Overview

This strategy is a trend-following system based on volume and price movements, using the Net Volume Oscillator (NVO) to predict market direction. It combines multiple types of moving averages (EMA, WMA, SMA, HMA) and generates trading signals by comparing the oscillator’s position relative to its EMA overlay. The strategy includes stop-loss and take-profit mechanisms for risk management.

Strategy Principles

The core mechanism calculates daily net volume oscillator values to gauge market sentiment. The calculation process includes: 1. Price range multiplier calculation: Based on daily high, low, and closing prices 2. Effective up/down volume calculation: Volume weighted by price movement direction and multiplier 3. Net volume calculation: Effective up volume minus effective down volume 4. Application of selected moving average: Smoothing the net volume data 5. EMA overlay calculation: Reference line for trend determination 6. Rate of Change (ROC) calculation: For trend strength analysis

Trading signals are generated based on: - Long entry: Oscillator crosses above EMA overlay - Short entry: Oscillator crosses below EMA overlay - Stop-loss: Percentage-based price stops - Take-profit: Percentage-based profit targets

Strategy Advantages

- Multi-dimensional analysis: Combines price, volume, and trend rate of change

- High flexibility: Supports multiple moving average types for different market characteristics

- Comprehensive risk management: Includes stop-loss and take-profit mechanisms

- Strong visualization: Histogram display of trend strength changes

- High adaptability: Parameterized design for different market conditions

Strategy Risks

- Trend reversal risk: May generate false signals in choppy markets

- Lag risk: Moving averages have inherent lag, potentially affecting entry/exit timing

- Parameter sensitivity: Different parameter combinations may lead to varying performance

- Market environment dependency: May underperform in certain market conditions

- Technical limitations: Relies solely on technical indicators, ignoring fundamentals

Risk control suggestions: - Optimize parameters for different market environments - Consider additional technical indicators for confirmation - Adjust stop-loss and take-profit parameters based on market volatility

Strategy Optimization Directions

Signal confirmation optimization:

- Add volume confirmation conditions

- Implement trend strength filters

- Introduce volatility adaptation mechanisms

Risk management optimization:

- Develop dynamic stop-loss mechanisms

- Add position sizing module

- Implement scaled entry/exit mechanisms

Parameter optimization:

- Develop adaptive parameter adjustment mechanisms

- Implement market condition-based parameter switching

- Add machine learning models for parameter optimization

Summary

This strategy builds a comprehensive trend-following trading system through integrated analysis of volume and price data. Its main features include the combination of multiple technical indicators and flexible parameter configuration options. While certain risks exist, the strategy shows potential for stable returns through proper risk control and continuous optimization. Traders are advised to conduct thorough backtesting and adjust parameters according to specific market conditions before live trading.

