BS, GAMMA, DELTA, THETA, VEGA

为什么期权做市商总能在波动中获利?

在量化交易的世界里,有一个看似矛盾的现象:当散户投资者因为市场波动而焦虑不安时,期权做市商却能够稳定盈利。这背后的秘密是什么?答案就在于今天要分析的这个基于Black-Scholes模型的伽马剥头皮策略。

这个策略的核心思想是模拟期权做市商的交易行为:通过构建合成跨式期权组合(long straddle),利用伽马效应进行动态对冲,从而在波动率套利中获取收益。简单来说,就是让数学为我们工作,而不是与市场情绪做斗争。

策略的数学基础:Black-Scholes模型的实战应用

Black-Scholes模型不仅仅是学术理论,它是现代期权定价的基石。在这个策略中,我们重点关注五个希腊字母:

Delta(Δ):衡量期权价格对标的资产价格变化的敏感性。对于跨式期权组合,Delta的变化为我们提供了对冲信号。

Gamma(Γ):Delta的变化率,这是策略的核心。正伽马意味着价格上涨时Delta增加,价格下跌时Delta减少,这为我们创造了”低买高卖”的机会。

Theta(Θ):时间衰减,这是我们需要克服的成本。只有当实际波动率超过隐含波动率时,伽马交易的收益才能覆盖时间衰减。

Vega(ν):对波动率的敏感性,帮助我们判断波动率环境。

从代码实现来看,策略使用了标准的Black-Scholes公式计算这些希腊字母,并通过标准正态分布函数(使用Abramowitz & Stegun近似)来确保计算精度。

如何识别最佳交易时机?

策略设计了三层信号过滤机制:

第一层:波动率制度识别 通过比较历史波动率与隐含波动率的比值来判断当前的波动率环境。当历史波动率/隐含波动率 > 1.2时,表明市场实际波动超过期权定价预期,这是进行伽马剥头皮的理想环境。

第二层:伽马剥头皮触发器 当价格移动超过ATR的特定倍数时,触发交易信号。这个设计很巧妙:它确保我们只在有足够价格移动时才进行对冲交易,避免了过度交易。

第三层:Delta对冲带 当跨式期权组合的净Delta偏离中性位置超过设定阈值时,产生对冲信号。这模拟了做市商维持Delta中性的行为。

什么情况下这个策略最有效?

从策略逻辑分析,最佳使用场景包括:

高波动率环境:当市场实际波动率持续高于隐含波动率时,伽马交易能够产生超额收益。

趋势性行情中的回调:在强趋势中的短期回调往往创造了良好的伽马剥头皮机会。

事件驱动的波动:财报、央行决议等事件前后的波动率变化为策略提供了理想的交易环境。

需要注意的是,策略在低波动率的盘整市场中效果有限,因为价格移动不足以触发有效的伽马交易信号。

风险管理的精妙设计

这个策略的风险管理体现了专业量化交易的水准:

动态仓位管理:根据波动率调整仓位大小,高波动率时减少仓位,低波动率时增加仓位,这与传统的固定仓位管理形成鲜明对比。

多层止损机制:结合ATR倍数的止损、最大回撤保护、以及基于时间价值的退出机制。

并发头寸限制:通过限制最大同时持仓数量来控制整体风险敞口。

策略的创新点与局限性

创新之处: 1. 将复杂的期权希腊字母计算完整移植到股票/期货交易中 2. 动态波动率制度识别,而非静态参数 3. 多维度信号确认机制,减少假信号

潜在局限: 1. 对交易成本敏感,需要较低的手续费环境 2. 在极端市场条件下,Black-Scholes模型的假设可能失效 3. 策略复杂度较高,需要充分的回测验证

实战建议与优化方向

基于对代码的深度分析,我建议:

