Overview

This strategy is a quantitative trading system based on timeframe breakout, utilizing the synergistic relationship between 15-minute and 2-minute timeframes to determine trading signals. It identifies entry opportunities by observing whether the 2-minute candle’s closing price breaks through the high or low of the previous completed 15-minute candle, while implementing a precise risk control mechanism that ensures a risk-to-reward ratio of 1:3, meaning each unit of risk can potentially yield 3 units of profit. The strategy essentially captures momentum continuation after short-term price breakouts, with an average win rate of approximately 30%, but can still achieve an overall positive expected return due to its well-designed risk-reward ratio.

Strategy Principles

The core principle of this strategy is to identify price breakout signals through multi-timeframe analysis. The specific implementation process is as follows:

First, the strategy uses the

request.securityfunction to obtain the highest price, lowest price, and time information for the 15-minute timeframe.When a new 15-minute candle is detected (by comparing the current and previous 15-minute period times), the strategy saves the high and low points of the previous completed 15-minute candle as breakout reference points.

For long conditions, the strategy determines whether the current 2-minute candle’s closing price breaks through the high of the last complete 15-minute candle. When this condition is met, the entry price is the 2-minute candle’s closing price, the stop loss is set at the low of the previous 15-minute candle, and the profit target is set at the entry price plus 3 times the risk value (risk value = entry price - stop loss price).

For short conditions, the strategy determines whether the current 2-minute candle’s closing price breaks through the low of the last complete 15-minute candle. When this condition is met, the entry price is the 2-minute candle’s closing price, the stop loss is set at the high of the previous 15-minute candle, and the profit target is set at the entry price minus 3 times the risk value (risk value = stop loss price - entry price).

This design leverages the concept of breakout trading while combining the advantages of multi-timeframe analysis, using a larger timeframe (15 minutes) to determine important price levels and a smaller timeframe (2 minutes) to optimize entry timing, reduce slippage, and improve execution precision.

Strategy Advantages

Clear Risk Management: The strategy features a precise risk-reward ratio (1:3), ensuring that the potential return for each trade is three times the potential loss, which allows for positive expected returns even with a win rate of only around 30%.

Multi-Timeframe Synergy: By combining 15-minute and 2-minute timeframes, the strategy can both capture important price levels from the larger timeframe and optimize entry points using the smaller timeframe, improving trading precision.

Automated Execution: The strategy is fully automated with clear entry and exit conditions, reducing emotional interference and subjective judgment.

Integrated Capital Management: The strategy adopts a percentage of equity approach for position sizing (default_qty_value=10), ensuring that risk scales proportionally with account size.

High Adaptability: The code structure is concise and clear, making it easy to extend and modify for application across different markets and products.

Strategy Risks

Low Win Rate Risk: The strategy has an average win rate of approximately 30%, meaning most trades will result in small losses. For some traders, consecutive losing trades may cause psychological pressure and premature abandonment of the strategy.

False Breakout Signals: After a price breakout, the price may not continue to move in the expected direction, leading to frequent stop-loss triggers. This is especially common in ranging markets or highly volatile conditions.

Slippage Risk: During rapid market movements, the actual execution price may differ from the planned price, affecting the precise implementation of the risk-reward ratio.

Overtrading Risk: Since the strategy executes trades based on a short timeframe (2 minutes), it may lead to overtrading and increased transaction costs.

Market Environment Dependency: This strategy performs better in trending markets and may underperform in range-bound, oscillating markets.

Solutions: - Add additional filtering conditions, such as trend indicators or volatility indicators, to reduce false signals. - Consider setting daily maximum trade limits to avoid overtrading. - Adjust risk parameters or pause the strategy during periods of low or high volatility. - Regularly backtest and optimize strategy parameters to ensure adaptation to the current market environment.

Strategy Optimization Directions

Add Trend Filters: Introduce trend confirmation indicators (such as moving averages, MACD, etc.) before executing breakout trades, only entering when aligned with the larger trend, which can significantly improve the strategy’s win rate.