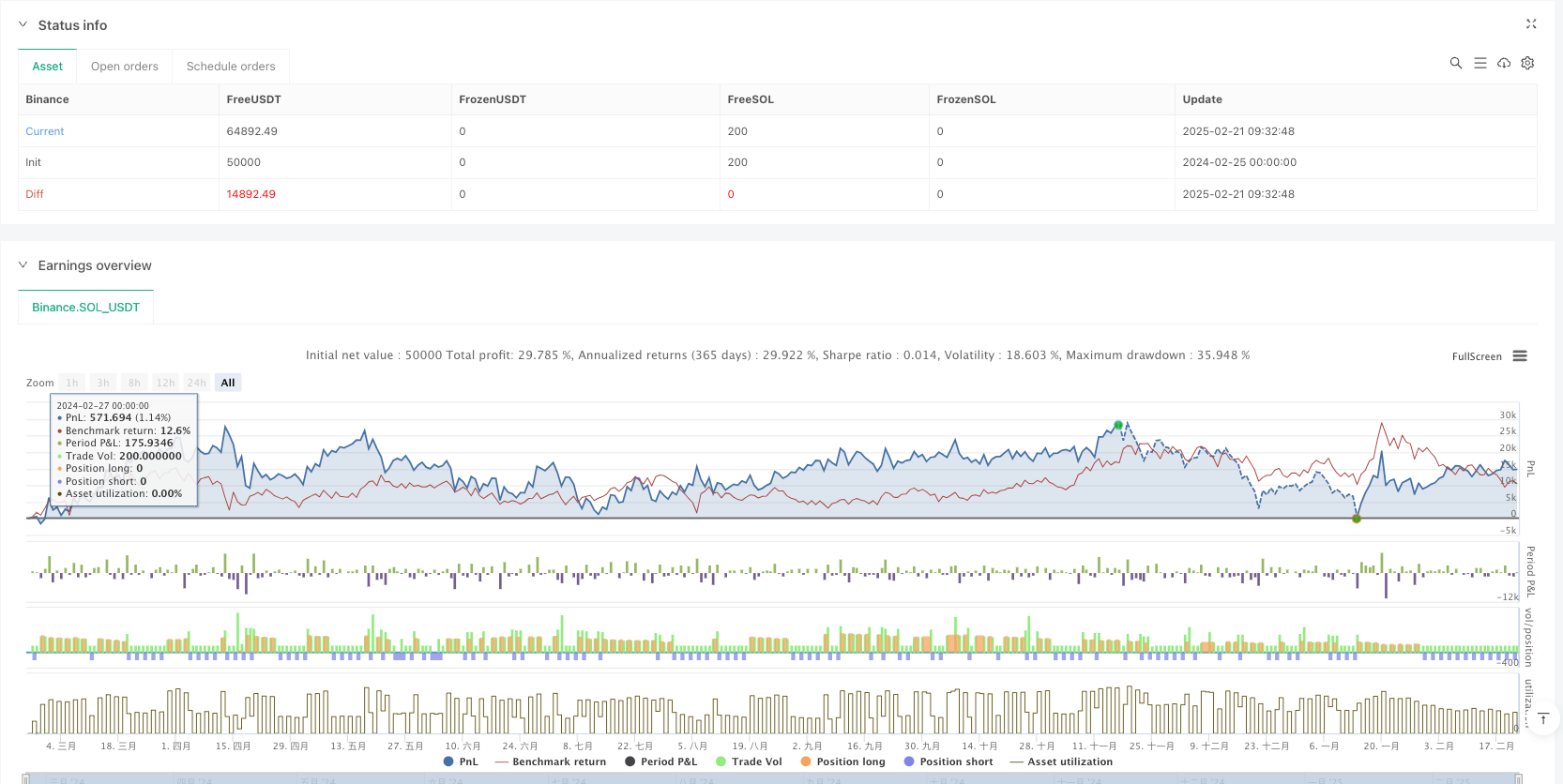

/*backtest

start: 2024-02-25 00:00:00

end: 2025-02-22 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("EMA-Based Net Volume Oscillator with Trend Change", shorttitle="NVO Trend Change", overlay=false, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input parameters

maType = input.string("WMA", "Moving Average Type", options=["WMA", "EMA", "SMA", "HMA"])

maLength = input.int(21, "MA Length", minval=1)

emaOverlayLength = input.int(9, "EMA Overlay Length", minval=1)

oscillatorMultiplier = input.float(1.0, "Oscillator Multiplier", minval=0.1, step=0.1)

showHistogram = input.bool(true, "Show Histogram")

stopLossPerc = input.float(1.0, "Stop Loss (%)", tooltip="Set 999 to disable")

takeProfitPerc = input.float(2.0, "Take Profit (%)", tooltip="Set 999 to disable")

// Calculate Net Volume Oscillator

priceRange = high - low

multiplier = priceRange > 0 ? (close - low) / priceRange : 0.5

var float effectiveUpVol = 0.0

var float effectiveDownVol = 0.0

if close > close[1]

effectiveUpVol := volume * multiplier

effectiveDownVol := volume * (1 - multiplier)

else if close < close[1]

effectiveUpVol := volume * multiplier

effectiveDownVol := volume * (1 - multiplier)

else

effectiveUpVol := 0.0

effectiveDownVol := 0.0

netVolume = effectiveUpVol - effectiveDownVol

dailyNetOscillator = volume > 0 ? (netVolume / volume) * 100 : 0

// Apply selected Moving Average

var float oscillator = na

if maType == "WMA"

oscillator := ta.wma(dailyNetOscillator, maLength) * oscillatorMultiplier

else if maType == "EMA"

oscillator := ta.ema(dailyNetOscillator, maLength) * oscillatorMultiplier

else if maType == "SMA"

oscillator := ta.sma(dailyNetOscillator, maLength) * oscillatorMultiplier

else if maType == "HMA"

oscillator := ta.hma(dailyNetOscillator, maLength) * oscillatorMultiplier

// EMA Overlay

emaOverlay = ta.ema(oscillator, emaOverlayLength)

// Rate of Change (ROC) for Oscillator

roc = ta.roc(oscillator, 1) // 1-period rate of change

// Trading logic

longCondition = oscillator > emaOverlay

shortCondition = oscillator < emaOverlay

// Exit conditions

exitLong = oscillator < emaOverlay and strategy.position_size > 0

exitShort = oscillator > emaOverlay and strategy.position_size < 0

// Execute trades

if longCondition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

if exitLong

strategy.close("Long")

if shortCondition and strategy.position_size >= 0

strategy.entry("Short", strategy.short)

if exitShort

strategy.close("Short")

// Stop Loss and Take Profit

stopLossLong = stopLossPerc != 999 ? strategy.position_avg_price * (1 - stopLossPerc/100) : na

takeProfitLong = takeProfitPerc != 999 ? strategy.position_avg_price * (1 + takeProfitPerc/100) : na

stopLossShort = stopLossPerc != 999 ? strategy.position_avg_price * (1 + stopLossPerc/100) : na

takeProfitShort = takeProfitPerc != 999 ? strategy.position_avg_price * (1 - takeProfitPerc/100) : na

if (not na(stopLossLong) and not na(takeProfitLong) and strategy.position_size > 0)

strategy.exit("Long SL/TP", "Long", stop=stopLossLong, limit=takeProfitLong)

if (not na(stopLossShort) and not na(takeProfitShort) and strategy.position_size < 0)

strategy.exit("Short SL/TP", "Short", stop=stopLossShort, limit=takeProfitShort)

// Plotting

plot(oscillator, "Net Volume Oscillator", color.blue)

plot(emaOverlay, "EMA Overlay", color.orange)

hline(0, "Zero Line", color.gray)

// Histogram with Trend Change Visualization

var color histogramColor = na

if oscillator > 0

histogramColor := roc >= 0 ? color.new(color.green, 70) : color.new(color.lime, 70) // Green for bullish, light green for weakening

else if oscillator < 0

histogramColor := roc >= 0 ? color.new(color.red, 70) : color.new(color.maroon, 70) // Red for bearish, light red for weakening

plot(showHistogram ? oscillator : na, style=plot.style_histogram, color=histogramColor, title="Histogram")