EMA Dual Crossover Dynamic Stop-Loss Quantitative Strategy

EMA CROSSOVER STOP-LOSS TREND FOLLOWING TECHNICAL INDICATORS

Overview

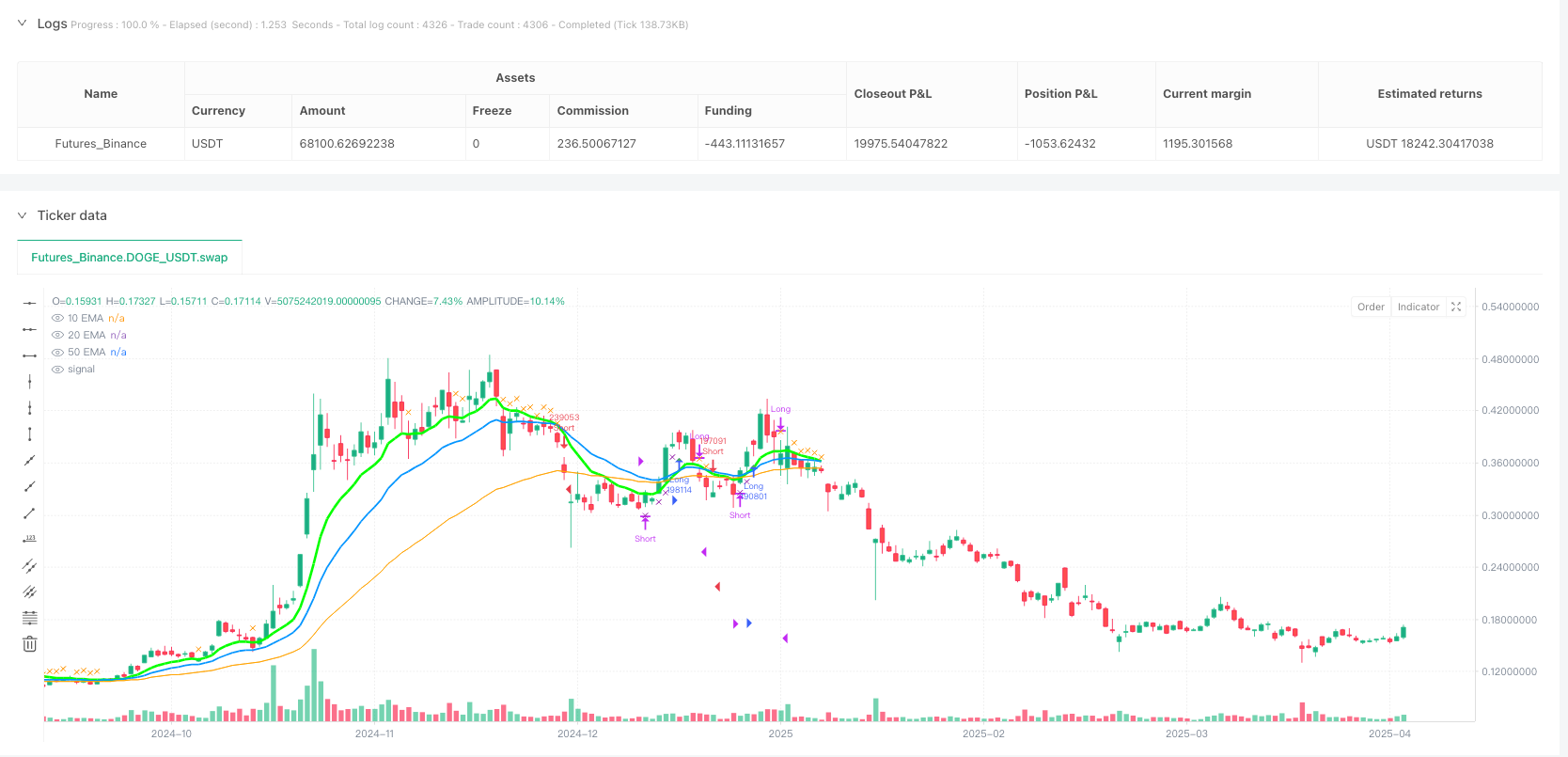

This strategy is designed based on the dual crossover principle of Exponential Moving Averages (EMA) combined with a dynamic stop-loss mechanism. It uses the golden/death cross of 10-day and 20-day EMAs as primary trading signals, with the 50-day EMA as a trend filter and the 10-day EMA as a dynamic stop-loss line. A buy signal is generated when the price is above the 50-day EMA and the 10-day EMA crosses above the 20-day EMA; a sell signal occurs when the price is below the 50-day EMA and the 10-day EMA crosses below the 20-day EMA. Positions are exited if the price reversely breaks the 10-day EMA.

