🎯 Strategy Core Highlights: More Than Just Price-Based EMA

You know what? Most people only use price for EMA calculations, but what makes this strategy powerful? It can calculate EMA from 6 different data sources! It’s like cooking - you don’t just use salt for seasoning, you can also use sugar, vinegar, and soy sauce for richer flavors and better trading signals.

Key point! These 6 data sources include: regular price, volume, rate of change, Heikin Ashi price, Heikin Ashi volume, and Heikin Ashi rate of change. Each provides different market insights!

📊 Triple Filter System: Making Signals More Precise

This strategy doesn’t give signals randomly! It has three “security checkpoints”:

First Gate: EMA Trend Detection 📈 Like checking the weather forecast, first determine if the overall direction is sunny or rainy

Second Gate: ADX Strength Filter 💪

ADX is like a wind speed meter - only when the trend is strong enough (default 25+), signals are generated. Avoid getting whipsawed in choppy markets!

Third Gate: Volume Confirmation 🔊 Volume spikes are like stocks “speaking loudly,” proving this signal is serious, not just noise

🎮 Three Exit Modes: Adapting to Different Trading Styles

The most thoughtful feature is the 3 exit methods, like a game with easy, normal, and hard difficulty levels:

Mode 1: Reverse Signal Exit 🔄 Simple and straightforward - close short and go long when long signal appears, close long and go short when short signal appears

Mode 2: ATR Dynamic Take Profit/Stop Loss 📏 Automatically adjusts based on market volatility - wider stops when volatility is high, tighter when low

Mode 3: Fixed Percentage Take Profit/Stop Loss 📊 Most intuitive - take profit at 2%, stop loss at 1.5% (customizable)

🚀 Practical Application Tips

Suitable Timeframes: Medium to short-term trading, especially effective in markets with decent volatility Pitfall Guide: Be careful in ranging markets, recommend enabling ADX filter Advanced Play: Try different data sources - volume source is particularly effective during breakouts with high volume!

The biggest advantage of this strategy is its flexibility. You can choose the most suitable data source and exit mode based on different market conditions. Remember, there’s no perfect strategy, only the most suitable strategy for current market conditions!

