Multi-dimensional Trend Trading System with EMA and Dynamic Trailing Stop

EMA TSL Pivot MT5 AUTOMATED TRADING risk management TREND FOLLOWING

Overview

The Multi-dimensional Trend Trading System with EMA and Dynamic Trailing Stop is an automated trading bot designed for the MetaTrader 5 (MT5) platform. This strategy integrates Exponential Moving Average (EMA) filtering, dynamic trailing stop loss mechanisms, and a risk-based position sizing method to optimize trade entries and exits. The system primarily uses an EMA trend filter to ensure trading direction aligns with market trends, employs dynamic trailing stops to protect accumulated profits, and utilizes a precise risk percentage method to automatically calculate appropriate trade volumes, maximizing control over risk exposure per trade. Additionally, the strategy offers time filtering capabilities, allowing traders to set specific trading sessions to avoid low-liquidity market environments, thereby enhancing overall trading quality.

Strategy Principles

The trading system operates based on several key components and logic:

EMA Trend Filtering: The system defaults to using an 8-period EMA as a trend indicator, executing buy operations only when the EMA is rising and sell operations when the EMA is falling. This ensures trading direction remains consistent with short-term trends, reducing the likelihood of counter-trend trading.

Key Price Level Identification Mechanism: The strategy uses pivot highs and lows (local extremes) as critical price levels, identifying these key points through a set lookback period (default is 3 bars). These pivot points serve as reference points for stop loss and take profit calculations, as well as trigger prices for pending orders.

Smart Order Execution:

- Long Entry: When price is below a recent pivot high by a certain distance and the EMA trend is upward, a Buy Stop order is placed at the pivot high position.

- Short Entry: When price is above a recent pivot low by a certain distance and the EMA trend is downward, a Sell Stop order is placed at the pivot low position.

Risk Management System: The strategy defaults to setting the risk for each trade at 4% of account funds, automatically calculating appropriate trade volume through this parameter to ensure consistent risk control.

Dynamic Stop Loss Mechanism: Once a trade profits beyond a set trigger point value (default 15 points), the trailing stop function activates, moving the stop loss line with price movement to protect realized profits while allowing trades to continue profiting.

Time Filter: Traders can set start and end hours for trading, avoiding specific periods (such as low liquidity, low volatility market environments). If prices move during non-trading hours, the system automatically closes positions to protect profits.

Strategy Advantages

Through deep analysis of the strategy’s code structure and logic, the following significant advantages can be summarized:

Trend-Synchronized Trading: Through the EMA filtering mechanism, the strategy ensures trading only in the established trend direction, greatly improving the quality and reliability of trading signals and avoiding frequent false breakouts in oscillating markets.

Precise Risk Control: The account percentage-based risk management method allows the strategy to maintain consistent risk levels under different market conditions and account sizes, preventing excessive leverage and improper fund management that could lead to account erosion.

Dynamic Protection Mechanism: The trailing stop function provides dual protection - both limiting maximum losses (through fixed stops) and protecting earned profits (through trailing stops), which is particularly important in volatile markets.

Key Level-Based Entry: Using pivot points as entry signals enables the strategy to trade at technically significant price levels, which often represent support or resistance levels, increasing trading precision.

Strong Adaptability: Multiple customizable parameters allow traders to adjust the strategy according to different market conditions and personal risk preferences, enhancing strategy adaptability and long-term usability.

Avoidance of Inefficient Periods: The time filtering function ensures the strategy runs only during preset efficient market periods, avoiding inefficient trading during periods of lower market volatility or insufficient liquidity.

Visual Feedback: The strategy provides graphical display of EMA and pivot points, allowing traders to intuitively understand trading logic and market conditions, facilitating strategy optimization and performance evaluation.

Strategy Risks

Despite being well-designed, the strategy still has some potential risks and limitations that traders need to fully understand:

Rapid Market Slippage Risk: Under extreme market conditions, especially during major news releases or black swan events, stop loss orders may not execute at set prices, resulting in actual losses exceeding expectations. Mitigating methods include appropriately reducing trading volume or pausing automated trading during periods of extreme volatility.

Trend Reversal Risk: The 8-period EMA is a short-term indicator and may produce false signals in sideways or rapidly reversing markets. Consider adding multiple timeframe analysis or additional trend confirmation indicators to reduce this risk.

Parameter Optimization Risk: Excessive optimization of strategy parameters may lead to “curve fitting” problems, where the strategy performs well on historical data but poorly in actual trading. It is recommended to use reasonable out-of-sample testing and forward validation to verify parameter robustness.

System Dependency Risk: As a fully automated system, the strategy depends on the stability and connectivity of the trading platform (MT5). Technical issues may cause order execution delays or failures. Maintaining reliable network connections and regularly monitoring system operational status is necessary.