Strategy Logic

- Bullish/Bearish Conditions:

- Bullish: When 10-day EMA crosses above 20-day EMA (golden cross) and closing price is above 50-day EMA.

- Bearish: When 10-day EMA crosses below 20-day EMA (death cross) and closing price is below 50-day EMA.

- Bullish: When 10-day EMA crosses above 20-day EMA (golden cross) and closing price is above 50-day EMA.

- Dynamic Stop-Loss:

- Long positions are closed if price falls below 10-day EMA.

- Short positions are closed if price rises above 10-day EMA.

- Long positions are closed if price falls below 10-day EMA.

- Trend Filtering: The 50-day EMA acts as a long-term trend filter to avoid overtrading in ranging markets.

Advantages

- Trend-Following Capability: Dual EMA crossover effectively captures medium-term trends, while the 50-day EMA reduces false signals.

- Dynamic Risk Management: The 10-day EMA serves as an adaptive stop-loss, protecting profits during trend movements.

- Visual Clarity: Distinct colors and line widths differentiate the three EMAs, with annotated signals for real-time monitoring.

- Parameter Flexibility: Adjustable EMA periods adapt to varying market volatilities.

Risks

- Lagging Risk: EMAs rely on historical data, potentially causing significant drawdowns during rapid reversals.

- Solution: Incorporate momentum indicators (e.g., RSI) to filter extreme volatility.

- Solution: Incorporate momentum indicators (e.g., RSI) to filter extreme volatility.

- Range Market Losses: Frequent whipsaws may occur in trendless conditions.

- Solution: Add volatility filters (e.g., ATR) to pause trading.

- Solution: Add volatility filters (e.g., ATR) to pause trading.

- Overfitting Risk: Fixed EMA periods may not suit all market regimes.

- Solution: Implement adaptive period algorithms or multi-timeframe confirmation.

- Solution: Implement adaptive period algorithms or multi-timeframe confirmation.

Optimization Directions

- Composite Signals:

- Add volume confirmation (e.g., breakout with high volume) to enhance signal reliability.

- Add volume confirmation (e.g., breakout with high volume) to enhance signal reliability.

- Dynamic Position Sizing:

- Adjust position size based on volatility (ATR values) to reduce exposure in high-risk periods.

- Adjust position size based on volatility (ATR values) to reduce exposure in high-risk periods.

- Machine Learning:

- Train models on historical data to dynamically optimize EMA period combinations.

- Train models on historical data to dynamically optimize EMA period combinations.

- Multi-Timeframe Validation:

- Require weekly EMA alignment with daily signals to improve win rates.

- Require weekly EMA alignment with daily signals to improve win rates.

Conclusion

This strategy balances trend-following and risk control through EMA dual crossover and dynamic stop-loss. Its core strengths lie in clear logic and intuitive visualization, making it suitable for medium-low frequency trading. Future enhancements could integrate multidimensional data (e.g., volatility, volume) for greater robustness.

