Trend-Following Dynamic Grid Allocation Strategy for Long Positions

RSI GRID TREND FOLLOWING DYNAMIC ALLOCATION LONG POSITION STOP LOSS TAKE PROFIT LIMIT ORDER MARKET ORDER

Overview

The Trend-Following Dynamic Grid Allocation Strategy for Long Positions is an enhancement and optimization of the traditional grid trading strategy. This strategy focuses on trend following in the long direction by establishing a grid system during upward market trends, generating profits from price fluctuations while controlling risk exposure during market downturns. Unlike conventional bidirectional grid strategies, this approach primarily focuses on long markets, using minimal short positions only when necessary to maintain the percentage distance between grids, thereby maximizing returns in bull markets. The core mechanism relies on making entry and exit decisions based on the profit or loss of the current position rather than price movement percentages, while supporting both market and limit orders, providing traders with flexible execution options.

Strategy Principles

The operating principles of this strategy are based on several key components:

Grid Configuration: The grid spacing is determined by a user-defined percentage parameter (percent), which establishes the trigger points for profit-taking and stop-losses.

Trade Type Selection: The strategy allows users to choose between market orders (0) or limit orders (1), adapting to different liquidity environments and execution preferences.

Condition Assessment and Execution:

- If there is no current position (position_size == 0), the strategy initiates a long position.

- If holding a long position (position_size > 0):

- When profit reaches or exceeds the set grid percentage, it closes the position and re-establishes a long position (locking in profit while continuing to track the upward trend).

- When loss reaches or exceeds the set grid percentage, it closes the long position and establishes a minimal short position (0.0001, serving only as a directional marker).

- If holding a short position (position_size < 0, actually minimal):

- When the short position profit reaches or exceeds the set grid percentage, it closes and re-establishes a small short position (continuing to wait for reversal signals).

- When the short position loss reaches or exceeds the set grid percentage, it closes the short position and re-establishes a long position (recognizing the end of the decline and re-entering the upward trend).

Trading Function Design: The strategy employs four functional methods (fun1 to fun4) to handle trading logic under different market conditions, executing appropriate operations based on order type (market or limit).

Strategy Advantages

Trend Following Capability: The strategy focuses on long markets, effectively capturing upward trends, especially suitable for bull market environments.

Risk Management Mechanism: The distance between grids actually serves as natural stop-loss and take-profit points, making risk control more systematic.

Strong Adaptability: Parameters can be optimized for different assets and timeframes, enhancing the strategy’s adaptability.

Safety with Full Position Operations: Supports full position operations with controlled risk, as each grid incorporates its own risk management mechanism.

Flexible Execution Methods: Supports both market and limit order modes, allowing traders to select the optimal execution method based on market conditions.

Operational Simplicity: The strategy logic is clear, parameter settings are simple, and it’s easy to understand and implement.

High Degree of Automation: Fully automated execution reduces the possibility of human intervention and emotional trading.

Strategy Risks

Parameter Sensitivity: Improper grid percentage settings may lead to overtrading (if too small) or missed opportunities (if too large). The solution is to find optimal parameters for specific markets through backtesting and optimization.

Trend Identification Limitations: The strategy lacks built-in trend identification indicators, relying solely on price movements as signals, which may generate false signals in oscillating markets. It is recommended to use this in clear trend markets or add trend filters.

Slippage and Trading Cost Impact: Frequent trading may result in significant slippage and trading costs, especially in less liquid markets. The solution is to increase grid spacing or prioritize limit orders.

Unidirectional Preference Risk: The strategy favors long positions and may perform poorly in bear markets. It is recommended to apply this to markets or assets with an overall bullish outlook.

Extreme Market Risk: In rapidly declining markets, significant losses may still occur despite the grid stop-loss mechanism. Consider adding additional risk management measures such as volatility filters or maximum loss limits.

Small Short Position Management: The strategy uses extremely small short positions (0.0001) as directional markers; some exchanges may not support such small positions, requiring adjustments based on actual circumstances.