- 参数优化:针对不同市场环境,动态调整波动率阈值和对冲带宽度

- 多时间框架确认:结合更长周期的波动率趋势进行信号过滤

- 成本控制:在实盘中严格控制滑点和手续费,这直接影响策略盈利能力

这个策略展现了量化交易的魅力:通过数学模型将复杂的市场行为简化为可执行的交易规则。虽然它不能保证每次交易都盈利,但从长期来看,它为我们提供了一个具有正期望值的交易框架。

对于想要深入理解期权交易本质的量化交易者来说,这个策略无疑是一个优秀的学习案例。它不仅展示了如何将理论转化为实践,更重要的是,它揭示了专业交易者思考市场的方式:不是预测方向,而是管理风险,让概率为我们工作。

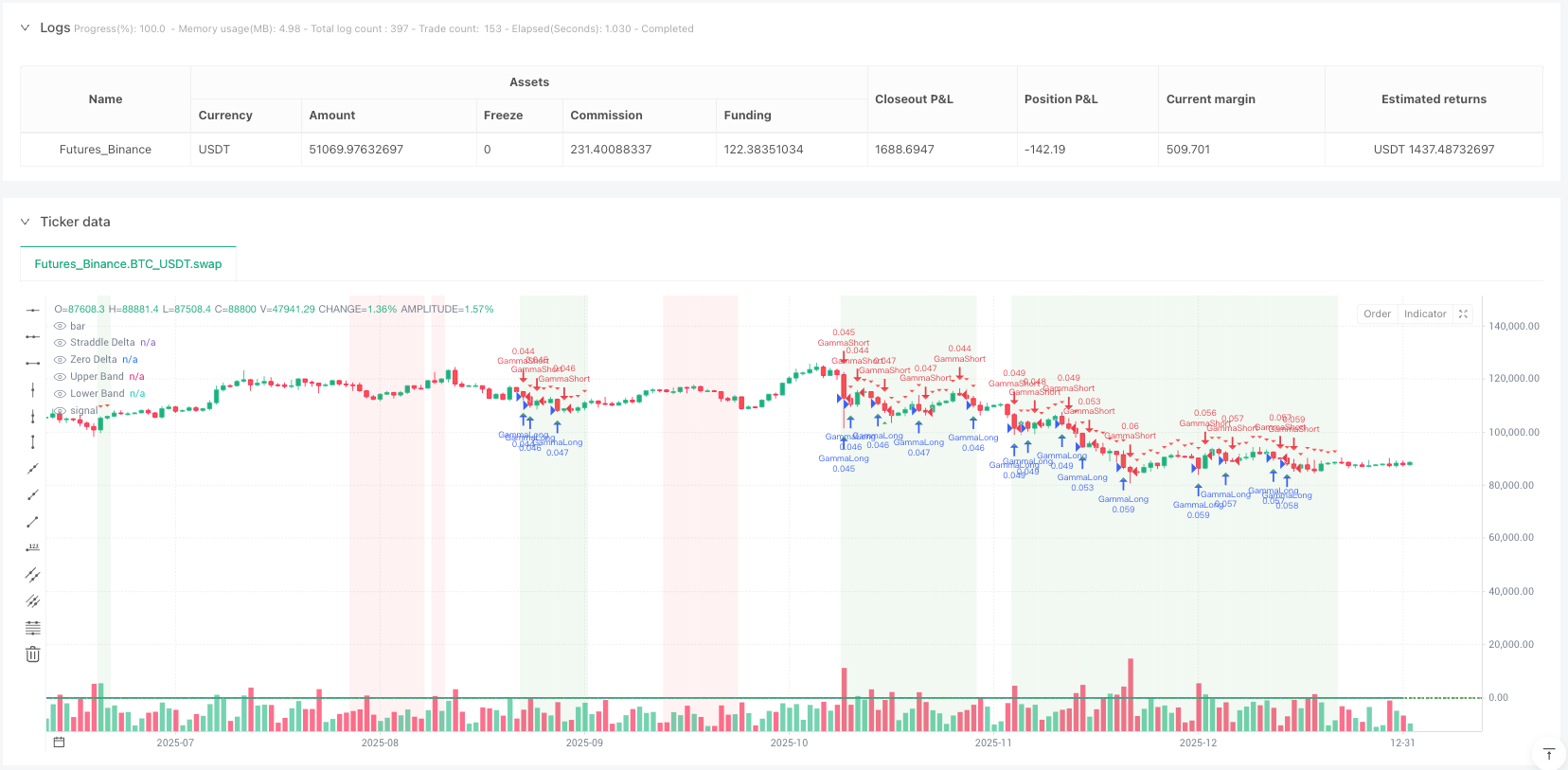

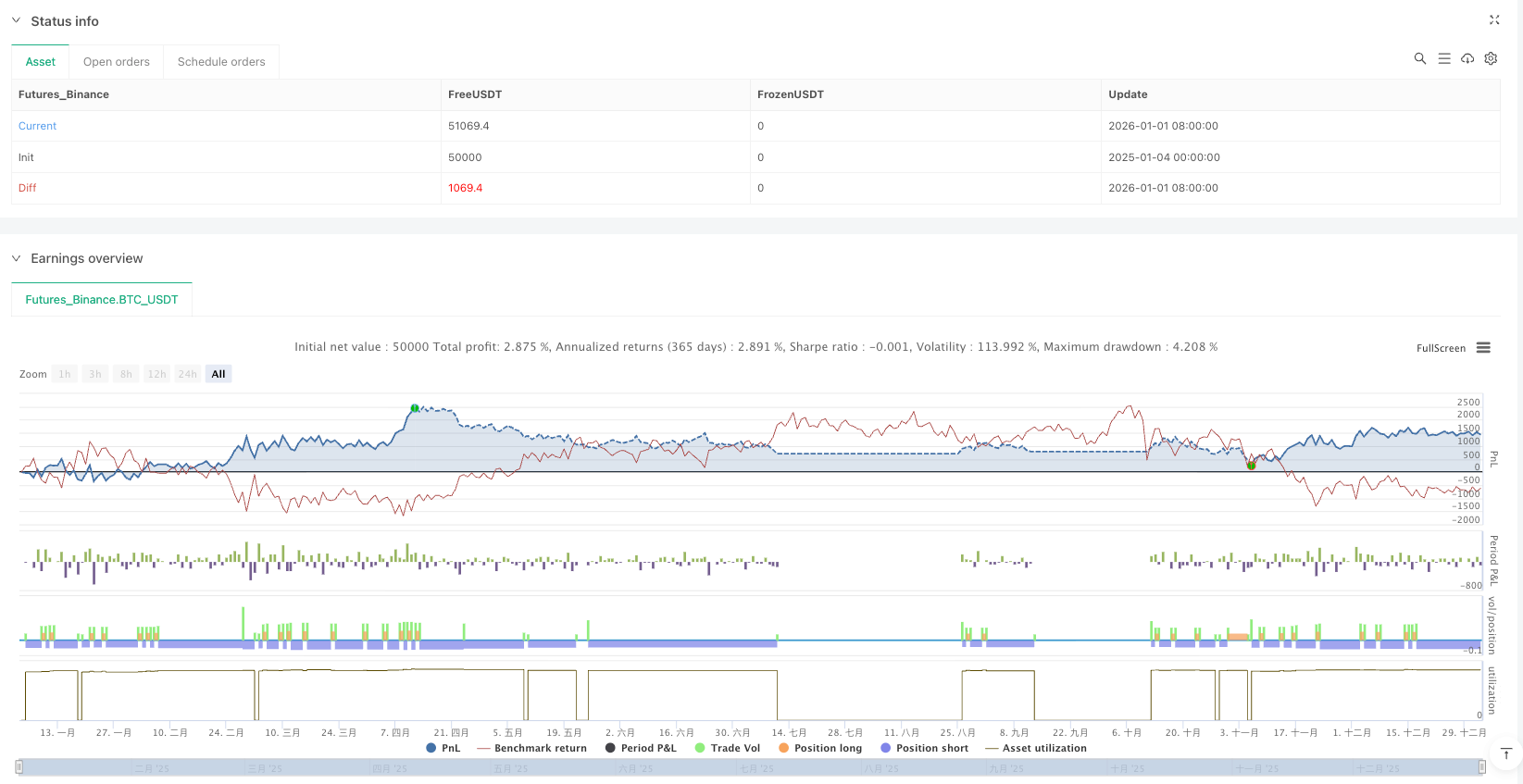

/*backtest

start: 2025-01-04 00:00:00

end: 2026-01-02 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Black-Scholes Gamma Scalping Strategy",