Dynamic Risk-Reward Ratio: The strategy currently uses a fixed 1:3 risk-reward ratio, but could be enhanced by dynamically adjusting this ratio based on market volatility, such as adopting more conservative targets in highly volatile markets.

Time Filtering: Add time-based filtering conditions to avoid trading during market open, close, or particularly low volatility periods.

Partial Profit-Taking Mechanism: Implement a staged profit-taking functionality that closes part of the position when certain price targets are reached, allowing the remaining position to continue tracking the trend, improving overall profitability.

Adaptive Parameters: Transform fixed parameters (such as the 15-minute period) into dynamic parameters that automatically adjust based on market conditions, enabling the strategy to better adapt to different market environments.

Volume Confirmation: Incorporate volume analysis to ensure price breakouts are accompanied by sufficient trading volume, which typically enhances the reliability of breakout signals.

These optimization directions primarily aim to improve the strategy’s win rate and stability while maintaining its core advantages—clear risk management and multi-timeframe synergy. By introducing consideration of more market factors, false signals can be reduced, increasing the probability of success for each trade.

Summary

The “15-Minute Breakout Multi-Timeframe Synergy Strategy with Risk-Reward Optimization Model” is a clearly structured, logically rigorous quantitative trading system that captures momentum opportunities after breakouts by combining price information from different timeframes. Despite the strategy’s relatively low win rate (approximately 30%), it achieves positive expected returns through a carefully designed 1:3 risk-reward ratio mechanism.

The strategy’s core strengths lie in its strict risk control, clear entry and exit rules, and multi-timeframe synergistic analysis method. The main risks come from false breakout signals and the psychological pressure associated with a low win rate. Future optimization should focus on improving signal quality, reducing false breakout trades, and considering the addition of trend filtering and dynamic parameter adjustment capabilities.

For quantitative traders seeking medium to short-term trading opportunities, this represents a worthwhile basic strategy framework that can be further customized and optimized according to individual risk preferences and trading objectives.

