Overview

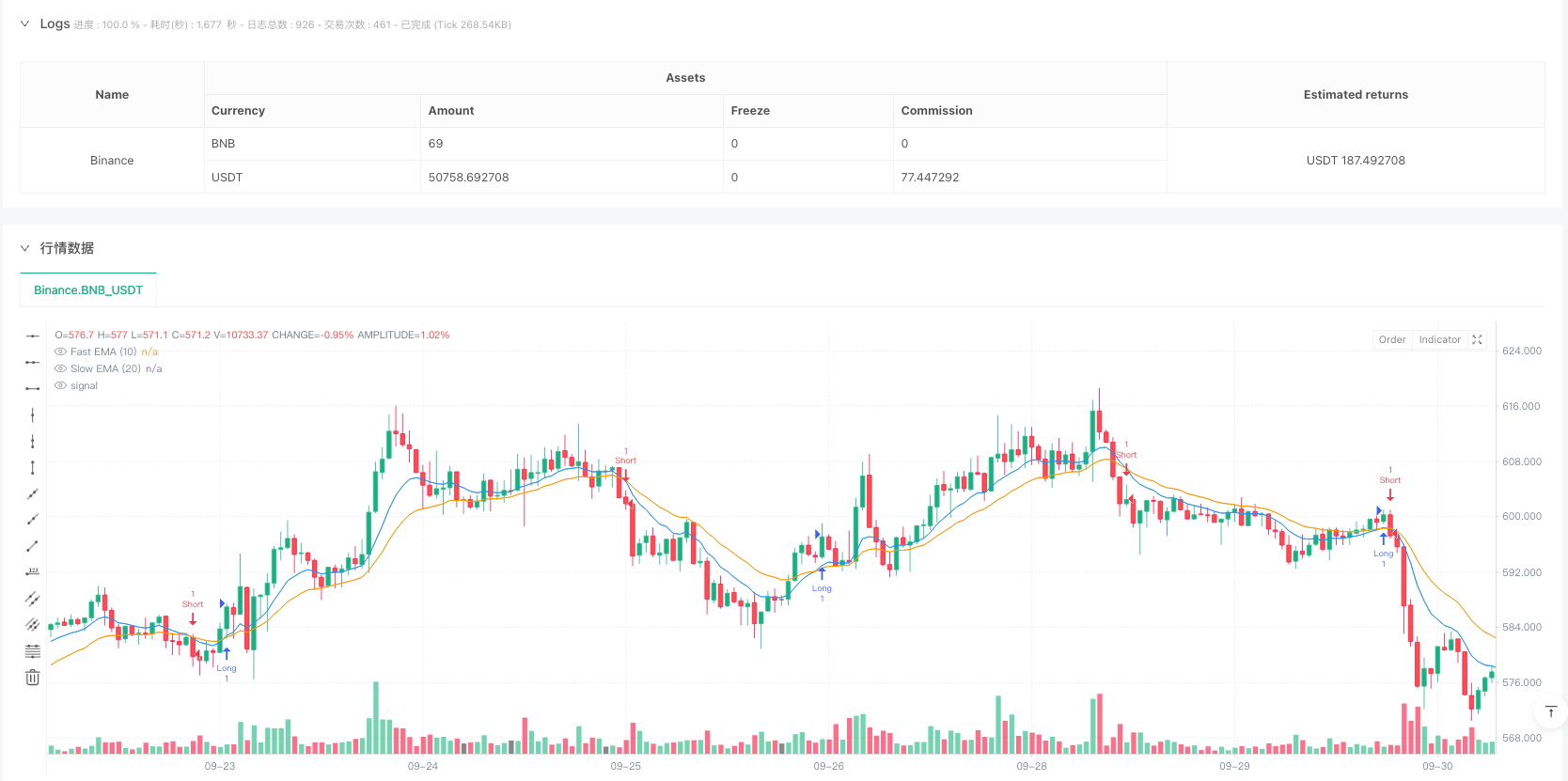

This strategy is a trend following trading system based on the crossover of fast and slow Exponential Moving Averages (EMA). It generates more reliable buy and sell signals by confirming price position relative to both EMAs. The strategy includes customizable backtesting timeframe settings for performance evaluation within specific periods.

Strategy Principle

The strategy utilizes 10-period and 20-period EMAs as core indicators. A long signal is triggered when the fast EMA crosses above the slow EMA and the closing price is above both EMAs; a short signal is triggered when the fast EMA crosses below the slow EMA and the closing price is below both EMAs. This dual confirmation mechanism enhances signal reliability.

Strategy Advantages

- Signal confirmation mechanism reduces false breakouts and improves trading accuracy

- EMAs provide more sensitive response to market trend changes

- Customizable backtesting timeframe facilitates strategy optimization

- Clear visual markers for intuitive trading decisions

- Applicable to various market conditions and trading instruments

Strategy Risks

- Choppy markets may generate frequent false signals

- Improper EMA parameter settings can lead to excessive lag

- Rapid market reversals may cause significant drawdowns

- Proper stop-loss settings are necessary for risk control

- Trading costs may impact overall strategy returns

Strategy Optimization Directions

- Incorporate volatility indicators to adjust EMA parameters for better adaptability

- Add volume confirmation mechanism to enhance signal reliability

- Implement trend strength filters to reduce false signals in ranging markets

- Optimize stop-loss and take-profit mechanisms to improve risk-reward ratio

- Consider adding market state detection for strategy adaptation

Summary

This is a well-structured and logically rigorous trend following strategy. By combining dual EMA crossover with price confirmation mechanism, it effectively balances signal timeliness and reliability. The strategy offers good scalability and can be further enhanced through optimization. It serves as an excellent foundation for medium to long-term trend following trading frameworks.

