Multi-Timeframe Mean Reversion Trend Breakout Trading System

EMA RSI ATR MACD MFI VAH VAL POC Wyckoff MEAN REVERSION TREND FOLLOWING Swing Trading

Strategy Overview

The Multi-Timeframe Mean Reversion Trend Breakout Trading System is a comprehensive quantitative trading strategy that ingeniously combines four powerful trading methodologies: Wyckoff Market Cycles, Price Map Profiling, Mean Reversion, and Trend Following. Designed specifically for medium to long-term swing traders, this strategy offers extensive customization options, allowing traders to flexibly adjust according to their risk preferences and market conditions.

The core components include Wyckoff analysis for identifying market cycle phases, Price Map Profiling for determining key support and resistance levels, Mean Reversion components for identifying overbought or oversold conditions, and a Trend Following system for capturing medium to long-term price movements. These components work together to form a comprehensive trading system aimed at providing high-probability trading signals.

Strategy Principles

The core principles of this strategy are based on the synergistic action of four main trading methods:

Wyckoff Analysis: This component identifies four major phases based on Richard D. Wyckoff’s market cycle theory - Accumulation Phase, Markup Phase, Distribution Phase, and Markdown Phase. The strategy also detects special formations such as “spring” patterns (false breakdowns followed by rapid reversals) and “upthrust” patterns (false breakouts). These phases are defined through the relationship between price and volume, helping traders follow institutional money flow.

Price Map Profiling: This component implements a simplified version of Market Profile/Volume Profile, calculating the Point of Control (POC), Value Area High (VAH), and Value Area Low (VAL) to establish the range where major price action occurs. The visual representation of these key levels helps identify potential support and resistance zones.

Mean Reversion: This component identifies potential reversal points when prices move to extreme areas. It uses Bollinger Bands to define overbought and oversold price zones and incorporates RSI divergence to confirm potential reversals. To avoid false signals in strong trends, the strategy requires multiple confirmation signals.

Trend Following: This component captures medium to long-term directional price movements, utilizing multiple moving averages (9, 21, 50, 200 EMAs) to confirm trend direction and strength, MACD analysis for momentum confirmation and trend intensity, and higher timeframe trend alignment through recent price structure analysis.

These four components complement each other and work together to generate trading signals. The system uses a sophisticated signal combination method, requiring confirmation from multiple systems to generate final trading signals, effectively reducing the possibility of false signals.

Strategy Advantages

The Multi-Timeframe Mean Reversion Trend Breakout Trading System has the following significant advantages:

Comprehensive Analysis Framework: By integrating four different but complementary trading methods, the strategy can analyze the market from multiple angles, improving the quality and reliability of trading signals. This multi-dimensional analysis reduces the bias and error signals that might come from a single indicator.

Adaptability to Different Market Conditions: The flexibility of the strategy allows it to perform well in different market environments. In trending markets, the trend following component dominates; in range-bound markets, mean reversion and price map analysis are more effective.

Institutional Money Flow Alignment: Through Wyckoff analysis, the strategy aims to align with institutional money flow, which is crucial for long-term trading success. This component helps traders identify accumulation and distribution phases of large funds, increasing the success rate of trades.

Robust Risk Management: The strategy incorporates multiple risk management features, including automatic take profit and stop loss based on ATR, trailing stops, exit strategies based on holding time, and position sizing calculated as a percentage of equity. These features together ensure the robustness of money management.

Highly Customizable: The strategy provides extensive parameter settings, allowing traders to adjust according to their trading style, market preferences, and risk tolerance. Major components can be enabled or disabled independently, enabling the strategy to adapt to different trading approaches.

Strategy Risks

Despite its numerous advantages, the strategy also presents the following potential risks and challenges:

Parameter Overoptimization Risk: The strategy includes a large number of adjustable parameters, which may lead to the risk of overfitting historical data. Traders should be careful to avoid overoptimization and conduct robust forward testing before actual trading.

Complexity Management: The comprehensiveness of the strategy also brings complexity. Understanding and managing the interaction of all components can be challenging, especially for novice traders. It is recommended to first understand each independent component, then gradually integrate their use.