Fixed Point Risk: The strategy uses fixed points to set stop losses, take profits, and trailing stop trigger points, which may not be flexible enough in different volatility environments. Consider using ATR (Average True Range) based dynamic points, which may be more suitable for varying market conditions.

Strategy Optimization Directions

Based on in-depth analysis of the code, here are directions for further optimization of the strategy:

Dynamic Parameter Adjustment: Convert fixed points (such as stop loss, take profit) to volatility-based dynamic calculations, for example, using the ATR indicator to adjust these parameters, enabling the strategy to better adapt to different market conditions and timeframes.

Multiple Timeframe Analysis: Introduce longer-term trend filters, such as calculating additional EMAs on higher timeframes, executing trades only when short-term and long-term trends align, which will reduce false signals and improve overall win rates.

Entry Optimization: The current strategy uses simple pivot points as entry signals; consider adding additional confirmation indicators such as Relative Strength Index (RSI), Stochastic, or MACD to enhance entry precision.

Intelligent Time Filtering: Upgrade fixed time filtering to session-based intelligent filtering, automatically identifying high and low volatility periods during Asian, European, and American trading sessions to optimize trade execution timing.

Dynamic Risk Adjustment: Dynamically adjust risk percentage based on recent strategy performance, for example, automatically reducing risk exposure after consecutive losses and gradually restoring normal risk levels during profitable trends, implementing more intelligent fund management.

Correlation Analysis: When trading multiple instruments, introduce correlation filtering to avoid simultaneously holding similar directional positions in highly correlated markets, thereby reducing overall portfolio risk.

Machine Learning Enhancement: Consider introducing basic machine learning algorithms to optimize parameter selection or predict optimal trading times, allowing the strategy to learn from historical patterns and self-improve.

Summary

The Multi-dimensional Trend Trading System with EMA and Dynamic Trailing Stop is a thoughtfully designed automated trading solution, particularly suitable for investors seeking systematic trading in clearly trending market environments. The strategy ensures trading direction remains consistent with market trends through EMA trend filtering, combined with precise entry using pivot points and dynamic trailing stop exit mechanisms, constructing a complete trading system framework.

The strategy’s main advantages lie in its precise control of risk, trend-synchronized trading method, and flexible parameter settings, enabling it to adapt to different market environments. However, traders need to be aware of potential slippage risks, trend reversal risks, and the limitations of fixed parameters in different market environments.

By introducing ATR-based dynamic parameters, multiple timeframe analysis, and more complex entry confirmation mechanisms, the strategy can be further optimized to improve its robustness and stability across various market conditions. Whether for experienced traders or automated trading newcomers, this strategy provides a solid foundation that can be adjusted and expanded according to personal risk preferences and trading objectives.

