RSI-EMA Crossover Quantitative Trading Strategy: A Trend Following System Based on Relative Strength Index and Moving Averages

RSI EMA SMA VOLUME ANALYSIS Intraday Trading TREND FOLLOWING Quantitative Analysis

Overview

The RSI-EMA Crossover Quantitative Trading Strategy is a technical analysis-based trading system primarily applied to 1-hour candlestick charts. This strategy utilizes the Relative Strength Index (RSI), Exponential Moving Average (EMA) of RSI, and volume indicators to capture market trend reversal points, thereby generating entry and exit signals. The core concept involves monitoring the crossover between RSI and its EMA along with volume expansion to identify potential trend changes, enabling effective trend-following trading.

Strategy Principles

The strategy operates based on the following key technical indicators and principles:

RSI Indicator: Uses 15-period RSI (RSI-15) as the primary momentum indicator to measure the speed and change of price movements.

EMA of RSI: Calculates a 50-period Exponential Moving Average (EMA-50) of RSI-15, serving as a reference line for RSI.

Volume Analysis: Employs a 50-period Simple Moving Average (SMA-50) of volume as a reference value for trading volume.

Signal Generation:

- Long Signal: Triggered when RSI-15 crosses above its EMA-50 and current volume exceeds the volume SMA-50.

- Short Signal: Triggered when RSI-15 falls below its EMA-50.

Intraday Trading Control: The strategy implements intraday trading control by counting the number of daily candles (numBars) and forces the closure of all positions at the 6th candle of each day.

Trading Logic:

- When a long signal is generated and it’s not the 6th candle of the day: If no position exists, open a long position; if a short position exists, close it and open a long position.

- When a short signal is generated and it’s not the 6th candle of the day: If no position exists, open a short position; if a long position exists, close it and open a short position.

- When the 6th candle of the day is reached: Close all positions if any exist.

The strategy is essentially a trend-following system that determines the direction of market momentum changes through the relationship between RSI and its EMA, along with volume confirmation, and trades accordingly.

Strategy Advantages

Through in-depth analysis of the strategy code, this trading system exhibits the following significant advantages:

Trend Capture Capability: Through the crossover of RSI and its EMA, the strategy effectively captures trend initiation points, performing exceptionally well in clearly trending markets.

Volume Confirmation: Long signals require volume confirmation, enhancing signal reliability and helping filter out false breakouts.

Automatic Trend Reversal: The strategy automatically transitions from long to short or from short to long based on market conditions, requiring no manual intervention.

Flexibility: The strategy can be used for intraday trading and can also be extended for swing trading, adapting to different trading styles and timeframes.

Clear Exit Time: The strategy automatically closes positions at a specific time each day (the 6th candle), avoiding overnight risk and suitable for traders who prefer not to carry positions overnight.

Simplicity: Despite containing some redundant elements in the code (such as the SuperTrend indicator and EMA21 of closing price), the core trading logic is clear, concise, and easy to understand and implement.

Bidirectional Strategy: Provides both long and short trading signals, enabling profit opportunities in both rising and falling markets.

Strategy Risks

Despite its numerous advantages, the strategy also presents several potential risk factors:

No Stop-Loss Mechanism: The strategy does not incorporate stop-loss settings, which may lead to substantial losses during sudden trend reversals. It is recommended to add appropriate stop-loss mechanisms in practical applications, such as ATR-based dynamic stop-loss or fixed percentage stop-loss.

Overtrading Risk: RSI and its EMA may frequently cross during range-bound markets, leading to overtrading and increased transaction costs. Consider adding filtering conditions such as price breakout confirmation or trend filters.

Trading Gaps: The strategy explicitly states that there might be no trading signals on certain days, potentially missing profitable opportunities. Consider adding supplementary indicators to capture these opportunities.

Intraday Trading Limitations: Fixed position closure at the 6th candle may result in premature exit from favorable trends, sacrificing potential profits. Consider flexibly adjusting the closing time based on market conditions.