Market Condition Changes: Under certain market conditions, specific components may perform poorly. For example, during rapid trend transitions, mean reversion signals may produce losses. Traders need to monitor the market environment and adjust the weight of strategy components accordingly.

Execution Delay Impact: The strategy’s multiple confirmation requirements may lead to delayed entry points, especially in rapidly fluctuating markets. This may result in missing part of a trend or entering the market at suboptimal prices.

Technical Indicator Dependence: The strategy heavily relies on technical indicators such as moving averages, RSI, and MACD. Under certain market conditions, these indicators may fail or produce misleading signals. It is recommended to complement with fundamental analysis or other non-technical factors.

Methods to mitigate these risks include: implementing the strategy gradually, starting with small positions; regular backtesting and optimization; using out-of-sample testing to validate strategy effectiveness; and setting strict risk management rules, such as maximum loss limits per trade and per day.

Strategy Optimization Directions

Based on an in-depth analysis of the code, the strategy can be optimized in the following directions:

Adaptive Parameter Settings: The current strategy uses fixed parameter values, such as RSI period and Bollinger Band standard deviations. By implementing adaptive parameters based on volatility or market state, the strategy’s performance in different market environments can be improved. For example, using wider Bollinger Bands in high volatility markets and narrower bands in low volatility markets.

Machine Learning Integration: Introduce machine learning algorithms to optimize signal generation and filtering processes. For example, classification algorithms can be used to predict the success probability of signals, or reinforcement learning to find the optimal parameter combinations. This will enable the strategy to continuously adapt and learn new market patterns.

Enhanced Timeframe Analysis: The current strategy primarily operates on a single timeframe. By adding true multi-timeframe analysis capabilities, signal quality can be improved. For example, only trading when daily, weekly, and monthly trend directions are aligned, thereby reducing the risk of counter-trend trading.

Improved Wyckoff Identification Algorithms: The current Wyckoff phase identification is relatively simple. More sophisticated algorithms can be developed to accurately identify Wyckoff accumulation and distribution patterns, such as using combinations of volume distribution, volume-weighted average price, and relative strength indicators.

Multi-Instrument Correlation Analysis: By adding multi-instrument correlation analysis, the strategy can consider the dynamics of related markets. For example, considering the trend of the US Dollar Index in commodity trading, or the performance of sector indices in stock trading. This will provide a more comprehensive market perspective.

Optimized Exit Strategies: The current exit mechanisms are primarily based on time and RSI. Profitability can be improved by implementing more sophisticated exit strategies, such as partial profit taking based on dynamic support/resistance levels, or using volatility contraction patterns as exit triggers.

Enhanced Risk Management: Add more sophisticated risk management features, such as drawdown-based position adjustment, correlation-weighted portfolio management, and order execution logic that considers market liquidity and slippage.

Summary

The Multi-Timeframe Mean Reversion Trend Breakout Trading System is a comprehensive, flexible quantitative trading strategy suitable for medium to long-term swing traders. Its core strength lies in the integration of multiple complementary trading methods, providing robust signal generation mechanisms and extensive risk management features.

The strategy creates a trading system capable of adapting to various market conditions by integrating Wyckoff Market Cycle theory, Price Map Profiling, Mean Reversion, and Trend Following. It is designed to align with institutional money flow, reduce false signals by requiring multiple confirmations, and provide flexible entry and exit mechanisms to optimize trading results.

Despite challenges such as parameter optimization, complexity management, and market condition changes, the strategy can be a powerful tool in a trader’s toolkit through careful implementation and continuous optimization. By introducing adaptive parameters, machine learning techniques, enhanced multi-timeframe analysis, and improved exit strategies, the system has the potential to further improve its performance and adaptability in the future.

For traders seeking robust, systematic trading methods, the Multi-Timeframe Mean Reversion Trend Breakout Trading System provides a solid foundation that can be customized and expanded based on personal preferences and market experience.

