Overview

The Dynamic Fibonacci Extension Breakout Trend-Following Strategy is a trading approach designed specifically for assets in an uptrend. This strategy combines the Fibonacci extension tool, trend filter, and risk management mechanisms to capture strong upward price movements. It is primarily suitable for higher timeframes such as daily (1D), 3-day (3D), or weekly (W) charts, and is designed for swing trading with holding periods ranging from several days to weeks. The strategy identifies market trends using the 200-period Exponential Moving Average (EMA), uses the Fibonacci 1.618 extension level as a breakout signal, and incorporates the Average True Range (ATR) for risk management.

Strategy Principles

The core principles of this strategy are based on the following key components:

Trend Identification: The strategy uses a 200-period Exponential Moving Average (EMA) as a trend filter. When the price is above the 200 EMA, we consider the market to be in an uptrend and allow long trades. This ensures that we only trade in the direction of the trend, increasing the probability of success.

Fibonacci Extension Levels: The strategy detects recent high and low pivot points (using 10-period pivot high and low functions) to draw Fibonacci extension levels. It specifically focuses on the 1.618 Fibonacci level, which is often considered an important target in strong trends. The code uses the following logic to calculate this level:

fibDiff = fibTop - fibBase fibTarget = fibTop + fibDiff * (fibLevel - 1)where fibTop is the recent pivot high, fibBase is the recent pivot low, and fibLevel is set to 1.618.

Entry Conditions: The strategy triggers a long signal when the closing price breaks above both the 1.618 Fibonacci extension level and is positioned above the 200 EMA. This condition indicates a potential momentum breakout is occurring, providing a good buying opportunity.

Risk Management: The strategy incorporates automatic risk management mechanisms:

- A stop-loss set at 1x ATR (14-period) below the entry price, protecting capital from sudden price drops

- A take-profit set at 3x ATR above the entry price, targeting a risk-reward ratio of 3:1

Strategy Advantages

Analyzing the strategy’s code, we can summarize the following significant advantages:

Trend Confirmation: Through the 200 EMA trend filter, the strategy ensures trading only in the direction of the main trend, avoiding the risks associated with counter-trend trading.

Technical Validity: Fibonacci extensions are a market-validated technical analysis tool, with the 1.618 level in particular demonstrating good predictive capability during strong trends across many assets.

Automated Risk Management: The strategy incorporates ATR-based stop-loss and take-profit mechanisms, which dynamically adjust to changes in market volatility, working effectively across different market environments.

Positive Risk-Reward Ratio: The strategy sets a 3:1 risk-reward ratio (take-profit at 3x ATR, stop-loss at 1x ATR), which aligns with professional trading risk management principles, ensuring long-term profitability even with a moderate win rate.

Strong Applicability: This strategy is particularly suitable for assets with long-term uptrends, such as precious metals, and performs better on higher timeframes, reducing the impact of market noise.

Strategy Risks

Despite its numerous advantages, through in-depth code analysis, we can identify the following potential risks:

Backtesting Limitations: Due to the calculation method of pivot points and Fibonacci levels, this strategy may not perform well in backtesting, as historical calculations may change with the addition of new data. The strategy is more suitable for real-time analysis and forward testing.

Pivot Point Detection Lag: The current pivot point detection uses the

ta.pivothighandta.pivotlowfunctions, requiring data from 10 periods before and after, which means there is a lag in pivot point confirmation, potentially leading to less timely entries.Subjectivity of Fibonacci Levels: While 1.618 is a commonly used extension level, markets don’t always respect this specific level, which may lead to false breakouts under certain market conditions.

Fixed ATR Multipliers: The strategy uses fixed ATR multipliers (1x for stop-loss, 3x for take-profit), which may not be suitable for all market environments, especially in markets with rapidly changing volatility.

Long-Only: The strategy is designed only for long trades, unable to capitalize on short opportunities when the market turns into a downtrend, potentially missing important profit opportunities.

Strategy Optimization Directions

Based on code analysis, here are possible optimization directions for this strategy:

Dynamic Fibonacci Levels: Consider dynamically adjusting the Fibonacci level used based on market conditions, rather than fixed use of 1.618. For example, test the effectiveness of different levels such as 1.414, 1.618, 2.0 in various market environments.

Multiple Confirmation Signals: Add additional confirmation indicators, such as Relative Strength Index (RSI), volume increase, or momentum indicators, to reduce the risk of false breakouts.

Adaptive Risk Management: Implement dynamic risk-reward ratios based on market volatility or historical performance, rather than a fixed 3:1 ratio. For example, looser stop-losses may be needed in more volatile markets.

Add Short Logic: Extend the strategy to include short trading logic, triggered when price breaks below key Fibonacci retracement levels and is below the 200 EMA.

Optimize Pivot Point Detection: Consider using more sophisticated pivot point detection algorithms, or adjust the parameters of the current algorithm, to reduce lag and improve accuracy.

Improve Capital Management: Currently, the strategy uses a fixed percentage of capital (10%) for trading; consider implementing more sophisticated money management systems, such as volatility-based position sizing or the Kelly criterion.

