Triple-Period CCI Trend Momentum Crossover Trading Strategy

CCI 商品通道指标 多周期分析 趋势跟踪 动量交易 零线穿越 Multi-Period Analysis TREND FOLLOWING Momentum Trading Zero-Line Crossover

Overview

The Triple-Period CCI Trend Momentum Crossover Trading Strategy is a quantitative trading system based on the Commodity Channel Index (CCI). This strategy’s uniqueness lies in its simultaneous use of three different CCI periods to confirm market trend direction and momentum strength. The core logic involves analyzing short-term (14-period), medium-term (25-period), and long-term (50-period) CCI indicators in concert, entering positions when the long-period CCI breaks through the zero line while other period CCIs are already positioned in the corresponding zones. This multiple confirmation mechanism effectively reduces false signals, enhances trading reliability, and is suitable for application on 15-minute or larger timeframes.

Strategy Principle

The core principle of this strategy is based on the trend-indicating characteristics of the CCI indicator and zero-line crossover signals:

Multi-period Collaborative Analysis: The strategy simultaneously calculates and monitors CCI values for three different periods (14, 25, and 50) to confirm market trends from different time scales.

Multiple Confirmation Mechanism:

- Long Entry Condition: CCI(25) > 0 AND CCI(14) > 0 AND CCI(50) crosses above zero

- Short Entry Condition: CCI(25) < 0 AND CCI(14) < 0 AND CCI(50) crosses below zero

Zero-Line Crossover Signal: The CCI indicator crossing the zero line typically indicates a change in market momentum direction. The long-period (50) CCI zero-line crossover serves as the primary trigger signal, while the positions of short and medium-period CCIs act as filtering conditions.

Precise Exit Mechanism: When any of the CCI indicators falls back to the opposite side of the zero line, the strategy closes positions, providing a sensitive stop-loss protection mechanism.

This design leverages the characteristics of CCI as a momentum indicator, identifying the beginning of strong trends by requiring consistency across multiple timeframes, while using sensitive exit conditions to protect profits.

Strategy Advantages

Multi-Level Confirmation Reduces False Signals: By requiring coordination of three different period CCI indicators, market noise is effectively filtered, reducing losses from false breakouts.

Captures Early Stages of Trends: The strategy focuses on capturing moments when CCI(50) has just crossed the zero line, which typically represents the early stage of a new trend, conducive to securing a larger proportion of trend profits.

Bidirectional Trading Opportunities: The strategy supports both long and short positions, enabling the pursuit of trading opportunities in various market environments and fully utilizing market fluctuations.

Clear Rule System: The entry and exit conditions of the strategy are clear and explicit, with no subjective judgment component, facilitating quantitative implementation and backtesting verification.

Flexible Timeframe Adaptability: The strategy can be applied to charts of 15 minutes or larger timeframes, demonstrating good cross-market and cross-timeframe adaptability.

Visual Feedback: The code includes visualization of the three CCI indicators, allowing traders to intuitively observe and understand the signal generation process.

Strategy Risks

Frequent Trading in Sideways Markets: In range-bound markets lacking clear trends, CCI may frequently cross the zero line, leading to consecutive losing trades. Countermeasure: Consider adding trend strength filters like ADX.

Entry Delays Due to Multiple Confirmations: Requiring all three indicators to simultaneously meet conditions may result in delayed entries, missing portions of price movements. Countermeasure: Adjust CCI period parameters for different market environments.

Overly Sensitive Stop-Loss Mechanism: Triggering position closure when any CCI indicator crosses the zero line may lead to premature exits from favorable trends. Countermeasure: Consider implementing partial position closures or using trailing stops.

Lack of Volatility Adaptation Mechanism: The strategy does not adjust parameters based on market volatility, potentially performing inconsistently in high and low volatility markets. Countermeasure: Introduce volatility indicators to dynamically adjust CCI periods.