/*backtest

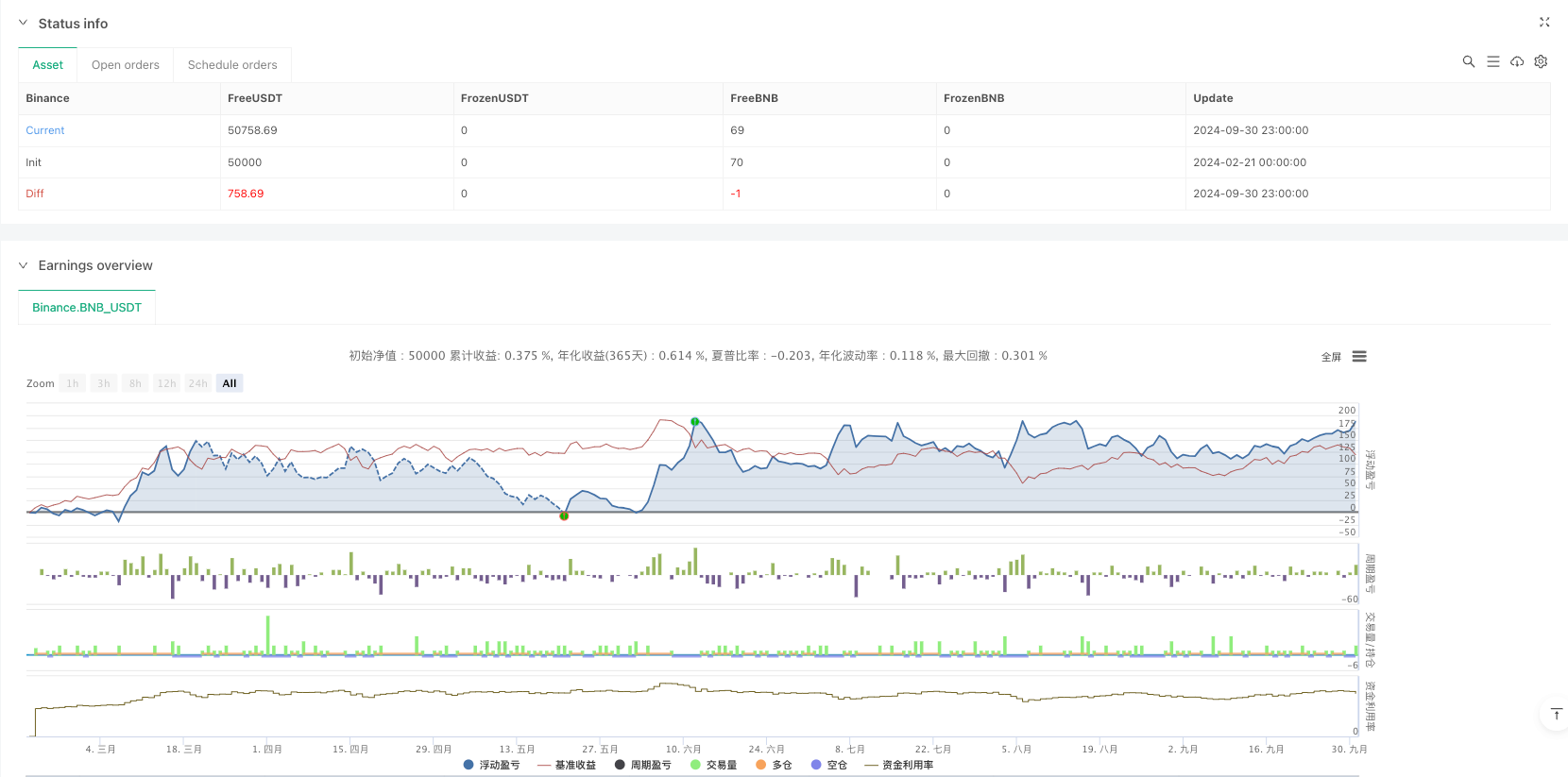

start: 2024-02-21 00:00:00

end: 2024-10-01 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"BNB_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BFXGold

//@version=5

strategy("BFX Buy and Sell", overlay=true)

// Inputs

ema_fast_length = input.int(10, title="Fast EMA Length")

ema_slow_length = input.int(20, title="Slow EMA Length")

// Calculate EMAs

ema_fast = ta.ema(close, ema_fast_length)

ema_slow = ta.ema(close, ema_slow_length)

// Confirmation candles

confirmation_above = close > ema_fast and close > ema_slow

confirmation_below = close < ema_fast and close < ema_slow

// Crossovers with confirmation

long_condition = ta.crossover(ema_fast, ema_slow) and confirmation_above

short_condition = ta.crossunder(ema_fast, ema_slow) and confirmation_below

// Plot signals

if (long_condition )

label.new(bar_index, low, text="BUY", style=label.style_label_up, color=color.new(color.green, 0), textcolor=color.white)

if (short_condition)

label.new(bar_index, high, text="SELL", style=label.style_label_down, color=color.new(color.red, 0), textcolor=color.white)

// Strategy execution for backtesting

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

// Plot EMAs

plot(ema_fast, title="Fast EMA (10)", color=color.blue, linewidth=1)

plot(ema_slow, title="Slow EMA (20)", color=color.orange, linewidth=1)