Adaptive Time Periods: Implement adaptive moving average and ATR periods that automatically adjust based on market conditions, rather than using fixed 200 and 14 periods.

Conclusion

The Dynamic Fibonacci Extension Breakout Trend-Following Strategy is a systematic trading approach that combines technical analysis and risk management. By utilizing Fibonacci extension levels (particularly the 1.618 level) and a trend filter (200 EMA), the strategy aims to capture strong breakout movements in uptrending assets. The built-in ATR risk management mechanism ensures a positive risk-reward ratio, while clear entry and exit rules make it a complete trading system.

This strategy is particularly suitable for swing trading on higher timeframes, especially for assets with long-term uptrends. However, users should be aware of its limitations in backtesting and consider implementing the suggested optimizations to improve its adaptability and performance across different market environments. In practical application, it is recommended to combine this with other analytical tools and money management techniques to maximize its effectiveness.

By deeply understanding the principles, advantages, and limitations of this strategy, traders can better assess its suitability and make necessary adjustments based on personal trading style and market conditions to achieve long-term stable trading performance.

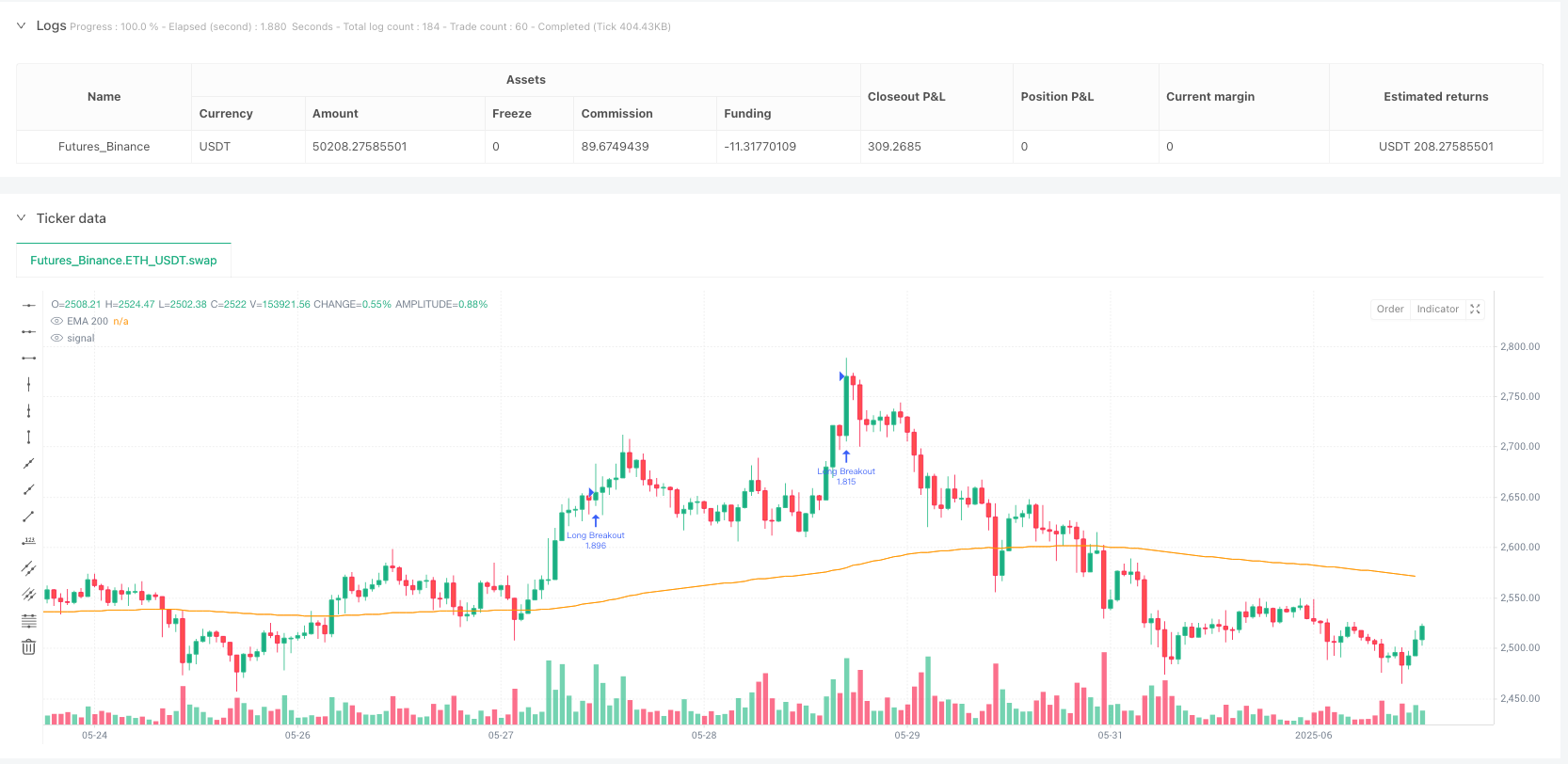

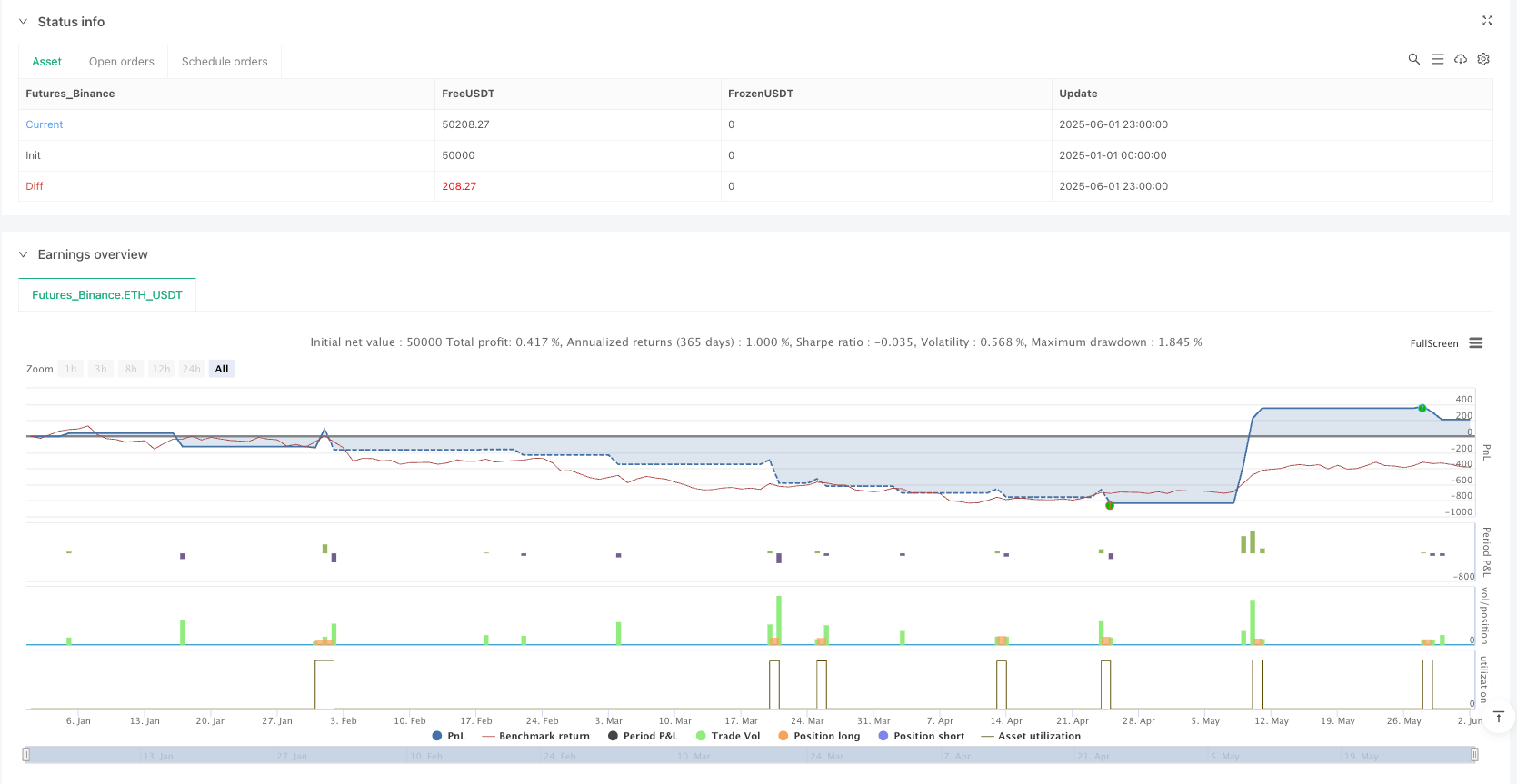

/*backtest

start: 2025-01-01 00:00:00

end: 2025-06-02 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("AutoFib Breakout Strategy for Uptrend Assets", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Trend Filter ===

ema200 = ta.ema(close, 200)

plot(ema200, "EMA 200", color=color.orange)

// === ATR for Risk Management ===

atr = ta.atr(14)

// === Fib Extension Level to Use ===

fibLevel = 1.618

fibColor = color.green

// === Fibonacci Anchor Logic (simple swing high/low detection) ===

pivotHigh = ta.pivothigh(high, 10, 10)

pivotLow = ta.pivotlow(low, 10, 10)

var float fibBase = na

var float fibTop = na

var line fibLine = na

if not na(pivotHigh)

fibTop := pivotHigh

if not na(pivotLow)

fibBase := pivotLow

fibDiff = fibTop - fibBase

fibTarget = fibTop + fibDiff * (fibLevel - 1)

// === Entry & Exit Conditions ===

longCondition = close > fibTarget and close > ema200

if (longCondition)

strategy.entry("Long Breakout", strategy.long, comment="Breakout Entry")

// Exits: TP and SL based on ATR

strategy.exit("Exit", from_entry="Long Breakout", stop=close - atr, limit=close + atr * 3)