Inadequate Position Management: The base code does not include position sizing logic, potentially leading to insufficient risk control. Countermeasure: Add a volatility-based position management module.

Strategy Optimization Directions

Add Market Environment Filters: Introduce ADX or volatility indicators to distinguish between trending and oscillating markets, executing the strategy only when trends are clear. This can significantly reduce false signals in range-bound markets.

Optimize CCI Period Parameters: Conduct optimization tests on the periods of the three CCI indicators for different markets and instruments to find optimal parameter combinations. Different instruments have different volatility characteristics, and adaptive parameters can improve strategy universality.

Implement Trailing Stop Mechanism: Replace the current fixed zero-line exit mechanism with ATR-based or percentage-based trailing stops to better protect profits.

Add Volume Confirmation: Use volume indicators as additional confirmation conditions, executing trade signals only when supported by volume to improve signal quality.

Introduce Time Filters: Add trading time window restrictions to avoid periods of abnormal volatility or insufficient liquidity, such as around market open and close.

Implement Phased Position Building and Reduction: Change the single full-position entry/exit strategy to phased position building and reduction, better managing risk and improving capital utilization efficiency.

Add Volatility-Based Position Management: Dynamically adjust position size for each trade based on current market volatility, reducing positions during high volatility periods and appropriately increasing positions during low volatility periods.

Summary

The Triple-Period CCI Trend Momentum Crossover Trading Strategy is a rigorously structured, logically clear quantitative trading system that effectively identifies the initial stages of market trends and executes corresponding trading operations through collaborative analysis of multi-period CCI indicators and zero-line crossover signals. This strategy is particularly suitable for markets with obvious medium to long-term trends, offering advantages such as reliable signals, clear rules, and ease of implementation.

While the basic version already possesses practical value, the strategy’s stability and profitability can be significantly enhanced through improvements in market environment filtering, exit mechanism optimization, volatility adaptation, and position management. For quantitative traders seeking trend-following strategies, this strategy provides a solid foundation framework that can be further customized and optimized according to personal risk preferences and market characteristics.