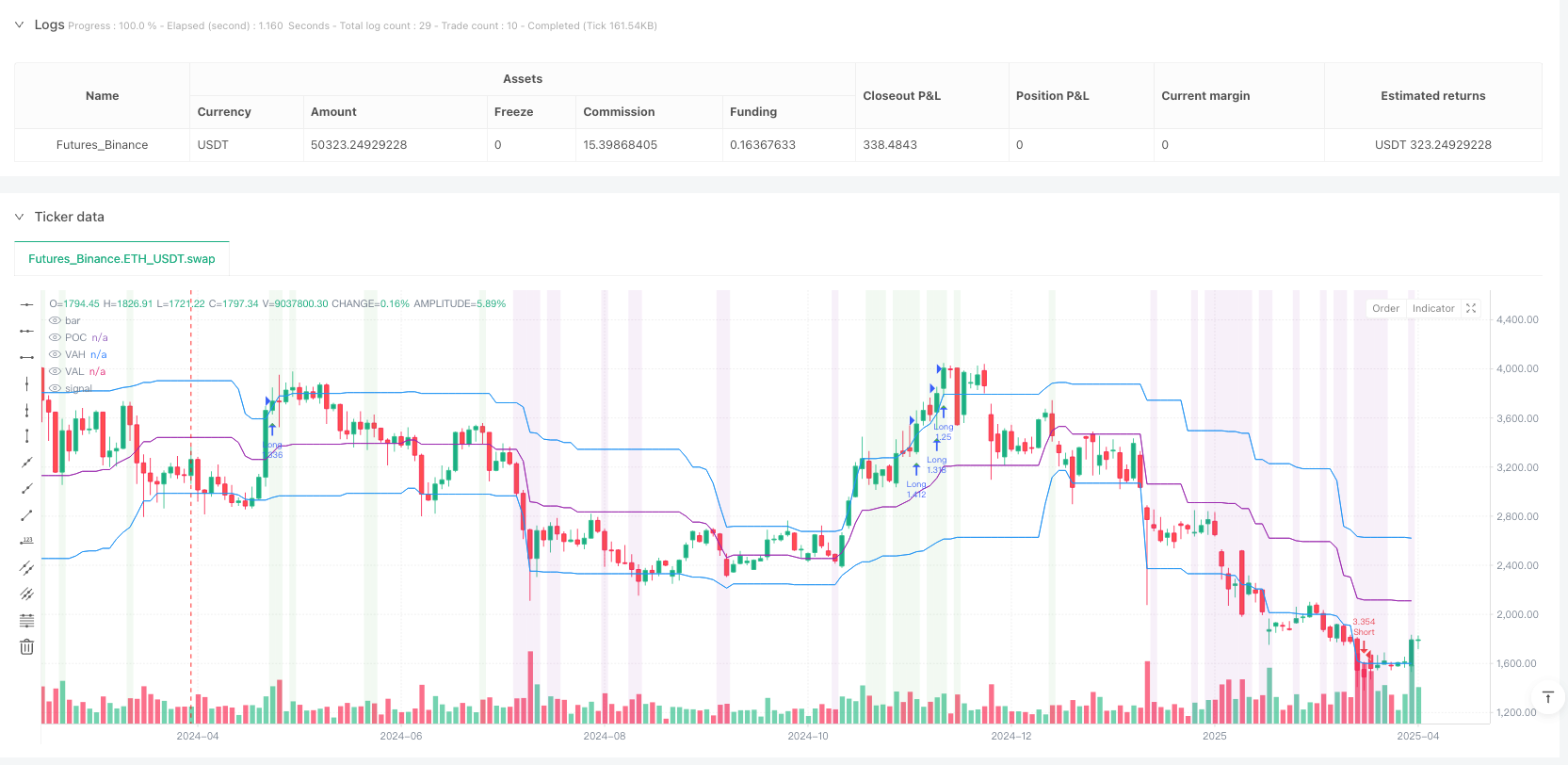

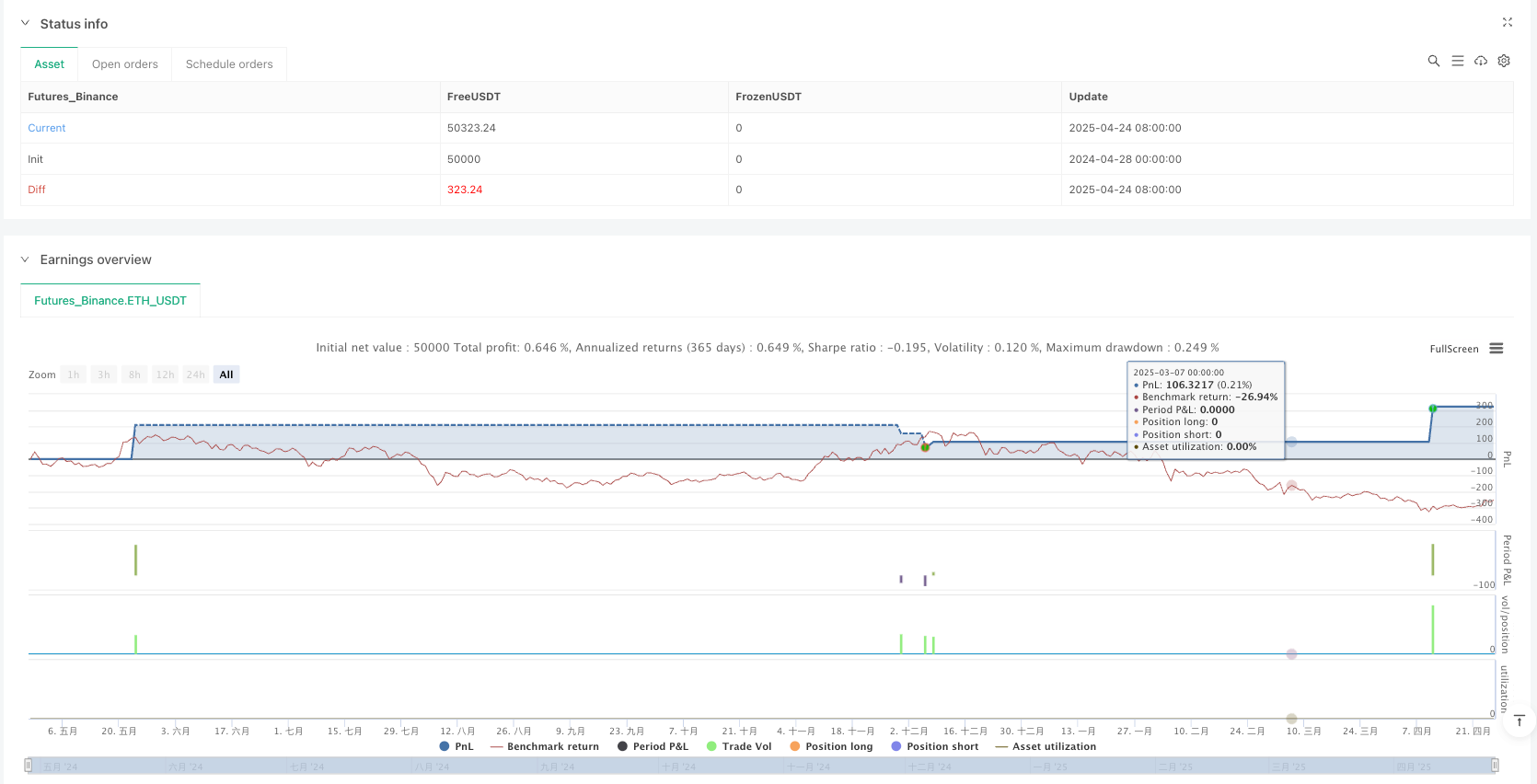

/*backtest

start: 2024-04-28 00:00:00

end: 2025-04-26 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Wyckoff Advanced Swing Strategy by TIAMATCRYPTO", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Main strategy settings

enableWyckoff = input.bool(true, "Enable Wyckoff")

enablePriceMap = input.bool(true, "Enable Price Map Profile")

enableMeanReversion = input.bool(true, "Enable Mean Reversion")

enableTrendFollowing = input.bool(true, "Enable Trend Following")

// TP/SL settings

useAutoTPSL = input.bool(true, "Use Auto TP/SL")

profitFactor = input.float(2.5, "Profit Factor (ATR multiple)")

stopLossFactor = input.float(1.5, "Stop Loss Factor (ATR multiple)")

