Black-Scholes Volatility-Adjusted Breakout with Dynamic Threshold Optimization

Black-Scholes volatility SMA Expected Move Breakout Strategy Dynamic Thresholds Trailing Stop

Overview

The Black-Scholes Volatility-Adjusted Breakout with Dynamic Threshold Optimization is an advanced quantitative trading system based on option pricing theory. The strategy’s core lies in utilizing the Black-Scholes model to calculate expected market volatility and transform it into dynamic price thresholds to capture breakout opportunities. The system estimates volatility by calculating the standard deviation of logarithmic returns and adjusts it according to different timeframes to predict the expected price movement range for a single bar. When the closing price breaks through these dynamic thresholds, the system automatically enters positions, uses a moving average filter to confirm trend direction, and employs intelligent stop-loss and trailing profit mechanisms to manage risk. The strategy maintains approximately 80% win rate while achieving a 1.818 profit ratio, demonstrating its excellence in capturing market breakouts.

Strategy Principles

The core principles of this strategy are based on financial market volatility and random walk theory. The specific execution logic is as follows:

Volatility Calculation: First, the system calculates logarithmic returns (logReturn) and computes their standard deviation based on a specified lookback period (volLookback). The volatility is then adjusted to an annualized value by multiplying by an annualization factor (square root of periodsPerYear). The key code here is:

volatility = ta.stdev(logReturn, volLookback) * math.sqrt(periodsPerYear).Expected Move Calculation: Following Black-Scholes model principles, the system calculates the expected price movement within a single time period. The formula is: previous closing price × volatility × √(1/periods per year). The code implementation is:

expectedMove = close[1] * volatility * math.sqrt(1.0 / periodsPerYear).Dynamic Threshold Setting: Based on the expected move, the system sets upper and lower thresholds from the previous closing price:

upperThreshold = close[1] + expectedMoveandlowerThreshold = close[1] - expectedMove.Signal Generation and Execution:

- When the closing price breaks above the upper threshold and meets the moving average filter condition, the system generates a long signal.

- When the closing price breaks below the lower threshold and meets the moving average filter condition, the system generates a short signal.

- Signals are only executed after bar confirmation to avoid look-ahead bias.

Exit Mechanisms: The system supports two stop-loss strategies:

- Fixed stop-loss/take-profit: Set based on a percentage of the entry price.

- Trailing stop: Set based on a multiple of the expected move, dynamically adjusting the stop price to protect existing profits.

The innovation of this strategy lies in applying option pricing theory to breakout trading, automatically adjusting entry thresholds based on the market’s own volatility characteristics, thereby improving signal quality.

Strategy Advantages

Deep analysis of this strategy code reveals the following significant advantages:

Strong Adaptability: The strategy uses the market’s own volatility to calculate expected moves rather than fixed parameters. This means thresholds automatically adjust with market conditions, expanding during high volatility periods and narrowing during low volatility periods, allowing the strategy to adapt to various market environments.

Solid Theoretical Foundation: Using mathematical principles from the Black-Scholes model to calculate expected moves provides a more solid statistical basis compared to purely empirical parameters, making predictions more scientific and reliable.

Avoidance of Look-ahead Bias: The code explicitly uses

barstate.isconfirmedto ensure trades are only executed after bar completion and uses previous bar data to calculate thresholds, avoiding common backtesting bias issues.Comprehensive Risk Management: Offers flexible risk control options, including fixed stop-loss/take-profit and market volatility-based trailing stops, which can be adjusted according to the trader’s risk preference.

Transaction Cost Consideration: The strategy includes commission settings (

commission_value=0.12), making backtest results closer to actual trading situations.Trend Confirmation Mechanism: An optional moving average filter helps confirm the overall market trend, reducing counter-trend trading and improving signal quality.

Standardized Capital Management: Uses a fixed number of contracts (5) for trading, simplifying trading rules and facilitating system execution.