Strategy Optimization Directions

Add Trend Indicators: Introduce trend indicators such as moving averages, ADX, or MACD to improve trend identification accuracy and avoid overtrading in oscillating markets. This ensures the strategy operates only in genuine trend environments.

Dynamic Grid Spacing: Automatically adjust grid spacing based on market volatility, narrowing spacing during low volatility periods to capture small fluctuations, and widening spacing during high volatility periods to avoid overtrading. Consider using the ATR (Average True Range) indicator for implementation.

Capital Management Optimization: Introduce dynamic adjustment of position sizes instead of simple full position operations for more refined risk control. For example, adjust the proportion of funds for each trade based on account profit/loss status or market volatility.

Multi-Timeframe Analysis: Add analysis across multiple timeframes, executing trades only when trends align in larger timeframes, improving signal quality.

Add Profit Retracement Protection: Implement retracement protection mechanisms after substantial profits, such as securing partial profits when prices fall a certain percentage from the peak.

Introduce Filtering Conditions: Add volume, volatility, or time filters to avoid trading under unsuitable market conditions.

Backtesting Parameter Optimization: Create parameter sets for different market environments and asset types to enhance strategy adaptability.

Summary

The Trend-Following Dynamic Grid Allocation Strategy for Long Positions is an improved grid trading system designed specifically for long markets. It innovatively combines grid trading with trend following, using the profit/loss status of current positions as trading signals, effectively generating profits in upward trends. The core advantage lies in its simple yet effective risk control mechanism, with grid spacing serving as natural stop-loss and take-profit points while maintaining sensitivity to upward trends.

However, the strategy also faces challenges including parameter sensitivity, trend identification limitations, and potential overtrading in oscillating markets. To optimize performance, it is recommended to introduce trend indicators, dynamic grid spacing, and multi-timeframe analysis as improvement measures.

Ultimately, this strategy is best suited for markets with clear upward trends, especially in medium to long-term bull market environments. Traders should adjust strategy parameters through thorough backtesting and optimization based on specific assets and market conditions to achieve optimal results. Through systematic execution and continuous optimization, this strategy can become an effective tool in a trend trader’s toolkit.