// Swing Trading Parameters

minHoldingDays = input.int(3, "Minimum Holding Period (days)")

maxHoldingDays = input.int(20, "Maximum Holding Period (days)")

useWeekdayFilter = input.bool(true, "Filter Trading Days")

useTrailingStop = input.bool(true, "Use Trailing Stop")

trailingStopAtrMult = input.float(2.0, "Trailing Stop (ATR multiple)")

// Alternative Exit Rules

useExitByRSI = input.bool(true, "Exit by RSI")

exitLongRSI = input.int(70, "Exit Long when RSI")

exitShortRSI = input.int(30, "Exit Short when RSI")

// General Parameters

atrPeriod = input.int(14, "ATR Period")

rsiPeriod = input.int(14, "RSI Period")

volPeriod = input.int(20, "Volume MA Period")

emaFastPeriod = input.int(9, "EMA Fast Period")

emaSlowPeriod = input.int(21, "EMA Slow Period")

emaMediumPeriod = input.int(50, "EMA Medium Period")

emaLongPeriod = input.int(200, "EMA Long Period")

// Indicators

atr = ta.atr(atrPeriod)

rsi = ta.rsi(close, rsiPeriod)

volMA = ta.sma(volume, volPeriod)

emaFast = ta.ema(close, emaFastPeriod)

emaSlow = ta.ema(close, emaSlowPeriod)

emaMedium = ta.ema(close, emaMediumPeriod)

emaLong = ta.ema(close, emaLongPeriod)

macd = ta.ema(close, 12) - ta.ema(close, 26)

macdSignal = ta.ema(macd, 9)

// Weekday Filters (1 = Monday, 5 = Friday)

isGoodEntryDay = useWeekdayFilter ? (dayofweek != 5 and dayofweek != 1) : true // Not on Monday and Friday

isGoodExitDay = useWeekdayFilter ? (dayofweek != 1 and dayofweek != 5) : true // Not on Monday and Friday

// ===================== Wyckoff Method =====================

accumulationPhase = false

markupPhase = false

distributionPhase = false

markdownPhase = false

spring = false

if enableWyckoff

// Define support and resistance

support = ta.lowest(low, 10)

resistance = ta.highest(high, 10)

// Detect Spring (fake downward breakout)

spring := low[1] < support[2] and close > support[1]

// Detect Upthrust (fake upward breakout)

upthrust = high[1] > resistance[2] and close < resistance[1]

// Wyckoff Market Phases

accumulationPhase := volume > volMA and rsi < 40 and ta.falling(high, 5) and close > open

markupPhase := emaFast > emaSlow and emaSlow > emaMedium and volume > volMA and rsi > 50

distributionPhase := volume > volMA and rsi > 60 and ta.rising(low, 5) and close < open

markdownPhase := emaFast < emaSlow and emaSlow < emaMedium and volume > volMA and rsi < 50

// ===================== Price Map Profile =====================

lookbackPeriod = 30

highestPrice = ta.highest(high, lookbackPeriod)

lowestPrice = ta.lowest(low, lookbackPeriod)

valueAreaHigh = highestPrice - (highestPrice - lowestPrice) * 0.15

valueAreaLow = lowestPrice + (highestPrice - lowestPrice) * 0.15

pointOfControl = (valueAreaHigh + valueAreaLow) / 2

// Plot Price Map Profile

plot(enablePriceMap ? pointOfControl : na, "POC", color.purple, 1)

plot(enablePriceMap ? valueAreaHigh : na, "VAH", color.blue, 1)

plot(enablePriceMap ? valueAreaLow : na, "VAL", color.blue, 1)

// ===================== Mean Reversion =====================

meanReversionBuy = false

meanReversionSell = false

if enableMeanReversion

// Optimized Bollinger Bands for swing trading

basisBB = ta.sma(close, 20)

devBB = ta.stdev(close, 20) * 2

upperBB = basisBB + devBB

lowerBB = basisBB - devBB

// Enhanced Mean Reversion Conditions

lowerBBHit = ta.crossunder(close, lowerBB) or (close < lowerBB and close[1] < lowerBB)

upperBBHit = ta.crossover(close, upperBB) or (close > upperBB and close[1] > upperBB)

