Moving Average Crossover with Dynamic Volatility-Based Stop Loss Strategy

SMA RSI ATR RISK-TO-REWARD RATIO TREND FOLLOWING

Overview

This quantitative trading strategy is a comprehensive system that combines moving average crossovers, Relative Strength Index (RSI) filtering, and dynamic stop-loss mechanisms based on Average True Range (ATR). The strategy is primarily designed to capture medium to long-term trends while avoiding entry in extremely overbought or oversold market conditions through RSI indicators, and employing ATR-based dynamic stop-loss to adapt to changing market volatility. The strategy performs particularly well on the 15-minute timeframe, achieving a good balance between capturing intraday trends and avoiding excessive noise often seen in lower timeframes.

Strategy Principles

The core logic of the strategy is based on several key components:

Moving Average Crossover Signals: The strategy utilizes two Simple Moving Averages (SMA), a 50-period short-term SMA and a 200-period long-term SMA. A long entry signal is triggered when the short-term SMA is below the long-term SMA and the RSI value is greater than 30. This design aims to identify potential trend reversal points.

RSI Filtering Mechanism: The strategy employs a 14-period RSI indicator for entry filtering. Specifically, long entries are only permitted when the RSI value is above 30, which helps avoid blind entries in deeply oversold areas. While the framework for short conditions is preserved in the code, the current version primarily focuses on long strategies.

ATR Dynamic Stop-Loss: The strategy uses a 14-period ATR indicator to calculate dynamic stop-loss levels. The stop-loss is set at the entry price minus (ATR value × multiplier), where the ATR multiplier defaults to 1.0. This dynamic stop-loss mechanism adapts to actual market volatility, providing wider stop-loss space during high volatility periods and maintaining tighter risk control during low volatility periods.

Risk-Reward Ratio: The strategy implements take-profit settings based on a Risk-Reward Ratio (RRR), with a default value of 1.5. The take-profit level is calculated as the entry price plus ((entry price - stop-loss price) × risk-reward ratio), ensuring that the potential gain for each trade maintains an appropriate proportion to the risk taken.

Strategy Advantages

Combination of Trend Following and Filtering: The strategy not only uses moving average crossovers to capture trend changes but also filters through the RSI indicator, reducing false signals and improving entry quality.

Dynamic Risk Management: The ATR-based stop-loss mechanism is a highlight of this strategy, as it dynamically adjusts stop-loss distances based on market volatility, avoiding the problem of fixed stops triggering too early in high volatility environments while maintaining appropriate risk control during low volatility periods.

Risk-Reward Ratio Optimization: Through a preset risk-reward ratio, the strategy ensures that the potential return for each trade is proportional to the risk, which aids long-term capital growth even when the win rate may not be high.

Trade Visualization: The strategy includes real-time plotting of stop-loss and take-profit levels, as well as marking of completed trades, which greatly enhances the visualization of strategy execution, facilitating backtesting analysis and strategy optimization.

Integrated Capital Management: By default, the strategy uses a percentage of the account’s total value for position sizing, which is more flexible than fixed lot sizing and can automatically adjust trading size as the account grows or shrinks.

Strategy Risks

Trend Reversal Risk: Although the strategy uses moving averages to identify trends, sudden market reversals can lead to significant losses. The solution is to consider introducing more sensitive short-term indicators as auxiliary confirmation or adjusting RSI thresholds to increase sensitivity to reversals.

Parameter Sensitivity: Key parameters such as SMA periods, RSI thresholds, and ATR multipliers have a significant impact on performance. Different market environments may require different parameter settings, so thorough historical backtesting is needed to find the optimal parameter combinations.

Unidirectional Market Limitations: The current version primarily focuses on long strategies and may not perform well in continuously declining markets. The solution is to activate the short conditions in the code to implement bidirectional trading capabilities.

Wide Stop-Loss Risk: During extremely high volatility periods, ATR values may increase significantly, leading to excessively wide stop-loss distances and increased potential losses. Consider setting upper limits for ATR multipliers or implementing a hybrid approach combining fixed monetary stop-losses with ATR dynamic stop-losses.

Trading Frequency Uncertainty: As the strategy relies on medium to long-term moving average crossovers, it may result in sparse trading signals, affecting capital utilization efficiency. The solution is to consider adding short-term trading signals as supplements or using shorter-term indicators for position additions after the main trend is established.

Strategy Optimization Directions

Multiple Timeframe Analysis Integration: The current strategy operates on a single timeframe. Consider integrating multiple timeframe analysis, such as using higher timeframes to confirm the main trend direction and then looking for entry points on lower timeframes to improve entry precision.

Refinement of Short Logic: Activate and optimize the short logic in the strategy to make it equally effective in declining markets. This may require adjusting RSI thresholds for shorts (such as shorting when RSI is above 70) and setting different parameters for different market directions.

