Dynamic Moving Average Crossover Trend Following Strategy

EMA SMA Moving Average CROSSOVER TREND FOLLOWING STOP LOSS TAKE PROFIT

Overview

This strategy is a trend following system based on multiple moving average crossovers, combining SMA and EMA indicators to capture market trends. The strategy utilizes a customizable period Simple Moving Average (SMA) and two Exponential Moving Averages (EMA) to construct a complete trend following trading system. It also integrates dynamic stop-loss and profit target management mechanisms to effectively control risk and lock in profits.

Strategy Principles

The strategy primarily makes trading decisions based on the dynamic relationships between three moving averages. The system determines trend direction by monitoring price position relative to SMA and crossovers between fast and slow EMAs. Entry signals are triggered in two ways: first, when price is above (below) SMA and fast EMA crosses above (below) slow EMA; second, when price breaks through SMA and previous price action consistently remains above (below) SMA. The strategy employs a dynamic stop-loss mechanism, with initial stops based on EMA position or fixed percentage, adjusting as profits increase.

Strategy Advantages

- Multiple moving averages working together improve trend identification accuracy and reduce losses from false breakouts

- Dual entry conditions design captures both early trend opportunities and confirmed trend continuations

- Dynamic stop-loss mechanism protects profits while allowing trends sufficient room to develop

- Reasonable profit-to-loss ratio settings achieve good balance between risk control and profit potential

- Moving average crossovers as additional exit conditions help avoid trend reversal risks

Strategy Risks

- May generate frequent trades resulting in losses in ranging markets

- Multiple moving average system may lag in rapidly volatile markets

- Fixed stop-loss multipliers may not suit all market conditions

- Trailing stops may lock in profits too early in highly volatile markets

- Over-optimization of parameters may lead to poorer live performance compared to backtests

Optimization Directions

- Introduce volatility indicators to dynamically adjust stop-loss and take-profit multipliers for better market adaptation

- Add volume indicators as confirmation to improve entry signal reliability

- Dynamically adjust moving average periods based on market volatility characteristics

- Implement trend strength filters to avoid frequent trading in weak trend environments

- Develop adaptive trailing stop mechanisms that dynamically adjust stop distances based on market volatility

Summary

The strategy constructs a complete trend following system through the coordination of multiple moving averages, with detailed rules for entries, exits, and risk management. Its strengths lie in effective trend identification and following, while protecting profits through dynamic stop-loss mechanisms. Though inherent risks exist, the proposed optimization directions can further enhance strategy stability and adaptability. The overall design is reasonable, offering good practical value and optimization potential.