overlay=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10,

pyramiding=5)

// ============================================================================

// STRATEGY CONCEPT:

// This strategy simulates gamma scalping - a volatility arbitrage technique

// used by options market makers. The core idea:

//

// 1. We model a synthetic long straddle position (long call + long put)

// 2. The straddle has positive gamma, meaning delta changes as price moves

// 3. We continuously delta-hedge by trading the underlying

// 4. If realized volatility > implied volatility, hedging profits exceed theta decay

// 5. Trading signals generated when price moves create hedging opportunities

//

// The Black-Scholes equation provides: Delta, Gamma, Theta, Vega

// ============================================================================

// === INPUT PARAMETERS ===

string grp_opt = "Option Parameters"

strike_offset_pct = input.float(0.0, "Strike Offset from Current Price %", group=grp_opt, step=0.5)

days_to_expiry = input.int(30, "Days to Expiration", group=grp_opt, minval=1, maxval=365)

implied_vol = input.float(0.25, "Implied Volatility (Annual)", group=grp_opt, minval=0.05, maxval=2.0, step=0.01)

risk_free_rate = input.float(0.05, "Risk-Free Rate (Annual)", group=grp_opt, step=0.001)

dividend_yield = input.float(0.0, "Dividend Yield (Annual)", group=grp_opt, step=0.001)

string grp_vol = "Volatility Analysis"

hist_vol_period = input.int(20, "Historical Volatility Period", group=grp_vol, minval=5)

vol_ratio_threshold = input.float(1.2, "HV/IV Ratio for Long Vol Signal", group=grp_vol, minval=1.0, step=0.05)

vol_ratio_short = input.float(0.8, "HV/IV Ratio for Short Vol Signal", group=grp_vol, minval=0.1, maxval=1.0, step=0.05)

string grp_trade = "Trading Parameters"

gamma_scalp_threshold = input.float(0.5, "Gamma Scalp Threshold (ATR mult)", group=grp_trade, minval=0.1, step=0.1)

hedge_band_pct = input.float(2.0, "Delta Hedge Band %", group=grp_trade, minval=0.5, step=0.5)

use_vol_filter = input.bool(true, "Use Volatility Regime Filter", group=grp_trade)

max_positions = input.int(3, "Max Concurrent Positions", group=grp_trade, minval=1, maxval=10)

string grp_risk = "Risk Management"

stop_loss_atr_mult = input.float(2.0, "Stop Loss (ATR Multiple)", group=grp_risk, minval=0.5, step=0.5)

take_profit_atr_mult = input.float(3.0, "Take Profit (ATR Multiple)", group=grp_risk, minval=1.0, step=0.5)

max_drawdown_pct = input.float(15.0, "Max Drawdown % to Pause Trading", group=grp_risk, minval=5.0, step=1.0)

// ============================================================================

// BLACK-SCHOLES MATHEMATICAL FUNCTIONS

// ============================================================================

// --- Standard Normal CDF (Abramowitz & Stegun approximation) ---

norm_cdf(float x) =>

float result = 0.0

if na(x)

result := na

else

float ax = math.abs(x)

if ax > 10

result := x > 0 ? 1.0 : 0.0

else

float t = 1.0 / (1.0 + 0.2316419 * ax)

float d = 0.3989422804 * math.exp(-0.5 * x * x) // 1/sqrt(2*pi) * exp(-x²/2)

float p = t * (0.31938153 + t * (-0.356563782 + t * (1.781477937 + t * (-1.821255978 + t * 1.330274429))))

result := x >= 0 ? 1.0 - d * p : d * p

result

// --- Standard Normal PDF ---

norm_pdf(float x) =>

na(x) ? na : 0.3989422804 * math.exp(-0.5 * x * x)

