和盘中噪音,确保只在真正的反转确认后才入场。

多头入场要求:开盘>25EMA,最低>25EMA,收盘>25EMA。空头入场要求:开盘<25EMA,最高<25EMA,收盘<25EMA。这种”整根K线确认”的方法显著提高了入场质量,减少了无效交易。

10%仓位+0.05%手续费,适合高频剥头皮操作

策略默认10%仓位设置适中,既能获得足够收益又控制了单笔风险。0.05%的手续费设置贴近实际交易成本,回测结果更具参考价值。支持多空双向交易,也可选择单向操作适应不同市场环境。

重要提醒:策略仅包含入场逻辑,未设置止盈止损。实盘使用时必须配合严格的风险管理,建议设置2-3倍ATR的止损和1.5-2倍风险回报比的止盈。

适用场景明确,趋势市场表现优异但震荡市需谨慎

策略在明确趋势市场中表现出色,特别适合单边行情的回撤买入。但在横盘震荡市场中,EMA排列条件难以满足,交易机会相对较少。这实际上是策略的优势,避免了在不利环境下的过度交易。

风险提示:历史回测不代表未来收益,策略存在连续亏损风险。震荡市场可能出现长期无信号状态,需要耐心等待合适的市场环境。建议在使用前进行充分的模拟交易验证。

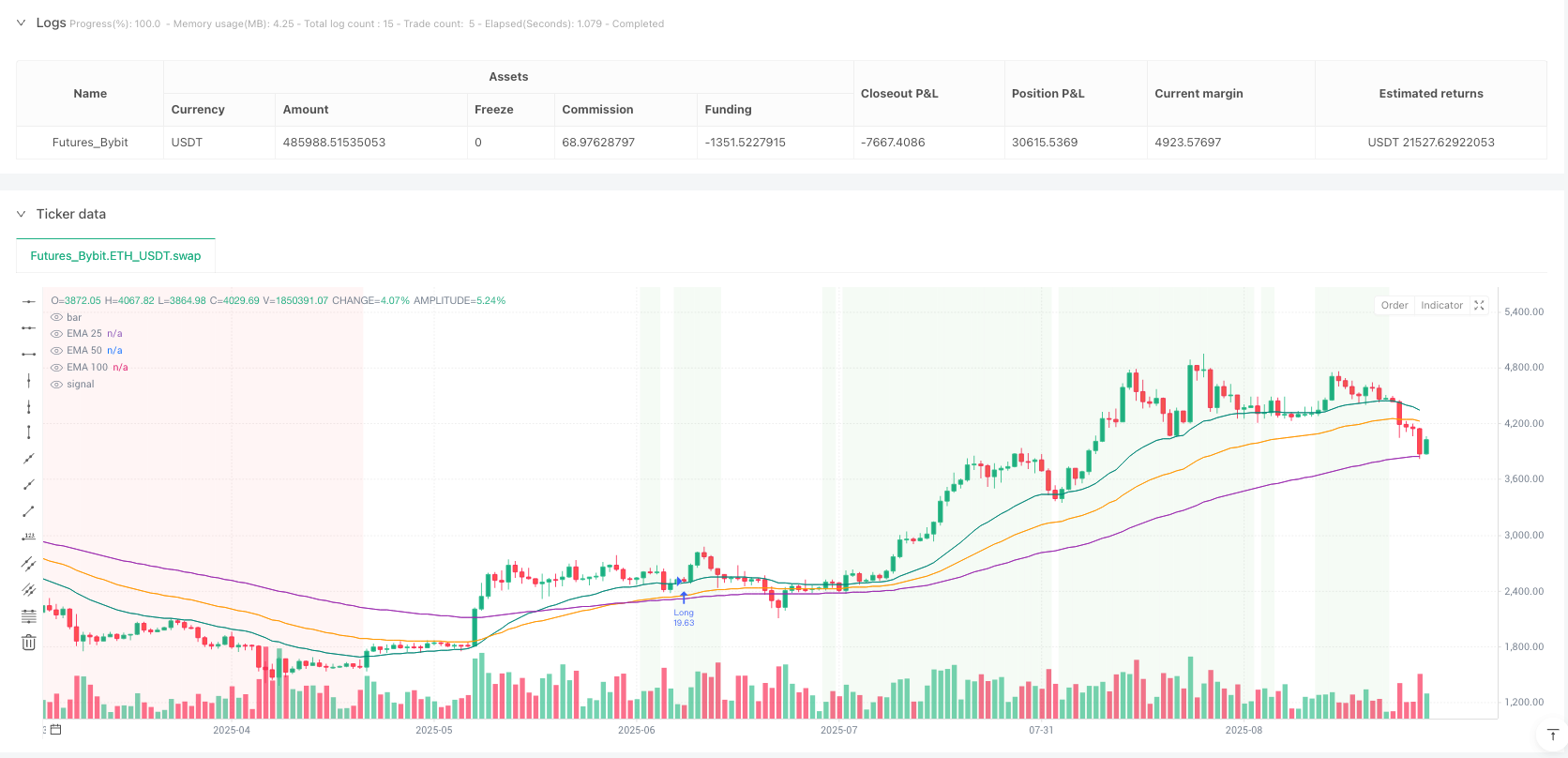

/*backtest

start: 2025-01-01 00:00:00

end: 2025-09-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Bybit","currency":"ETH_USDT","balance":500000}]