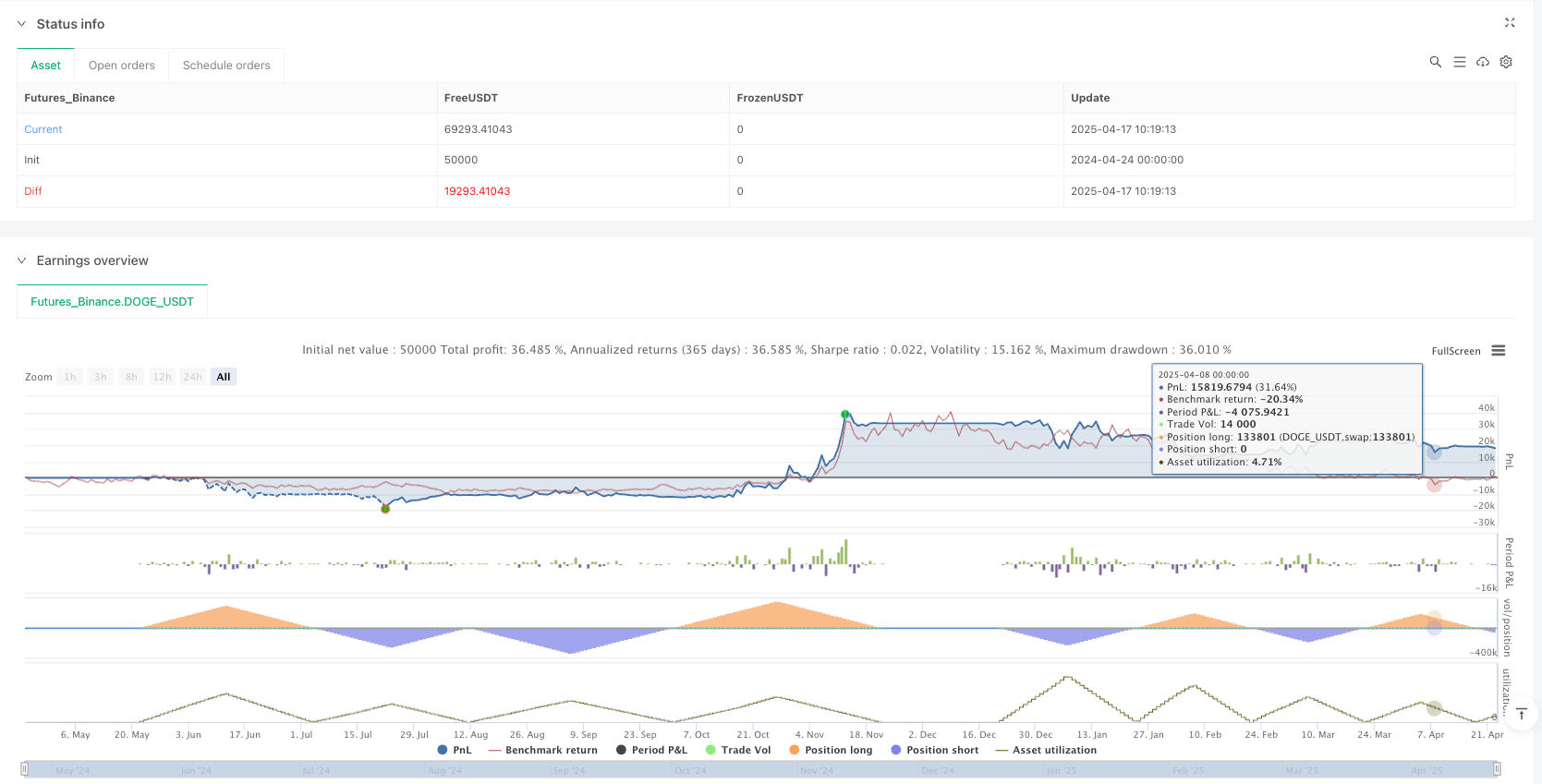

/*backtest

start: 2024-04-24 00:00:00

end: 2025-04-23 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=5

//@description Ovtlyer EMA Crossover price over 50 Indicator

//@author YourName

strategy("EMA Crossover Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input EMA lengths

length10 = input.int(10, minval=1, title="10 EMA Length")

length20 = input.int(20, minval=1, title="20 EMA Length")

length50 = input.int(50, minval=1, title="50 EMA Length")

// Calculate EMAs

ema10 = ta.ema(close, length10)

ema20 = ta.ema(close, length20)

ema50 = ta.ema(close, length50)

// Bullish Condition: 10 EMA crosses above 20 EMA AND price is above 50 EMA

bullishCondition = ta.crossover(ema10, ema20) and close > ema50

// Bearish Condition: 10 EMA crosses below 20 EMA AND price is below 50 EMA

bearishCondition = ta.crossunder(ema10, ema20) and close < ema50

// Track the current market state

var isBullish = false

var isBearish = false

if (bullishCondition)

isBullish := true

isBearish := false

if (bearishCondition)

isBearish := true

isBullish := false

// Exit conditions

bullishExit = isBullish and close < ema10

bearishExit = isBearish and close > ema10

// Plot EMAs

plot(ema10, title="10 EMA", color=color.rgb(0, 255, 0), linewidth=3) // Thick green line for 10 EMA

plot(ema20, title="20 EMA", color=color.rgb(0, 150, 255), linewidth=2) // Medium blue line for 20 EMA

plot(ema50, title="50 EMA", color=color.rgb(255, 165, 0), linewidth=1) // Thin orange line for 50 EMA

// Strategy Entry and Exit

if (bullishCondition)

strategy.entry("Long", strategy.long)

if (bearishCondition)

strategy.entry("Short", strategy.short)

if (bullishExit)

strategy.close("Long")

if (bearishExit)

strategy.close("Short")

// Plot Entry Signals (for visualization)

plotshape(bullishCondition, title="Bullish Signal",

location=location.belowbar, style=shape.triangleup,

size=size.small, color=color.green)

plotshape(bearishCondition, title="Bearish Signal",

location=location.abovebar, style=shape.triangledown,

size=size.small, color=color.red)

// Plot Exit Signals (for visualization)

plotshape(bullishExit, title="Bullish Exit",

location=location.abovebar, style=shape.xcross,

size=size.small, color=color.orange)

plotshape(bearishExit, title="Bearish Exit",

location=location.belowbar, style=shape.xcross,

size=size.small, color=color.purple)