Overview

This strategy combines EMA (Exponential Moving Average) crossovers with RSI (Relative Strength Index) confirmation to identify market trend direction and generate trading signals. The strategy uses a short-term EMA (9-period) and a long-term EMA (21-period) to determine the overall trend direction, while utilizing RSI to confirm trend strength and filter out potential false signals. The core logic is based on directional changes when the short-term moving average crosses the long-term moving average, with RSI serving as an additional confirmation condition, ensuring trades are only executed when trends are clearly established.

Strategy Principle

The strategy is based on the crossover of two EMAs (9 and 21 periods) combined with RSI readings to assess market conditions. When EMA9 crosses above EMA21 and RSI is above 30, a bullish trend is confirmed, generating a long entry signal. Conversely, when EMA9 crosses below EMA21 and RSI is below 30, a bearish trend is confirmed, generating a short entry signal. The code defines clear trend determination criteria: bullish when EMA9 is greater than EMA21 and RSI is above 30; bearish when EMA9 is less than EMA21 and RSI is below 30. The system enters long positions when long signals appear and enters short positions when short signals appear. Exit conditions are similarly based on EMA crossovers and RSI thresholds: long positions are closed when EMA9 crosses below EMA21 or RSI falls below 30; short positions are closed when EMA9 crosses above EMA21 or RSI rises above 30. The strategy provides intuitive visual feedback by simultaneously displaying moving averages, signal arrows, and background colors on the chart.

Strategy Advantages

This strategy combines several technical advantages that make it perform well in real trading:

- Perfect Integration of Trend Following and Momentum Confirmation: The strategy combines EMA crossovers (trend following) with RSI (momentum confirmation) to provide more reliable signals.

- Clear Visual Indicators: By using shapes, arrows, and background colors on the chart, the strategy provides traders with intuitive cues for trend direction and signals.

- False Signal Filtering: Requiring RSI confirmation helps filter out some potential false signals, improving signal quality.

- Wide Applicability: This simple yet effective approach can be applied to various timeframes and markets, demonstrating good adaptability.

- Automated Exit Rules: Clear exit conditions help traders maintain discipline in trading, avoiding emotional decision-making.

- Concise and Efficient Code: The entire strategy code has a clear structure, tight logic, and is easy to understand and maintain.

- Dual Confirmation Mechanism: Signals are generated only when both the EMA crossover and RSI threshold conditions are met simultaneously, greatly enhancing signal reliability.

Risk Analysis

Despite its numerous advantages, the strategy also has some potential risks and limitations:

- False Signals in Oscillating Markets: In sideways or trendless markets, EMA crossovers may occur frequently, leading to excessive false signals and unnecessary trades.

- Delayed Entry Timing: EMAs as lagging indicators may generate signals only after trends have already formed and developed for some time, missing part of the profits from the early trend.

- Fixed RSI Threshold: The RSI threshold of 30 used in the code may not be suitable for all market conditions; different markets may require different threshold settings.

- Lack of Stop-Loss Mechanism: The strategy does not include explicit stop-loss mechanisms, which could lead to larger losses during sudden market reversals.

- No Position Sizing Rules: The strategy does not adjust position size based on market volatility or risk levels, potentially leading to inadequate risk management.

- Signal Conflicts: Under certain market conditions, EMA crossovers and RSI may send conflicting signals, increasing decision-making complexity.

- Parameter Optimization Challenges: EMA periods and RSI thresholds need to be optimized for different markets, requiring extensive historical testing and validation.

Optimization Directions

Based on in-depth analysis of the code, the strategy has several potential optimization directions:

- Adaptive EMA Periods: Dynamically adjust EMA periods based on market volatility and specific trading instruments, for example, using longer periods in more volatile markets to reduce false signals.

- RSI Threshold Optimization: Adjust RSI thresholds for different market conditions, or even consider using adaptive RSI thresholds that automatically adjust according to market volatility characteristics.

- Add Stop-Loss Mechanisms: Introduce fixed stop-losses, trailing stops, or ATR (Average True Range) based stop-losses to limit potential losses per trade.

- Integrate Position Management: Adjust position size based on volatility or risk levels, such as reducing positions in high-volatility markets and increasing positions in low-volatility markets.

- Add Additional Filters: Incorporate volume confirmation, trend strength filtering, or volatility filtering to reduce false signals in sideways markets.

- Implement Trailing Profit Stops: Add trailing profit mechanisms based on recent highs/lows or percentages to protect realized profits.

- Time Filters: Add time-based filtering conditions to avoid trading during periods of extremely low or high volatility.

- Multi-Timeframe Confirmation: Filter out signals that contradict the trend direction of higher timeframes by checking the trend direction on higher timeframes.