Introduction of Volume Indicators: Consider integrating volume indicators into the entry logic, executing trading signals only when confirmed by volume, which helps reduce losses from false breakouts.

Optimization of Take-Profit Strategy: The current strategy uses a fixed risk-reward ratio for take-profit setting. Consider implementing partial profit locking or trailing stops to capture more profit when trends continue to develop.

Adding Trading Session Filters: For markets with obvious session characteristics, add time filters to avoid trading during low liquidity or high uncertainty sessions.

Parameter Adaptive Mechanism: Implement parameter adaptive adjustment mechanisms based on historical volatility or other market characteristics, allowing the strategy to automatically optimize parameters according to changing market environments.

Summary

This quantitative strategy based on moving average crossovers, RSI filtering, and ATR dynamic stop-loss provides a balanced trading framework particularly suited for medium to long-term trend trading. Its core advantage lies in the seamless integration of technical indicator analysis with dynamic risk management, capable of both capturing trend changes and adjusting risk exposure based on market volatility.

Although the strategy has limitations in parameter sensitivity and unidirectional trading, these issues can be effectively addressed through the suggested optimization directions, such as multiple timeframe analysis, refined short logic, volume confirmation, etc. In particular, combining dynamic parameter adjustment mechanisms with more sophisticated take-profit strategies promises to further enhance the robustness and profitability of the strategy.

For traders seeking medium to long-term trend trading while emphasizing risk control, this strategy provides a solid starting point that, through personalized adjustments and continuous optimization, has the potential to become an efficient trading system.