Volume Anomaly Impact: Over-reliance on volume confirmation may generate false signals during abnormal volume fluctuations. Consider adding volume filters or using relative volume indicators.

Parameter Sensitivity: The selection of RSI period (15) and EMA period (50) may significantly impact strategy performance, requiring backtesting optimization.

Strategy Optimization Directions

Based on strategy analysis, here are several potential optimization directions:

Add Stop-Loss Mechanism: Implement ATR-based or fixed point/percentage stop-loss to control maximum risk per trade. This is the most critical optimization item, as trading without stop-loss carries extreme risk during sudden market reversals.

Add Profit Targets: Set profit targets based on support/resistance levels or fixed risk-reward ratios to lock in profits.

Optimize Parameters: Conduct parameter optimization for RSI period (15), RSI’s EMA period (50), and volume SMA period (50) to find the optimal parameter combination for specific markets.

Add Filtering Conditions: Introduce trend filters (such as moving average direction or ADX indicator) to avoid generating excessive signals in range-bound markets.

Improve Volume Analysis: Use relative volume indicators or volume profile analysis to enhance the accuracy of volume confirmation.

Dynamic Exit Time: Dynamically adjust the exit time based on market volatility or daily trend strength, rather than fixing it at the 6th candle.

Backtest Different Timeframes: Test strategy performance across different timeframes (15-minute, 30-minute, etc.) beyond the 1-hour candle to identify optimal application scenarios.

Integrate Other Technical Indicators: Consider incorporating other technical indicators such as MACD, Bollinger Bands, or Fibonacci retracements to enhance signal reliability.

Implement Partial Position Closing: Implement staged position closure during trend development to both secure partial profits and maintain positions to capture larger trends.

These optimization directions aim to enhance strategy robustness, reduce risk, increase profit opportunities, while maintaining the simplicity and effectiveness of the core strategy logic.

Summary

The RSI-EMA Crossover Quantitative Trading Strategy is a trend-following system that combines momentum indicators (RSI), moving averages (EMA), and volume analysis. The strategy generates trading signals by monitoring the crossover relationship between RSI-15 and its EMA-50 along with volume confirmation, and automatically closes positions at a specific time each day to control risk.

The core advantages of this strategy lie in its ability to capture trend reversal points, enhance signal reliability through volume confirmation, and provide automatic trend reversal functionality. However, the lack of a stop-loss mechanism, potential overtrading risk, and limitations of fixed exit times are primary concerns that need attention.

Through adding stop-loss mechanisms, optimizing technical parameters, improving volume analysis, and incorporating trend filters, this strategy has significant optimization potential and application prospects. Whether for intraday trading or swing trading, the strategy provides a clear, actionable trading framework suitable for quantitative investors pursuing trend trading.

Ultimately, the key to successfully applying this strategy lies in understanding its fundamental principles, recognizing its strengths and limitations, and making appropriate adjustments and optimizations based on specific market environments and individual risk preferences.