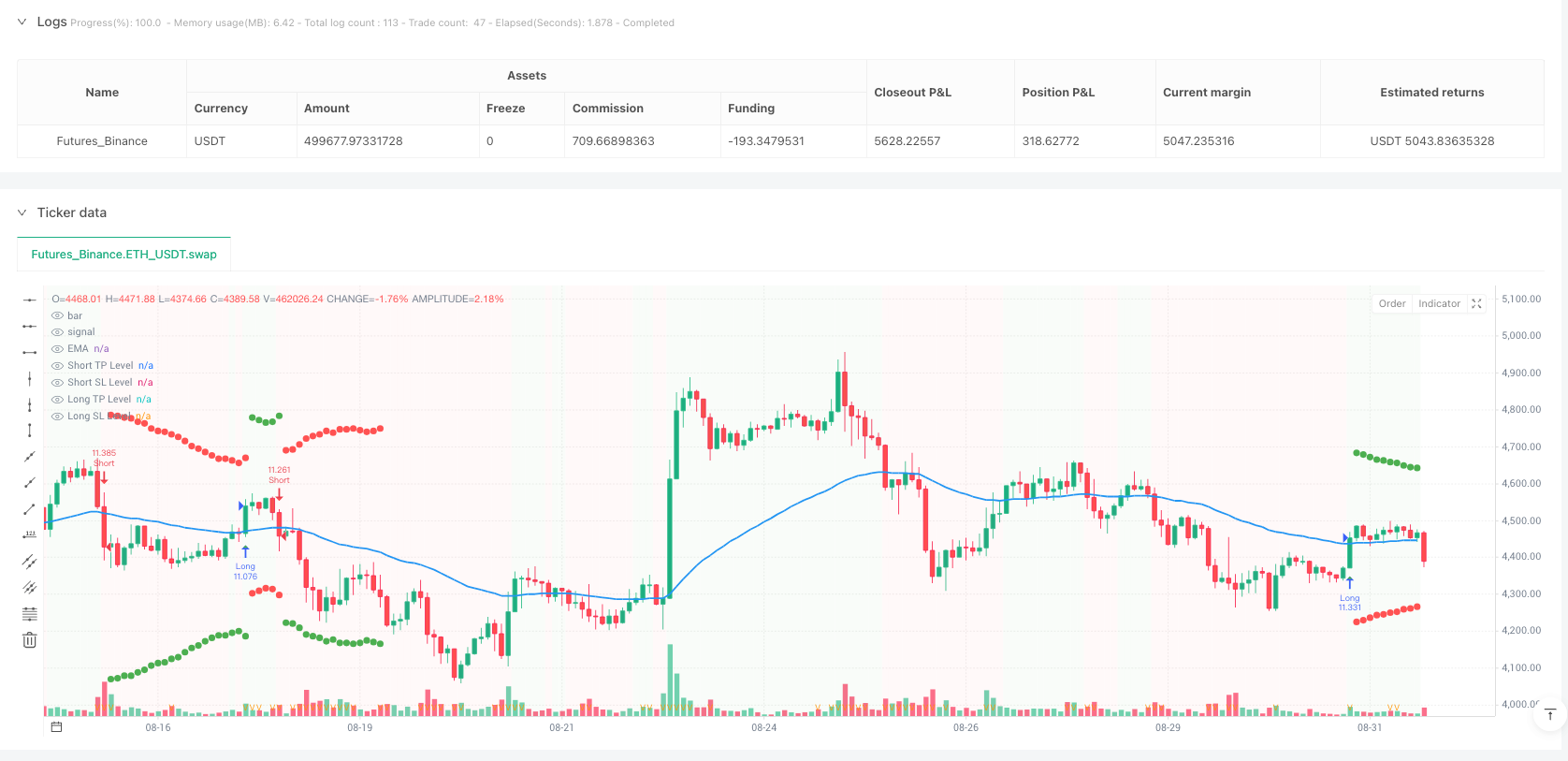

/*backtest

start: 2025-01-01 00:00:00

end: 2025-09-01 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

//@fenyesk

strategy("EMA inFusion Pro - Source Selection", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// =============================================

// === INPUT PARAMETERS =======================

// =============================================

// Moving Average Source Selection

maSourceSelection = input.string("Price", "Moving Average Source",

options=["Price", "Volume", "Rate of Change", "Heikin Ashi Price", "Heikin Ashi Volume", "Heikin Ashi Rate of Change"],

tooltip="Select data source for EMA calculation")

// EMA Settings

emaLength = input.int(50, title="EMA Length", minval=1, maxval=200)

rocLength = input.int(1, title="Rate of Change Length", minval=1, maxval=50, tooltip="Length for ROC calculation")

// ADX Filter Settings

useAdxFilter = input.bool(true, title="Use ADX Filter", group="ADX Settings")

adxLength = input.int(14, title="ADX Length", minval=1, maxval=50, group="ADX Settings")

adxThreshold = input.float(25, title="ADX Threshold", minval=10, maxval=50, step=0.5, group="ADX Settings")

// Volume Spike Settings

useVolumeFilter = input.bool(true, title="Use Volume Spike Filter", group="Volume Settings")

volumeMultiplier = input.float(1.0, title="Volume Spike Multiplier", minval=1.0, maxval=5.0, step=0.1, group="Volume Settings")

volumeSmaLength = input.int(20, title="Volume SMA Length", minval=5, maxval=100, group="Volume Settings")

// Trading Exit Mode Selector

tradingMode = input.int(2, title="Trading Exit Mode", minval=1, maxval=3,

tooltip="1: Exit on reverse signal\n2: ATR based TP/SL\n3: Percent based TP/SL",

group="Exit Strategy")