// RSI divergence for better timing

rsiLow = ta.lowest(rsi, 5)

priceLow = ta.lowest(low, 5)

rsiHigh = ta.highest(rsi, 5)

priceHigh = ta.highest(high, 5)

bullishDivergence = low < priceLow and rsi > rsiLow

bearishDivergence = high > priceHigh and rsi < rsiHigh

// Mean Reversion Swing Trading Signals

meanReversionBuy := lowerBBHit and rsi < 30 and bullishDivergence

meanReversionSell := upperBBHit and rsi > 70 and bearishDivergence

// ===================== Trend Following =====================

trendFollowingBuy = false

trendFollowingSell = false

if enableTrendFollowing

// Strong Trend Conditions

strongUptrend = emaFast > emaSlow and emaSlow > emaMedium and emaMedium > emaLong

strongDowntrend = emaFast < emaSlow and emaSlow < emaMedium and emaMedium < emaLong

// Simulated multi-day trend confirmation

recentHigherHigh = high > ta.highest(high[1], 5)

recentLowerLow = low < ta.lowest(low[1], 5)

// MACD Filters

macdRising = macd > macd[1] and macd[1] > macd[2]

macdFalling = macd < macd[1] and macd[1] < macd[2]

// Stronger Filters for Swing Trading

trendFollowingBuy := strongUptrend and macd > macdSignal and macdRising and recentHigherHigh

trendFollowingSell := strongDowntrend and macd < macdSignal and macdFalling and recentLowerLow

// ===================== Combine Signals =====================

wyckoffBuy = enableWyckoff and spring and accumulationPhase

wyckoffSell = enableWyckoff and distributionPhase

mrBuy = enableMeanReversion and meanReversionBuy

mrSell = enableMeanReversion and meanReversionSell

tfBuy = enableTrendFollowing and trendFollowingBuy

tfSell = enableTrendFollowing and trendFollowingSell

// Combine all strategies

buySignal = (wyckoffBuy or mrBuy or tfBuy) and isGoodEntryDay

sellSignal = (wyckoffSell or mrSell or tfSell) and isGoodEntryDay

// Add Candle Confirmation for better entries - full candle above/below EMA

buyConfirmation = close > open and close > emaMedium

sellConfirmation = close < open and close < emaMedium

// Track holding days

var int daysInTrade = 0

daysInTrade := strategy.position_size != 0 ? daysInTrade + 1 : 0

// Time-Based Exit

exitLongByTime = strategy.position_size > 0 and (daysInTrade >= maxHoldingDays or (daysInTrade >= minHoldingDays and isGoodExitDay))

exitShortByTime = strategy.position_size < 0 and (daysInTrade >= maxHoldingDays or (daysInTrade >= minHoldingDays and isGoodExitDay))

// Exit by RSI

exitLongByRSI = useExitByRSI and strategy.position_size > 0 and rsi >= exitLongRSI and daysInTrade >= minHoldingDays

exitShortByRSI = useExitByRSI and strategy.position_size < 0 and rsi <= exitShortRSI and daysInTrade >= minHoldingDays

// Trading logic - Swing Trading adjusted with TP/SL optional

if buySignal and buyConfirmation and strategy.position_size <= 0

strategy.cancel_all()

strategy.entry("Long", strategy.long)

if useAutoTPSL

strategy.exit("TP/SL Long", "Long", profit = atr * profitFactor, loss = atr * stopLossFactor)

if sellSignal and sellConfirmation and strategy.position_size >= 0

strategy.cancel_all()

strategy.entry("Short", strategy.short)

if useAutoTPSL

strategy.exit("TP/SL Short", "Short", profit = atr * profitFactor, loss = atr * stopLossFactor)

// Trailing Stop if enabled and no fixed TP/SL

if useTrailingStop and not useAutoTPSL and strategy.position_size != 0

longTrailPrice = high - atr * trailingStopAtrMult

shortTrailPrice = low + atr * trailingStopAtrMult

if strategy.position_size > 0

strategy.exit("Trailing Stop Long", "Long", trail_price=longTrailPrice)

else if strategy.position_size < 0

strategy.exit("Trailing Stop Short", "Short", trail_price=shortTrailPrice)