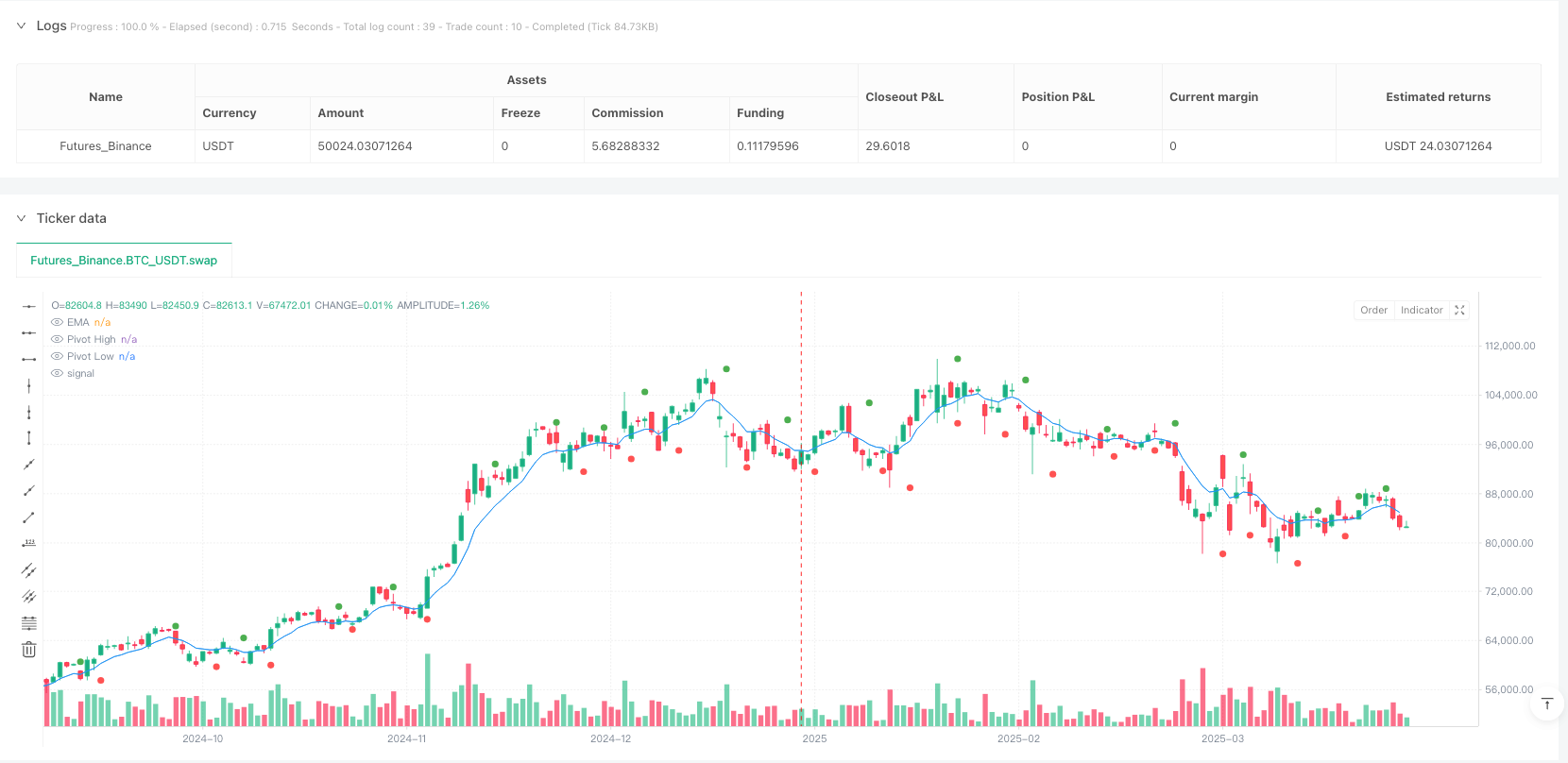

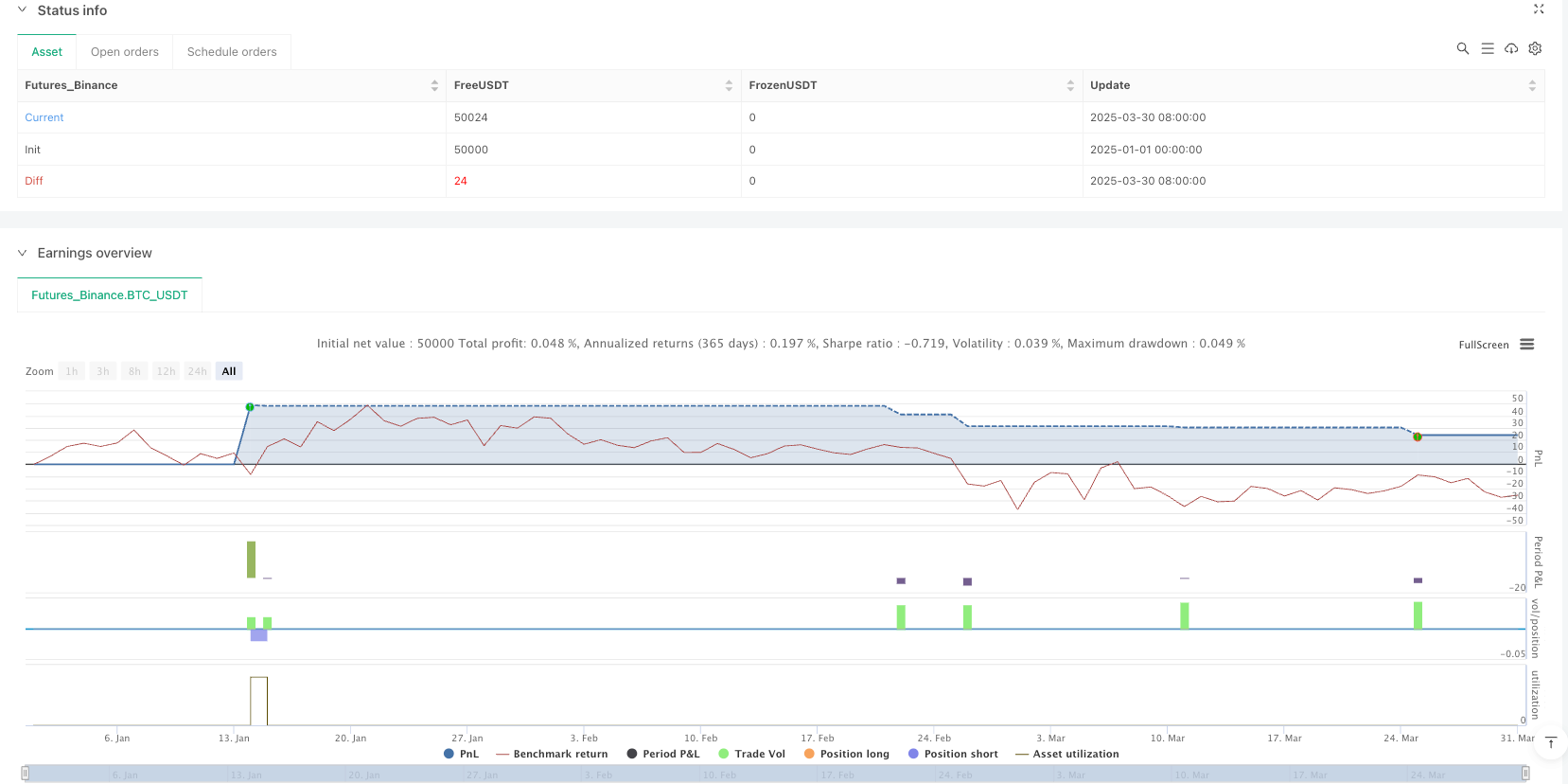

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Trend Robot with EMA & Trailing Stop", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=4)

//===== Inputs =====//

riskPercent = input.float(title="Risk Percent", defval=4.0, step=0.1)

tpPoints = input.int(title="Take Profit Points", defval=300)

slPoints = input.int(title="Stop Loss Points", defval=150)

tslTriggerPoints = input.int(title="Trailing SL Trigger Points", defval=15)

tslPoints = input.int(title="Trailing SL Points", defval=10)

orderDistPoints = input.int(title="Order Distance Points", defval=50)

emaPeriod = input.int(title="EMA Period", defval=8)

useEmaFilter = input.bool(title="Use EMA Filter", defval=true)

startHour = input.int(title="Start Hour (0 = no restriction)", defval=0, minval=0, maxval=23)

endHour = input.int(title="End Hour (0 = no restriction)", defval=0, minval=0, maxval=23)

barsN = input.int(title="Pivot Lookback (BarsN)", defval=3)

//===== Conversion Factor =====//

// syminfo.mintick is used as the smallest price increment.

minTick = syminfo.mintick

//===== EMA Calculation & Filter Conditions =====//

emaValue = ta.ema(close, emaPeriod)

isEmaBullish = not useEmaFilter or (emaValue > emaValue[1])

isEmaBearish = not useEmaFilter or (emaValue < emaValue[1])

//===== Time Filter =====//

currentHour = hour(time)

sessionOK = true

if startHour != 0 and currentHour < startHour

sessionOK := false

if endHour != 0 and currentHour >= endHour

sessionOK := false

//===== Out-of-Session Position Closing =====//

if not sessionOK and strategy.position_size != 0

// Close all existing positions when outside session hours

strategy.close("Long", comment="Session Close")