Efficient Performance Metrics: Approximately 80% win rate and 1.818 profit ratio indicate the strategy’s excellent ability to capture effective breakouts.

Strategy Risks

Despite its sophisticated design, the strategy still has the following potential risks and challenges:

False Breakout Risk: Markets often exhibit short breakouts followed by quick reversals, which may lead to false signals. Solution: Add confirmation mechanisms, such as requiring the breakout to persist for a specific time or using volume confirmation.

Parameter Optimization Risk: Excessive optimization of parameters (such as volatility lookback period or moving average length) may lead to overfitting and poor future performance. Solution: Use step optimization and cross-timeframe validation to select robust parameters.

High-Frequency Trading Risk: Running on small timeframes (such as 1 minute) may generate too many signals, increasing transaction costs. Solution: Add signal filters or extend the timeframe to reduce trading frequency.

Extreme Market Risk: In extremely volatile markets, expected move calculations may be inaccurate, and stops may be breached by gaps. Solution: Set maximum volatility limits and additional risk constraints.

Liquidity Risk: Fixed contract quantities may cause slippage issues in low-liquidity markets. Solution: Dynamically adjust trading size based on volume.

System Dependency: Requires stable data sources and execution systems; technical failures may interrupt trading. Solution: Set up backup systems and manual monitoring mechanisms.

Strategy Exposure Risk: As more traders adopt similar strategies, their effectiveness may decrease. Solution: Regularly evaluate strategy performance and adjust according to market changes.

Strategy Optimization Directions

Based on code analysis, the following optimization directions can be considered:

Adaptive Volatility Calculation: The current strategy uses a fixed lookback period (volLookback) to calculate volatility. Consider implementing adaptive volatility calculation, such as shortening the lookback period during high volatility and extending it during low volatility, or using a GARCH model to more accurately predict volatility. This would better adapt to changing market conditions.

Multiple Timeframe Analysis: Add trend confirmation from higher timeframes, for example, checking whether a higher timeframe is also in an uptrend when a long signal is generated in the current timeframe. This will reduce counter-trend trading and improve win rates.

Dynamic Position Sizing: Replace the fixed trading quantities (longQty=5, shortQty=5) with dynamic position calculations based on account size, market volatility, and expected risk. This can improve capital efficiency and risk-adjusted returns.

Machine Learning Enhancement: Introduce machine learning algorithms to predict which breakouts are more likely to continue, rather than simply relying on price crossing thresholds. This can reduce losses from false breakouts.

Volatility Skew Consideration: Incorporate volatility skew factors into expected move calculations, setting different thresholds for upward and downward movements, as markets typically have greater volatility during downtrends. This can be implemented by calculating upside and downside volatility separately.

Trading Timing Optimization: The current strategy executes trades after bar confirmation, potentially missing optimal entry points. Consider adding intrabar breakout confirmation mechanisms for more timely entries when certain conditions are met.

Integration with Other Technical Indicators: Combine RSI, volume, money flow, and other indicators to build a multi-factor confirmation system. This will improve signal quality and reduce false breakout trades.

Stop-Loss Strategy Optimization: Implement smarter stop-loss logic, such as setting stops based on support/resistance levels or dynamically adjusting trailing stop distances according to market volatility.

Summary

The Black-Scholes Volatility-Adjusted Breakout with Dynamic Threshold Optimization represents a deep integration of theory and practice in quantitative trading. The strategy applies mathematical models from option pricing theory to calculate expected market movements and transforms them into dynamic breakout thresholds, effectively capturing market opportunities.

The core advantages of the strategy lie in its adaptability and theoretical foundation, enabling it to maintain stable performance across different market environments. Meanwhile, comprehensive risk management mechanisms and trend confirmation systems further enhance the strategy’s reliability. However, traders still need to be vigilant about risks such as false breakouts and parameter optimization.

Future optimization directions can focus on adaptive volatility calculation, multiple timeframe analysis, dynamic position sizing, and machine learning enhancements. Through continuous improvement, the strategy has the potential to provide more stable returns under various market conditions.