// Mode 3: Percent-Based Settings

takeProfitPercent = input.float(2.0, title="Take Profit %", minval=0.1, maxval=10.0, step=0.1, group="Percent Exit")

stopLossPercent = input.float(1.5, title="Stop Loss %", minval=0.1, maxval=10.0, step=0.1, group="Percent Exit")

// Mode 2: ATR-Based Settings

atrLength = input.int(14, title="ATR Length", minval=1, maxval=50, group="ATR Exit")

atrMultiplierTp = input.float(4.0, title="ATR Take Profit Multiplier", minval=0.1, maxval=10.0, step=0.1, group="ATR Exit")

atrMultiplierSl = input.float(4.0, title="ATR Stop Loss Multiplier", minval=0.1, maxval=10.0, step=0.1, group="ATR Exit")

// =============================================

// === SOURCE CALCULATIONS ====================

// =============================================

// Rate of Change calculation

roc(src, length) =>

change = src - src[length]

src[length] != 0 ? (change / src[length] * 100) : 0

// Standard Rate of Change

rocPrice = roc(close, rocLength)

rocVolume = roc(volume, rocLength)

// Heikin Ashi calculations

haClose = (open + high + low + close) / 4

var float haOpen = na

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2

haHigh = math.max(high, math.max(haOpen, haClose))

haLow = math.min(low, math.min(haOpen, haClose))

// Heikin Ashi Rate of Change

haRocPrice = roc(haClose, rocLength)

haRocVolume = roc(volume, rocLength) // Volume remains same for HA

// Define EMA source based on selection

emaSource = switch maSourceSelection

"Price" => close

"Volume" => volume

"Rate of Change" => rocPrice

"Heikin Ashi Price" => haClose

"Heikin Ashi Volume" => volume // Volume doesn't change in HA

"Heikin Ashi Rate of Change" => haRocPrice

=> close // Default fallback

// =============================================

// === INDICATOR CALCULATIONS =================

// =============================================

// Core Indicators

emaValue = ta.ema(emaSource, emaLength)

[diPlus, diMinus, adx] = ta.dmi(adxLength, adxLength)

volumeSma = ta.sma(volume, volumeSmaLength)

volumeSpike = volume > (volumeSma * volumeMultiplier)

atrValue = ta.atr(atrLength)

// Trend Conditions (adjusted for different source types)

bullishTrend = switch maSourceSelection

"Price" => close > emaValue

"Heikin Ashi Price" => haClose > emaValue

"Volume" => volume > emaValue

"Heikin Ashi Volume" => volume > emaValue

"Rate of Change" => rocPrice > emaValue

"Heikin Ashi Rate of Change" => haRocPrice > emaValue

=> close > emaValue

bearishTrend = not bullishTrend

// Cross conditions (adjusted for source type)

emaCrossUp = switch maSourceSelection

"Price" => ta.crossover(close, emaValue)

"Heikin Ashi Price" => ta.crossover(haClose, emaValue)

"Volume" => ta.crossover(volume, emaValue)

"Heikin Ashi Volume" => ta.crossover(volume, emaValue)

"Rate of Change" => ta.crossover(rocPrice, emaValue)

"Heikin Ashi Rate of Change" => ta.crossover(haRocPrice, emaValue)

=> ta.crossover(close, emaValue)

emaCrossDown = switch maSourceSelection

"Price" => ta.crossunder(close, emaValue)

"Heikin Ashi Price" => ta.crossunder(haClose, emaValue)

"Volume" => ta.crossunder(volume, emaValue)

"Heikin Ashi Volume" => ta.crossunder(volume, emaValue)

"Rate of Change" => ta.crossunder(rocPrice, emaValue)

"Heikin Ashi Rate of Change" => ta.crossunder(haRocPrice, emaValue)

=> ta.crossunder(close, emaValue)