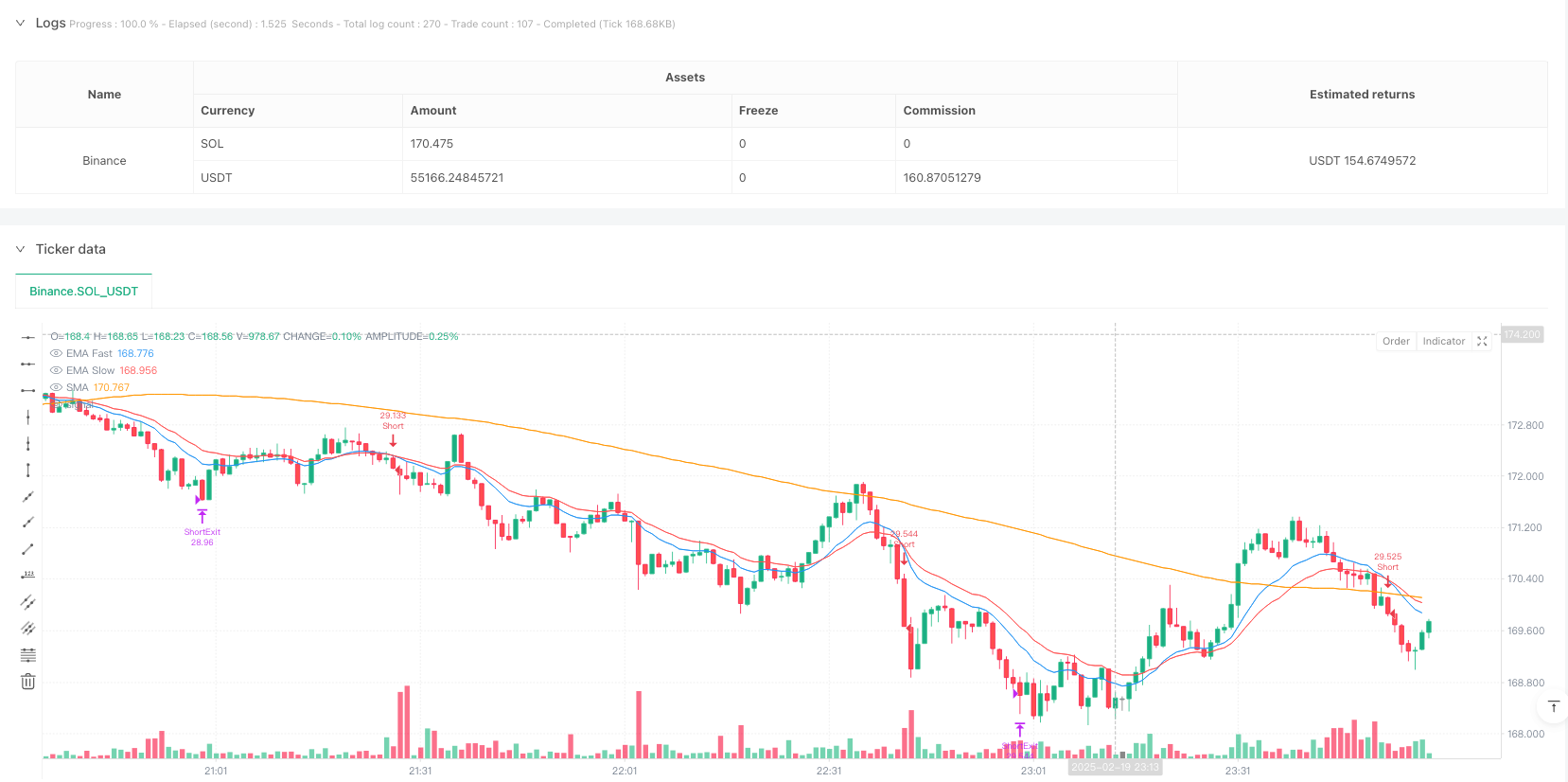

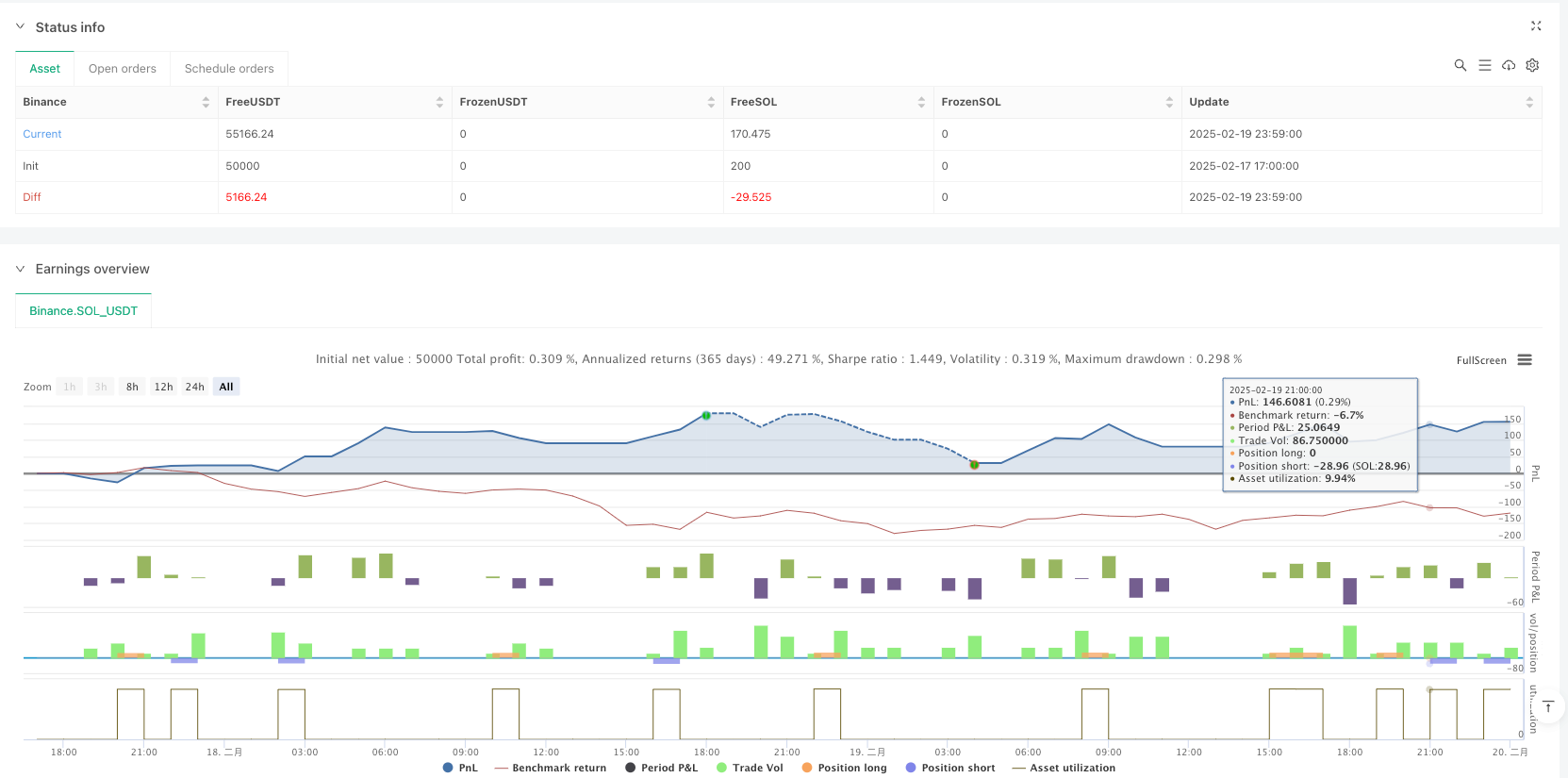

/*backtest

start: 2025-02-17 17:00:00

end: 2025-02-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("交易策略(自定义EMA/SMA参数)", overlay=true, initial_capital=100000, currency=currency.EUR, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// 输入参数:可调的 SMA 和 EMA 周期

smaLength = input.int(120, "SMA Length", minval=1, step=1)

emaFastPeriod = input.int(13, "EMA Fast Period", minval=1, step=1)

emaSlowPeriod = input.int(21, "EMA Slow Period", minval=1, step=1)

// 计算均线

smaVal = ta.sma(close, smaLength)

emaFast = ta.ema(close, emaFastPeriod)

emaSlow = ta.ema(close, emaSlowPeriod)

// 绘制均线

plot(smaVal, color=color.orange, title="SMA")

plot(emaFast, color=color.blue, title="EMA Fast")

plot(emaSlow, color=color.red, title="EMA Slow")

// 入场条件 - 做多

// 条件1:收盘价高于SMA 且 EMA Fast 向上穿越 EMA Slow

longTrigger1 = (close > smaVal) and ta.crossover(emaFast, emaSlow)