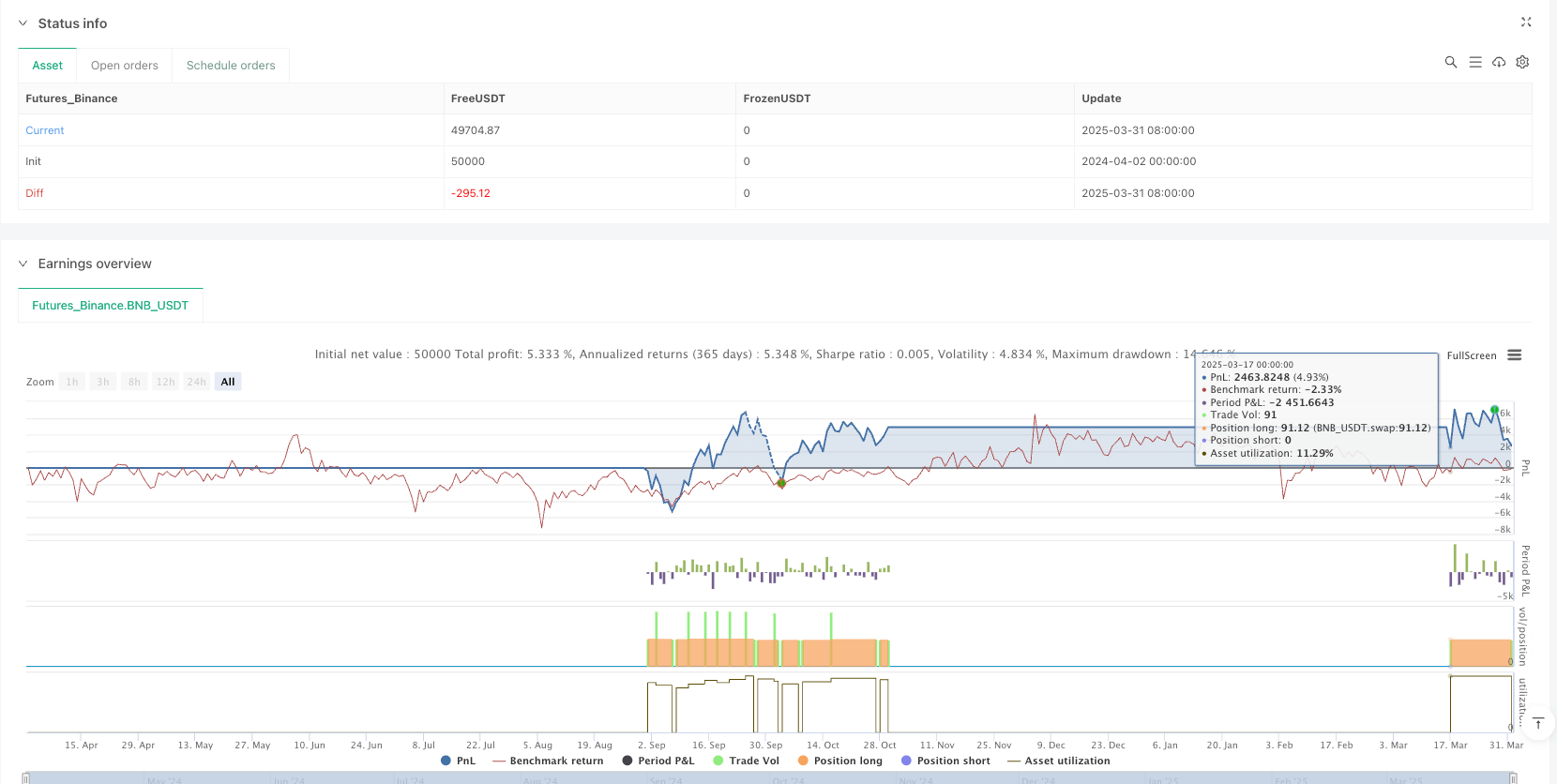

/*backtest

start: 2024-04-02 00:00:00

end: 2025-04-01 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BNB_USDT"}]

*/

//@version=6

strategy(title=" VS-NTC> NASDQ100 Long MA+RSI+ATR", shorttitle="VS-NTC> Long NASDQ100 MA+RSI+ATR", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// ————— Inputs —————

smaLenShort = input.int(50, title="Short SMA Length")

smaLenLong = input.int(200, title="Long SMA Length")

rsiLen = input.int(14, title="RSI Length")

atrPeriod = input.int(14, title="ATR Period")

atrMult = input.float(1.0, title="Stop-Loss ATR Multiplier", step=0.1)

rrRatio = input.float(1.5, title="Risk-to-Reward Ratio", step=0.1)

// ————— Indicator Calculations —————

smaShort = ta.sma(close, smaLenShort)

smaLong = ta.sma(close, smaLenLong)

rsiVal = ta.rsi(close, rsiLen)

atrVal = ta.atr(atrPeriod)

// ————— Entry Conditions —————

// Long Condition: 50SMA > 200SMA and RSI < 70

longCondition = (smaShort < smaLong) and (rsiVal > 30)

// Short Condition: 50SMA < 200SMA and RSI > 30 (example: avoid oversold)

// Or use RSI > 70 to short if the market is overbought.

shortCondition = false

// shortCondition = (smaShort > smaLong) and (rsiVal < 35)

// ————— Entry Logic —————

if longCondition

strategy.entry(id="Long", direction=strategy.long)

if shortCondition

strategy.entry(id="Short", direction=strategy.short)

// ————— Stop-Loss & Take-Profit Calculation —————

var float stopPrice = na

var float takeProfitPrice = na

// If we have a position open, we determine SL & TP differently for Long or Short.

if strategy.position_size > 0

// We are in a Long trade

stopPrice := strategy.position_avg_price - (atrVal * atrMult)

takeProfitPrice := strategy.position_avg_price + ((strategy.position_avg_price - stopPrice) * rrRatio)

strategy.exit("Exit SL/TP", stop=stopPrice, limit=takeProfitPrice)

else if strategy.position_size < 0

// We are in a Short trade

stopPrice := strategy.position_avg_price + (atrVal * atrMult)

// For short, the distance from entry to stop is (stopPrice - entry)

// So the take-profit is entry - that same distance times RR

takeProfitPrice := strategy.position_avg_price - ((stopPrice - strategy.position_avg_price) * rrRatio)

strategy.exit("Exit SL/TP", stop=stopPrice, limit=takeProfitPrice)

else

// No open position → reset plots to na

stopPrice := na

takeProfitPrice := na

// ————— Plot the Planned Stop-Loss & Take-Profit —————

plot(stopPrice, title="Stop Loss", color=color.red, linewidth=2)

plot(takeProfitPrice, title="Take Profit", color=color.green, linewidth=2)

// ————— Label Each Closed Trade (Wins & Losses) —————

var int lastClosedTradeCount = 0

currentClosedCount = strategy.closedtrades

// If there's at least one new closed trade, label it

if currentClosedCount > lastClosedTradeCount

newTradeIndex = currentClosedCount - 1

tradeProfit = strategy.closedtrades.profit(newTradeIndex)

exitBarIndex = strategy.closedtrades.exit_bar_index(newTradeIndex)

exitPrice = strategy.closedtrades.exit_price(newTradeIndex)

// Win label if profit > 0

if tradeProfit > 0

labelText = "Win: " + str.tostring(tradeProfit)

labelStyle = label.style_label_up

labelColor = color.new(color.green, 0)

label.new(exitBarIndex, exitPrice, text=labelText, style=labelStyle, color=labelColor, size=size.tiny)

// Loss label if profit < 0

if tradeProfit < 0

labelText = "Loss: " + str.tostring(tradeProfit)

labelStyle = label.style_label_down

labelColor = color.new(color.red, 0)

label.new(exitBarIndex, exitPrice, text=labelText, style=labelStyle, color=labelColor, size=size.tiny)

lastClosedTradeCount := currentClosedCount