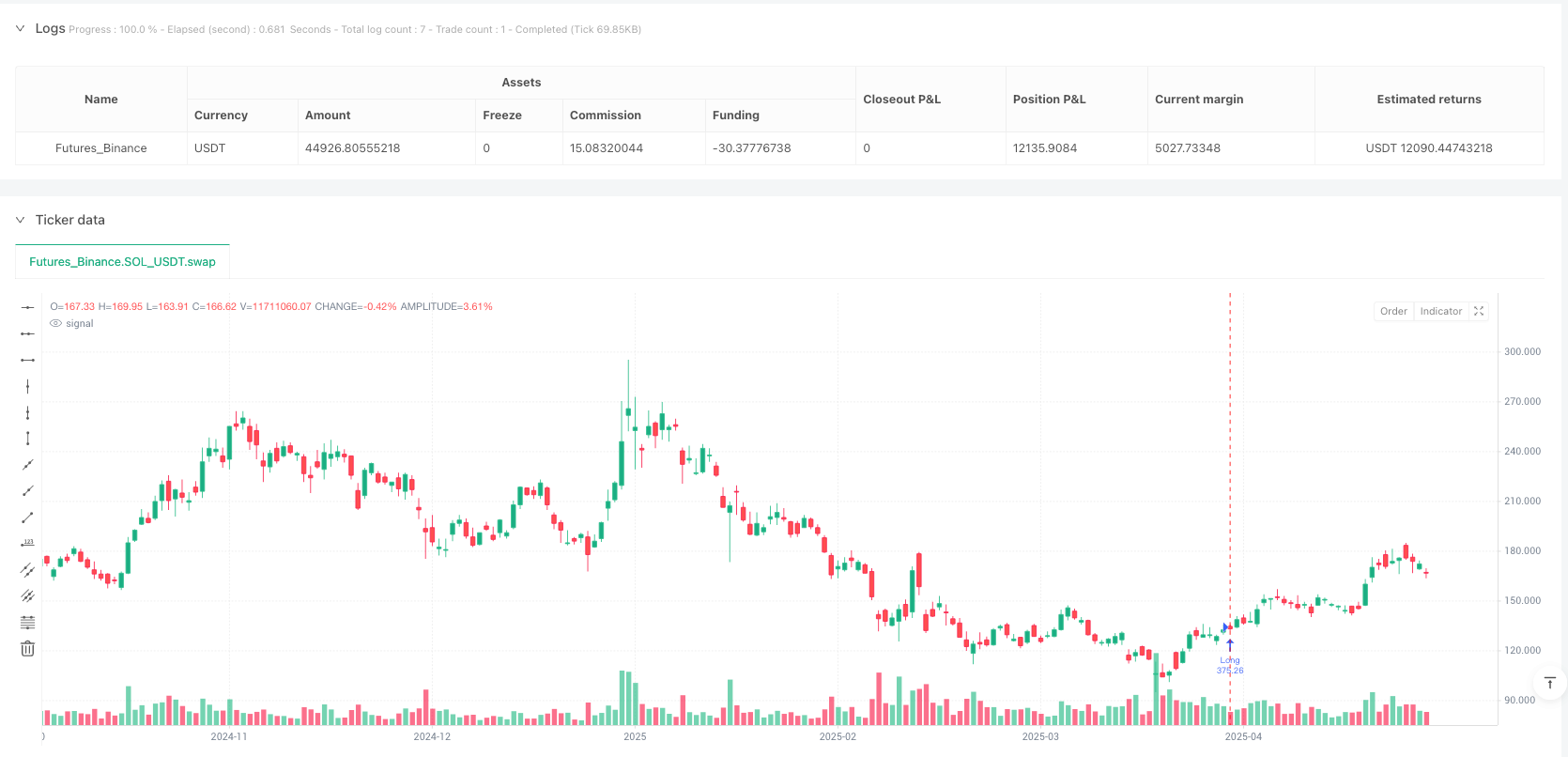

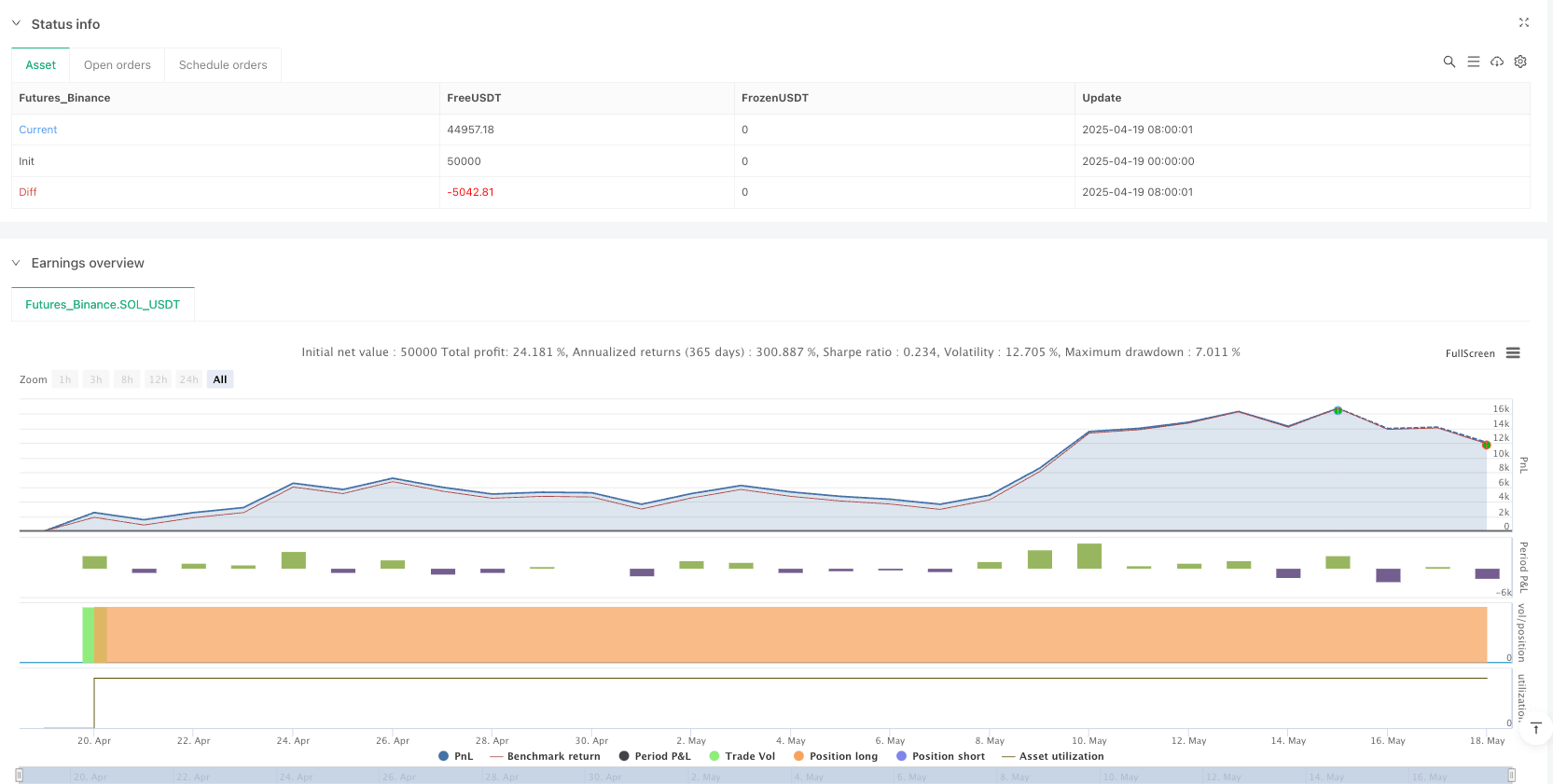

/*backtest

start: 2025-04-19 00:00:00

end: 2025-05-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © manorz

//@version=6

strategy('Grid Tendence Long V1', overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, calc_on_every_tick = true)

//Inputs

percent = input.float(1.00, title = '(%) Grid:', minval = 0.1, step = 0.1)

order = input.int(0, title = 'Orders: Market [0] Limit [1]', options = [0, 1])

entry = strategy.closedtrades.exit_price(strategy.closedtrades - 1)

//Functions

fun1(close) =>

if order == 0

strategy.close_all()

strategy.entry('Long', strategy.long)

else if order == 1

strategy.exit('Exit Long', limit = close)

strategy.entry('Long', strategy.long, limit = close)

fun2(close) =>

if order == 0

strategy.close_all()

strategy.entry('Short', strategy.short, qty = 0.0001)

else if order == 1

strategy.exit('Exit Long', limit = close)

strategy.entry('Short', strategy.short, qty = 0.0001, limit = close)

fun3(close) =>

if order == 0

strategy.close_all()

strategy.entry('Short', strategy.short, qty = 0.0001)

else if order == 1

strategy.exit('Exit Short', limit = close)

strategy.entry('Short', strategy.short, qty = 0.0001, limit = close)

fun4(close) =>

if order == 0

strategy.close_all()

strategy.entry('Long', strategy.long)

else if order == 1

strategy.exit('Exit Short', limit = close)

strategy.entry('Long', strategy.long, limit = close)

//Script

if strategy.position_size == 0

strategy.entry('Long', strategy.long)

else if strategy.position_size > 0

if strategy.opentrades.profit_percent(strategy.opentrades - 1) >= percent

fun1(close)

else if strategy.opentrades.profit_percent(strategy.opentrades - 1) <= -percent

fun2(close)

else if strategy.position_size < 0

if strategy.opentrades.profit_percent(strategy.opentrades - 1) >= percent

fun3(close)

else if strategy.opentrades.profit_percent(strategy.opentrades - 1) <= -percent

fun4(close)

//Plot

plot(entry, title = 'Close', color = color.gray, linewidth = 1, style = plot.style_circles)