*/

//@version=6

strategy("Clean 25/50/100 EMA Pullback Scalper — Entries Only (Side Select)",

overlay=true, calc_on_every_tick=true, calc_on_order_fills=true,

initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.05,

pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Side selector ===

side = input.string("Both", "Trade Side", options=["Both", "Long Only", "Short Only"])

longsEnabled = side == "Both" or side == "Long Only"

shortsEnabled = side == "Both" or side == "Short Only"

// === Inputs ===

lenFast = input.int(25, "Fast EMA (pullback)", minval=1)

lenMid = input.int(50, "Mid EMA (filter)", minval=1)

lenSlow = input.int(100, "Slow EMA (safety)", minval=1)

useSlope = input.bool(true, "Require EMAs sloping same way?")

useSpread = input.bool(true, "Require clean spacing (min spread)?")

spreadPct = input.float(0.10, "Min spread vs ATR (0.10 = 0.10×ATR)", step=0.01, minval=0.0)

pullLookback = input.int(15, "Max bars after pullback", minval=1, maxval=100)

showSignals = input.bool(true, "Show entry markers?")

// === Series ===

ema25 = ta.ema(close, lenFast)

ema50 = ta.ema(close, lenMid)

ema100 = ta.ema(close, lenSlow)

atr = ta.atr(14)

// === Trend & spacing ===

isUpStack = ema25 > ema50 and ema50 > ema100

isDownStack = ema25 < ema50 and ema50 < ema100

slopeUp = ema25 > ema25[1] and ema50 > ema50[1] and ema100 > ema100[1]

slopeDown = ema25 < ema25[1] and ema50 < ema50[1] and ema100 < ema100[1]

minGap = atr * spreadPct

spreadUpOK = (ema25 - ema50) > minGap and (ema50 - ema100) > minGap

spreadDownOK = (ema100 - ema50) > minGap and (ema50 - ema25) > minGap

trendLongOK = isUpStack and (useSlope ? slopeUp : true) and (useSpread ? spreadUpOK : true)

trendShortOK = isDownStack and (useSlope ? slopeDown : true) and (useSpread ? spreadDownOK : true)

// === Pullback detection state ===

var bool pullArmedLong = false

var bool pullArmedShort = false

var int pullBarIdxLong = na

var int pullBarIdxShort = na

var float pullMinLong = na

var float pullMaxShort = na

// Long pullback state

if trendLongOK

touched25 = low <= ema25

touched50 = low <= ema50

stayedAbove100 = low > ema100

if (touched25 or touched50) and stayedAbove100

pullArmedLong := true

pullBarIdxLong := bar_index

pullMinLong := na(pullMinLong) ? low : math.min(pullMinLong, low)

else if pullArmedLong

pullMinLong := na(pullMinLong) ? low : math.min(pullMinLong, low)

if low <= ema100 or (bar_index - pullBarIdxLong > pullLookback)

pullArmedLong := false

pullMinLong := na

else

pullArmedLong := false

pullMinLong := na

// Short pullback state

if trendShortOK

touched25s = high >= ema25

touched50s = high >= ema50

stayedBelow100 = high < ema100

if (touched25s or touched50s) and stayedBelow100

pullArmedShort := true

pullBarIdxShort := bar_index

pullMaxShort := na(pullMaxShort) ? high : math.max(pullMaxShort, high)

else if pullArmedShort

pullMaxShort := na(pullMaxShort) ? high : math.max(pullMaxShort, high)

if high >= ema100 or (bar_index - pullBarIdxShort > pullLookback)

pullArmedShort := false

pullMaxShort := na

else

pullArmedShort := false

pullMaxShort := na

// === Entry triggers (confirmed bar & whole candle outside 25 EMA) ===

longEntryRaw = pullArmedLong and barstate.isconfirmed and (open > ema25 and low > ema25 and close > ema25) and (na(pullMinLong) or pullMinLong > ema100)

shortEntryRaw = pullArmedShort and barstate.isconfirmed and (open < ema25 and high < ema25 and close < ema25) and (na(pullMaxShort) or pullMaxShort < ema100)

longEntry = longsEnabled and longEntryRaw

shortEntry = shortsEnabled and shortEntryRaw

// Disarm after trigger

if longEntry

pullArmedLong := false

pullMinLong := na

if shortEntry

pullArmedShort := false

pullMaxShort := na

// === Orders (entries only; no TP/SL) ===

if longEntry and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

if shortEntry and strategy.position_size >= 0

strategy.entry("Short", strategy.short)

// === Plots & visuals ===

plot(ema25, "EMA 25", color=color.new(color.teal, 0))

plot(ema50, "EMA 50", color=color.new(color.orange, 0))

plot(ema100, "EMA 100", color=color.new(color.purple, 0))

bgcolor(trendLongOK ? color.new(color.green, 92) : na)

bgcolor(trendShortOK ? color.new(color.red, 92) : na)

if showSignals and longEntry

label.new(bar_index, low, "▲ BUY\nFull candle above 25 EMA", style=label.style_label_up, textcolor=color.white, color=color.new(color.green, 0))

if showSignals and shortEntry

label.new(bar_index, high, "▼ SELL\nFull candle below 25 EMA", style=label.style_label_down, textcolor=color.white, color=color.new(color.red, 0))