// --- Black-Scholes d1 and d2 ---

bs_d1(float S, float K, float r, float q, float sigma, float T) =>

T > 0 and sigma > 0 ? (math.log(S / K) + (r - q + 0.5 * sigma * sigma) * T) / (sigma * math.sqrt(T)) : na

bs_d2(float S, float K, float r, float q, float sigma, float T) =>

float d1 = bs_d1(S, K, r, q, sigma, T)

na(d1) ? na : d1 - sigma * math.sqrt(T)

// --- Greeks ---

// Call Delta

call_delta(float S, float K, float r, float q, float sigma, float T) =>

T <= 0 ? (S >= K ? 1.0 : 0.0) : math.exp(-q * T) * norm_cdf(bs_d1(S, K, r, q, sigma, T))

// Put Delta

put_delta(float S, float K, float r, float q, float sigma, float T) =>

T <= 0 ? (S <= K ? -1.0 : 0.0) : math.exp(-q * T) * (norm_cdf(bs_d1(S, K, r, q, sigma, T)) - 1)

// Gamma (same for call and put)

option_gamma(float S, float K, float r, float q, float sigma, float T) =>

if T <= 0 or sigma <= 0

0.0

else

float d1 = bs_d1(S, K, r, q, sigma, T)

math.exp(-q * T) * norm_pdf(d1) / (S * sigma * math.sqrt(T))

// ============================================================================

// HISTORICAL VOLATILITY CALCULATION

// ============================================================================

// Calculate annualized historical volatility

calc_historical_vol(int period) =>

float log_return = math.log(close / close[1])

float std_dev = ta.stdev(log_return, period)

// Annualization factor based on timeframe

float periods_per_year = switch

timeframe.isdaily => 365.0

timeframe.isweekly => 52.0

timeframe.ismonthly => 12.0

=> 365.0 * 390.0 / (timeframe.isminutes ? timeframe.multiplier : 1440.0)

nz(std_dev * math.sqrt(periods_per_year), 0.20)

hist_vol = calc_historical_vol(hist_vol_period)

// ============================================================================

// STRATEGY CALCULATIONS

// ============================================================================

// Dynamic strike price (ATM or offset)

float atm_strike = math.round(close / syminfo.mintick) * syminfo.mintick

float strike_price = atm_strike * (1 + strike_offset_pct / 100)

// Time to expiration in years

float tau = days_to_expiry / 365.0

// Calculate Greeks for synthetic straddle (1 call + 1 put at same strike)

float c_delta = call_delta(close, strike_price, risk_free_rate, dividend_yield, implied_vol, tau)

float p_delta = put_delta(close, strike_price, risk_free_rate, dividend_yield, implied_vol, tau)

float straddle_delta = c_delta + p_delta // Net delta of straddle

float gamma = option_gamma(close, strike_price, risk_free_rate, dividend_yield, implied_vol, tau)

float straddle_gamma = 2 * gamma // Straddle has 2x gamma

// Volatility ratio: Historical / Implied

float vol_ratio = hist_vol / implied_vol

// ATR for position sizing and stops

float atr = ta.atr(14)

// ============================================================================

// TRADING SIGNALS

// ============================================================================

// --- Signal 1: Volatility Regime ---

// Long volatility when realized > implied (gamma scalping profitable)

// Short volatility when realized < implied (collect theta)

bool long_vol_regime = vol_ratio > vol_ratio_threshold

bool short_vol_regime = vol_ratio < vol_ratio_short

// --- Signal 2: Gamma Scalp Trigger ---

// When price moves significantly, delta changes. We trade to capture this.