strategy.close("Short", comment="Session Close")

//===== Pivot (Local Extreme) Detection =====//

// ta.pivothigh and ta.pivotlow return a value only at the pivot bar (after lookback period).

pivotHigh = ta.pivothigh(high, barsN, barsN)

pivotLow = ta.pivotlow(low, barsN, barsN)

//===== Entry Conditions & Orders =====//

// Only evaluate at confirmed (closed) bars and during valid session.

if barstate.isconfirmed and sessionOK

//---- Long Entry Condition ----//

if strategy.position_size <= 0 and isEmaBullish and not na(pivotHigh)

if close < (pivotHigh - orderDistPoints * minTick)

// Place a Buy Stop order at the pivotHigh price.

strategy.order("Long", strategy.long, stop=pivotHigh, comment="BuyStop")

// Attach an exit order with SL, TP and trailing stop parameters.

strategy.exit("Long Exit", from_entry="Long", stop=pivotHigh - slPoints * minTick, limit=pivotHigh + tpPoints * minTick, trail_points=tslTriggerPoints, trail_offset=tslPoints)

//---- Short Entry Condition ----//

if strategy.position_size >= 0 and isEmaBearish and not na(pivotLow)

if close > (pivotLow + orderDistPoints * minTick)

// Place a Sell Stop order at the pivotLow price.

strategy.order("Short", strategy.short, stop=pivotLow, comment="SellStop")

// Attach an exit order with SL, TP and trailing stop parameters.

strategy.exit("Short Exit", from_entry="Short", stop=pivotLow + slPoints * minTick, limit=pivotLow - tpPoints * minTick, trail_points=tslTriggerPoints, trail_offset=tslPoints)

//===== Plots for Visual Reference =====//

plot(emaValue, color=color.blue, title="EMA")

plot(pivotHigh, style=plot.style_circles, color=color.green, title="Pivot High")

plot(pivotLow, style=plot.style_circles, color=color.red, title="Pivot Low")