// Filters

strongTrend = useAdxFilter ? adx >= adxThreshold : true

volumeConfirm = useVolumeFilter ? volumeSpike : true

// Entry Signals

longCondition = emaCrossUp and strongTrend and volumeConfirm

shortCondition = emaCrossDown and strongTrend and volumeConfirm

// =============================================

// === STRATEGY EXECUTION WITH EXIT MODES =====

// =============================================

// MODE 1: EXIT ON REVERSE SIGNAL

if (tradingMode == 1)

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.close("Short")

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.close("Long")

// MODE 2: ATR-BASED TAKE PROFIT & STOP LOSS

else if (tradingMode == 2)

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Long TP/SL", "Long",

profit=atrMultiplierTp * atrValue / syminfo.mintick,

loss=atrMultiplierSl * atrValue / syminfo.mintick)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Short TP/SL", "Short",

profit=atrMultiplierTp * atrValue / syminfo.mintick,

loss=atrMultiplierSl * atrValue / syminfo.mintick)

// MODE 3: PERCENT-BASED TAKE PROFIT & STOP LOSS

else if (tradingMode == 3)

if (longCondition)

longTpPrice = close * (1 + takeProfitPercent / 100)

longSlPrice = close * (1 - stopLossPercent / 100)

strategy.entry("Long", strategy.long)

strategy.exit("Long TP/SL", "Long", limit=longTpPrice, stop=longSlPrice)

if (shortCondition)

shortTpPrice = close * (1 - takeProfitPercent / 100)

shortSlPrice = close * (1 + stopLossPercent / 100)

strategy.entry("Short", strategy.short)

strategy.exit("Short TP/SL", "Short", limit=shortTpPrice, stop=shortSlPrice)

// =============================================

// === VISUALIZATIONS =========================

// =============================================

// Plot EMA with dynamic color based on source type

emaColor = switch maSourceSelection

"Price" => color.blue

"Volume" => color.orange

"Rate of Change" => color.purple

"Heikin Ashi Price" => color.green

"Heikin Ashi Volume" => color.red

"Heikin Ashi Rate of Change" => color.maroon

=> color.blue

plot(emaValue, title="EMA", color=emaColor, linewidth=2)

// Plot source data for reference (in separate pane when not price-based)

sourceColor = maSourceSelection == "Price" or maSourceSelection == "Heikin Ashi Price" ? na : color.gray

plot(str.contains(maSourceSelection, "Price") ? na : emaSource, title="Source Data", color=sourceColor)

// Background color based on trend

bgcolor(bullishTrend ? color.new(color.green, 95) : color.new(color.red, 95), title="Trend Background")

// Entry signals

plotshape(longCondition, title="Long Signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(shortCondition, title="Short Signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Volume spikes

plotchar(useVolumeFilter and volumeSpike, title="Volume Spike", char="V", location=location.bottom, color=color.orange, size=size.tiny)

// ATR-based levels for Mode 2

plot(tradingMode == 2 and strategy.position_size > 0 ? strategy.position_avg_price + (atrMultiplierTp * atrValue) : na,

title="Long TP Level", color=color.green, style=plot.style_circles, linewidth=1)

plot(tradingMode == 2 and strategy.position_size > 0 ? strategy.position_avg_price - (atrMultiplierSl * atrValue) : na,

title="Long SL Level", color=color.red, style=plot.style_circles, linewidth=1)

plot(tradingMode == 2 and strategy.position_size < 0 ? strategy.position_avg_price - (atrMultiplierTp * atrValue) : na,

title="Short TP Level", color=color.green, style=plot.style_circles, linewidth=1)

plot(tradingMode == 2 and strategy.position_size < 0 ? strategy.position_avg_price + (atrMultiplierSl * atrValue) : na,

title="Short SL Level", color=color.red, style=plot.style_circles, linewidth=1)

// Alert conditions

alertcondition(longCondition, title="Long Entry", message="EMA Fusion Pro: Long entry signal")

alertcondition(shortCondition, title="Short Entry", message="EMA Fusion Pro: Short entry signal")