float price_move = close - close[1]

float move_threshold = atr * gamma_scalp_threshold

bool significant_up_move = price_move > move_threshold

bool significant_down_move = price_move < -move_threshold

// --- Signal 3: Delta Hedge Bands ---

// Trade when straddle delta deviates from neutral

float delta_band = hedge_band_pct / 100

bool delta_long_signal = straddle_delta < -delta_band // Need to buy to hedge

bool delta_short_signal = straddle_delta > delta_band // Need to sell to hedge

// --- Combined Entry Signals ---

bool vol_filter = use_vol_filter ? long_vol_regime : true

// Long entry: Price dropped significantly OR delta needs positive hedge

bool long_entry = vol_filter and (significant_down_move or delta_long_signal)

// Short entry: Price rose significantly OR delta needs negative hedge

bool short_entry = vol_filter and (significant_up_move or delta_short_signal)

// ============================================================================

// RISK MANAGEMENT

// ============================================================================

// Track equity for drawdown protection

var float equity_peak = strategy.initial_capital

equity_peak := math.max(equity_peak, strategy.equity)

float current_drawdown = (equity_peak - strategy.equity) / equity_peak * 100

bool drawdown_exceeded = current_drawdown > max_drawdown_pct

// Position counting

int open_trades = strategy.opentrades

// ============================================================================

// STRATEGY EXECUTION

// ============================================================================

// Stop loss and take profit levels

float long_stop = close - atr * stop_loss_atr_mult

float long_target = close + atr * take_profit_atr_mult

float short_stop = close + atr * stop_loss_atr_mult

float short_target = close - atr * take_profit_atr_mult

// Entry conditions

bool can_trade = not drawdown_exceeded and open_trades < max_positions

if can_trade

// Long entries

if long_entry and strategy.position_size <= 0

strategy.entry("GammaLong", strategy.long,

comment="Δ:" + str.tostring(straddle_delta, "#.##") + " Γ:" + str.tostring(straddle_gamma, "#.###"))

strategy.exit("LongExit", "GammaLong", stop=long_stop, limit=long_target)

// Short entries

if short_entry and strategy.position_size >= 0

strategy.entry("GammaShort", strategy.short,

comment="Δ:" + str.tostring(straddle_delta, "#.##") + " Γ:" + str.tostring(straddle_gamma, "#.###"))

strategy.exit("ShortExit", "GammaShort", stop=short_stop, limit=short_target)

// Exit on extreme conditions

if drawdown_exceeded

strategy.close_all(comment="Drawdown Protection")

// Exit if volatility regime shifts against us

if use_vol_filter and short_vol_regime and strategy.position_size != 0

strategy.close_all(comment="Vol Regime Shift")

// ============================================================================

// VISUALIZATIONS

// ============================================================================

// Plot straddle delta

plot(straddle_delta, "Straddle Delta", color=color.blue, linewidth=2)

hline(0, "Zero Delta", color=color.gray, linestyle=hline.style_dashed)

hline(delta_band, "Upper Band", color=color.red, linestyle=hline.style_dotted)

hline(-delta_band, "Lower Band", color=color.green, linestyle=hline.style_dotted)

// Background color for volatility regime

bgcolor(long_vol_regime ? color.new(color.green, 90) : short_vol_regime ? color.new(color.red, 90) : na)

// Entry signals

plotshape(long_entry and can_trade, "Long Signal", shape.triangleup, location.belowbar, color.green, size=size.small)

plotshape(short_entry and can_trade, "Short Signal", shape.triangledown, location.abovebar, color.red, size=size.small)

// ============================================================================

// ALERTS

// ============================================================================

alertcondition(long_entry and can_trade, "Gamma Long Entry", "BS Strategy: Long entry signal - Delta={{straddle_delta}}")

alertcondition(short_entry and can_trade, "Gamma Short Entry", "BS Strategy: Short entry signal - Delta={{straddle_delta}}")

alertcondition(drawdown_exceeded, "Drawdown Alert", "BS Strategy: Max drawdown exceeded - trading paused")