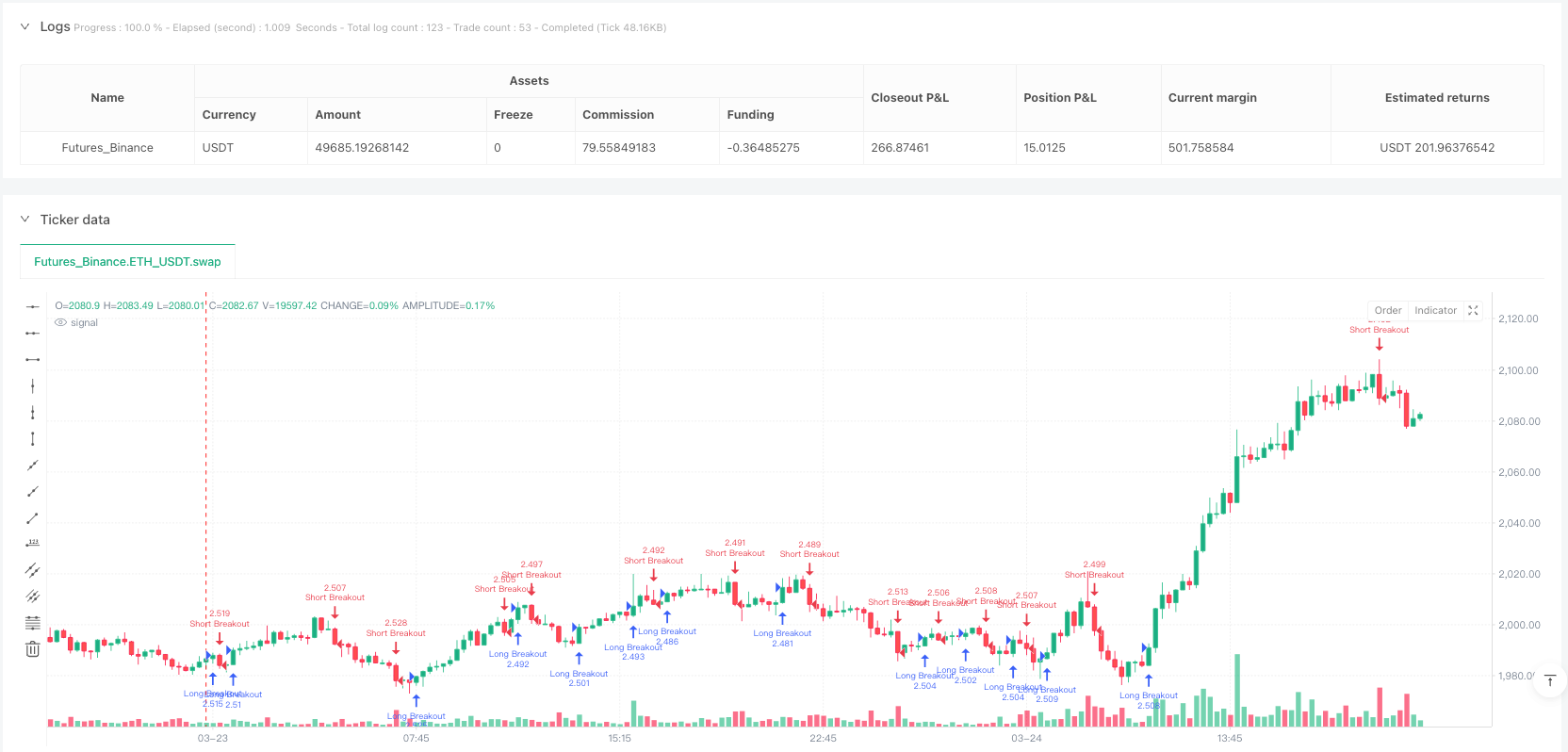

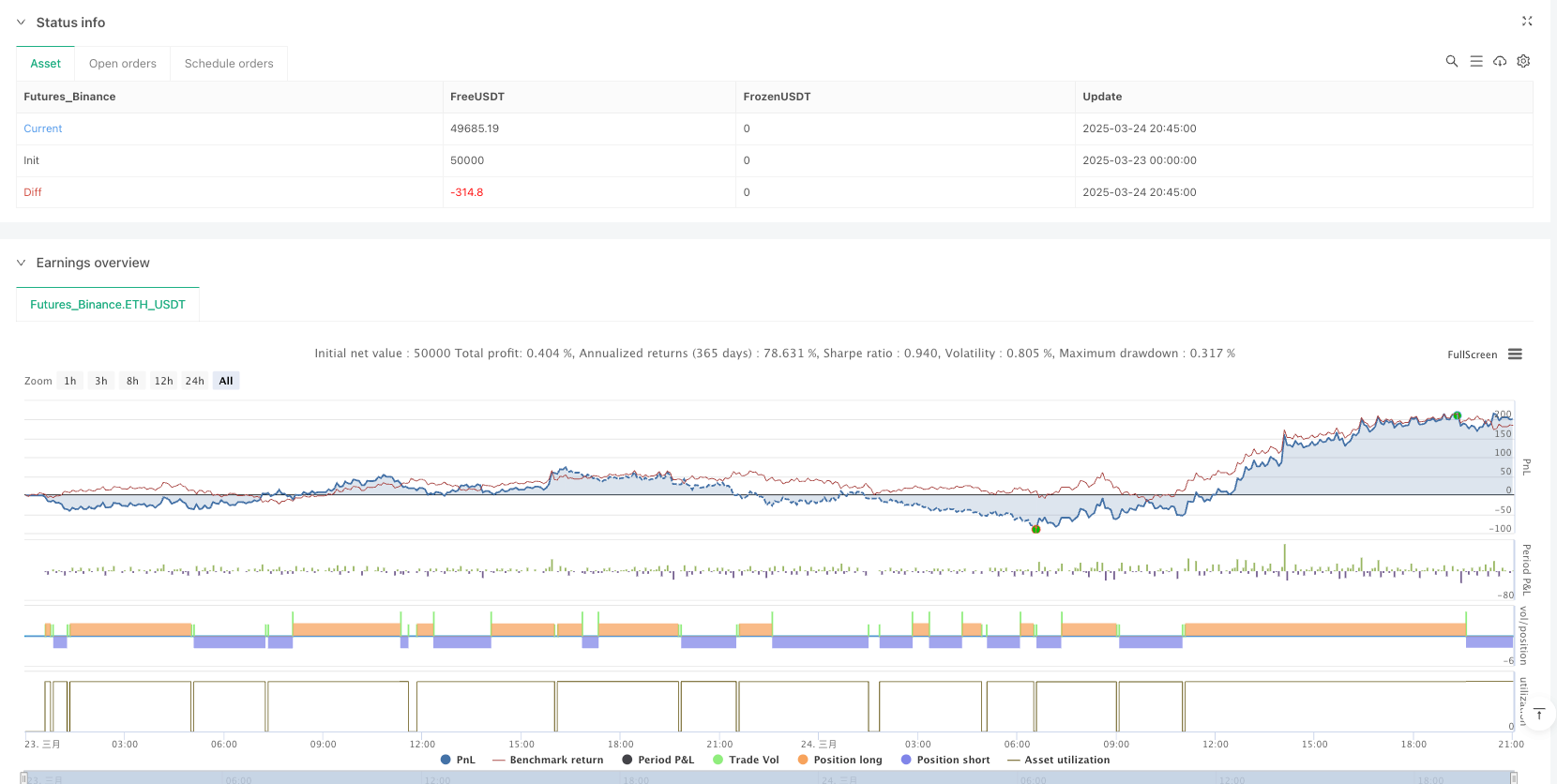

/*backtest

start: 2025-03-23 00:00:00

end: 2025-03-24 21:00:00

period: 15m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("15-min Breakout via 2-min Candle (R:R=1:3)",

overlay=true,

initial_capital=100000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10)

//-----------------------------------------------------

// 1) Retrieve 15-min high/low & time via request.security

//-----------------------------------------------------

fifteenHigh = request.security(syminfo.tickerid, "15", high)

fifteenLow = request.security(syminfo.tickerid, "15", low)

time15 = request.security(syminfo.tickerid, "15", time)

//-----------------------------------------------------

// 2) Store the most recent closed 15-min bar's high/low

//-----------------------------------------------------

// We use a var variable (stored over time) and update it

// whenever a NEW 15-min bar is detected.

var float last15High = na

var float last15Low = na

// A new 15-min bar (in the "15" series) is indicated when time15 changes.

bool new15bar = time15 != time15[1]

// Update high/low when a new 15-min bar starts

if new15bar

// [1] = previous closed 15-min bar value

last15High := fifteenHigh[1]

last15Low := fifteenLow[1]

//-----------------------------------------------------

// 3) Long position: 2-min close > most recent closed 15-min high

//-----------------------------------------------------

bool longCondition = not na(last15High) and close > last15High

if longCondition

// Entry is 2-min close

float stopPrice = last15Low

float risk = close - stopPrice

float takeProfit = close + 3 * risk

strategy.entry("Long Breakout", strategy.long)

strategy.exit("Long Exit (SL/TP)", "Long Breakout", stop=stopPrice, limit=takeProfit)

//-----------------------------------------------------

// 4) Short position: 2-min close < most recent closed 15-min low

//-----------------------------------------------------

bool shortCondition = not na(last15Low) and close < last15Low

if shortCondition

float stopPrice = last15High

float risk = stopPrice - close

float takeProfit = close - 3 * risk

strategy.entry("Short Breakout", strategy.short)

strategy.exit("Short Exit (SL/TP)", "Short Breakout", stop=stopPrice, limit=takeProfit)