Summary

The Dual EMA Crossover with RSI Trend Confirmation Strategy provides a balanced approach to trend following by combining EMA crossovers with RSI confirmation. It offers clear entry and exit signals while visually displaying the current market trend through graphic elements. The core strength of the strategy lies in its clear and effective logic, combining market information from both trend and momentum dimensions to improve signal quality. While the strategy has limitations in certain market conditions, it provides a solid foundational framework that can be further refined and customized through the optimization directions mentioned above to suit individual trading preferences and risk tolerance. With appropriate parameter optimization and integration of risk management measures, this strategy has the potential to become a powerful tool in a trader’s arsenal.

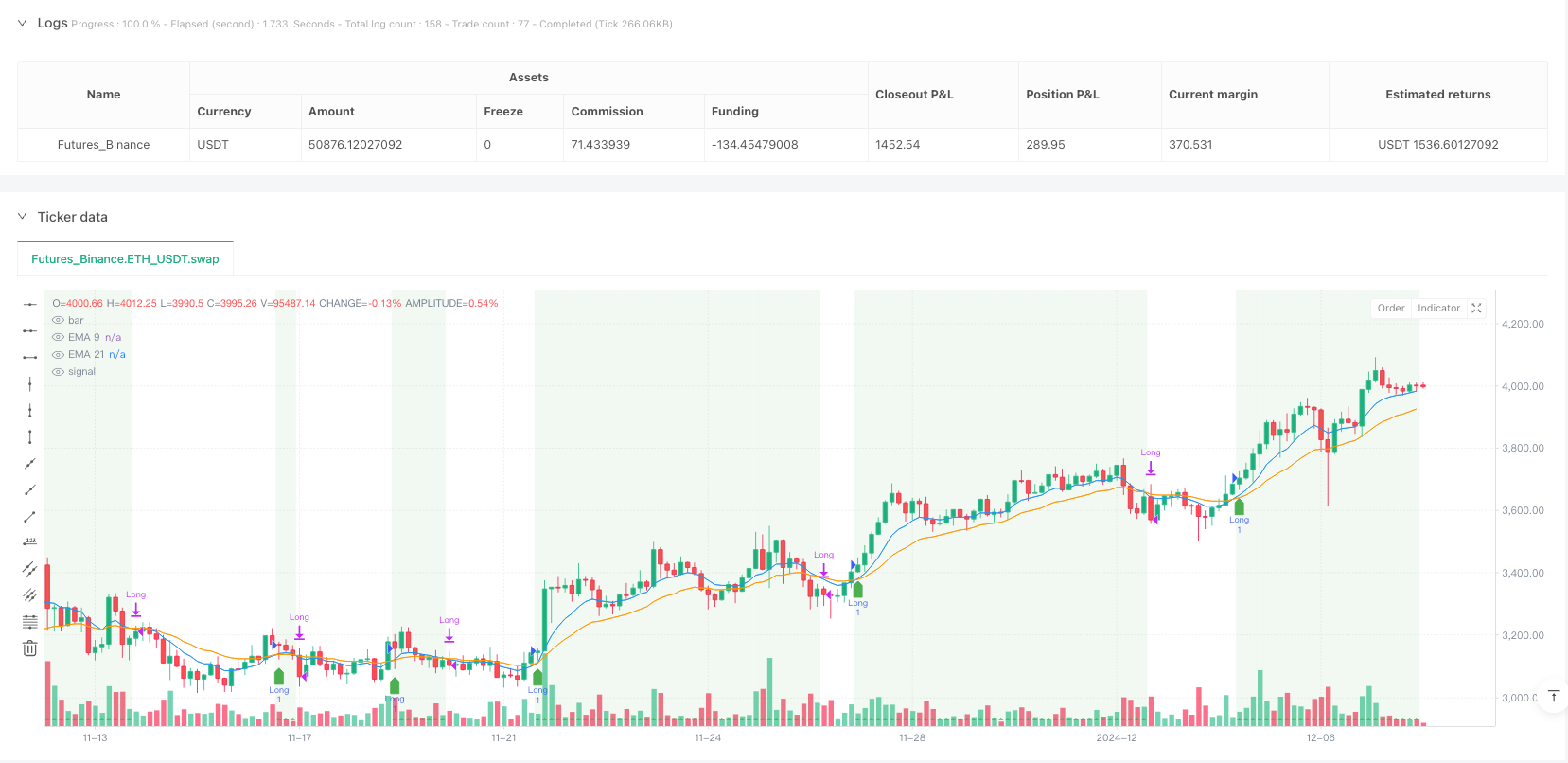

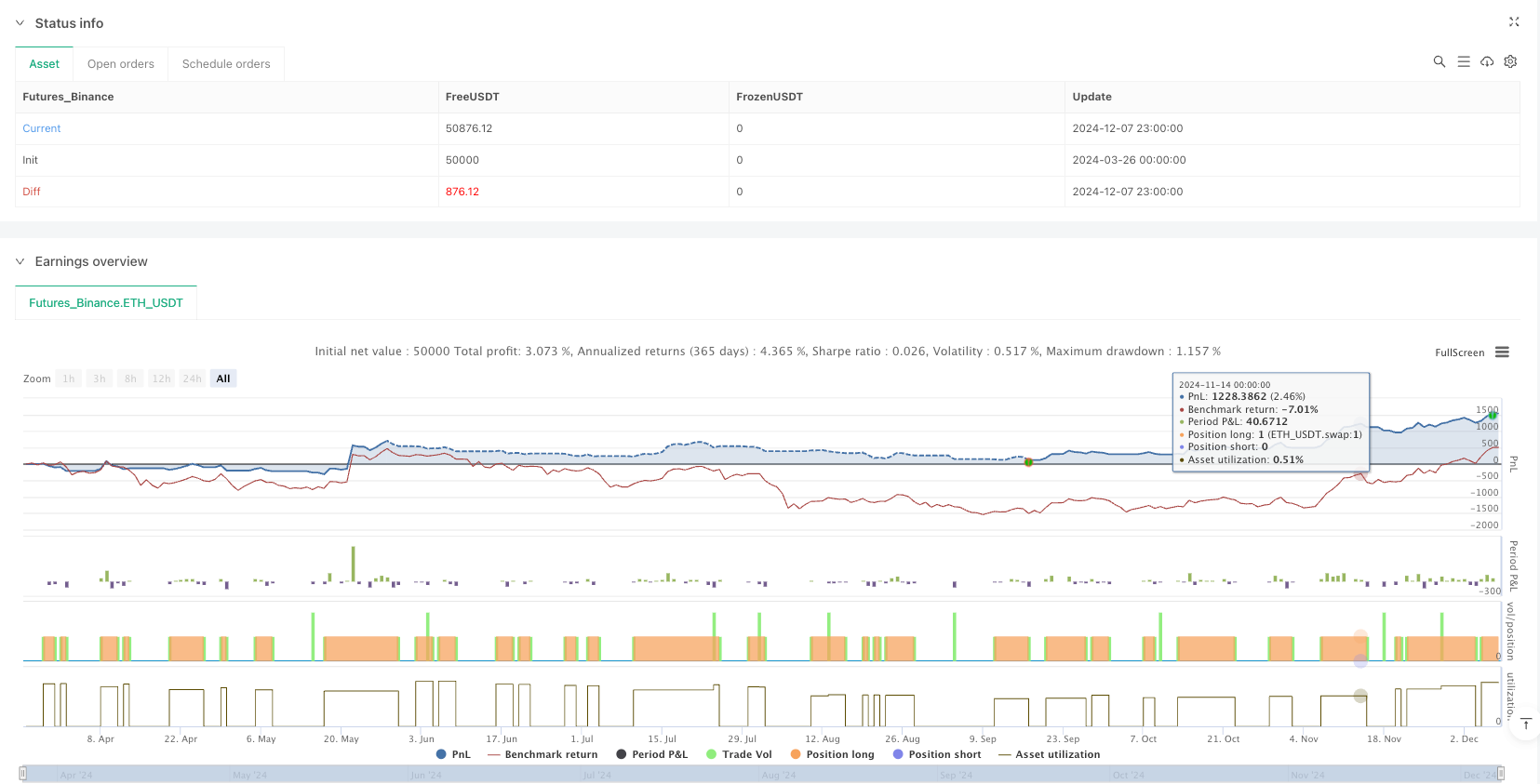

/*backtest

start: 2024-03-26 00:00:00

end: 2024-12-08 00:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("vefaema", overlay=true)

// EMA'ları hesapla

ema9 = ta.ema(close, 9)

ema21 = ta.ema(close, 21)

// RSI hesapla

rsi = ta.rsi(close, 14)