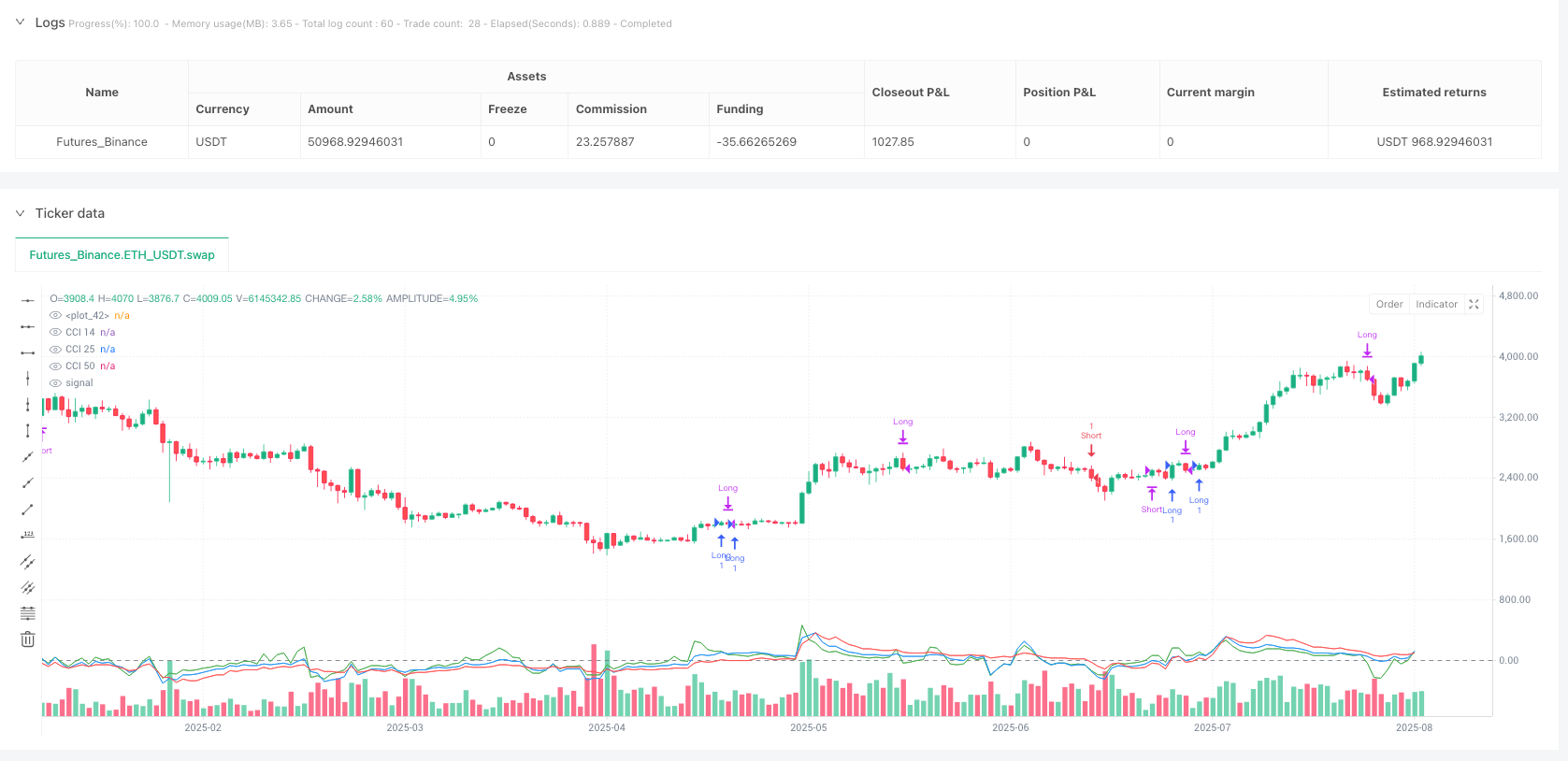

/*backtest

start: 2024-08-11 00:00:00

end: 2025-08-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("CCI Multi-Period Long/Short Strategy", overlay=true)

// Parameters

cciPeriod1 = 25

cciPeriod2 = 14

cciPeriod3 = 50

// CCI calculations

cciVal1 = ta.cci(close, cciPeriod1)

cciVal2 = ta.cci(close, cciPeriod2)

cciVal3 = ta.cci(close, cciPeriod3)

cciPrev3 = ta.cci(close[1], cciPeriod3)

// Long Entry: CCI(25) > 0 and CCI(14) > 0 and CCI(50) crosses above 0

longEntry = (cciVal1 > 0) and (cciVal2 > 0) and (cciPrev3 <= 0) and (cciVal3 > 0)

// Long Exit: Any CCI closes below 0

longExit = (cciVal1 < 0) or (cciVal2 < 0) or (cciVal3 < 0)

// Short Entry: CCI(25) < 0 and CCI(14) < 0 and CCI(50) crosses below 0

shortEntry = (cciVal1 < 0) and (cciVal2 < 0) and (cciPrev3 >= 0) and (cciVal3 < 0)

// Short Exit: Any CCI closes above 0

shortExit = (cciVal1 > 0) or (cciVal2 > 0) or (cciVal3 > 0)

// Strategy orders

if longEntry

strategy.entry("Long", strategy.long)

if longExit

strategy.close("Long")

if shortEntry

strategy.entry("Short", strategy.short)

if shortExit

strategy.close("Short")

// Optional plot for visualization

plot(cciVal1, color=color.blue, title="CCI 25")

plot(cciVal2, color=color.green, title="CCI 14")

plot(cciVal3, color=color.red, title="CCI 50")

hline(0, color=color.gray)