Overall, this is a professional quantitative strategy built on solid theoretical foundations, suitable for traders with some understanding of statistics and financial markets. When correctly implemented and continuously optimized, it has the potential to bring significant value to an investment portfolio.

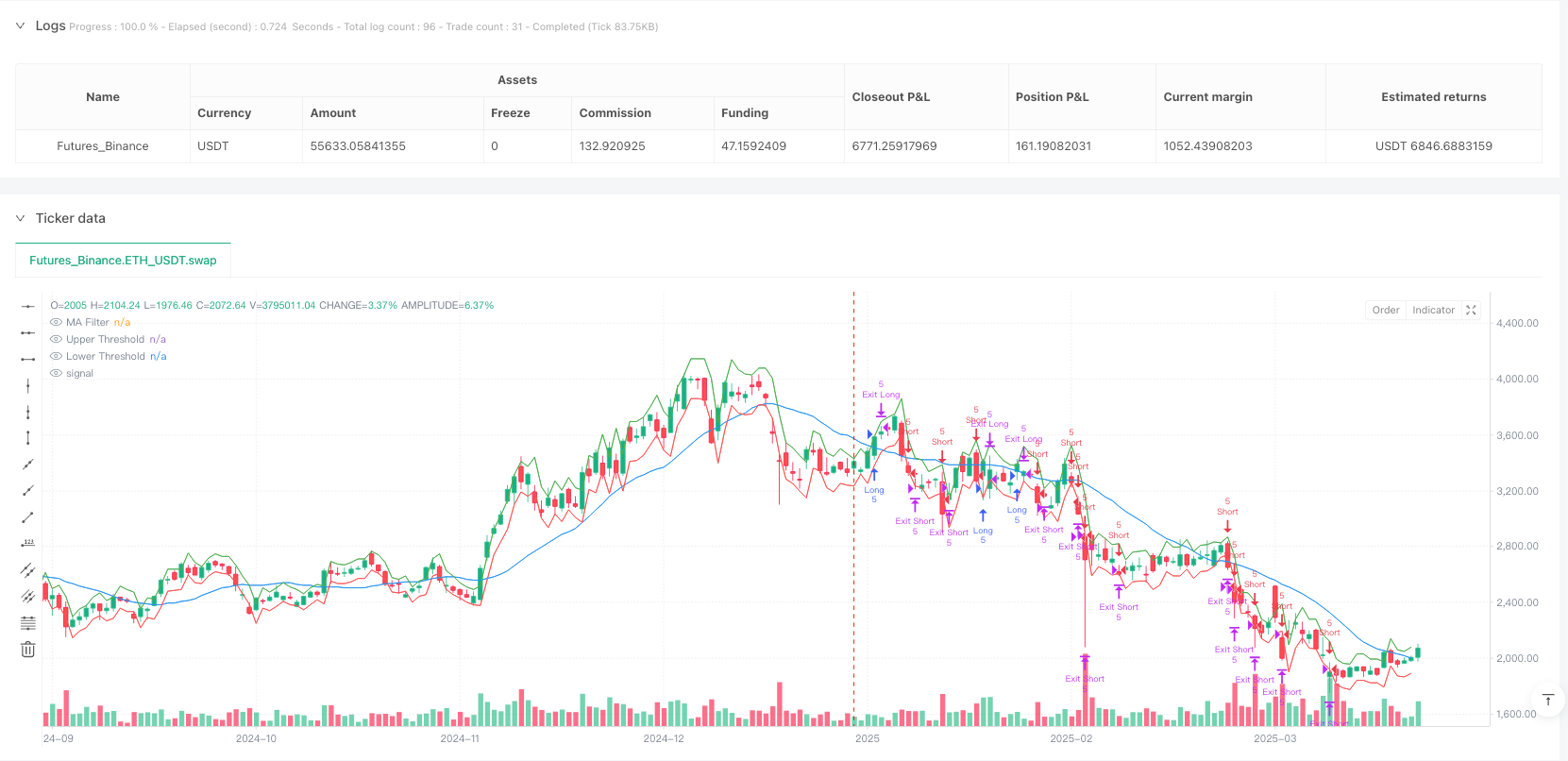

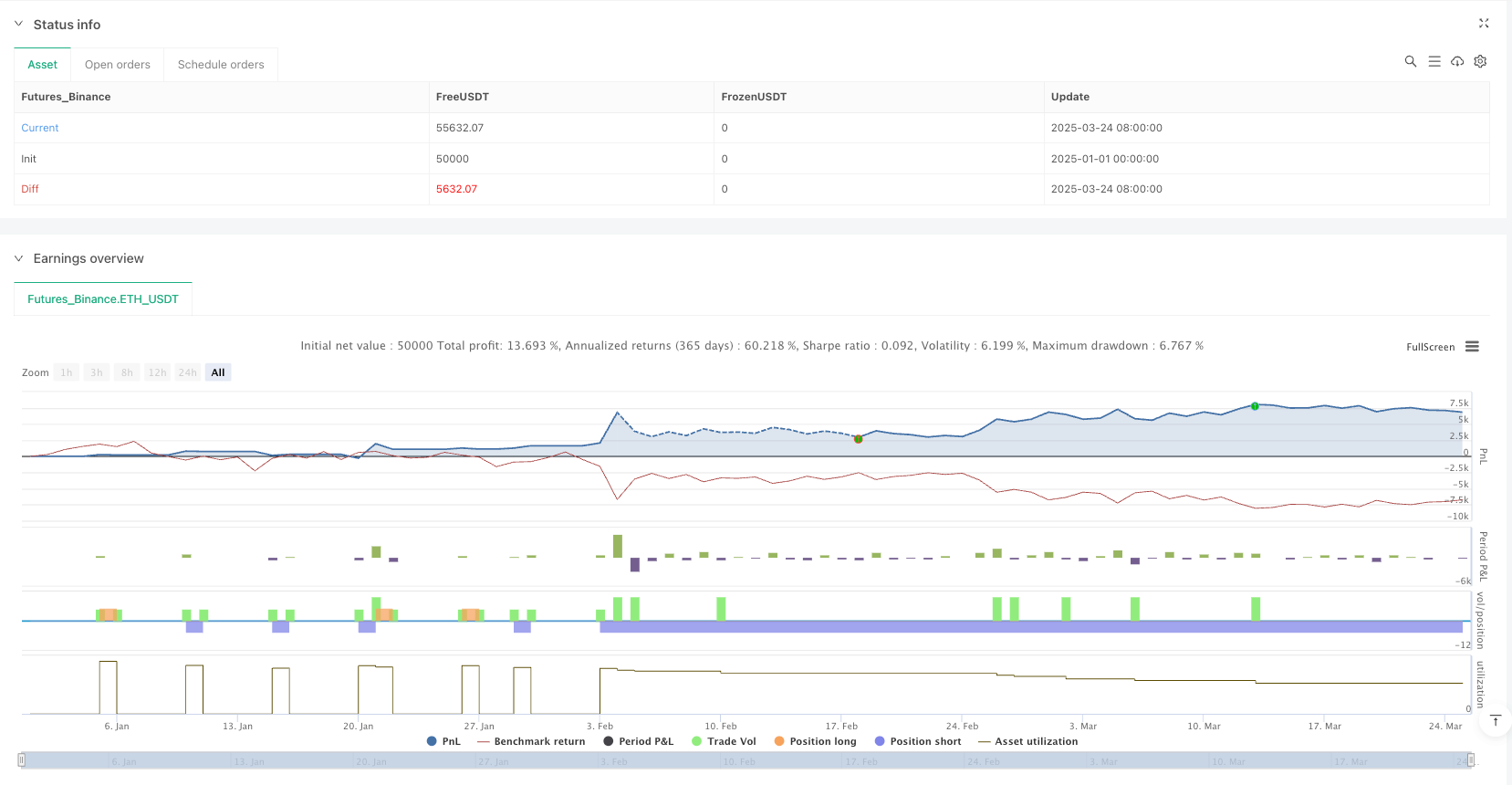

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-25 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Black-Scholes Expected Breakout Enhanced Bias-Free", overlay=true, initial_capital=15000, currency=currency.USD, pyramiding=5, calc_on_order_fills=false, calc_on_every_tick=false, commission_type=strategy.commission.cash_per_contract, commission_value=0.12)