// Trend belirleme kriterleri

bullish = ema9 > ema21 and rsi > 30

bearish = ema9 < ema21 and rsi < 30

// Long ve short sinyalleri

longSignal = ta.crossover(ema9, ema21) and rsi > 30

shortSignal = ta.crossunder(ema9, ema21) and rsi < 30

// Renkleri belirle

plot(ema9, title="EMA 9", color=color.blue)

plot(ema21, title="EMA 21", color=color.orange)

// Grafik üzerine ok ekleme

plotshape(series=longSignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Long")

plotshape(series=shortSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Short")

// Trend yönünü simge olarak ekleme

plotshape(series=bullish, location=location.bottom, color=color.green, style=shape.triangleup, title="Bullish Trend")

plotshape(series=bearish, location=location.top, color=color.red, style=shape.triangledown, title="Bearish Trend")

// Arka plan rengi

bgcolor(bullish ? color.new(color.green, 90) : bearish ? color.new(color.red, 90) : na)

// Al/Sat işlemleri

if (longSignal)

strategy.entry("Long", strategy.long)

if (shortSignal)

strategy.entry("Short", strategy.short)

if (ta.crossunder(ema9, ema21) or rsi < 30)

strategy.close("Long")

if (ta.crossover(ema9, ema21) or rsi > 30)

strategy.close("Short")