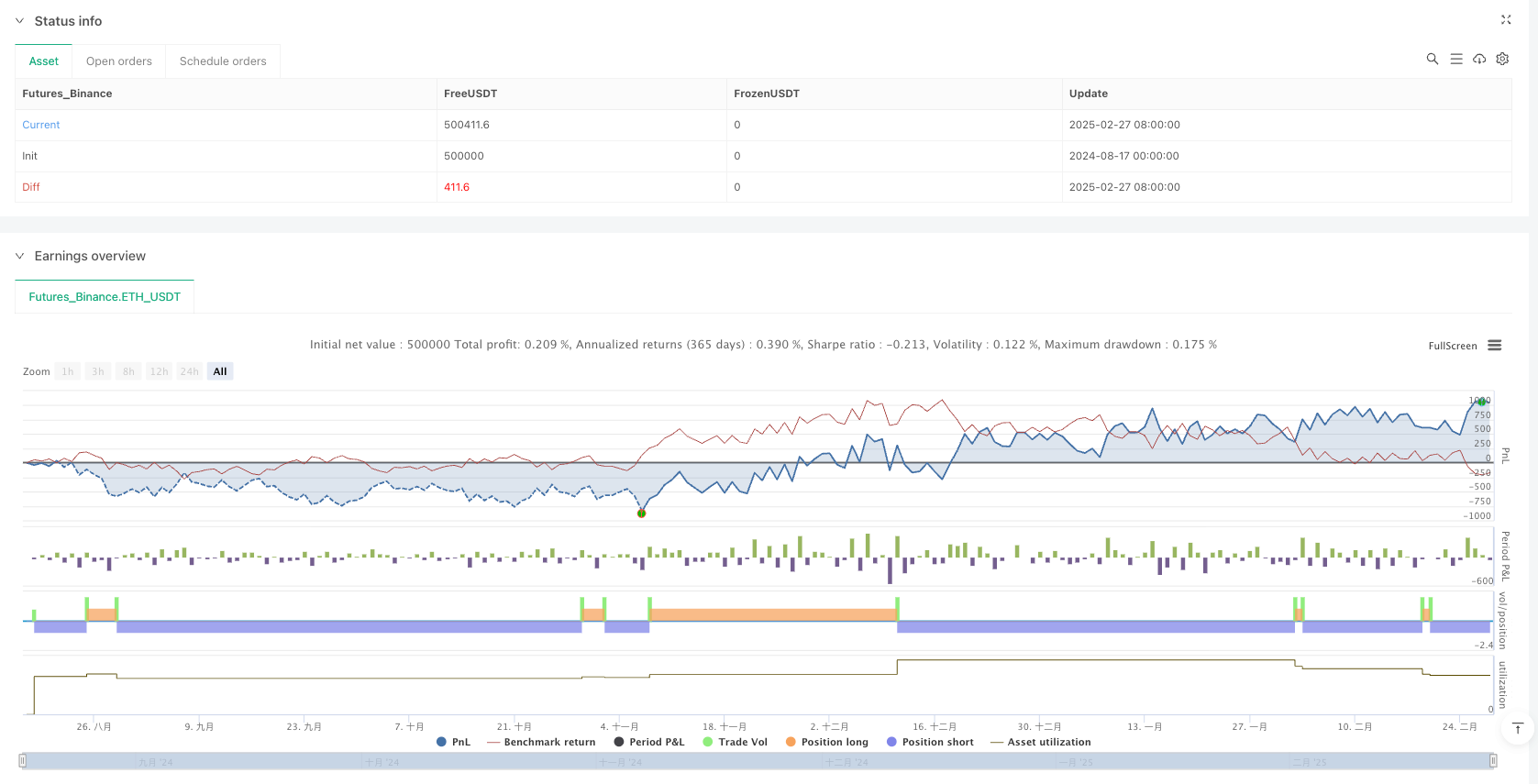

/*backtest

start: 2024-08-17 00:00:00

end: 2025-02-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Archer_Trade

//@version=6

strategy("Nifty Teaching")

numBars=1

t = time('D')

if t == t[1]

numBars := nz(numBars[1]) + 1

else

numBars := 1

RSI = ta.rsi(close,15)

EMA21 = ta.ema(RSI,50)

ema21 = ta.ema(close,21)

emavol = ta.sma(volume,50)

[supertrend, direction] = ta.supertrend(3, 10)

highestHigh = ta.highest(high, 50)

lowestLow = ta.lowest(low, 50)

up = ta.crossover(RSI,EMA21) and volume>emavol?true:false

down = RSI<EMA21?true:false

if up and numBars!=6

if strategy.position_size==0

strategy.entry("BUY",strategy.long)

else if strategy.position_size<0

strategy.close_all()

strategy.entry("BUY",strategy.long)

if down and numBars!=6

if strategy.position_size==0

strategy.entry("SELL",strategy.short)

else if strategy.position_size>0

strategy.close_all()

strategy.entry("SELL",strategy.short)

if numBars==6 and strategy.position_size!=0

strategy.close_all()