// User Inputs

chartRes = input.int(title="Chart Timeframe in Minutes", defval=1, minval=1)

volLookback = input.int(title="Volatility Lookback (bars)", defval=20, minval=1)

stopLossPerc = input.float(title="Stop Loss (%)", defval=1.0, minval=0.1, step=0.1)

takeProfitPerc = input.float(title="Take Profit (%)", defval=2.0, minval=0.1, step=0.1)

useMAFilter = input.bool(title="Use MA Trend Filter", defval=true)

maLength = input.int(title="MA Length", defval=20, minval=1)

useTrailingStop = input.bool(title="Use Trailing Stop", defval=true)

trailMultiplier = input.float(title="Trailing Stop Multiplier (Expected Move)", defval=1.0, minval=0.1, step=0.1)

// Calculate periods per year based on chart timeframe (252 trading days * 390 minutes per day)

periodsPerYear = (252.0 * 390.0) / chartRes

// Calculate annualized volatility from log returns

logReturn = math.log(close / close[1])

volatility = ta.stdev(logReturn, volLookback) * math.sqrt(periodsPerYear)

// Expected move for one bar: previous close * volatility * √(1/periodsPerYear)

expectedMove = close[1] * volatility * math.sqrt(1.0 / periodsPerYear)

// Define dynamic thresholds around the previous bar’s close

upperThreshold = close[1] + expectedMove

lowerThreshold = close[1] - expectedMove

// Plot thresholds for visual reference

plot(upperThreshold, color=color.green, title="Upper Threshold")

plot(lowerThreshold, color=color.red, title="Lower Threshold")

// Moving Average Filter for trend confirmation

ma = ta.sma(close, maLength)

plot(ma, color=color.blue, title="MA Filter")

// Fixed 5 contracts per trade

longQty = 5

shortQty = 5

// Only execute trades at the close of a bar to avoid intrabar look-ahead bias

if barstate.isconfirmed

// Long Condition

longCondition = close > upperThreshold and (not useMAFilter or close > ma)

if longCondition

strategy.entry("Long", strategy.long, qty=longQty, comment="Long Entry")

// Short Condition

shortCondition = close < lowerThreshold and (not useMAFilter or close < ma)

if shortCondition

strategy.entry("Short", strategy.short, qty=shortQty, comment="Short Entry")

// Exit Orders for Long Positions

if strategy.position_size > 0

if useTrailingStop

// Trailing stop needs both trail_offset & trail_points

trailOffset = expectedMove * trailMultiplier

strategy.exit("Exit Long", from_entry="Long", trail_offset=trailOffset, trail_points=trailOffset)

else

stopPrice = strategy.position_avg_price * (1 - stopLossPerc / 100)

takePrice = strategy.position_avg_price * (1 + takeProfitPerc / 100)

strategy.exit("Exit Long", from_entry="Long", stop=stopPrice, limit=takePrice)

// Exit Orders for Short Positions

if strategy.position_size < 0

if useTrailingStop

trailOffset = expectedMove * trailMultiplier

strategy.exit("Exit Short", from_entry="Short", trail_offset=trailOffset, trail_points=trailOffset)

else

stopPrice = strategy.position_avg_price * (1 + stopLossPerc / 100)

takePrice = strategy.position_avg_price * (1 - takeProfitPerc / 100)

strategy.exit("Exit Short", from_entry="Short", stop=stopPrice, limit=takePrice)