// 条件2:收盘价上穿SMA 且前5根K线的最低价均高于各自的SMA

longTrigger2 = ta.crossover(close, smaVal) and (low[1] > smaVal[1] and low[2] > smaVal[2] and low[3] > smaVal[3] and low[4] > smaVal[4] and low[5] > smaVal[5])

longCondition = longTrigger1 or longTrigger2

// 入场条件 - 做空

// 条件1:收盘价低于SMA 且 EMA Fast 向下穿越 EMA Slow

shortTrigger1 = (close < smaVal) and ta.crossunder(emaFast, emaSlow)

// 条件2:收盘价下穿SMA 且前5根K线的最高价均低于各自的SMA

shortTrigger2 = ta.crossunder(close, smaVal) and (high[1] < smaVal[1] and high[2] < smaVal[2] and high[3] < smaVal[3] and high[4] < smaVal[4] and high[5] < smaVal[5])

shortCondition = shortTrigger1 or shortTrigger2

// 定义变量记录入场时的价格与EMA Fast值,用于计算止损

var float entryPriceLong = na

var float entryEMA_Fast_Long = na

var float entryPriceShort = na

var float entryEMA_Fast_Short = na

// 入场与初始止盈止损设置 - 做多

// 止损取“开仓时的EMA Fast价格”与“0.2%止损”中较大者;止盈为止损的5倍

if (longCondition and strategy.position_size == 0)

entryPriceLong := close

entryEMA_Fast_Long := emaFast

strategy.entry("Long", strategy.long)

stopPercLong = math.max(0.002, (entryPriceLong - entryEMA_Fast_Long) / entryPriceLong)

stopLong = entryPriceLong * (1 - stopPercLong)

tpLong = entryPriceLong * (1 + 5 * stopPercLong)

strategy.exit("LongExit", "Long", stop=stopLong, limit=tpLong)

// 入场与初始止盈止损设置 - 做空

// 止损取“开仓时的EMA Fast价格”与“0.2%止损”中较大者;止盈为止损的5倍

if (shortCondition and strategy.position_size == 0)

entryPriceShort := close

entryEMA_Fast_Short := emaFast

strategy.entry("Short", strategy.short)

stopPercShort = math.max(0.002, (entryEMA_Fast_Short - entryPriceShort) / entryPriceShort)

stopShort = entryPriceShort * (1 + stopPercShort)

tpShort = entryPriceShort * (1 - 5 * stopPercShort)

strategy.exit("ShortExit", "Short", stop=stopShort, limit=tpShort)

// 移动止损逻辑

// 当持仓盈利达到0.8%时更新止损和止盈,保持止盈为止损的5倍

var float longHighest = na

if (strategy.position_size > 0)

longHighest := na(longHighest) ? high : math.max(longHighest, high)

if (high >= entryPriceLong * 1.008)

newLongStop = longHighest * (1 - 0.003)

newPerc = (entryPriceLong - newLongStop) / entryPriceLong

newLongTP = entryPriceLong * (1 + 5 * newPerc)

strategy.exit("LongExit", "Long", stop=newLongStop, limit=newLongTP)

else

longHighest := na

var float shortLowest = na

if (strategy.position_size < 0)

shortLowest := na(shortLowest) ? low : math.min(shortLowest, low)

if (low <= entryPriceShort * 0.992)

newShortStop = shortLowest * (1 + 0.003)

newPercShort = (newShortStop - entryPriceShort) / entryPriceShort

newShortTP = entryPriceShort * (1 - 5 * newPercShort)

strategy.exit("ShortExit", "Short", stop=newShortStop, limit=newShortTP)

else

shortLowest := na

// 额外平仓条件

// 如果持多仓时EMA Fast下穿EMA Slow,则立即平多

if (strategy.position_size > 0 and ta.crossunder(emaFast, emaSlow))

strategy.close("Long", comment="EMA下穿平多")

// 如果持空仓时EMA Fast上穿EMA Slow,则立即平空

if (strategy.position_size < 0 and ta.crossover(emaFast, emaSlow))

strategy.close("Short", comment="EMA上穿平空")